Learning Options

- Online Video-Based Learning

- Flexible Schedule

- Expert Trainers with Industry Experience

- High Pass Rates

- 24/7 Personalised Support

- Interactive Learning Materials

- Live Online Classes

- Expert Trainers with Industry Experience

- Live Assessment and Feedback

- Interactive Learning Materials

- Networking Opportunities

- High Pass Rates

Overview

The Financial Accounting and Reporting: UK GAAP (FAR) Course is designed for professionals aiming to deepen their expertise in financial reporting. As part of the ACA Professional Level qualifications, this course focuses on equipping learners with the ability to apply UK GAAP principles in preparing and interpreting complex financial statements.

This course emphasises key topics, including financial statement preparation for single entities and groups, application of UK GAAP standards, and the interpretation of financial performance and position. Learners will also develop a strong understanding of regulatory frameworks, ethical considerations, and the role of professional judgment in financial reporting.

By mastering these skills, learners will be well-prepared to support organisations in meeting their financial reporting obligations and making informed decisions based on accurate financial data.

Course Objectives

Understand the UK GAAP framework and its application in financial reporting

Develop skills to prepare financial statements for single entities and groups under UK GAAP

Gain proficiency in interpreting and analysing financial performance and position

Learn to apply specific UK GAAP standards to various transactions and reporting scenarios

Enhance understanding of regulatory compliance and ethical considerations in financial reporting

Build expertise in handling complex reporting issues, including leases, tax, and revenue recognition

Apply professional judgment in resolving financial reporting challenges

Upon completion, learners will possess the knowledge and skills to prepare and interpret financial statements effectively, ensuring compliance with UK GAAP standards and supporting strategic decision-making in their organisations.

Average completion time

1 Month

with unlimited support

100% online

Start anytime

Study At Your Own PaceCourse Includes

- Expert-led Sessions

- Digital Delegate Pack

- 24/7 Tutor Support

- Downloadable Resources & Challenges

- Interactive Learning

- Exercise Files

- Scenario-Based Learning

Course Details

Develop your understanding of essential financial, business and management accounting techniques with ACCA Applied Knowledge. You'll learn basic business and management principles and the skills required of an accountant working in business.

Entry Requirements

Certificate Level Completion: Candidates must have successfully completed the Certificate Level, demonstrating foundational knowledge in relevant subject areas.

Qualifications in Accountancy and Finance: Prior education or certifications in accountancy and finance are essential to ensure readiness for advanced topics covered in the course.

Business Knowledge: A background in business studies or equivalent qualifications is required to support understanding of strategic and operational aspects of the curriculum.

Learning Outcomes

Understand the UK GAAP Framework: Gain an in-depth understanding of the principles and objectives of UK GAAP.

Prepare Financial Statements: Develop the ability to prepare and present financial statements for single entities and groups.

Apply UK GAAP Standards: Learn to handle complex reporting issues, including revenue recognition, leases, and deferred tax.

Interpret Financial Performance: Enhance skills in analysing and interpreting financial statements to support decision-making.

Target Audience

Aspiring Financial Accountants

Financial Reporting Specialists

Audit Associates

Compliance Officers

Finance Managers

Controllers

The Financial Accounting and Reporting: UK GAAP (FAR) Course is perfect for learners aiming to advance their expertise in financial reporting or pursue roles requiring deep knowledge of UK GAAP. Below are the roles and individuals who can benefit from this course:

Course content

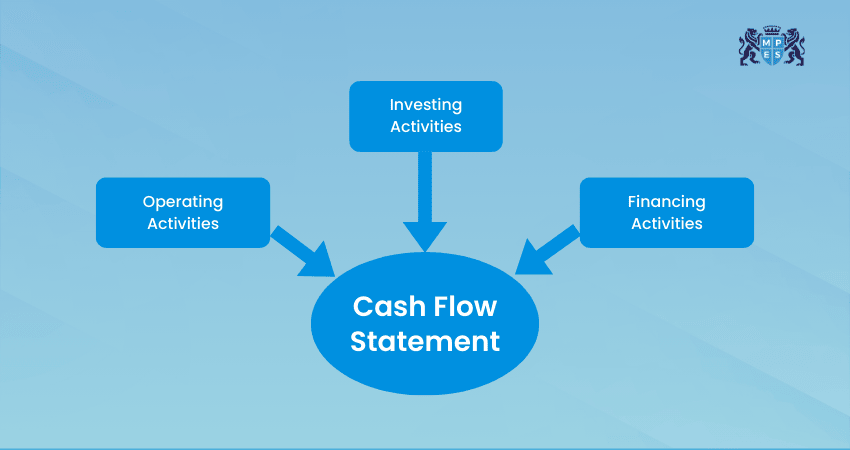

Accounting and reporting concepts and ethics

Single entity financial statements

Consolidated financial statements

MPES Support That Helps You Succeed

At MPES, we offer comprehensive support to help you succeed in your studies. With expert guidance and valuable resources, we help you stay on track throughout your course.

