Table Of Contents

When managing business finances, one key question arises - should you choose Cash or Accrual Accounting? This choice impacts how you track profits, handle taxes, manage cash flow, and plan growth. Cash vs Accrual Accounting isn’t just a technical decision; it also influences budgeting and shapes how investors view your business. So, how do you know which method is right for you?

In this blog, we’ll explore what Cash vs Accrual Accounting means, compare their key differences, and help you decide which is the best fit for your business.

Table of Contents

What is Cash Basis Accounting?

What is Accrual Basis Accounting?

Differences Between Cash and Accrual Accounting

Cash vs Accrual Accounting: Which One Should You Use?

Conclusion

What is Cash Basis Accounting?

Cash basis accounting is a straightforward approach where transactions are recorded only when cash actually changes hands. This means revenue is recognised when you receive payment from a customer, and expenses are recorded when you pay a bill.

For instance, if you send a client an invoice in December and they pay you in January, you record that income in January the moment the cash enters your bank account. This method keeps your books closely aligned with your bank statement, making it ideal for businesses with a low volume of transactions.

Benefits of Cash Accounting

Simple to Maintain: No need to track complex entries like accruals or deferrals. Everything is recorded as it happens.

Real-time Cash Insights: Since you only record actual cash movement, your financial reports always reflect your current cash position.

Lower Administrative Burden: Accounts can easily be managed in-house using basic tools like Excel or simple accounting apps.

Favourable Tax Timing: You're taxed only on income you’ve received, which can allow you to defer taxes by managing the timing of payments.

Limitations of Cash Accounting

No Future Tracking: Cash Accounting doesn’t automatically show outstanding payments or upcoming bills.

Misleading Reports: Income spikes can appear due to delayed payments, not actual growth.

Limited Acceptance: Many investors, banks, and tax authorities prefer Accrual Accounting for larger businesses.

Not for Inventory Businesses: Companies with inventory or high revenue often must use Accrual Accounting by law.

Master performance metrics with our CIMA’s CGMA® Managing Performance (E2) Course now.

What is Accrual Basis Accounting?

Accrual basis accounting offers a complete financial view by recording income when earned and expenses when incurred, irrespective of when cash is exchanged. For example, a December invoice is recorded as December income, even if the payment arrives in January.

Similarly, if you receive a supplier’s invoice in November but pay it in December, it still counts as a November expense. This matching principle ensures income and related expenses are recorded in the same period, giving a clearer picture of financial performance.

Benefits of Accrual Accounting

More Accurate Financial Reports: Reflects true business performance by matching income and expenses to the correct periods.

Better Forecasting: With receivables and payables accounted for, you can plan cash flow, budgets, and future financial commitments more effectively.

Stronger Stakeholder Confidence: Banks and investors prefer accrual-based reports for assessing financial stability and growth.

Regulatory Compliance: Aligns with Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS).

Advance your reporting skills and stay compliant with our CIMA’s CGMA® Advanced Financial Reporting (F2) Course today!

Limitations of Accrual Accounting

More Complex: Requires detailed tracking of non-cash items and accurate financial systems.

Cash Flow Challenges: You may owe taxes on unpaid income, potentially creating cash flow strain.

Higher Accounting Costs: Often requires professional support or advanced accounting software.

Increased Paperwork: Managing transactions across periods demands greater administrative effort.

