Table Of Contents

Long hours, last-minute number checks, and endless spreadsheets are still a reality for many people working in accounting. If managing financial data feels more stressful than it should be, you are not alone. As businesses grow and expectations rise, the pressure on accounting professionals continues to increase. This is where Accounting Technology becomes a game-changer, helping professionals work smarter, faster, and with far fewer errors.

This blog explains what Accounting Technology is and the main types used in modern accounting. It reveals how smart tools are turning accounting from a daily struggle into a smoother, more confident way of working. Read ahead to learn more!

What is Accounting Technology?

Accounting Technology uses digital tools such as Artificial Intelligence (AI), cloud platforms, and Machine Learning (ML) to manage financial data efficiently. It replaces manual and paper-based processes with real-time digital workflows, improving speed, accuracy and access to financial information.

By automating tasks such as data entry and reporting, Accounting Technology reduces manual effort and allows accountants to focus on analysis and advisory work, supporting better decision-making and financial management.

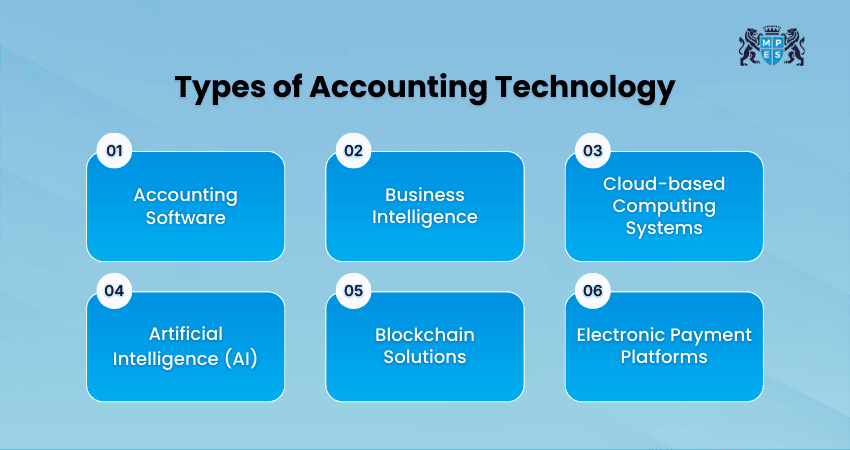

Types of Accounting Technology

Accounting Technology includes different tools that help businesses manage financial tasks more efficiently. Each type supports a specific part of the accounting process.

1) Accounting Software

Accounting Software helps record and manage daily financial transactions. It is used for tasks such as bookkeeping, invoicing, payroll, and preparing financial reports. This software reduces manual work and helps keep financial records accurate and organised.

2) Business Intelligence

Business Intelligence tools analyse financial data and present it in visual formats such as reports, charts, and dashboards. They help businesses understand trends, track performance, and make informed financial decisions based on real data.

3) Cloud-based Computing Systems

Cloud-based Accounting Systems store financial data online instead of on a local computer. This allows users to access accounting information anytime and from any location. These systems support real-time updates, easy collaboration, and secure data storage.

4) Artificial Intelligence (AI)

Artificial Intelligence in accounting is used to automate tasks and analyse data. AI can help categorise expenses, detect unusual transactions, and support forecasting. It enhances accuracy and reduces the time spent on repetitive tasks.

5) Blockchain Solutions

Blockchain Solutions record financial transactions in a secure and transparent way. Each transaction is stored in a digital record that is difficult to change. This improves trust, accuracy, and audit reliability in accounting systems.

6) Electronic Payment Platforms

Electronic Payment Platforms allow businesses to send and receive payments digitally. They support online transfers, card payments, and automated payment processing. These platforms make payments faster and improve financial tracking.

7) Tax Preparation Software

Tax Preparation Software helps calculate, prepare, and file taxes accurately. It follows current tax rules and reduces the risk of errors. This software also helps manage deadlines and maintain proper tax records.

8) Data Collection & Gathering Tools

Data Collection tools capture financial data from sources such as invoices, receipts, and bank statements. They ease manual data entry and ensure that accounting records are complete and accurate.

9) Enterprise Resource Planning (ERP) Systems

ERP Systems combine accounting with other business functions like human resources, inventory, and operations. They provide a complete view of business activities and help large organisations manage complex financial processes efficiently.

10) Robotic Process Automation (RPA)

Robotic Process Automation uses software bots to perform repetitive accounting tasks. These tasks may involve data entry, invoice processing, and account reconciliation. RPA improves speed, accuracy, and overall efficiency.

Build strong business, technology, and finance expertise with the Business, Technology & Finance (BTF) Training now.

What are the Benefits of Accounting Technology?

Accounting Technology improves efficiency, accuracy, and collaboration across accounting firms. Automating routine processes helps accountants deliver better services while managing workloads more effectively. The key benefits are outlined below.

