Table Of Contents

Assets and profits matter, but Equity is what truly shows who owns a business and how stable it is. While revenue and asset values are often focused, Equity in Accounting reveals the real financial position by showing the value that remains after all liabilities are settled. It reflects ownership, financial strength, and the long-term sustainability of a business.

Understanding Equity helps you read financial statements with clarity, assess business health accurately, and make better financial decisions. In this blog, you will explore what is Equity in Accounting, how to calculate it, its types, components, and real-world applications. Let's dive in!

What is Equity in Accounting?

Equity in Accounting is generally the book value of a company in its balance sheet. It refers to the owners’ share in a business when all liabilities are deducted from the company’s total assets. It is directly linked to what a business owns and what it owes.

Equity = Total Assets – Total Liabilities

Equity can originate from multiple sources. It may come from the initial capital invested by owners, additional investments over time, profits of the business, or gains from issuing shares. At the same time, Equity can decrease due to losses, withdrawals, or dividend payments to shareholders.

Why is Equity Important in Accounting?

Equity in Accounting plays a central role in understanding a company’s financial stability and performance. For business owners, it indicates how much value they have built over time. Below are the key reasons why equity is important:

1) Shows Ownership Value: Equity represents the portion of a business that belongs to its owners or shareholders, helping determine who owns the company and in what proportion.

2) Indicates Financial Stability: A strong Equity position shows that a business can cover its liabilities and still retain value, indicating financial health and lower risk.

3) Supports Investment Decisions: Investors use Equity to check whether a company is worth investing in and to evaluate its long-term growth potential.

4) Measures Business Performance: Changes in Equity over time reflect profits, losses, and management efficiency, helping track overall business performance.

5) Assists in Financial Analysis: Equity is used in key financial ratios, such as return on equity, which help compare performance across periods or with other businesses.

6) Helps in Loan Approval: Lenders analyse Equity to judge a company’s ability to repay debt. Higher equity usually improves creditworthiness.

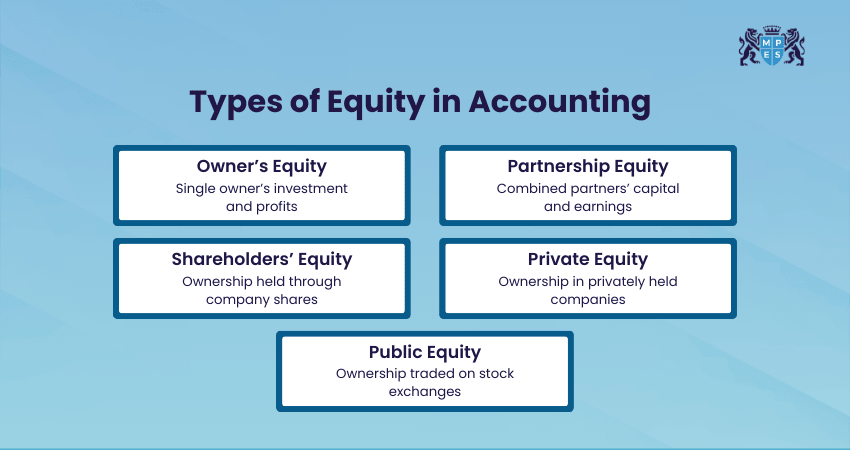

Types of Equity in Accounting

Equity in Accounting can take different forms depending on the business structure and ownership model. Each type explains how ownership interests and financial value are recorded and managed. Below are some of the most common types of equity:

1) Owner’s Equity

Owner’s Equity is used in businesses owned by one person, such as sole proprietorships. It shows how much the owner has invested in the business, along with the profits earned, minus money taken out for personal use. All profits and losses directly affect the owner. It is used:

1) To represent the owner’s financial stake in the business

2) To track capital invested by the owner

3) To record business profits and losses

4) To prepare balance sheets for sole proprietorships

5) To support tax reporting and financial planning

2) Partnership Equity

Partnership Equity applies to businesses owned by two or more people. Each partner has a separate capital account showing their investment, profit share, and withdrawals. Total partnership equity is the combined value of all partners’ capital accounts. This has been used:

1) To allocate profits and losses among partners

2) To record individual partner contributions

3) When partners join or leave the business

4) To reduce disputes through clear financial records

5) For accurate partnership Accounting and reporting

3) Shareholders’ Equity

Shareholders’ Equity belongs to companies owned by shareholders. It includes money raised by issuing shares, profits kept in the business, and reserves. Ownerships of this type are divided into shares that can be bought and sold. It is used:

