Table Of Contents

Taking a selfie with two different filters changes how it looks, the same photo, but with different feelings. That’s how UK GAAP vs IFRS works in accounting. Both show your business’s financial picture, but each with its own focus and level of detail. UK GAAP keeps it local and simple, while IFRS gives it a global, polished finish.

Understanding UK GAAP vs IFRS helps you present your business clearly to any audience. This blog explores the key differences, core principles, scope, challenges, and future trends in financial reporting.

UK GAAP vs IFRS

In the United Kingdom Generally Accepted Accounting Principles (UK GAAP), and International Financial Reporting Standards (IFRS) are the two main accounting standards. IFRS is used in over 168 countries and is preferred by global companies like Nestlé and Samsung because it makes financial reports easier to compare worldwide.

Many UK businesses, like Tesco, still use UK GAAP as it suits local needs and is simpler. Choosing between them depends on a company’s size, structure, and whether it operates internationally.

What is UK GAAP?

UK GAAP stands for United Kingdom Generally Accepted Accounting Principles. It is a set of accounting standards used by UK companies to prepare and present their financial statements. These standards help businesses report their income, expenses, assets, and liabilities in a clear and consistent manner.

The Financial Reporting Council (FRC) is responsible for issuing and updating UK GAAP. Important principles include the accrual basis of accounting, the going concern assumption, and the use of standardised formats like FRS 102 for financial reporting.

What is IFRS?

IFRS stands for International Financial Reporting Standards. These are global accounting rules made by the International Accounting Standards Board (IASB). IFRS helps companies in different countries prepare financial reports in the same way, making them easy to read and compare worldwide. It also sets clearer guidelines that reduce the chances of Creative Accounting, where financial information may otherwise be structured or presented in misleading ways.

Some countries adjust these rules to fit local needs. The United States still mostly uses its own rules, called GAAP. Many large companies working in different countries use IFRS, especially those listed on global stock markets. This helps investors understand and trust their financial reports.

Master international reporting standards with our Financial Accounting and Reporting (FARI) Training led by experts.

UK GAAP vs IFRS: Major Differences

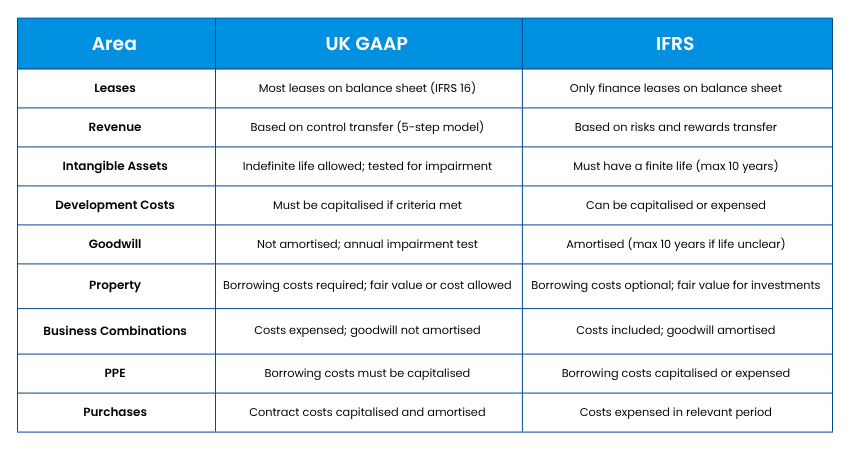

Here are the key UK GAAP and IFRS differences across major accounting areas.

1. Leases

UK GAAP: Leases are classified as finance or operating leases. Only finance leases appear on the balance sheet. Operating leases are treated as rental expenses (FRS 102, Section 20).

IFRS: Under IFRS 16, all leases over 12 months (excluding low-value ones) are recorded on the balance sheet as right-of-use assets and lease liabilities, including both finance and operating leases.

2. Revenue

UK GAAP: Revenue is recognised when risks and rewards are transferred, and the amount can be measured reliably and is probable (FRS 102, Section 23).

IFRS: Revenue is recognised based on a five-step model, focusing on the transfer of control to the customer (IFRS 15).

3. Intangible Assets

UK GAAP: Intangible assets must have a finite useful life. If not clearly known, it is capped at 10 years. Assets are amortised over this period (FRS 102, Section 18).

IFRS: Intangible assets are recognised if the criteria are met. They may have an indefinite useful life and are not amortised unless impaired (IAS 38).

4. Development Costs

UK GAAP: Development costs can be capitalised or expensed, depending on the policy adopted. The chosen method must be used consistently (FRS 102, Section 18).

IFRS: Development costs must be capitalised when specific recognition criteria are met. They are recorded as assets and tested for impairment (IAS 38).

5. Goodwill

UK GAAP: Goodwill is amortised over its useful life. If the life cannot be reliably determined, the maximum period is 10 years (FRS 102, Section 19).

IFRS: Goodwill is not amortised, but it must be tested annually for impairment (IFRS 3).

6. Property

UK GAAP: Borrowing costs may be capitalised or expensed. Investment properties must be calculated at fair value through profit or loss (FRS 102, Section 16).

IFRS: Borrowing costs must be capitalised if they relate to the construction of qualifying assets (IAS 23). Investment property can be measured using cost or fair value models (IAS 40).

7. Business Combinations

UK GAAP: Transaction costs are included in acquisition costs. Goodwill and intangible assets must have finite lives; a maximum of 10 years if not known. Bargain purchase gains are capitalised and amortised (FRS 102, Section 19).

