Table Of Contents

Every business wants clarity over its money, yet achieving that is not always simple. Daily transactions, payments, expenses, and income can quickly become difficult to track without a structured system in place. To bring order to this complexity, businesses rely on the General Ledger.

It organises all financial activities and helps businesses maintain control over their finances. In this blog, you will discover What is General Ledger, how it works, why it matters, and how it supports smarter financial decisions. Let's get started!

What is a General Ledger (GL)?

A General Ledger, commonly known as a GL, is the primary accounting record that contains all financial transactions of a business. It serves as a complete collection of all accounts used by a company, including assets, liabilities, equity, income, and expenses.

Whenever a business buys something, sells something, pays money, or receives money, that transaction is recorded. First, the transaction is written in a journal. After that, it is transferred to the General Ledger. Over time, the ledger becomes a complete record of the organisation’s financial activities.

Why is the General Ledger Important?

General Ledger is important because it provides a single, reliable source of financial data. All major financial reports are prepared using this information from the GL. It ensures that financial records remain consistent, traceable, and accurate across all accounting activities.

The General Ledger also helps business owners and managers understand how the business is performing. By looking at ledger balances, they can see whether income is increasing, expenses are under control, or cash is running low. This makes it easier to plan for the future and avoid financial problems.

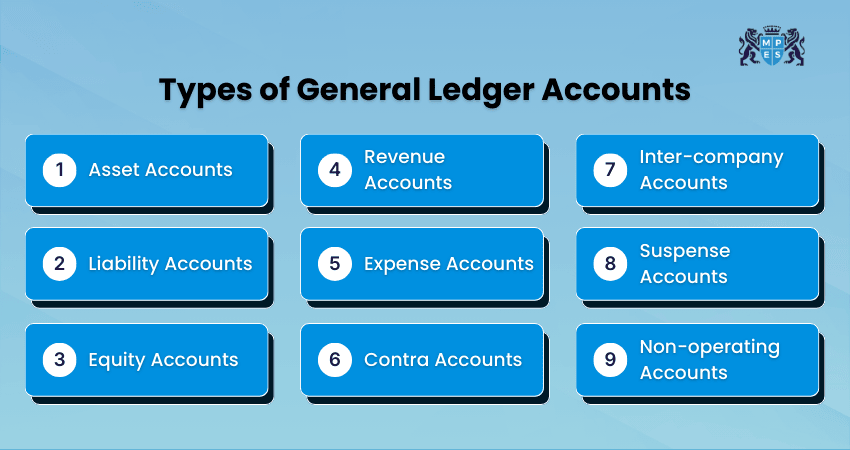

Types of General Ledger Accounts

General Ledger accounts are grouped into categories based on the type of financial information they record. Each account plays a specific role in showing the overall financial position of a business. Common types of GL include the following:

1) Asset Accounts

Asset accounts show what the business owns. These resources help the business operate and generate income over time. Asset accounts usually increase when money or value comes into the business.

Examples Include:

1) Cash

2) Accounts receivable

3) Inventory

4) Equipment

5) Buildings

2) Liability Accounts

Liability accounts show what the business owes to others. These amounts must be paid in the future and represent financial responsibilities of the business.

Examples Include:

1) Accounts payable

2) Loans payable

3) Salaries payable

4) Unpaid bills

5) Taxes due

3) Equity Accounts

Equity accounts represent the owner’s or shareholders’ claim on the business after all liabilities are paid. They reflect the value invested in the business and the profits retained over time.

Examples Include:

1) Owner’s capital

2) Common stock

3) Retained earnings

4) Revenue Accounts

Revenue accounts record income earned from normal business operations. These accounts show how much money the business generates by selling goods or providing services.

Examples Include:

1) Sales revenue

2) Service fees

Learn how to record transactions accurately with Maintaining Financial Records (FA2) Training – Register today!

5) Expense Accounts

Expense accounts track the costs required to run the business. Monitoring expenses helps businesses control spending and improve profitability.