1) To show ownership in a company

2) To check a company’s financial strength

3) To help investors make decisions

4) To calculate return on equity

5) For company financial statements

4) Private Equity

Private Equity refers to ownership in privately held companies that are not listed on stock exchanges. It is usually invested in by founders, private investors, or private equity firms, often to support growth or restructuring. Here is for what purpose it has been used:

1) To finance business growth and expansion

2) To restructure underperforming companies

3) To support mergers and acquisitions

4) To be involved in long-term strategic investment

5) For startup and growth-stage investments

5) Public Equity

Public Equity refers to ownership in companies that are publicly traded on stock exchanges. It allows investors to buy and sell shares easily, providing liquidity and market-based valuation. This type of Equity is typically used to:

1) To raise capital from public investors

2) To enable the buying and selling of shares in stock markets

3) To determine a company’s market value

4) To support large-scale business growth

5) For investment and market performance analysis

Master key finance concepts such as audit evidence and assurance engagement with the Assurance (AS) Course – Register today!

Components of Equity

Equity is made up of several components that show how ownership value is created and maintained in a business. These components can vary by business type, but together they represent the total owners’ or shareholders’ interest. Those include:

1) Owner’s Capital: Money invested by the owner into the business. It is common in sole proprietorships and partnerships.

2) Share Capital: Funds raised by a company by issuing shares to investors. This includes ordinary and preference shares.

3) Additional Paid-in Capital (APIC): The extra amount investors pay above the face value of shares.

4) Retained Earnings: Profits kept in the business after paying dividends. These are reinvested to support growth.

5) Reserves: Portions of profits set aside for specific purposes, such as expansion, legal requirements, or asset revaluation.

6) Treasury Shares: Shares that a company has repurchased from the market. These reduce total shareholders’ Equity.

7) Accumulated Other Comprehensive Income (AOCI): Gains or losses that are not included in the profit and loss statement, such as foreign currency translation differences.

8) Drawings or Dividends: Withdrawals by owners or dividend payments to shareholders, which reduce Equity.

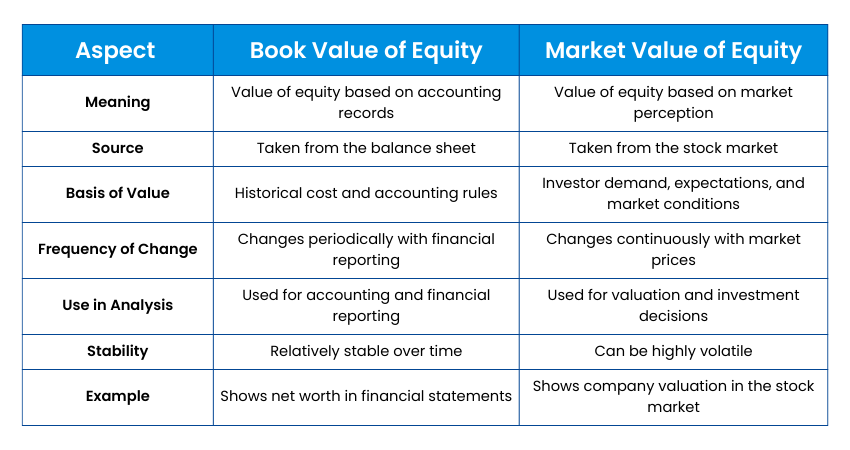

Book Value vs Market Value of Equity

Equity can be measured in different ways, with book value and market value being the most common. The Book Value of Equity is derived from Accounting records and is calculated as total assets minus total liabilities shown on the balance sheet. It reflects historical costs, Accounting adjustments, and accumulated profits or losses over time.

The Market Value of Equity represents the current value of a company based on investor perception and market demand. It shows what investors believe the company is worth at a specific point in time, rather than what is recorded in the Accounting books. The table below highlights the key differences to make this comparison easier to understand.

Equity on Balance Sheet

Equity is shown on the balance sheet as one of the three main sections, along with assets and liabilities. It usually appears at the bottom of the balance sheet. This shows that Equity is the value left for the owners after all debts are paid.

The Equity section typically includes share capital, retained earnings, reserves, and owner’s capital. Each component explains how the owners’ value is created, maintained, and changed over time through business operations and financial decisions.