Real-time Collaboration

Modern accounting systems allow real-time sharing of data and documents between accountants, staff, and clients. This supports remote working, improves communication, and enhances both staff productivity and client engagement.

Tax Workflow Automation

Technology enables end-to-end automation of tax workflows, from gathering data and preparation to review and final submission. Cloud-based systems support seamless data sharing and paperless processing, reducing non-billable work and improving operational efficiency.

A Shift to Value-added Work

By automating routine accounting tasks, professionals can focus on higher-value activities like analysis, advisory services, and client relationship management. This supports a more sustainable business model beyond seasonal workloads.

Surfacing Valuable Insights

Accounting Technology analyses financial and tax data to identify trends and opportunities. It helps accountants stay informed about regulatory changes and provide proactive guidance, supporting informed decision-making and long-term growth.

Elimination of Manual Data Entry

Accounting Technology automates data capture and validation, reducing repetitive data entry. It identifies missing or incorrect information early by comparing current and past records, which lowers errors and speeds up reviews.

Key Signs You Need to Invest in Accounting Technology

When accounting processes start to slow down or create errors, it often indicates that current systems are no longer sufficient. The following signs highlight when investing in Accounting Technology becomes more essential than optional.

1) Rising Workload and Complexity

As a business grows, transactions, reporting, and compliance become more complex. Managing this manually increases time and error risks, while Accounting Technology handles larger workloads efficiently and accurately.

2) Employees Spend Too Much Time on Repetitive Tasks

If accounting staff spend most of their time on data entry, reconciliations, or basic checks, productivity is reduced. Accounting Technology automates these repetitive tasks, allowing employees to focus on analysis, planning, and client-facing work.

3) Meeting Client Expectations is Becoming Difficult

Clients expect quick responses, accurate reports, and easy access to financial information. Manual processes can cause delays, while Accounting Technology improves speed, accuracy, and transparency.

4) Your Competitors Have Already Adopted it

When competitors adopt modern accounting tools, they often gain efficiency and service advantages. Falling behind in technology can impact competitiveness. Investing in Accounting Technology helps firms keep pace with industry standards and client demands.

5) Slow and Inefficient Document Collection Process

Manually collecting and organising invoices, receipts, and financial documents leads to delays and errors. Accounting Technology streamlines document collection and storage, making information easier to access and improving overall workflow.

Advance your assurance expertise with the Assurance (AS) Training and boost your professional credentials.

How Secure is Accounting Technology?

Accounting Technology is generally very secure and uses strong protection measures such as encryption, Multi-factor Authentication (MFA), and secure cloud storage to protect important financial data. These technologies help prevent unauthorised access and reduce the risk of data loss or breaches.

However, security depends on how well the provider implements the system. Strong access controls, regular audits, and active monitoring of cyber and social engineering risks are essential. While Accounting Technology is more secure than manual methods, ongoing vigilance is still required.

The Future of Accounting Technology

The future of Accounting Technologies is driven by digital advances that are changing how accountants work. The key technologies shaping this future are outlined below:

1) Autonomous Accounting Systems:

Platforms are being developed to handle end-to-end accounting tasks (transaction classification, reconciliation, reporting) with minimal human intervention. These systems aim to move beyond partial automation toward fully autonomous financial management.

2) Advanced Predictive & Prescriptive Analytics:

Future tools will not only forecast outcomes but also recommend specific financial actions aligned with business goals and risk levels. Implementation is underway in ERP and BI platforms, but widespread adoption is still emerging.

3) Cognitive AI Assistants for Accountants:

Intelligent assistants are evolving to provide real-time guidance, draft complex reports, interpret regulations, and support strategic decision-making. Generative AI is being integrated into accounting platforms, but the next stage is context-aware, regulation-savvy assistants.

4) Continuous Real-time Auditing:

Instead of periodic audits, future systems will enable continuous audit models where financial data is validated automatically as transactions occur. Blockchain and AI-driven audit tools are being piloted, pointing toward real-time assurance.

5) Integration with Regulatory Technologies (RegTech):

Accounting platforms are expected to automatically adapt to changing tax laws and financial regulations. This ensures ongoing compliance without manual updates, a capability now being embedded into advanced systems.

Conclusion

Accounting Technology is reshaping the accounting landscape by turning routine tasks into streamlined, intelligent processes. With automation, cloud platforms, and advanced analytics, accountants can focus on insight and strategy rather than paperwork. Embracing these tools not only improves accuracy and efficiency but also helps businesses adapt, grow, and stay ahead in a quickly changing financial environment.

Unlock core accounting skills and advance your career with the ACA Certificate Level Training now.

Frequently Asked Questions

FaQ's not available

Have Any Question?

Have Any Question?

+44 7452 122728

+44 7452 122728

Back

Back

44 7452 122728

44 7452 122728