Table Of Contents

Behind every balanced sheet and strategic financial decision stands a Senior Accountant, the professional who brings fiscal clarity and structure to an organisation. More than just a spreadsheet pro, a Senior Accountant blends analytical precision with leadership finesse to guide teams and shape financial health. This is precisely what will be expected of you when you appear for a Senior Accountant interview.

This blog assembles 25 of the most asked Senior Accountant Interview Questions to help you secure your dream job in today’s evolving finance landscape. So read on and show your next interviewer that you are the whole package: financial expertise, strategic thinking and leadership skills wrapped into one!

Senior Accountant Interview Questions

The following curated Senior Accountant Interview Questions will help you prepare for real-world scenarios in finance, auditing, budgeting, and compliance. Let's dive in

1) Please introduce yourself and review your CV for two to four minutes.

“I have over eight years of experience in Accounting, covering financial reporting, budgeting and audit coordination. I’ve worked with Enterprise Resource Planning (ERP) systems, led month-end closes and handled decision-making through data insights. I enjoy streamlining processes and mentoring the juniors to improve team efficiency.”

2) How do you ensure your Accounting practices align with ethical standards?

“I strictly follow Accounting principles, maintain transparency in reporting and avoid any action that could compromise integrity. I make sure that the documentation is clear, approvals are tracked and financial decisions are well justified. I also stay updated on regulations and discuss ethical dilemmas openly with leadership when needed.”

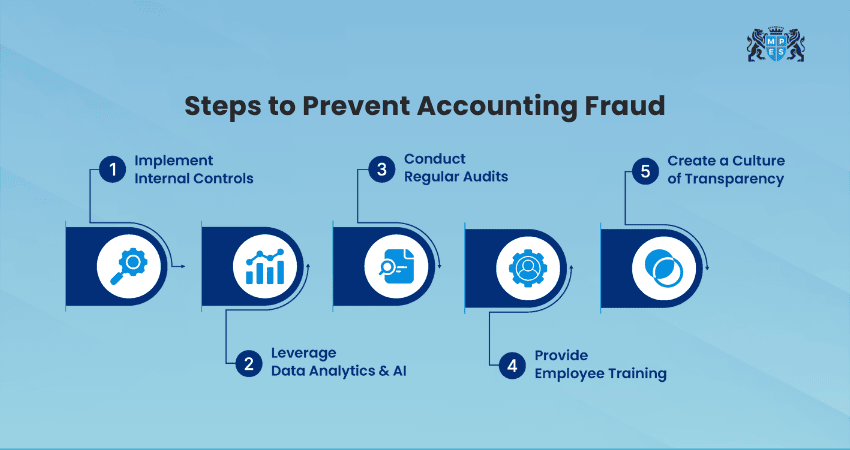

3) What measures do you take to detect and prevent fraud in your organisation?

“I implement strong internal controls, guarantee clear segregation of duties and regularly review transactions for any anomalies. I also promote a transparent reporting culture and conduct surprise audits. I use data validation tools to spot inconsistencies early, before they turn into bigger financial risks.”

4) Can you talk about your experience with Cost Accounting?

“I’ve used Cost Accounting to analyse production expenses, allocate overheads accurately and support pricing strategies. I enjoy breaking down cost behaviour to improve the margins and advising management on areas where cost optimisation can directly impact profitability. I ensure it without compromising operational quality.”

5) Can you share your experience with creating budgets and preparing financial forecasts?

“I work closely with the department heads to gather data, review past trends and build realistic budgets. I prepare rolling forecasts, analyse variances and adjust projections based on the business performance. I also present insights to leadership to support strategic planning and cash flow decisions.”

6) What motivates you to develop yourself and grow your career?

“I like challenging myself with new responsibilities and I enjoy learning advanced financial tools. Seeing how my insights can help shape business strategies motivates me. I also enjoy mentoring others, which pushes me to constantly improve my own knowledge and leadership skills to grow into senior financial roles.”

7) Describe a time when you led a team through a major financial transition or project.

“During a system migration to a new ERP, I led the finance team, coordinated data transfer and oversaw compliance checks. I created a clear transition plan, trained the team on it and monitored their progress daily. We completed the migration smoothly without delays in reporting or month-end close.”

Reshape the financial future, not just report it. Sign up for CIMA’s CGMA® Strategic Level Course now!

