Table Of Contents

Becoming a Financial Manager is all about mastering the art of turning numbers into a future-ready strategy. These professionals are the masterminds behind budgeting, forecasting and guiding financial decisions that shape business success. If you are aiming for this career path, you’ve come to the right place.

In this blog, we’ll explore How to Become a Financial Manager, why their role is so vital, how they balance numbers with big-picture thinking and the salary you can expect in this high-stakes role. So read on and own the road to Financial Management!

What is a Financial Manager?

A Financial Manager serves as an essential professional in an organisation’s financial landscape. They are tasked with making strategic financial decisions, overseeing investments and maintaining fiscal stability, thus becoming instrumental in promoting sustainable business growth.

Companies actively seek Financial Managers for strategic guidance on investments, budgeting, and acquisitions, especially when working with large-scale or high-value portfolios. Think of a Financial Manager as a financial doctor for an organisation’s overall well-being.

How to Become a Financial Manager?

Pursuing a career as a Financial Manager requires careful planning and a strategic mindset. Here are the steps you must take to achieve this position:

1) Earn a Secondary Education

1) The journey to becoming a Financial Manager begins with achieving strong results in your GCSEs or A-Levels.

2) As most employers expect higher education, focus on subjects such as business, mathematics, statistics, or economics to build a solid foundation.

3) Excelling in these areas prepares you for entry into relevant undergraduate or postgraduate programmes.

4) During this stage, exploring the finance industry through personal research can further boost your understanding and career direction.

2) Earn a Higher Education Degree

1) The next step towards becoming a Financial Manager is completing an undergraduate degree.

2) This qualification demonstrates your knowledge, commitment, and enthusiasm for the finance industry.

3) You can choose a degree in finance, accounting, business management, or economics, depending on your interests and university offerings.

4) Most finance degrees span three years, though some extend to four with a placement year in a business setting.

5) After earning your undergraduate degree, consider pursuing a postgraduate qualification.

6) This advanced degree can open doors to senior positions in larger firms.

Step into the engine room of enterprise success with our CIMA’s CGMA® Management Accounting (P1) Course - Sign up now and fuel smarter, faster decisions!

3) Start Building Experience

1) You’re unlikely to start your career directly as a Financial Manager, so gaining experience in related entry-level positions is vital.

2) You can consider an internship or work-study placement while pursuing a bachelor’s degree.

3) Working in roles within Accounting teams or banks can provide valuable insights into the financial sector and the responsibilities of Financial Managers.

4) Relevant work experience strengthens your job applications.

5) It also builds the foundation needed to pursue industry certifications that set you apart.

6) During this stage, connecting with experienced professionals or finding a mentor can offer valuable guidance.

4) Earn a Certification

1) Pursuing industry-recognised certifications elevates your expertise.

2) These qualifications tell employers that you possess the knowledge and competence required for a Financial Management role.

3) You might pursue certifications in the Chartered Institute of Management Accountants (CIMA) qualifications to enhance your professional credibility.

4) Such credentials allow you to specialise in key areas and are widely respected across the finance sector.

5) This can give you a competitive advantage in your career progression and job applications.

5) Build Your Contacts and Knowledge

1) Throughout your career, you’ll encounter professionals from diverse roles and organisations.

2) Building strong connections with them can open doors to future opportunities within the financial sector.

3) Take the initiative to deepen your understanding of financial operations and the real-world challenges faced by Financial Managers.

4) Engaging with senior colleagues, especially those in Financial Management roles, can provide practical guidance.

5) This will help you align your skills and goals with long-term career success.

6) Build Soft Skills

1) While formal education equips you with technical and financial knowledge, cultivating soft skills is equally important.

2) In the finance sector, focus on improving your attention to detail, organisational abilities and analytical thinking.

3) These qualities are essential for making sound financial decisions.

4) These will help you manage complex data and excel as an effective Financial Manager.

Sharpen your reporting skills and bring clarity to the numbers with our CIMA’s CGMA® Financial Reporting Training (F1) Course - Sign up now!

What Skills Do You Need to Be a Financial Manager?

A Financial Manager needs a wide range of skills to keep up with all their responsibilities. Here are the essential skills:

1) Communication Skills

Finance Managers must clearly present complex financial information to diverse audiences, including stakeholders with limited technical expertise. Strong verbal and written communication skills are foundational for simplifying financial reports, delivering concise recommendations and collaborating with internal departments.

2) Computing Skills

For modern Financial Managers, proficiency in financial and analytical software is essential. They have to utilise specialised tools and standard office applications to interpret data and create reports. Gaining expertise in financial software and Enterprise Resource Planning (ERP) systems boosts analytical accuracy and improves one's employability in competitive finance roles.

3) Attention to Detail

A keen eye for detail helps Financial Managers identify errors and emerging trends in financial data. Since they work with sensitive and complex figures, maintaining precision is crucial for ensuring accuracy and producing reliable reports for stakeholders.