- MPES Learning offers dedicated support to help you succeed in Accounting and Finance courses.

- Get expert guidance from tutors available online to assist with your studies.

- Check your eligibility for exemptions with the relevant professional body before starting.

- Our supportive team is here to offer study advice and support throughout your course.

- Access a range of materials to help enhance your learning experience. These resources include practice exercises and additional reading to support your progress.

ACA Salary Growth

Career Growth Stories

Discover how MPES Learning transforms careers with real success stories.

Arvy Pasanting

As a qualified accountant, studying at MPES has been a very rewarding experience. Its team of passionate and dedicated mentors gave me the confidence and knowledge I needed to not just excel at my current role as an auditor, but also inspired me to expand my horizons.

Arvy Pasanting

David Ford

I was recommended MPES after searching for a way to pursue a career in the accounting profession, I have studied with them throughout my journey utilising both their “in class” and online learning opportunities that fit around the needs of my employer, I have found them to be consummate professionals delivering first class accounting courses with support always available.

David Ford

Aaron Allcote

As a finance officer, MPES has been a huge help in understanding the process of recording and processing transactions from all different perspectives. The courses are very easy to follow, and the training they provide can be applied to real-life scenarios. The courses have been a huge help for me, and I would highly recommend them.

Aaron Allcote

Bob Beaumont

I completed all of my ACA studies with MPES and I think you would struggle to find a better training provider anywhere in the British Isles. MPES' tutors are excellent both at delivering training and giving individualised feedback and coaching. the supporting materials and the out of class support are also great.

Bob Beaumont

George Evans

The Financial Risk Management Course at MPES was invaluable in deepening my understanding of risk assessment and mitigation strategies. The hands-on learning approach allowed me to apply new concepts directly to my work. I highly recommend it for professionals in finance.

George Evans

James Robinson

As a financial consultant, I am always seeking ways to enhance my expertise. The Investment Analysis Course at MPES exceeded my expectations, offering practical skills and knowledge that I can apply immediately in my consulting work. It's an outstanding choice for professionals in finance.

James Robinson

Laura Bennett

The Corporate Finance Course I attended at MPES was transformative. The depth of knowledge shared by the instructors and the relevance of the topics covered have directly impacted on our financial strategy. I strongly endorse this program for anyone in a leadership position in finance.

Laura Bennett

Emma Johnson

The Financial Modeling and Valuation Course at MPES was incredibly insightful. The practical applications and real-world examples helped solidify my understanding of complex concepts. I highly recommend this course to anyone looking to enhance their financial acumen.

Emma JohnsonACA Roadmap

Have Questions? We’ve Got You

If you have any questions, we’re here to help. Find the answers you need in the MPES detailed FAQ section.

Q. What is the focus of the ACA Financial Accounting and Reporting: UK GAAP course?

The course focuses on understanding UK GAAP principles, preparing financial statements, and ensuring compliance with UK-specific reporting standards.

Q. Who should join this course?

This course is ideal for accountants, auditors, financial analysts, and professionals managing or analysing financial reports under UK GAAP.

Q. How will this course benefit my career?

This course enhances the learner’s knowledge of financial reporting, compliance, and decision-making, preparing you for advanced professional roles in financial management.

Q. Is prior knowledge required for this course?

Yes, a basic understanding of accounting principles is recommended for optimal learning outcomes.

Q. What learning outcomes can I expect?

You’ll gain skills in preparing financial statements, interpreting reports, ensuring compliance, and solving financial reporting challenges effectively.

Q. What topics are covered in the Financial Accounting and Reporting: UK GAAP (FAR) Course?

The course covers the UK GAAP framework, preparation of single entity and group financial statements, application of key standards, regulatory compliance, and interpretation of financial performance and position.

Q. How is the course assessed?

The FAR Course is assessed through a written exam that tests theoretical understanding and practical application of UK GAAP principles in financial reporting scenarios.

Q. What career opportunities does the course prepare learners for?

Completing the FAR Course equips learners with advanced knowledge to pursue roles in financial reporting, audit, and compliance, such as financial accountant, financial reporting specialist, or audit associate.

Q. What learning materials are provided during the course?

Learners receive comprehensive study guides, practice exams, access to interactive e-learning resources, and materials to ensure a well-rounded understanding of the subject matter.