Examples Include:

1) Rent

2) Salaries expense

3) Utilities

4) Depreciation

6) Contra Accounts

Contra accounts are used to reduce the balance of a related main account. They help present a more accurate value of assets or liabilities in financial records.

Examples Include:

1) Accumulated depreciation

2) Allowance for doubtful accounts

7) Intercompany Accounts

Inter-company accounts record transactions between related entities within the same organisation. These accounts help track internal transfers and balances accurately.

Examples Include:

1) Intercompany receivables

2) Intercompany payables

8) Suspense Accounts

Suspense accounts temporarily hold transactions when information is incomplete or unclear. Once details are confirmed, amounts are moved to the correct accounts.

Examples Include:

1) Unidentified payments

2) Unclassified receipts

9) Non-operating Accounts

Non-operating accounts record income or expenses that do not arise from core business activities. These items are usually irregular or unrelated to daily operations.

Examples Include:

1) Investment gains or losses

2) Sale of fixed assets

How a General Ledger Works?

The General Ledger records all the money a business earns and spends. It works as the main system for recording and organising all financial activities in a business. Here's how it works:

1) Set up the Chart of Accounts

The process starts by creating a chart of accounts. It includes a list of accounts a business uses, such as cash, expenses, sales, loans, and capital. Each account is given a unique number or name to help organise transactions.

2) A Financial Transaction Occurs

A transaction happens when the business receives money, pays a bill, buys something, or makes a sale. Every financial activity involving money needs to be recorded.

3) Recording as a Journal Entry

Each transaction is first documented through a journal entry. This includes debit and credit records to show how the transaction affects different accounts. Debits usually increase assets or expenses, while credits usually increase liabilities, equity, or revenue.

4) Posting to the General Ledger

After recording the transaction in the journal, it is transferred to the correct accounts in the General Ledger. This step transfers the transaction details and updates individual account balances.

5) Updating Account Balances

Each account in the General Ledger shows a running total. This allows businesses to see how much cash they have, how much they owe, and how much they have earned or spent.

6) Preparing a Trial Balance

At the end of an accounting period, a trial balance is created to check that total debits match total credits. A trial balance is a summary of all General Ledger account balances prepared to verify the accuracy of accounting records. This helps identify errors in your financial records.

7) Adjustments and Reconciliation

After preparing the trial balance, necessary adjustments are made for items such as accruals, prepayments, or errors. The General Ledger is then reconciled with bank statements and supporting documents to ensure that all records are complete, accurate, and up to date.

8) Financial Reporting and Analysis

Finally, the information from the General Ledger is used to prepare financial reports. These reports help businesses understand their financial position, track performance, and make better decisions.

Understand key accounting principles with the Financial Accounting (FFA) Course – Join now!

Benefits of the General Ledger

The General Ledger offers multiple benefits that help businesses manage their finances effectively. Such benefits include the following:

1) Easier Tax Filing

The General Ledger keeps all income and expenses properly organised throughout the year. This reduces errors during tax calculations and saves time when preparing tax returns. Clear and structured records also make it easier to meet tax regulations and provide accurate information to tax authorities when required.

2) Preparation of Financial Statements

A well-maintained General Ledger organises financial data in a way that allows faster and more accurate preparation of financial statements. It supports the creation of balance sheets and income statements while making it easier to compare results across different accounting periods. This reduces the overall effort involved in reporting.

3) Simplified Auditing

The General Ledger provides a clear audit trail for every transaction recorded by the business. This makes it easier to verify records, reduces audit time, and minimises complications during reviews. Transparent and traceable records also help build trust with auditors and external stakeholders.

4) Final Balances of Specific Accounts

Each account in the General Ledger shows an up-to-date balance, allowing businesses to monitor cash, liabilities, income, and expenses at any time. This visibility supports budgeting, forecasting, and financial control while simplifying the review of individual accounts when needed.

