Table Of Contents

Have you ever imagined working with global companies, learning from top experts, and building a career that opens doors worldwide? For many aspiring professionals, that dream leads to Deloitte, PwC, EY, and KPMG - the world’s Big 4 Accounting Firms.

In this blog, you’ll discover who the Big 4 Accounting Firms are, what they do, how they hire, their salaries, and their future growth, guiding you towards a successful accounting career. Let’s explore what makes these firms the top choice for finance professionals worldwide.

What are the Big Four Accounting Firms?

The Big 4 Accounting Firms are the biggest and most recognised accounting companies in the world: Deloitte, PricewaterhouseCoopers (PwC), Ernst & Young (EY) and Klynveld Peat Marwick Goerdeler (KPMG). They work across many countries, generate billions each year, and offer services like auditing, tax support and financial advice. They also audit the financial statements of many major publicly listed companies.

Even though each firm is independent, they use global brand names and follow similar working styles everywhere. They are much bigger than other firms in size and clients, including many Fortune 500 companies. Because of this strong reputation, many people aim to build their careers with the Big Four. Let’s explore each firm and discover what makes them unique.

1) Deloitte

Deloitte is one of the world’s leading professional services firms, providing accounting, consulting, and advisory solutions to organisations across industries. It was founded in London in 1845 and has grown through global mergers and partnerships to become a trusted name in finance and business. As of 2025, Deloitte employs over 470,000 professionals worldwide, making it the largest of the Big Four.

Deloitte supports organisations through business transformation, technology integration, and workforce development. It values continuous learning, offering employees structured training, mentorship, and leadership initiatives that foster long-term career growth.

Key Focus & Work Culture:

a) Business strategy, operations and financial support

b) Technology-driven solutions and innovation

c) People and workplace development services

d) Encourages learning and personal development

e) Strong training and professional growth courses

f) Opportunities to mentor and be mentored

g) Focus on building long-term career skills and confidence

2) PwC

PwC is a multinational network offering accounting, consulting, and assurance services across industries. It was formed in 1998 through the merger of Price Waterhouse and Coopers & Lybrand. By 2025, PwC will employ more than 364,000 people in over 150 countries, reflecting its global reach and influence.

PwC helps organisations with strategy, technology, and risk management. It promotes collaboration and learning through structured graduate training, diverse project exposure, and mentorship opportunities that prepare professionals for leadership roles.

Key Focus & Work Culture:

a) Strategy, management and technology support

b) Risk and business advisory services

c) Chance to work with many industries and clients

d) Strong learning and training

e) Support from experienced professionals

f) Opportunity to work on varied projects

3) EY

Ernst & Young (EY) is a global professional services organisation specialising in consulting, assurance, and advisory solutions. It was established in 1989 following the merger of Ernst & Whinney and Arthur Young. As of 2025, EY employs over 400,000 professionals across more than 136 countries, with its global headquarters in London.

EY supports clients in improving performance, managing risk, and ensuring compliance. It is known for its focus on innovation, technology, and continuous learning, creating a workplace that encourages adaptability and career development.

Key Focus & Work Culture:

a) Business performance improvement

b) Risk review and regulatory support

c) Technology and assurance services

d) Strong focus on innovation and change

e) Learning and development opportunities

f) Competitive hiring process encouraging preparation

4) KPMG

KPMG is a global network providing audit, tax, and advisory services to businesses and governments. It was founded in 1987 through the merger of Klynveld Main Goerdeler (KMG) and Peat Marwick. In 2025, KPMG employs more than 273,000 people across 140 countries, with its global headquarters in the Netherlands.

KPMG helps organisations with business improvement, risk management, and digital transformation. It promotes a culture of sustainability, innovation, and accountability, offering structured training and detailed recruitment processes to attract high-performing professionals.

Key Focus & Work Culture:

a) Audit, tax and advisory services

b) Support for digital transformation

c) Business performance and risk management

d) Focus on environmental and social responsibility

e) Structured hiring with skill assessments

f) Encourages strong communication and problem-solving skills

Advance your career with business, tech and finance knowledge with our Business, Technology & Finance (BTF) Training – Join today!

The History of The Big 4 Accounting Firms

The Big 4 Accounting Firms were once part of a group called the Big Eight, which operated mainly in the US and UK. In the late 1980s and 1990s, several firms merged to strengthen their global presence.

1) 1987: Peat Marwick merged with Klynveld Main Goerdeler (KMG) - KPMG

2) 1989: Ernst & Whinney merged with Arthur Young - EY

3) 1989: Deloitte Haskins & Sells merged with Touche Ross - Deloitte

4) 1998: Price Waterhouse merged with Coopers & Lybrand - PwC

These mergers reduced the Big Eight to five firms. Later, Arthur Andersen collapsed in 2002 following its involvement in the Enron scandal, leaving four major firms. Today, Deloitte, PwC, EY and KPMG are known as the Big Four and remain the most influential Accounting Firms in the world.

