Learning Options

- Live Interactive Sessions

- Dedicated 1-to-1 Tutor Support (30-min Weekly)

- Expert Trainers with Industry Experience

- Flexible Schedule

- Networking Opportunities

- High Pass Rates

- 24/7 Personalised Support

- Online Video-Based Learning

- Flexible Schedule

- Expert Trainers with Industry Experience

- High Pass Rates

- 24/7 Personalised Support

- Interactive Learning Materials

- Live Online Classes

- Expert Trainers with Industry Experience

- Live Assessment and Feedback

- Interactive Learning Materials

- Networking Opportunities

- High Pass Rates

Overview

The Foundations in Taxation (FTX) Course is designed for individuals aiming to gain a strong foundation in taxation principles and practices. Ideal for aspiring finance and accounting professionals, this course equips learners with the knowledge and skills required to navigate complex tax regulations effectively.

This course focuses on the principles of taxation, including income tax, corporate tax, and VAT, providing practical insights into compliance and tax planning. Learners will develop the ability to calculate tax liabilities and apply tax laws in real-world scenarios, ensuring accuracy and efficiency in financial operations.

Part of the foundational ACCA suite, this course lays the groundwork for understanding key taxation concepts and their application in various business contexts. It is an excellent starting point for learners looking to specialise in taxation or enhance their expertise for broader financial management roles.

Course Objectives

Develop a solid understanding of taxation principles and their application in business

Gain the ability to calculate tax liabilities for individuals and businesses

Learn to ensure compliance with current tax regulations and laws

Build proficiency in identifying and applying tax-saving opportunities where appropriate

Enhance skills in interpreting tax policies and their implications for decision-making

Establish a foundation for further studies and advanced qualifications in taxation and finance

Upon completion, learners will have the skills and knowledge to manage taxation tasks effectively, contribute to organisational compliance, and prepare for higher-level ACCA qualifications and career advancement.

Average completion time

1 Month

with unlimited support

100% online

Start anytime

Study At Your Own Pace

Blended Learning

Study At Your Own PaceCourse Includes

- Expert-led Sessions

- Digital Delegate Pack

- 24/7 Tutor Support

- Downloadable Resources & Challenges

- Interactive Learning

- Exercise Files

- Scenario-Based Learning

Course Details

Develop your understanding of essential financial, business and management accounting techniques with ACCA Applied Knowledge. You'll learn basic business and management principles and the skills required of an accountant working in business.

Entry Requirements

Educational Background: No prior taxation or finance experience is required. However, a basic understanding of mathematics and analytical reasoning will assist learners in navigating the course content effectively.

Language Proficiency: Learners should have a good command of English, as all course materials, assessments, and discussions are conducted in English.

Interest in Taxation and Finance: This course is ideal for those keen to understand tax systems and compliance, as well as for learners aiming to pursue further ACCA qualifications in taxation or related fields.

Learning Outcomes

Understand Taxation Principles: Gain a solid foundation in tax laws, including income tax, corporate tax, and VAT, and how they apply to individuals and businesses.

Develop Tax Calculation Skills: Learn to calculate tax liabilities accurately for both individuals and businesses, ensuring compliance with tax regulations.

Ensure Tax Compliance: Master the principles of tax compliance and understand how to interpret and apply tax legislation effectively.

Apply Taxation Strategies: Develop the ability to identify opportunities for tax savings and efficient tax planning within business contexts.

