Table Of Contents

In business, there are only two financial states: control or chaos. Either you know your financial status and make accurate decisions, or you rely on guesswork and hope everything works out. When finances are not clearly tracked, even small mistakes can become serious problems. In such cases, Business Accounting is what brings order to your financial uncertainty.

It helps you track income, manage expenses, and understand your profit levels. In this blog, you will learn what Business Accounting is, its key types, practical management steps, and the benefits it offers for building a stable business. Let's dive in!

What is Business Accounting?

Business Accounting is the structured process of recording, analysing, interpreting, and reporting a company’s financial information. At its core, it helps organisations understand what a business earns, what it spends, what it owns, and what it owes. In simple words, it helps businesses understand their financial status.

Business Accounting also plays an important role in decision-making and long-term planning. With accurate accounting records, Business Owners can monitor profits, control expenses, manage cash flow, and ensure compliance with tax regulations.

Fundamentals of Business Accounting

Understanding Business Accounting starts with its core principles. These fundamentals shape how financial data is collected, classified, and reported. Business Accounting has its accounting equation:

Assets = Liabilities + Equity

This equation ensures that financial records remain balanced and transparent. It shows that everything a business owns comes either from borrowed money or the owner’s investment. Now, let’s check the fundamentals of Business Accounting:

1) Assets, Liabilities, and Equity

1) Assets: Assets are everything a business owns that has financial value. This includes cash, equipment, property, inventory, and even accounts receivable.

2) Liabilities: Liabilities are the amounts the business owes to others. These include bank loans, supplier payments, rent due, and taxes that must be paid.

3) Equity: Equity is the owner’s share in the business. It is what remains after subtracting liabilities from assets. If a business sells everything and pays off all debts, equity is what the owner would keep.

2) Double-entry System

The double-entry system is a core accounting method used to record transactions accurately. For every debit entry recorded in one account, there is an equal and corresponding credit entry in another. This helps maintain accuracy, reduces errors, and provides a complete view of a business’s financial activities.

For example, if a business purchases equipment with cash, one account (equipment) increases while another account (cash) decreases. This balance keeps financial records reliable and organised.

3) Financial Statements

Financial statements summarise a company’s financial performance and position. They provide structured reports that help business owners, investors, and stakeholders understand how the company is performing.

The three main financial statements include:

1) Income Statement: Shows revenue, expenses, and profit over a specific period

2) Balance Sheet: Displays assets, liabilities, and equity at a particular point in time

3) Cash Flow Statement: Tracks how cash moves in and out of the business

Unlock your accounting potential with CIMA Fundamentals of Financial Accounting (BA3) Training – Explore now!

4) Cash Accounting vs Accrual Accounting

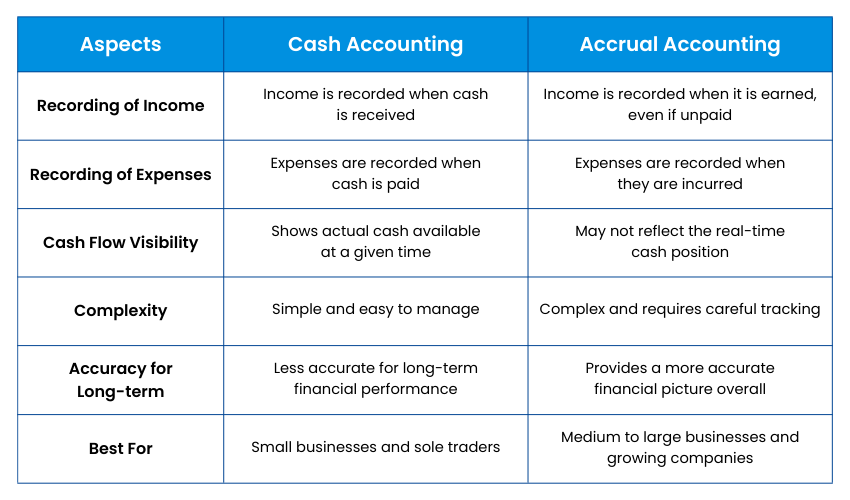

Businesses can record their income and expenses in two main ways. Cash accounting records money only when it is actually received or paid. On the other hand, accrual accounting recognises income at the time it is earned and records expenses when they are incurred, regardless of when the actual payment is received or made.

Here is a detailed difference between cash accounting and accrual accounting:

![]() What are the Different Types of Business Accounting?

What are the Different Types of Business Accounting?