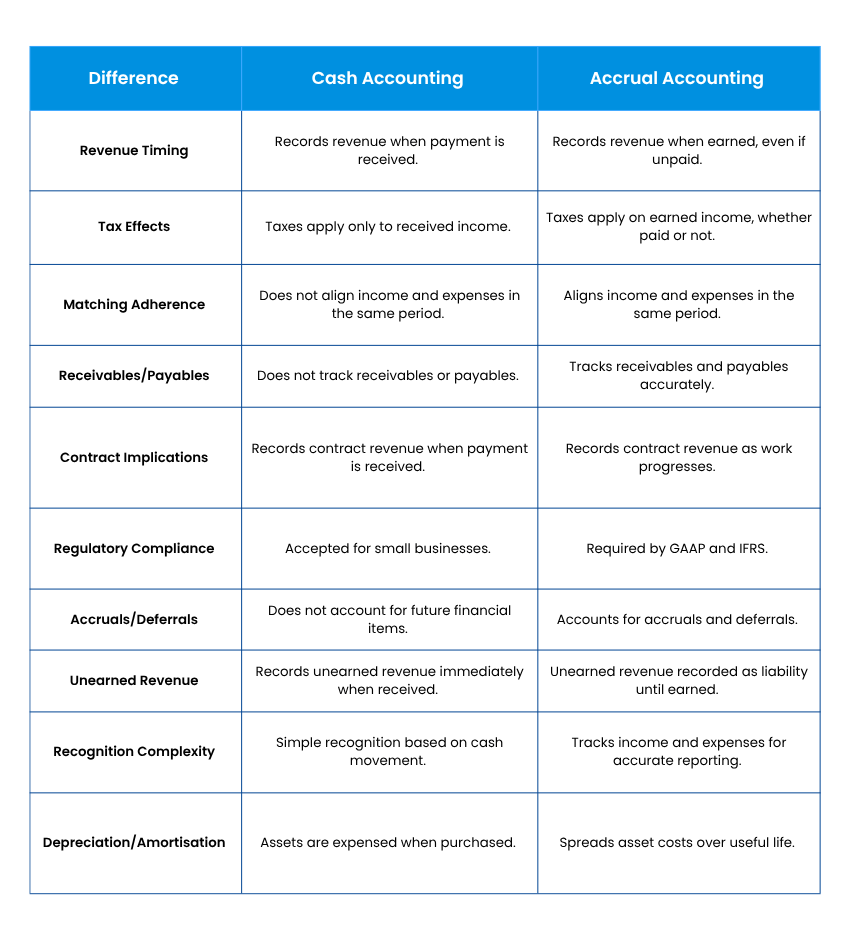

Differences Between Cash and Accrual Accounting

Let’s now look at where these methods diverge in practical terms:

1. Revenue Timing

Cash Accounting:

Revenue is documented only when payment is received, providing a real-time view of cash flow but not necessarily when the work was done. This method is clear and appropriate for businesses with straightforward, immediate transactions.

Accrual Accounting:

Revenue is recorded when it is earned, offering a more accurate financial picture even if the payment is received later. It helps match income to the correct reporting period, improving financial accuracy and planning.

2. Tax Effects

Cash Accounting:

Taxes are paid only on income actually received, which may help small businesses manage cash flow and tax liabilities. This method can offer some flexibility in timing income to manage taxable amounts.

Accrual Accounting:

Taxes must be paid on all earned income, even if the cash hasn’t been collected yet. This can create tax obligations before cash is in hand, affecting cash flow management.

3. Matching Adherence

Cash Accounting:

Does not follow the matching principle, meaning income and related expenses might not appear in the same period. This can cause income statements to look inconsistent and may not reflect true profitability.

Accrual Accounting:

Follows the matching principle by aligning income and expenses in the same reporting period. This provides a clearer and more consistent view of financial performance.

4. Receivables/Payables

Cash Accounting:

Does not track accounts receivable or accounts payable, so unpaid bills and future income are not visible in the records. This limits long-term financial visibility and may overlook outstanding obligations.

Accrual Accounting:

Actively records receivables and payables, providing a complete view of what is owed and what is due. This helps businesses manage cash flow, credit, and financial planning more effectively.

5. Contract Implications

Cash Accounting:

Records contract revenue only when payments are received, potentially delaying revenue recognition. This may understate income during ongoing projects and misalign with project progress.

Accrual Accounting:

Recognises contract revenue as work progresses, even if payments are pending. This method offers an accurate financial snapshot for long-term or project-based contracts.

6. Regulatory Compliance

Cash Accounting:

Often accepted for small businesses but may not meet regulatory standards for larger organisations. It’s usually not accepted by banks, investors, or international accounting standards for complex businesses.

Accrual Accounting:

Required under Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS). It is widely accepted by regulators, investors, and financial institutions for accurate reporting.

7. Accruals/Deferrals

Cash Accounting:

Does not account for accruals or deferrals, meaning future income and expenses are not included in the records. This limits the ability to reflect upcoming obligations or revenues accurately.

Accrual Accounting:

Actively records accruals and deferrals, ensuring financial statements reflect all expected income and expenses. This approach supports better forecasting and reporting across multiple periods.

8. Unearned Revenue

Cash Accounting:

Records unearned revenue immediately when cash is received, even if the service is not yet provided. This may inflate revenue figures before the work is actually performed.

Accrual Accounting:

Records unearned revenue as a liability until the product or service is delivered. This ensures revenue is only recognised when it is truly earned.

9. Recognition Complexity

Cash Accounting:

Recognition is simple; just record when money is received or paid. This keeps accounting easy but provides limited financial detail.

Accrual Accounting:

Recognition involves detailed tracking of earned income and incurred expenses. Though more complex, it offers accurate and complete financial statements.

10. Depreciation/Amortisation

Cash Accounting:

Does not systematically record depreciation or amortisation; assets are typically expensed when purchased. This can misstate long-term asset value and profitability.

Accrual Accounting:

Spreads asset costs over their useful life through depreciation or amortisation. This provides a more realistic view of asset value and expense allocation over time.

Sharpen strategic insights and cost control with our CIMA’s CGMA® Advanced Management Accounting (P2) Course now!

Cash vs Accrual Accounting: Which One Should You Use?

Choosing between Cash and Accrual Accounting depends on your business size and financial needs. Cash Accounting is simple and ideal for small businesses and freelancers who need real-time tracking of cash flow.

Accrual Accounting suits growing businesses with complex transactions, offering a clearer long-term financial picture by recording income and expenses when they are incurred. Selecting the right method can improve financial reporting, tax management, and decision-making based on your business’s structure and growth plans.

Conclusion

Choosing between Cash vs Accrual Accounting depends on your business size, complexity, and financial goals. Cash Accounting offers simplicity and real-time tracking, while Accrual Accounting provides accuracy and long-term insights. Understanding both methods helps you make informed decisions that support growth, improve reporting, and align with your financial strategy.

Prepare for real-world finance challenges with our CIMA’s CGMA® Management Level Case Study.

Have Any Question?

Have Any Question?

+44 7452 122728

+44 7452 122728

Back

Back

44 7452 122728

44 7452 122728