Q. How does this course fit into the broader ACA Qualification framework?

The Financial Accounting and Reporting: UK GAAP (FAR) Course is part of the ACA Professional Level qualifications and provides the groundwork for more advanced ACA modules, building towards full ICAEW membership.

Related Courses

Explore additional courses designed to complement your learning journey and enhance your professional skills. Expand your knowledge with these expertly curated options tailored to your career goals.

Resources

Access a wide range of free resources to support your learning journey. From blogs to news and podcasts, these valuable guides are available at no cost to help you succeed.

Top 15 Effective Business Analysis Techniques to Achieve Success

Veronica Davis14-Jan-2025

Equity in Accounting: Meaning, Components & How to Calculate it

Maria Thompson10-Jan-2026

Accounting Principles: Definition, Types, Importance, and Benefits

Grace Mitchell22-Sep-2025

Drawings in Accounting: Definition, Characteristics, and Examples

Maria Thompson21-Jul-2025

The Best Accounting and Finance Books for Professionals and Students

Maria Thompson07-Jul-2025

Activity-Based Costing (ABC): Definition, Benefits & Limitations

Maria Thompson16-Jun-2025

Job Shadowing: How it Benefits Teams via Observational Learning

Maria Thompson13-Jun-2025

Deferred Revenue: Definition, Liability Risks & Examples Explained

Maria Thompson10-Jun-2025

18 High Income Skills to Master in 2026 for Great Profitability

Maria Thompson26-May-2025

AI in Workplace: Benefits & Examples Shaping the Future of Work

Maria Thompson20-May-2025

15 Reasons Why to Become an Accountant: Benefits & Career Growth

Maria Thompson14-May-2025

How to Motivate Yourself: 20 Powerful Tips for Self-improvement

Maria Thompson12-May-2025

What Is Accounting Software? Features, Types & Benefits Explained

Maria Thompson07-May-2025

Cyber Security for Business: Meaning, Importance & Tips Explained

Maria Thompson02-May-2025

What is Bookkeeping, Its Importance and How to Become a Bookkeeper

Maria Thompson28-Apr-2025

Freelancing vs Full-Time Employment: Choosing the Right Career Path

Maria Thompson25-Apr-2025

What is Financial Reporting: Types, Importance and Uses Explained

Maria Thompson21-Apr-2025

Asset Disposal: Definition, Types, Methods and Examples Explained

Maria Thompson16-Apr-2025

Allowable and Disallowable Expenses in the UK: Explained in Detail

Maria Thompson09-Apr-2025

What is Human Resource Management (HRM)? Principles and Functions

Maria Thompson08-Apr-2025

Navigating Career Transitions with the 10 Steps Framework Guide

Maria Thompson28-Mar-2025

Top 15 IT Soft Skills Every Tech Professional Should Have in 2025

Maria Thompson05-Mar-2025

Trade Payables: Definition, Benefits, Tips, and Examples for Business

Maria Thompson03-Mar-2025

What is Goodwill in Accounting? Importance, Types, and Examples

Maria Thompson11-Feb-2025

Audit vs. Assurance: Definitions, Key Differences & Similarities

Maria Thompson03-Feb-2025

What is DeepSeek R1 Model, and How it Ranks Against OpenAI's o1?

Maria Thompson31-Jan-2025

What Is Cash Basis Accounting? Definition, Example and New Updates

Maria Thompson29-Jan-2025

Corporate Tax Planning: Definition, Types, Strategies, and Benefits

Maria Thompson27-Jan-2025

The Power of Resilience: Strategies to Develop Your Inner Strength

Maria Thompson23-Jan-2025

Financial Accounting vs Management Accounting: What's the Difference?

Maria Thompson22-Jan-2025

Role of Mentorship in Career Development: A Catalyst for Success

Maria Thompson16-Jan-2025

What is a Stakeholder: Definition, Types and Examples Explained

Maria Thompson13-Jan-2025

15 Reasons You Should Invest in Professional Development: Explained

Maria Thompson03-Jan-2025

What is Corporate Governance: Principles, Models, and Best Practices

Maria Thompson23-Dec-2024

What Is Management Accounting? Types and Key Functions Explained

Maria Thompson18-Dec-2024

Accounting Secrets to Effective Budgeting: Proven Strategies for Creating Effective Budgets

Maria Thompson16-Dec-2024

Financial Accounting in a Remote Work Era: Adapting Key Practices

Maria Thompson12-Dec-2024

Future-ready Accountants: Top Certifications to Bridge Skills Gaps in 2025

Maria Thompson04-Dec-2024

Have Any Question?

Have Any Question?

+44 7452 122728

+44 7452 122728

Back

Back