Target Audience

Aspiring Tax Advisors

Junior Tax Accountants

Finance Assistants

Accounts Clerks

Accounting Trainees

Payroll Managers

Business Consultants

The Foundations in Taxation (FTX) Course is ideal for individuals seeking to develop a strong understanding of taxation principles or begin their journey towards a professional qualification in finance. Below are the roles and individuals who can benefit from this course:

Course content

Principal sources of revenue law and practice

Different types of taxes

Adjustment of trading profits/losses for tax purposes

Capital allowances

Basis of assessments

Relief for trading losses

Partnerships

National Insurance contributions for the self-employed

Preparing relevant pages of a tax return

Introduction to personal taxation

Income from employment and Class 1 National Insurance Contributions

Income from property, savings, and investments

Comprehensive computation of taxable income and income tax liability

Use of pension contributions in deferring and minimising income tax liabilities

Income tax administration

Scope of the taxation of capital gains for individuals

Basic principles of computing gains and losses

Gains and losses on the disposal of shares and securities

Gains and losses on the disposal of movable and immovable property

Computation of capital gains tax payable by individuals and completion of the self-assessment tax return

Use of exemptions and reliefs in deferring and minimising tax liabilities arising on the disposal of capital assets

Scope of corporation tax

Taxable total profits

Comprehensive computation of corporation tax liability

Chargeable gains for companies

Relief for losses

Use of exemptions and reliefs in deferring and minimising corporation tax liabilities

Completing the corporation tax return

Corporation tax administration

Scope of value added tax (VAT)

VAT registration requirements

Basic principles of VAT

VAT invoices and records

Administration of VAT

Effect of special schemes

Preparing and completing VAT returns

Communicating VAT information

Using computer technology to efficiently access and manipulate relevant information

Working on relevant response options using available functions and technology

Navigating windows and computer screens to create and amend responses to exam requirements using appropriate tools

Presenting data and information effectively using the appropriate tools

Module 1: Introduction to the UK Tax System

Module 2: Adjusted Profit/Loss Computations for Trades and Professions

Module 3: Income Tax Liabilities

Module 4: Capital Gains Tax

Module 5: Corporation Tax Liabilities

Module 6: Value Added Tax (VAT)

Module 7: Employability and Technology Skills

MPES Support That Helps You Succeed

At MPES, we offer comprehensive support to help you succeed in your studies. With expert guidance and valuable resources, we help you stay on track throughout your course.

- MPES Learning offers dedicated support to help you succeed in Accounting and Finance courses.

- Get expert guidance from tutors available online to assist with your studies.

- Check your eligibility for exemptions with the relevant professional body before starting.

- Our supportive team is here to offer study advice and support throughout your course.

- Access a range of materials to help enhance your learning experience. These resources include practice exercises and additional reading to support your progress.

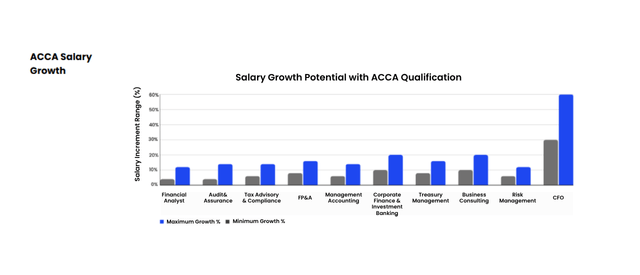

ACCA Salary Growth

Career Growth Stories

Discover how MPES Learning transforms careers with real success stories.

Arvy Pasanting

As a qualified accountant, studying at MPES has been a very rewarding experience. Its team of passionate and dedicated mentors gave me the confidence and knowledge I needed to not just excel at my current role as an auditor, but also inspired me to expand my horizons.

Arvy Pasanting

David Ford

I was recommended MPES after searching for a way to pursue a career in the accounting profession, I have studied with them throughout my journey utilising both their “in class” and online learning opportunities that fit around the needs of my employer, I have found them to be consummate professionals delivering first class accounting courses with support always available.

David Ford

Aaron Allcote

As a finance officer, MPES has been a huge help in understanding the process of recording and processing transactions from all different perspectives. The courses are very easy to follow, and the training they provide can be applied to real-life scenarios. The courses have been a huge help for me, and I would highly recommend them.

Aaron Allcote

Bob Beaumont

I completed all of my ACA studies with MPES and I think you would struggle to find a better training provider anywhere in the British Isles. MPES' tutors are excellent both at delivering training and giving individualised feedback and coaching. the supporting materials and the out of class support are also great.