What Services do the Big Four Accounting Companies Provide?

The Big 4 Accounting Firms offer many services to help businesses manage their money, follow rules and grow. While they are well known for checking company accounts, they now also support organisations in many other areas.

Main Services Provided by the Big Four:

1) Audit and Financial Review: They check the company’s financial statements to make sure everything is correct and honest. This helps build trust with shareholders, banks and the public.

2) Tax Support: They help businesses and individuals prepare taxes, follow tax laws and plan their taxes in a smart and legal way.

3) Business Advice: They guide companies on how to work better, improve processes, reduce costs and grow successfully.

4) Risk Support: They help organisations identify problems, avoid fraud, manage risks and follow important rules.

5) Technology Support: They assist companies in using modern technology, improving systems, protecting data and using digital tools to work faster and smarter.

6) Financial Deals and Planning: They support companies when they buy or sell businesses, need valuation help or require financial planning and restructuring.

7) Legal Support (in some countries): They offer legal advice related to business, tax and workplace matters.

The Sources of Revenue for the Big Four Accounting Firms

The Big 4 Accounting Firms earn money by offering different services to businesses and organisations. Their main income comes from:

1) Audits: Checking the company’s financial records

2) Tax Services: Helping with tax filing and planning

3) Consulting: Advising on business improvement and growth

4) Technology Services: Supporting digital systems and cyber security

5) Financial Advisory: Helping with mergers, valuations and major deals

6) Risk and Compliance: Guiding companies to follow rules and manage risks

Learn principles of Taxation Certification now and elevate your understanding of tax. Join our Principles of Taxation (PTX) Training now!

How Do the Big Four Accounting Firms Hire?

The Big Four Accounting Firms hiring process usually involves submitting an online application, taking aptitude tests and attending interviews with HR and technical teams. They look for good communication, teamwork, problem-solving skills and a positive attitude.

Many scholars start through internships or graduate schemes, which help them build experience and prepare for full-time roles. Each firm has specific qualities it looks for when choosing candidates. What Each Company Looks For:

1) Deloitte

1) Hires graduates and postgraduates

2) Values honesty, teamwork and strong work ethics

3) Offers chances to work with top global companies

4) Encourages continuous learning and professional growth

2) PwC

1) Provides internships for students while studying

2) Let's interns join client meetings and learn from experts

3) Great place to build early career skills

4) Focuses strongly on developing communication and teamwork abilities

3. EY

1) Hires graduates and MBA scholars

2) Some roles may need a few years of experience

3) Offers training and support for new associates

4) Promotes innovation and welcomes fresh ideas from young talent

4. KPMG

1) Looks for strong analytical and technical skills

2) Hires graduates and postgraduates

3) Provides training and opportunities to work with large companies

4) Values problem-solving and encourages growth through hands-on projects

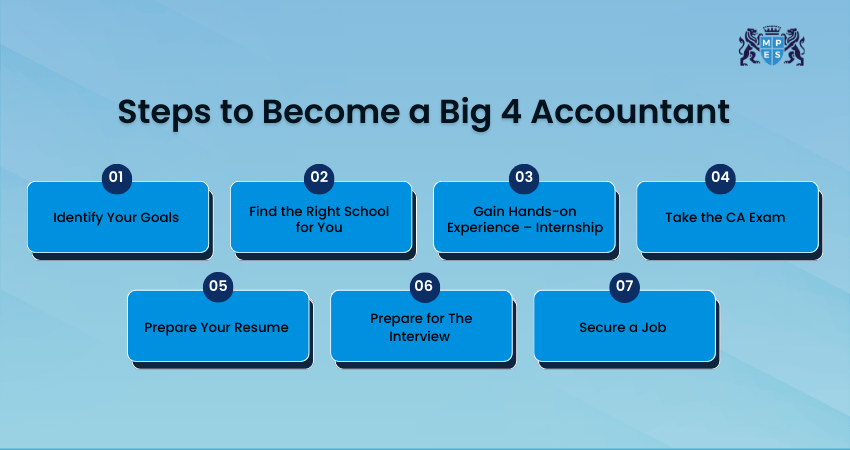

How to Become a Big 4 Accountant?

Working at a Big 4 Accounting Firms requires planning, learning and gaining the right skills. The steps below will help you build a strong career path. Let’s go through them one by one.