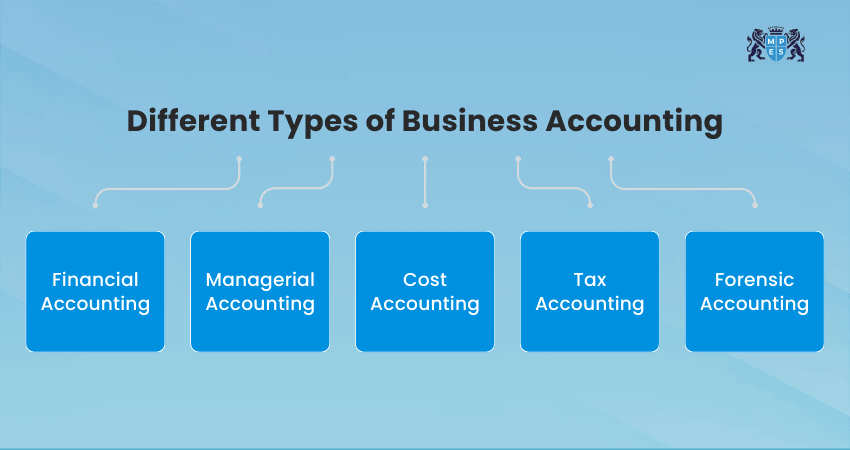

Business Accounting includes different types, and each type serves a different purpose. Here are the most common types:

1) Financial Accounting

Financial accounting focuses on preparing reports for people outside the business, such as investors, banks, and government authorities. These reports involve the income statement, balance sheet, and cash flow statement.

2) Managerial Accounting

Managerial accounting is used by managers inside the company. It helps them plan, control budgets, and make smart business decisions. It also provides detailed reports, cost analysis, and performance reviews.

3) Cost Accounting

Cost accounting focuses on understanding how much it costs to produce goods or services. It looks at expenses such as materials, labour, and overhead costs. By calculating this, businesses can set better prices and find ways to reduce waste.

4) Tax Accounting

Tax accounting focuses on preparing and filing tax returns. It focuses on calculating taxable income, deductions, credits, and liabilities. Proper tax accounting ensures accurate filings, minimises tax risk, and supports strategic tax planning.

5) Forensic Accounting

Forensic accounting is used to investigate financial problems, such as fraud, financial misconduct, or disputes. Forensic Accountants examine financial records to find mistakes or illegal activities. It combines accounting knowledge with investigative skills.

Steps to Manage Your Business Accounting

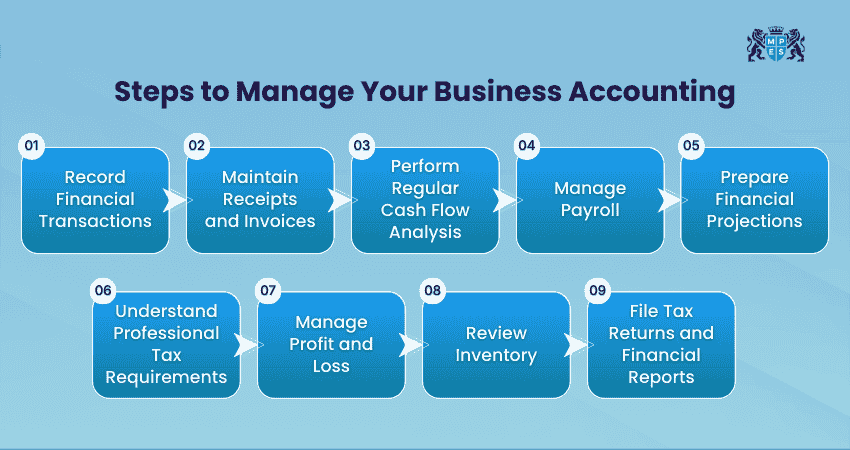

Managing your Business Accounting requires regular attention, organised systems, and clear processes to keep your finances accurate and under control. Here are the steps you can follow to maintain accurate financial records:

1) Record Financial Transactions

Recording financial transactions is the first step in managing your Business Accounting. Every sale, purchase, payment, and expense needs to be recorded on time. If you forget or delay recording them, it can cause mistakes in your financial reports.

Tips to Consider:

1) Use reliable accounting software tools

2) Separate business and personal expenses

3) Match records with bank statements regularly

4) Review records weekly for accuracy

2) Maintain Receipts and Invoices

Receipts and invoices act as proof of financial transactions and support transparency. Keeping them organised helps during audits, tax filing, and financial reviews. Poor documentation can cause compliance issues or lost deductions.

