Table Of Contents

Think of Financial Statements as the roadmap to a company’s financial journey. They highlight where the business is right now, what’s working, what’s not and where it is going. For anyone looking to make informed decisions, these statements provide a strong foundation.

By digging into Financial Statements, you uncover the real story behind the numbers. They offer insights into a company’s profitability, stability and potential for growth. Whether you're analysing an investment or simply trying to understand a business better, this blog will guide you every step of the way.

What are Financial Statements?

Financial Statements are essential documents that provide a detailed summary of a company’s financial performance. They serve as the foundation for assessing a business’s health and offer valuable insights for decision-making. Investors, management, regulators, and creditors use them to analyse a company’s financial status and make informed decisions.

These statements typically cover key financial aspects such as a company’s assets, liabilities, equity, revenues, and expenses. The three important Financial Statements are the Balance Sheet, Income Statement and Cash Flow Statement. Each of these assists a different purpose, helping stakeholders obtain a complete understanding of the company’s operations.

How Financial Statements Work?

Financial Statements work by organising and presenting a company’s financial data in a structured format. They are usually prepared at the end of an accounting period, monthly, quarterly, or annually and follow standard accounting principles such as GAAP or IFRS.

Each statement captures a different aspect of the business:

1) Balance Sheet: Shows assets, liabilities, and equity, providing a snapshot of financial position.

2) Income Statement: Focuses on profitability by tracking revenue and expenses over a specific period.

3) Cash Flow Statement: Details cash inflows and outflows, showing how cash is generated and used.

4) Key Insights: These statements offer a complete picture of the company’s financial health. They are interconnected, with data often appearing across different statements.

Stakeholders can assess profitability, financial stability, and potential challenges by reviewing these documents.

What are the Three Financial Statements?

The three main Financial Statements that businesses use to report their financial status are Balance Sheet, Income Statement and Cash Flow Statement.

Each of these statements serves a distinct function and is used in different ways by various stakeholders. Let’s explore them in detail:

Balance Sheet

A Balance Sheet is one of the most important financial documents. It gives a picture of a company’s financial position at a specific point in time. The Balance Sheet is separated into two main parts: assets and liabilities, with the difference between the two representing equity.

Key Features of Balance Sheet

The balance sheet is separated into three main sections:

1) Assets: This will list everything the company owns, including cash, accounts receivable, inventory, equipment and real estate. Assets are normally divided as current or non-current based on their liquidity and expected time of use.

2) Liabilities: This will list the company’s debts and obligations, like loans, accounts payable and other financial responsibilities. Like assets, liabilities are divided as current (due within one year) and non-current.

3) Equity: Equity represents the ownership interest in the company. It is calculated by subtracting liabilities from assets. Equity can include stockholder equity, retained earnings and other reserves.

4) Subtotals and Total: The Balance Sheet ensures that the total value of assets equals the sum of liabilities and equity, maintaining the fundamental accounting equation: Assets = Liabilities + Equity. This check ensures accuracy and consistency in financial reporting.

If you are planning on building your financial future from the ground up, our ACCA Foundations will help you out - Sign up now!

Example of a Balance Sheet

Here is an example of a simplified Balance Sheet:

Income Statement

The Income Statement is a main financial document that gives a summary of the company’s revenues, expenses and profits over a period. This statement helps determine the company’s profitability during that period.

Key Features of Income Statement

The Income Statement generally includes these sections:

1) Revenue: This is the total income made by the company from its core business operations. It could include sales, services rendered or other forms of income.

2) Cost of Goods Sold (COGS): This shows the direct costs included in producing the goods or services sold by the company.

3) Operating Expenses: This includes expenses related to the company’s operations, such as rent, salaries, marketing and utilities.

4) Net Income: This is the company’s profit after all expenses have been deducted from revenue.

Example of an Income Statement

Here is an example of a simple income statement for a one-year period:

Cash Flow Statement

A Cash Flow Statement is another important document that describes how cash moves in and out of the business. It showcases the company's liquidity and shows whether it has enough cash to cover its responsibilities.

Key Features of Cash Flow Statement

A Cash Flow Statement is segmented into the following parts:

1) Operating Activities: This shows the cash generated or used in the main business activities, such as sales of goods and services.

2) Investing Activities: This section reflects cash used for buying or selling assets like equipment, property, or investments.

3) Financing Activities: This section details cash movements related to the company’s capital structure, including issuing stock, borrowing, and repaying debt.

Trust is built on truth and our Foundations in Audit (FAU) Course teaches you how to verify it. Sign up now and become the go-to Auditor!

Example of a Cash Flow Statement

Here’s a simple example of a Cash Flow Statement:

How to Read and Understand Financial Statements?

To make better-informed business decisions, it is important to understand how to read Financial Statements correctly. Here is a breakdown of how to interpret the three main financial documents:

1) How to Read a Balance Sheet?

1) Focus on Liquidity: Compare the company’s assets and liabilities to assess its liquidity.

2) Current vs Non-current Assets: Look at the relationship between current and non-current assets to understand the company’s short- and long-term assets.

3) Short-Term Debt Coverage: Check the company’s ability to cover short-term debts with short-term assets.

4) Assess Equity: Evaluate the equity to see how much of the company is owned by shareholders versus owed to creditors.

2) How to Read an Income Statement?

1) Gross Profit Margin: Pay attention to the gross profit margin (revenue minus cost of goods sold) to understand basic profitability.

2) Operating Profit Margin: Focus on the operating profit margin to evaluate how well the company controls operating expenses.