8) Could you explain a situation where you used data to drive decision-making?

“While analysing expense trends, I noticed recurring high vendor costs. I presented the data to management and suggested some alternatives, which led to renegotiations and a significant reduction in spending. That experience reinforced how data-based insights can directly influence better financial decisions.”

9) Why are you leaving your previous position?

“I’m looking for a role that offers more strategic involvement and leadership opportunities. I’ve gained strong technical experience in my current role, and now I’m excited to contribute at a higher level where I can influence financial decisions and mentor a growing team.”

10) Tell us about a time you resolved a conflict within your team. What was your approach?

“Two team members had differing approaches during the month-end close. This caused significant delays. I facilitated a quick discussion, clarified responsibilities and aligned everyone on a shared process. By focusing on accuracy and deadlines rather than blame, we cleared tension and improved collaboration moving forward.”

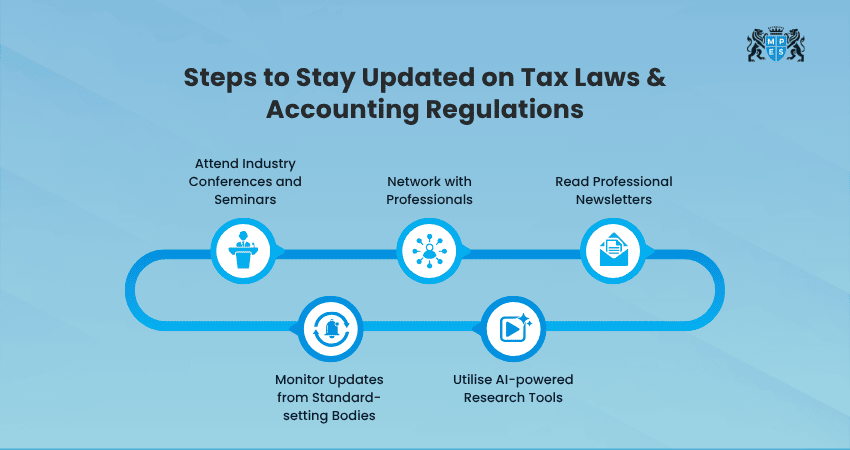

11) How do you keep up to date with the latest tax laws and Accounting regulations?

“I regularly read regulatory updates, follow professional Accounting forums and attend webinars. I also rely on official government portals and professional bodies like ACCA. When major changes occur, I discuss them with the team to make sure there's a smooth implementation in our processes.”

12) What personal goals or hobbies do you pursue outside of your professional life?

“Outside work, I enjoy reading and my interests range from fiction to works on personal finance and investing, which also helps me professionally. I enjoy outdoor walks to clear my mind and occasionally mentor students preparing for careers in Accounting. Staying balanced helps me stay sharp and focused at work.”

13) How do you manage and prioritise tasks when working under tight deadlines on multiple projects?

“I start by breaking tasks down into smaller milestones and ranking them based on urgency and business impact. I communicate the timelines clearly with stakeholders and set internal deadlines ahead of actual due dates. Staying organised and calm helps me deliver quality work even under pressure.”

14) Could you describe a challenging audit you conducted and how you managed it?

“During an external audit, discrepancies were flagged in inventory valuation. I coordinated with operations, traced documentation, and reconciled records. I worked closely with auditors, clarified our process and implemented a revised tracking method. The audit closed successfully with improved internal transparency.”

15) What can your previous employers, colleagues and friends say about you if the company representatives ask them?

“They would describe me as reliable, detail-focused and calm under pressure. My colleagues know me for being supportive and approachable, especially during tight deadlines. I believe they would also mention my habit of finding practical improvements in financial processes without complicating the workflows.”

Deliver breakthrough business strategies when it matters the most. Learn how in CIMA’s CGMA® Strategic Management (E3) Training - Sign up now!

16) Describe a situation where you presented financial information to senior leadership. How did you prepare?

“I prepared a forecast variance report and simplified complex figures into clear visuals. I focused on the business impact rather than just numbers and anticipated possible questions. Presenting the data with clarity helped the leadership quickly understand trends and make confident decisions.”

17) What has been your experience working with ERP systems?