Bob Beaumont

George Evans

The Financial Risk Management Course at MPES was invaluable in deepening my understanding of risk assessment and mitigation strategies. The hands-on learning approach allowed me to apply new concepts directly to my work. I highly recommend it for professionals in finance.

George Evans

James Robinson

As a financial consultant, I am always seeking ways to enhance my expertise. The Investment Analysis Course at MPES exceeded my expectations, offering practical skills and knowledge that I can apply immediately in my consulting work. It's an outstanding choice for professionals in finance.

James Robinson

Laura Bennett

The Corporate Finance Course I attended at MPES was transformative. The depth of knowledge shared by the instructors and the relevance of the topics covered have directly impacted on our financial strategy. I strongly endorse this program for anyone in a leadership position in finance.

Laura Bennett

Emma Johnson

The Financial Modeling and Valuation Course at MPES was incredibly insightful. The practical applications and real-world examples helped solidify my understanding of complex concepts. I highly recommend this course to anyone looking to enhance their financial acumen.

Emma JohnsonACCA Roadmap

Have Questions? We’ve Got You

If you have any questions, we’re here to help. Find the answers you need in the MPES detailed FAQ section.

Q. What does the ACCA Foundations in Taxation (FTX) course cover?

The course covers essential principles of taxation, including income tax, corporate tax, VAT, and capital gains. It focuses on compliance, tax calculations, and planning strategies, providing a comprehensive introduction to foundational tax practices.

Q. Who is this course for?

This course is ideal for tax assistants, finance administrators, and accountants aiming to enhance their knowledge of taxation. It’s also suitable for anyone starting their career in finance and taxation or pursuing ACCA qualifications.

Q. What skills will I gain?

Delegates will gain a solid understanding of tax laws, compliance procedures, and effective tax planning techniques. These skills include calculating liabilities, identifying tax-saving opportunities, and preparing accurate tax reports aligned with regulatory standards.

Q. Can I take this course without prior tax knowledge?

Yes, the ACCA Foundations in Taxation (FTX) course is designed for beginners and requires no prior tax knowledge. It provides a comprehensive introduction to taxation principles, making it accessible for those new to the field.

Q. What are the career benefits of this course?

Completing this course opens pathways to roles in tax preparation, compliance, and advisory services. It also provides a strong foundation for advanced qualifications, enhancing career prospects in finance and taxation.

Q. What is the Foundations in Taxation (FTX) course about?

The course provides a solid understanding of taxation principles, covering income tax, corporate tax, VAT, and compliance. It equips learners with the skills to calculate tax liabilities and apply tax laws in real-world scenarios.

Q. Who is this course suitable for?

This course is ideal for aspiring tax professionals, accounting trainees, and individuals interested in learning about tax systems, compliance, and planning, particularly those pursuing further ACCA qualifications in taxation.

Q. Are there any prerequisites for this course?

No prior taxation or finance experience is required. However, a basic understanding of mathematics and analytical thinking will be beneficial for understanding the course material effectively.

Q. How will this course benefit my career?

The course provides essential tax knowledge, preparing learners for roles in tax accounting, compliance, and financial management. It also serves as a stepping stone for further qualifications and career advancement in taxation.

Q. What materials and support are provided during the course?

Learners will receive comprehensive study materials, practical exercises, and expert guidance to ensure they master taxation principles, tax calculations, and compliance, enabling them to apply their knowledge in professional settings.

Related Courses

Explore additional courses designed to complement your learning journey and enhance your professional skills. Expand your knowledge with these expertly curated options tailored to your career goals.

Resources

Access a wide range of free resources to support your learning journey. From blogs to news and podcasts, these valuable guides are available at no cost to help you succeed.