Analyse business performance and financial data through the Business, Technology & Finance (BTF) Course – Join now!

How to Calculate Equity?

The basic formula to calculate Equity in Accounting is to subtract total liabilities from total assets. Assets include everything the business owns, such as cash, inventory, equipment, and property. Liabilities include obligations like loans, accounts payable, and accrued expenses.

Example: If a business has total assets worth £500,000 and total liabilities of £300,000, then its Equity would be £200,000. This means the owners collectively have a £200,000 claim on the business after all debts are settled.

How do Accountants Track and Report Equity?

Accountants are responsible for tracking every change in Equity and making sure it is reported correctly in the financial statements. This process begins with the general ledger, which records all equity-related transactions and is managed using Accounting software such as QuickBooks or Xero.

Investments, withdrawals, profits, and dividends are posted to Equity accounts such as capital, share capital, and retained earnings. Journal entries capture Equity changes in real time, while net profit or loss is closed into retained earnings at the end of the Accounting period. Accurate tracking and regular reconciliation ensure Equity is reported correctly and reflects the true financial position of the business.

Support effective financial and business decisions with Principles of Taxation (PTX) Training – Sign up soon!

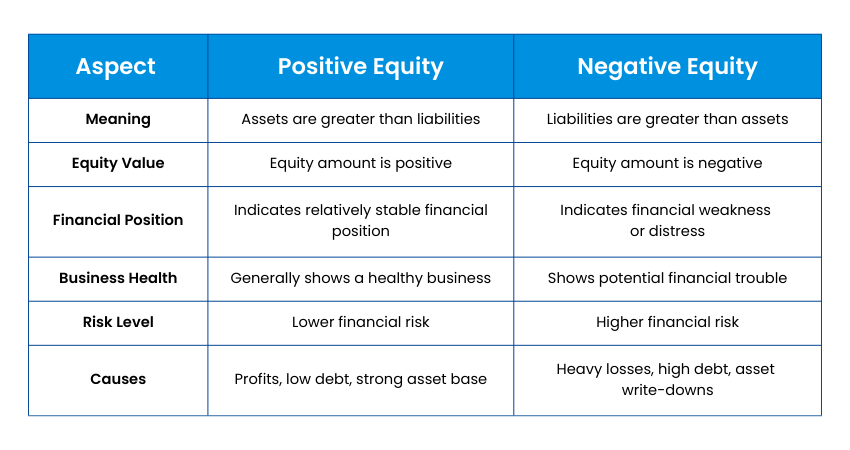

What is Positive and Negative Equity?

Positive Equity happens when a company owns more assets than its liabilities. This means the business is financially stable and in good condition. Companies with positive equity are usually more attractive to investors and lenders because they can pay their debts and still have value left.

On the other hand, Negative Equity occurs when a company’s liabilities exceed its assets. This shows financial weakness and can be caused by ongoing losses, too much debt, or a drop in asset value. Here is a table that explains their difference in simple terms:

Real World Use Cases of Equity

Equity plays a significant role in many real-world financial decisions. The following are some of the use cases of it:

1) Business Valuation: Equity is used to estimate the value of a business, especially during mergers, acquisitions, or when selling a company.

2) Investment Decisions: Investors analyse a company’s equity position to assess financial health and long-term growth potential.

3) Loan and Credit Assessment: Banks and lenders review equity to evaluate a business’s ability to repay loans and manage financial risk.

4) Performance Measurement: Businesses track changes in Equity to measure profitability, growth, and overall financial performance.

5) Ownership and Control: Equity determines who owns the business and how much control each owner or shareholder has.

6) Regulatory and Financial Reporting: Equity must be reported in financial statements to ensure transparency, accuracy, and compliance with Accounting standards.

Conclusion

Equity in Accounting is more than just a figure on the balance sheet. It represents ownership, financial strength, and business value. A strong Equity position reflects stability and long-term sustainability, making it an essential concept for anyone looking to understand or manage a business effectively. Whether you are analysing financial statements or planning future growth, a clear understanding of Equity helps you make well-informed business decisions.

Establish a strong foundation in core Accounting concepts through ACA Certificate Level Training – Start now!

Frequently Asked Questions

FaQ's not available

Have Any Question?

Have Any Question?

+44 7452 122728

+44 7452 122728

Back

Back

44 7452 122728

44 7452 122728