IFRS: Transaction costs are expensed. Intangible assets are separately recognised, and goodwill is not amortised. Bargain purchase gains are recognised immediately in profit or loss (IFRS 3).

8. Property, Plant and Equipment

UK GAAP: Borrowing costs can be capitalised or expensed, based on accounting policy (FRS 102, Section 17).

IFRS: Borrowing costs related to construction must be capitalised when the criteria are met (IAS 23).

9. Purchases

UK GAAP: Costs are expensed in the period they relate to (e.g. commissions recognised in the month earned).

IFRS: Contract-related costs that meet specific criteria are capitalised and amortised over the contract period (IFRS 15).

Key Principles and Frameworks of GAAP and IFRS

Even though UK GAAP and IFRS use different terms and focus on different aspects, they share several core accounting principles:

Accrual Basis: Transactions are recorded when they occur, not when cash is received or paid.

Going Concern: The business is expected to continue operating in the foreseeable future.

Consistency: The same accounting methods are applied year after year for comparability.

Relevance and Reliability: Financial data must be meaningful, dependable, and useful for decision-making.

Materiality: Only significant items that could impact decisions are included in reports.

Understandability and Fair Presentation: Financial statements must be clear, truthful, and understandable to users with basic knowledge.

The key difference between GAAP and IFRS is how they are applied. GAAP is strict and rules-based, while IFRS is more flexible and based on general principles. IFRS allows more judgment and interpretation.

Scope and Applicability of UK GAAP and IFRS

UK GAAP and IFRS apply to different types of companies based on their size, structure, and reporting needs. Understanding who uses each standard helps businesses choose the right one.

UK GAAP

Used primarily by UK-based Small and Medium-sized Entities (SMEs)

Standards given by the Financial Reporting Council (FRC) since 2012

Distinct from both IFRS and US GAAP, with unique rules and terminology

UK-listed companies adopted IFRS in 2005, but UK GAAP remains for non-listed entities

Key differences lie in structure, terminology, transaction handling, and disclosures

IFRS

Used in over 160 countries, including the UK and the EU

Promotes global consistency and comparability in financial reporting

UK-listed companies have followed IFRS since 2005

Principles-based and allows greater professional judgement

Helps multinational companies maintain consistent financial reporting across borders

Strengthen your finance skills with our Financial Management (FM) Training today.

Challenges in Switching Between UK GAAP and IFRS Standards and Solutions

Switching from UK GAAP to IFRS (or vice versa) can be difficult. Here are some common issues and how to solve them:

1. Different Principles of Accounting

Challenge: UK GAAP and IFRS follow different rules, which can lead to confusion in how financial transactions are managed and reported.

Solution: Identify the key differences, review your current accounting methods, and make a clear plan. Update policies and records as needed. Provide IFRS training or expert support for your team.

2. Data Integration and Conversion

Challenge: Switching from UK GAAP to IFRS means changing how past financial data is recorded and used. This can be hard without the right tools and support.

Solution: Use data conversion software to change old records into IFRS format. Test the system before fully switching by checking that the data is correct and fits well in the new format.

3. Complicated Financial Instruments

Challenge: IFRS has more detailed rules for handling complex financial items like derivatives, which are not fully covered under UK GAAP.

Solution: Work with IFRS experts to manage complex financial instruments. Set clear steps to identify, value, and record them. Keep detailed records to ensure accuracy and support for audits.

4. Instruction and Communication

Challenge: Changing accounting standards affects not just the business, but also the people involved, especially the accounting team and stakeholders.

Solution: Train your team on UK GAAP and IFRS. Share a clear communication plan and keep stakeholders informed about the impact. Encourage questions and feedback throughout the process.

5. Regulatory Obstacles

Challenge: Rules and laws in your area or industry may change quickly, often without notice, and affect your move to IFRS in unexpected ways.

Solution: Stay updated on local regulations and speak with legal experts to stay compliant. Be flexible and ready to adjust your plan. Communicate clearly with regulators to avoid issues and keep your financial reporting correct and legal.

Future Trends of GAAP and IFRS

GAAP and IFRS are getting closer, but full alignment is still in progress. Here's what's happening now and in the future:

Working Together: FASB (US) and IASB (global) continue collaborating to bring accounting standards closer together.

Shared Rules: Examples of alignment include similar revenue recognition rules, such as ASC 606 (US GAAP) and IFRS 15.

Support From Governments: Governments are promoting IFRS adoption or convergence to simplify cross-border reporting.

New Topics Coming: Upcoming standards may address cryptocurrencies, digital assets, and ESG reporting.

More Countries Using IFRS: The IASB continues encouraging wider global adoption of IFRS by countries still using local standards.

Better Technology: AI, blockchain, and cloud tools are transforming accounting, making reporting faster and more accurate.

Simple and Clear Rules: Efforts are ongoing to simplify rules and standardise interpretation across jurisdictions.

Conclusion

Understanding UK GAAP vs IFRS is essential for businesses navigating global financial reporting. As the two standards gradually move closer, companies must stay informed and adapt to changes. Aligning with the right framework improves clarity, compliance and decision-making, helping organisations succeed in an increasingly connected financial world.

Ready to master accounting standards? Register for our trusted ACA Professional Level Course today!

Have Any Question?

Have Any Question?

+44 7452 122728

+44 7452 122728

Back

Back

44 7452 122728

44 7452 122728