Top 15 Effective Business Analysis Techniques to Achieve Success

Veronica Davis14-Jan-2025

Equity in Accounting: Meaning, Components & How to Calculate it

Maria Thompson10-Jan-2026

Accounting Principles: Definition, Types, Importance, and Benefits

Grace Mitchell22-Sep-2025

Drawings in Accounting: Definition, Characteristics, and Examples

Maria Thompson21-Jul-2025

The Best Accounting and Finance Books for Professionals and Students

Maria Thompson07-Jul-2025

Activity-Based Costing (ABC): Definition, Benefits & Limitations

Maria Thompson16-Jun-2025

Job Shadowing: How it Benefits Teams via Observational Learning

Maria Thompson13-Jun-2025

Deferred Revenue: Definition, Liability Risks & Examples Explained

Maria Thompson10-Jun-2025

18 High Income Skills to Master in 2026 for Great Profitability

Maria Thompson26-May-2025

AI in Workplace: Benefits & Examples Shaping the Future of Work

Maria Thompson20-May-2025

15 Reasons Why to Become an Accountant: Benefits & Career Growth

Maria Thompson14-May-2025

How to Motivate Yourself: 20 Powerful Tips for Self-improvement

Maria Thompson12-May-2025

What Is Accounting Software? Features, Types & Benefits Explained

Maria Thompson07-May-2025

Cyber Security for Business: Meaning, Importance & Tips Explained

Maria Thompson02-May-2025

What is Bookkeeping, Its Importance and How to Become a Bookkeeper

Maria Thompson28-Apr-2025

Freelancing vs Full-Time Employment: Choosing the Right Career Path

Maria Thompson25-Apr-2025

What is Financial Reporting: Types, Importance and Uses Explained

Maria Thompson21-Apr-2025

Asset Disposal: Definition, Types, Methods and Examples Explained

Maria Thompson16-Apr-2025

Allowable and Disallowable Expenses in the UK: Explained in Detail

Maria Thompson09-Apr-2025

What is Human Resource Management (HRM)? Principles and Functions

Maria Thompson08-Apr-2025

Navigating Career Transitions with the 10 Steps Framework Guide

Maria Thompson28-Mar-2025

Top 15 IT Soft Skills Every Tech Professional Should Have in 2025

Maria Thompson05-Mar-2025

Trade Payables: Definition, Benefits, Tips, and Examples for Business

Maria Thompson03-Mar-2025

What is Goodwill in Accounting? Importance, Types, and Examples

Maria Thompson11-Feb-2025

Audit vs. Assurance: Definitions, Key Differences & Similarities

Maria Thompson03-Feb-2025

What is DeepSeek R1 Model, and How it Ranks Against OpenAI's o1?

Maria Thompson31-Jan-2025

What Is Cash Basis Accounting? Definition, Example and New Updates

Maria Thompson29-Jan-2025

Corporate Tax Planning: Definition, Types, Strategies, and Benefits

Maria Thompson27-Jan-2025

The Power of Resilience: Strategies to Develop Your Inner Strength

Maria Thompson23-Jan-2025

Financial Accounting vs Management Accounting: What's the Difference?

Maria Thompson22-Jan-2025

Role of Mentorship in Career Development: A Catalyst for Success

Maria Thompson16-Jan-2025

What is a Stakeholder: Definition, Types and Examples Explained

Maria Thompson13-Jan-2025

15 Reasons You Should Invest in Professional Development: Explained

Maria Thompson03-Jan-2025

What is Corporate Governance: Principles, Models, and Best Practices

Maria Thompson23-Dec-2024

What Is Management Accounting? Types and Key Functions Explained

Maria Thompson18-Dec-2024

Accounting Secrets to Effective Budgeting: Proven Strategies for Creating Effective Budgets

Maria Thompson16-Dec-2024

Financial Accounting in a Remote Work Era: Adapting Key Practices

Maria Thompson12-Dec-2024

Future-ready Accountants: Top Certifications to Bridge Skills Gaps in 2025

Maria Thompson04-Dec-2024

Have Any Question?

Have Any Question?

+44 7452 122728

+44 7452 122728

Back

Back