5) Identification of Unusual Transactions

By reviewing General Ledger entries regularly, businesses can quickly identify unusual or unexpected transactions. This helps detect errors, duplicate entries, or potential fraud early. Early identification improves the accuracy of financial records and prevents long-term financial issues.

6) Evaluation of the Company’s Financial Health

The General Ledger provides a complete overview of a company’s financial position. It helps assess profitability, cash availability, and outstanding obligations. With this information, businesses can plan effectively, manage risks, and make informed strategic decisions.

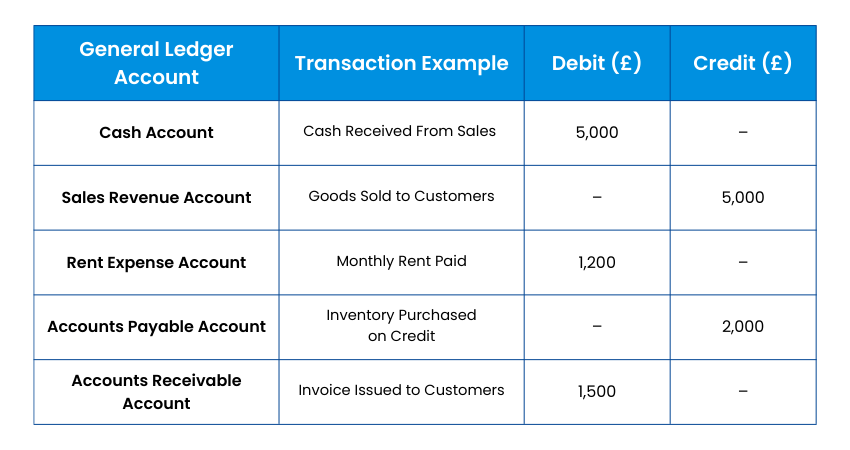

Example of General Ledger Accounts

To understand how a General Ledger works in real life, let’s consider a small retail business during one month of operations. The table below shows how common transactions are recorded in different accounts. Each transaction affects specific accounts through debit or credit entries.

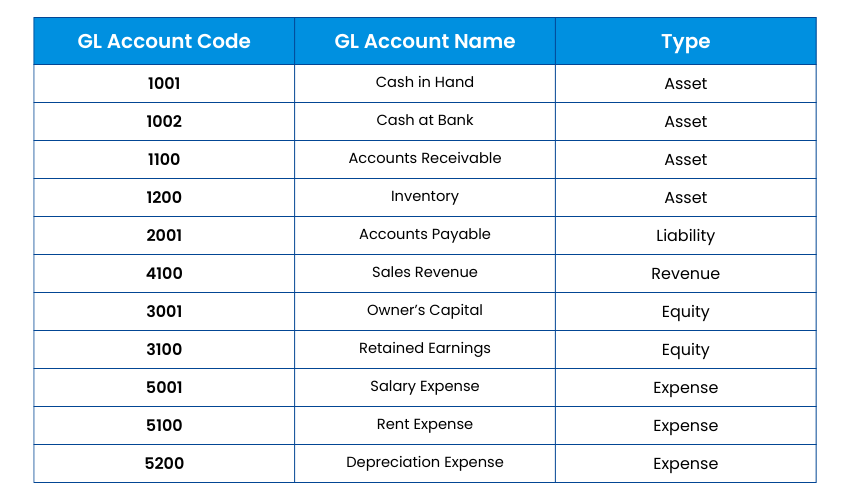

Now that you know how each transaction is recorded, let’s check how GL accounts are grouped with codes:

Conclusion

The General Ledger is one of the most important parts of accounting. It records every financial transaction and keeps all accounts organised in one place. Without it, businesses would find it difficult to prepare reports, manage cash, or understand their financial position. Whether you are an accountant, business owner, or finance student, mastering it is inevitable for long-term success.

Gain practical accounting skills for today’s business world with ACCA Foundations Training – Explore now!

Have Any Question?

Have Any Question?

+44 7452 122728

+44 7452 122728

Back

Back

44 7452 122728

44 7452 122728