3) Net Income: Look at the net income to see the company’s overall profit after all expenses are accounted for.

4) Revenue vs Expenses: Compare revenue to expenses to gauge the company’s operational efficiency and cost management.

3) How to Read a Cash Flow Statement?

1) Operating Cash Flow: Ensure the company has positive cash flow from operating activities, indicating financial health.

2) Investing Activities: Negative cash flow from investing activities could indicate the company is investing in growth or expansion.

3) Financing Activities: Understand how the company manages debt and equity through its financing activities.

4) Net Change in Cash: Look at the net increase or decrease in cash to see if the company is generating enough liquidity to support its operations.

4) How to Read an Annual Report?

1) Review the Financial Statements: Investigate the balance sheet, income statement, and cash flow statement for the company’s financial health.

2) Management’s Discussion and Analysis (MD&A): Pay attention to the CEO’s letter and the MD&A section for insights into the company’s strategy and outlook.

3) Evaluate Risks and Opportunities: Look for discussions on potential risks and growth opportunities.

4) Future Strategy: Understand the company’s future strategies for growth, expansion, and risk management to gauge its long-term prospects.

Information is the key to power and profit. Master it in our Management Information (MA1) Course - Join now!

Benefits of Financial Statements

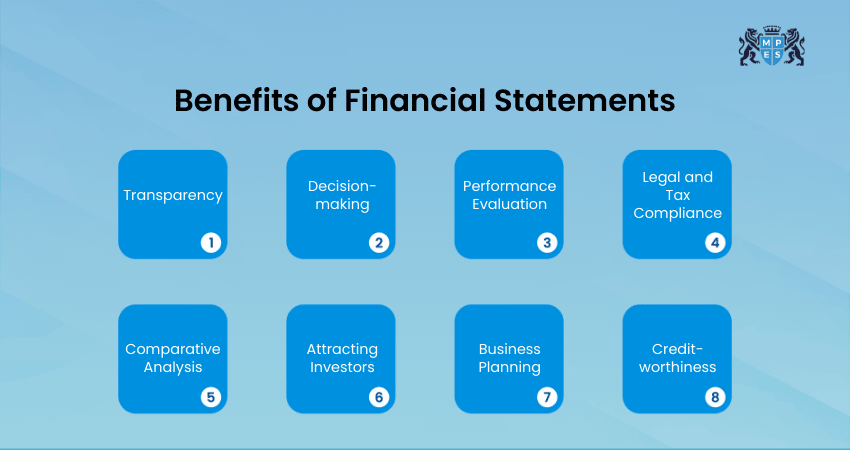

These are the key advantages of a Financial Statement:

1) Transparency: Financial Statements give a clear picture of a company’s financial health, which builds trust with investors and stakeholders.

2) Decision-making: These documents are vital for making informed decisions regarding investments, credit, and business strategies.

3) Performance Evaluation: Financial Statements allow management to assess the performance of various departments and operations.

4) Legal and Tax Compliance: Accurate Financial Statements are necessary for regulatory compliance and tax reporting.

5) Comparative Analysis: Financial Statements allow stakeholders to compare a company’s financial performance with competitors or industry benchmarks, aiding in competitive analysis and positioning.

6) Attracting Investors: Transparent and well-prepared Financial Statements make it easier for companies to attract investors, as they demonstrate the company’s financial stability and growth potential.

7) Business Planning: Financial Statements are invaluable tools for business planning and forecasting. This helps management make decisions about budgeting, resource allocation and strategic goals.

8) Creditworthiness: Creditors and beneficiaries rely on Financial Statements to evaluate a company's creditworthiness, ensuring that the company can repay loans or debts in the future.

Limitations of Financial Statements

These are disadvantages the of a Financial Statements:

1) Snapshot Limitations: Financial Statements typically offer a snapshot of financial data at a specific point in time. This may not reflect ongoing changes.

2) Subject to Manipulation: Financial Statements can be manipulated to reflect a more favourable financial position through creative accounting.

3) Complexity: For non-experts, Financial Statements can be difficult to interpret, which may lead to misunderstandings.

4) Overemphasis on Quantitative Data: While Financial Statements are based on quantitative data, they often fail to capture the full scope of intangible assets like brand value or employee skills, which can also affect a company’s long-term performance.

5) Timing Issues: Financial Statements are usually reported quarterly or annually, but businesses may experience significant changes between reporting periods, which may not be reflected in the statements immediately.

6) Not Always Reflective of Market Conditions: Financial Statements may not always reflect external market conditions, such as changes in consumer demand or economic shifts, which could significantly affect a company’s performance.

7) Depreciation and Repayment: The accounting practices of depreciation and repayment can obscure the true value of assets and expenses, potentially misrepresenting a company’s financial position.

8) Lack of Non-financial Insights: Financial Statements do not always capture important non-financial aspects, such as employee satisfaction or customer loyalty, which can be critical to a company’s success in the long term.

Conclusion

Financial Statements play an important role in understanding a company’s financial health. By analysing the Balance Sheet, Income Statement and Cash Flow Statement, stakeholders gain valuable insights that guide strategic decisions, ensuring long-term success and growth. Understanding these documents empowers investors, managers, and business owners to plan effectively, minimise risks, and drive long-term success.

Make accuracy the unflinching backbone of your finances with our Recording Financial Transactions (FA1) Course - Join today!

Have Any Question?

Have Any Question?

+44 7452 122728

+44 7452 122728

Back

Back

44 7452 122728

44 7452 122728