Tips to Consider:

1) Store documents in digital format

2) Categorise receipts by expense type

3) Keep backup copies securely stored

4) Review documents before finalising them

3) Perform Regular Cash Flow Analysis

Cash flow analysis shows how money moves in and out of your business. It shows how much cash is coming in from sales and how much is going out for expenses like rent, salaries, and bills. By tracking this, you can spot problems and avoid running short of money.

Tips to Consider:

1) Monitor weekly incoming and outgoing cash

2) Predict future cash requirements

3) Maintain emergency cash reserves

4) Follow up on overdue payments

4) Manage Payroll

Payroll Management makes sure that employees are paid correctly and on time. It includes salary calculations, deductions, bonuses, and tax compliance. Errors in payroll can affect employee trust and legal standing. A systematic payroll process keeps operations smooth and compliant.

Tips to Consider:

1) Automate payroll processing systems

2) Verify employee records regularly

3) Stay updated with tax regulations

4) Schedule payroll dates consistently

5) Prepare Financial Projections

Financial projections estimate future income, expenses, and profits. They help businesses plan for growth, investments, and potential risks. Accurate forecasting supports better budgeting, resource allocation, and strengthens future business plans.

Tips to Consider:

1) Analyse past financial performance trends

2) Use realistic revenue growth assumptions

3) Include fixed and variable costs

4) Prepare for the best and worst scenarios

6) Understand Professional Tax Requirements

Tax compliance is essential for avoiding penalties and legal issues. Businesses need to understand applicable tax rates, deadlines, and filing requirements. Ignoring tax responsibilities can create serious financial problems and penalties.

Tips to Consider:

1) Track all tax-related deadlines carefully

2) Consult professional tax advisors if required

3) Maintain organised tax documentation

4) Set aside funds for tax payments

Deepen your business law essentials knowledge with CIMA Fundamentals of Ethics, Corporate Governance and Business Law (BA4) Course – Sign up soon!

7) Manage Profit and Loss

The profit and loss statement reflects whether your business is earning or losing money. Reviewing this statement helps identify cost-saving opportunities. It also highlights areas where revenue can be increased.

Tips to Consider:

1) Review monthly profit and loss reports

2) Identify high-performing revenue streams

3) Cut unnecessary operational expenses

4) Compare performance with previous statements

8) Review Inventory

Inventory Management directly affects cash flow and business profits. Overstocking ties up capital, while understocking leads to lost sales. Regular reviews ensure accurate stock levels and proper valuation while supporting smoother operations.

Tips to Consider:

1) Conduct regular stock audits

2) Use Inventory Management software systems

3) Track fast-moving product categories

4) Analyse demand trends before restocking

9) File Tax Returns and Financial Reports

Filing your tax returns and financial reports on time helps your business comply with the law. If you delay, you may have to pay fines, and it can harm your business reputation. Therefore, setting a clear schedule for reporting helps you avoid last-minute pressure and mistakes.

Tips to Consider:

1) Review tax law updates regularly

2) Verify bank statements before filing

3) Keep copies of previous tax returns

4) Conduct an internal review before final submission

What are the Benefits of Business Accounting?

Let's now check the benefits gained from implementing a proper Business Accounting:

1) Better Financial Control: Tracks income and expenses clearly, helping businesses manage budgets and avoid unnecessary financial risks.

2) Improved Decision-making: Provides accurate financial data that supports smarter planning, investments, and strategic business decisions.

3) Legal Compliance and Tax Management: Ensures timely tax filing and compliance with regulations, reducing penalties and legal complications.

4) Better Cash Flow Management: Monitors cash inflows and outflows to prevent shortages and maintain smooth daily operations.

5) Supports Business Growth: Identifies profitable areas and builds investor confidence, supporting long-term expansion and stability.

Conclusion

Business Accounting is not just about maintaining records; it is about building financial clarity and control. When you understand your income, expenses, assets, and liabilities, you are better prepared to make informed decisions and avoid costly mistakes. In the end, clear numbers lead to smarter decisions and a stronger future for your business.

Turn data into smart business decisions with CIMA Fundamentals of Management Accounting (BA2) Training – Register today!

Have Any Question?

Have Any Question?

+44 7452 122728

+44 7452 122728

Back

Back

44 7452 122728

44 7452 122728