4) Analytical Skills

Analytical thinking lies at the heart of Financial Management. Financial Managers must interpret large datasets, analyse trends and gauge business performance. These insights guide strategic decisions and help senior management plan for sustainable growth, making analytical skills a cornerstone of financial leadership.

5) Risk Management

A Financial Manager must be adept at identifying and mitigating financial risks. This involves developing strategies to protect assets, manage credit exposure, and ensure regulatory adherence. Strong Risk Management ensures financial stability even during uncertain economic conditions.

6) Organisation

Financial Managers have to handle extensive documentation, including reports, contracts, projections and cash flow data. Managing multiple files and tracking team performance demands excellent organisational skills. Staying organised helps them access information quickly, maintain clarity, and deliver accurate analyses.

7) Leadership

Financial Managers have to frequently oversee teams of analysts and finance professionals. Strong leadership helps them to motivate team members and guide the company’s financial progress. Effective leaders can delegate tasks efficiently, build trust and inspire collaboration. These are key to driving sound financial strategies and outcomes.

8) Problem-solving

When assessing risks or managing budgets, Financial Managers rely on their sharp problem-solving abilities. These skills help them identify issues, develop out-of-the-box solutions and take corrective actions when financial challenges arise. This is key to ensuring the organisation stays on track to achieve its objectives.

What are the Responsibilities of a Financial Manager?

A Financial Manager plays a multifaceted role, covering a wide range of responsibilities. Here are some of the key responsibilities:

1) Developing Financial Strategies: Create and implement long-term financial plans that align with organisational goals.

2) Monitoring Financial Performance: Regularly track and assess financial results against set targets and budgets.

3) Analysing Market Trends and Economic Indicators: Study market conditions and economic data to forecast trends and guide strategic decisions.

4) Advising on Investment Decisions: Provide expert advice on investment opportunities to maximise returns while managing risk.

5) Ensuring Regulatory Compliance: Ensure all financial practices adhere to relevant laws, regulations and reporting standards.

6) Managing Financial Risks: Identify, evaluate and mitigate potential financial risks that could affect the organisation’s stability.

7) Overseeing Budgeting and Financial Reporting: Supervise and review the preparation of budgets, forecasts, and accurate financial statements to support management decisions.

From cost control to performance analysis, master the core of business finance with our CIMA’s CGMA® Operational Level Training - Sign up now!

How Long Does it Take to Become a Financial Manager?

The time it can take to become a Financial Manager can vary based on your education, experience and career path. Some professionals reach this goal within a few years, while others may take longer:

1) Typically, it takes around four to five years of academic study to qualify for the role.

2) Most Financial Management positions also require at least two years of relevant work experience to be considered fully competent.

3) Postgraduate study and professional experience together may extend the process by two to three years beyond your undergraduate degree.

However, the duration can vary from person to person. Those with prior business or finance experience might progress faster, sometimes entering Financial Management roles right after completing a finance-related postgraduate qualification.

Financial Manager Salary

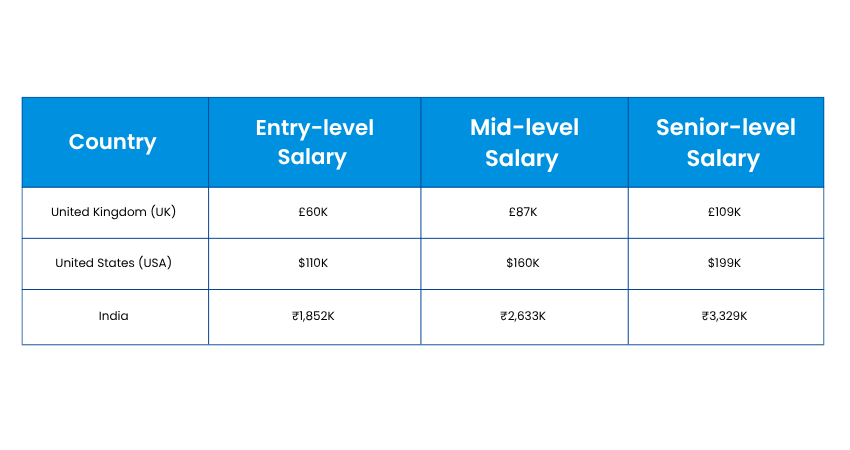

Let’s take a look at the Financial Manager salary range across three major regions: the UK, USA and India:

Source: Salary Expert

Conclusion

Learning How to Become a Financial Manager is a journey of precision, strategy and leadership. With the right education, experience and skills, you can transform any financial data into noteworthy business success. As organisations seek strong financial guidance, this career offers huge rewards, empowering you to shape the financial future of businesses and drive sustainable growth.

Frequently Asked Questions

FaQ's not available

Have Any Question?

Have Any Question?

+44 7452 122728

+44 7452 122728

Back

Back

44 7452 122728

44 7452 122728