1) Identify Your Goals

Begin by deciding which area you want to work in, such as audit, tax, consulting or technology. Knowing your path early helps you choose the right subjects, skills and experience, and stay focused on your goals.

Example: If you want to work in audit, study financial reporting and join your university’s audit or finance club.

2) Find the Right School for You

Choose a university or college that offers strong courses in accounting, finance or business. Look for a course that provides good teaching, career support and openings for internships or work placements.

Example: Look for universities that have campus hiring partnerships with Deloitte, PwC, EY or KPMG.

3) Gain Hands-on Experience – Internship

Secure internships or industrial placements while studying. This gives you real workplace experience, allows you to work with professionals and helps you understand how Accounting Firms operate. Internships also make your CV stronger.

Example: Apply for summer internships at Big 4 firms or join a local accounting firm to gain experience.

4) Take the CA Exam

Gain a recognised professional accounting qualification to strengthen your credibility and open global career opportunities. Depending on your region, this could include CA, ACCA, ACA or CIMA. These credentials enhance your technical knowledge, demonstrate professional competence, and are often essential for advanced roles in major accounting firms.

Example: Start preparing for the ACA qualification during your final year of university.

5) Prepare Your Resume

Create a clear, professional CV that highlights your education, skills, internships, achievements and any relevant certifications. Keep it neat, focused and tailored to the role you are applying for.

Example: Include university accounting projects, Excel skills and any volunteer finance work in your CV.

6) Prepare for The Interview

Practise general interview questions and be ready to talk about your experience, strengths and career goals. Work on communicating confidently, speaking clearly and demonstrating your interest in the firm and the role.

Example: Practice explaining a time you solved a problem or worked on a team project.

7) Secure a Job

Once you have completed your studies, gained experience and earned your qualification, apply for graduate roles or trainee positions at Big Four firms. Stay motivated, consistent and open to learning, as these companies value dedication and growth.

Example: After an internship in these companies, apply for their graduate programme to secure a full-time role.

Develop your management information expertise and thrive professionally with our Management Information (MI) Course – Join today!

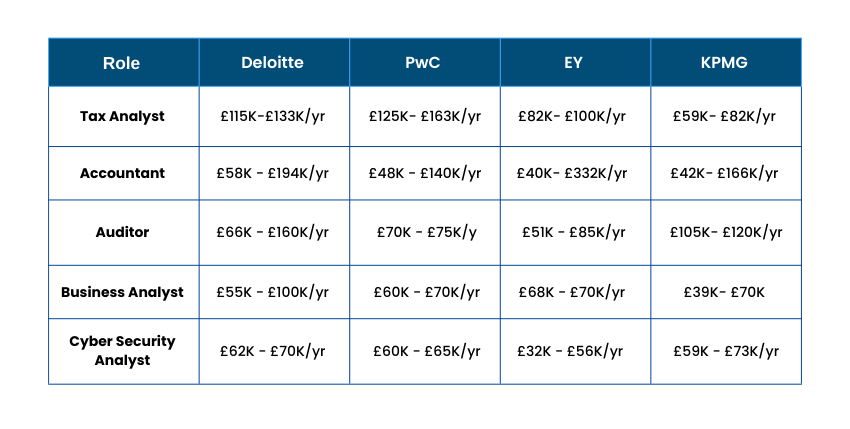

Salaries in Big 4 Accounting Firms

Salaries depend on country, role, and experience. Entry-level salaries are good and grow fast. Here is what professionals in Big Four Accounting Firms generally earn in the UK:

The Future of the Big Four Accounting Firms

The Big Four Accounting Firms - Deloitte, PwC, EY, and KPMG are transforming through technology and changing business needs. Beyond traditional auditing and tax services, they now focus on digital transformation, advisory, and consulting. Using Artificial Intelligence, data analytics, and automation, they deliver faster and smarter results. They’re also expanding in cyber security, sustainability and ESG consulting to support global business goals.

In the future, these firms will be increasingly technology-driven, blending finance expertise with innovation. Aspiring accountants will need strong digital, analytical, and problem-solving skills, along with solid accounting knowledge, to thrive in this evolving professional landscape.

Conclusion

The Big 4 Accounting Firms continue to lead the world in finance, technology and business support. They offer powerful learning opportunities, global exposure and strong career growth for future professionals. Whether you dream of working in audit, tax or consulting, building the right skills and experience can open doors to a rewarding future with the Big Four Accounting Firms.

Gain the skills needed to succeed in the accounting profession. Join the ACA Certificate Level now!

Frequently Asked Questions

FaQ's not available

Have Any Question?

Have Any Question?

+44 7452 122728

+44 7452 122728

Back

Back

44 7452 122728

44 7452 122728