“I’ve worked extensively with SAP and Oracle for the purpose of financial reporting, budgeting and reconciliation. I’ve also assisted in implementing workflow automation to reduce the need for manual entries. I enjoy optimising ERP systems use by setting up templates and shortcuts that make reporting faster and more accurate.”

18) Can you provide an example of a time when you had to analyse a large set of data to make a decision?

“I once analysed three years of expense data to identify patterns in operational costs. By categorising the spending and comparing vendor rates, I recommended adjustments that reduced overheads. That analysis helped the management renegotiate contracts with tangible savings.”

19) How do you approach training and mentoring Junior Accountants?

“I begin by understanding their strengths and giving them responsibilities in a gradual manner. I guide them through complex tasks step by step and encourage questions. I believe mentorship works best when the juniors feel supported and confident enough to handle tasks independently over time.”

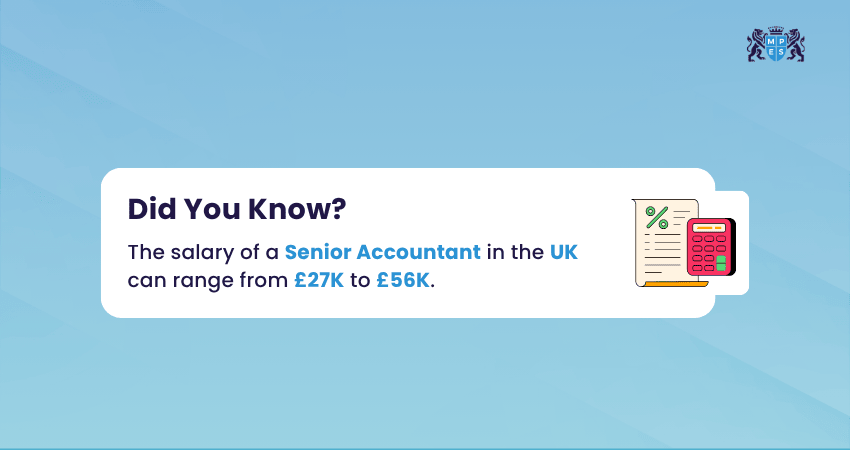

20) What are your salary expectations for this role?

“I’m looking for a compensation package in line with the responsibilities of a senior Accounting role and industry standards. I’m open to a fair discussion and more focused on long-term growth, contribution and being part of a team where I can add value.”

21) Tell us about a time when your ethical judgment was challenged.

“Once, I was asked to adjust reporting to make the results look more favourable. I immediately clarified that accuracy and transparency were non-negotiable. I offered an alternative way to present the data with context instead of manipulation. This helped me ensure integrity while addressing management concerns.”

22) Mention three weaknesses and describe what you're doing to improve those areas.

“I tend to be overtly detail-focused, so I’ve been working on balancing my speed. I also used to hesitate in delegating, but now I trust the team more. Additionally, I’m improving my presentation skills by practising more structured communication in meetings.”

23) Which Accounting Software are you most comfortable using, and how have you applied it in past roles?

“I’m highly comfortable with SAP, Oracle and QuickBooks. I’ve used them for financial reporting, reconciliations and budget preparation. I enjoy creating automated templates and using built-in analytics features to save time and improve accuracy across repetitive financial tasks.”

24) How do you cope with stress during high-pressure periods like month-end close or audits?

“During high-pressure periods, I stay organised, break tasks into manageable parts and start early to avoid last-minute pressure. I also communicate clearly with the team to prevent any bottlenecks. Taking short mental breaks helps me stay focused and maintain accuracy under pressure.”

25) Have you held any leadership roles? If so, please elaborate.

“Yes, I’ve led small finance teams during various audits and system transitions. I assigned them responsibilities, monitored their progress and supported the team members in resolving issues. I enjoy leadership roles because they allow me to combine technical expertise with People Management and process improvement.”

Conclusion

Success in finance role requires strong technical expertise, leadership and ethical judgment. These Senior Accountant Interview Questions help you prepare confidently for real workplace scenarios. With thoughtful preparation and clear communication, you can present yourself as a capable professional ready to support an organisation’s financial success.

Put your leadership to the test and emerge triumphant with CIMA’s CGMA® Strategic Level Case Study Course – Register now!

Have Any Question?

Have Any Question?

+44 7452 122728

+44 7452 122728

Back

Back

44 7452 122728

44 7452 122728