Table Of Contents

Are you good with numbers but unsure whether Finance or Accounting is right for you? Choosing between Finance vs Accounting can be confusing if you enjoy money-related problem-solving but are not sure which field fits you better. Many students and professionals face the same choice, as both careers involve money but require different skills and offer different paths.

In this blog, you will get to know how Finance vs Accounting work, the skills they need, top jobs, and what you study in each degree. We will help you choose the right path based on your strengths. Get ready to find the career that truly fits you.

Table of Contents

1) What is Finance?

2) What is Accounting?

3) Differences Between Finance and Accounting

4) Finance or Accounting: Which is Better for You?

5) Conclusion

What is Finance?

Finance is about managing money for people, companies, and governments. It helps them plan how to save, spend, and invest their money wisely. People who work in Finance can have careers in investment banking, wealth management, or financial planning. Their role is to make sure there is enough money available for different needs and goals.

Finance professionals also focus on increasing the value of money over time. They invest funds in a safe and smart way while aiming for good returns. They study risks, analyse future opportunities, and help make financial decisions that support long-term growth and success.

What is Accounting?

Accounting is the process of recording, organising, and managing all the money a business receives and spends. It tracks financial activities such as sales, purchases, income, and payments. Accountants may work for a single company, for individuals, or for multiple clients in public Accounting firms. Their work helps businesses understand their financial position and overall performance.

Accounting professionals ensure that all financial records are accurate and up to date. They verify that account balances match and prepare key financial statements such as the balance sheet and income statement. These reports reflect the true financial health of a business and help owners, investors, and leaders make informed decisions for the future.

Differences Between Finance and Accounting

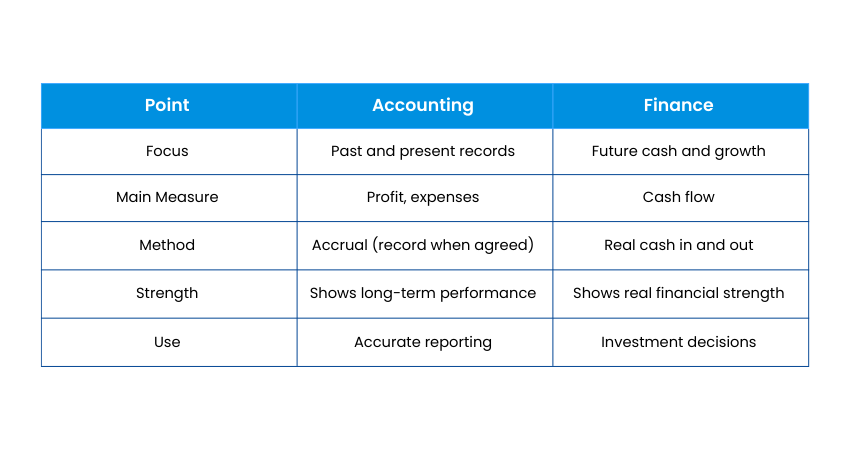

Finance and Accounting work together in every organisation, but they are not the same. In the Finance vs Accounting comparison, Accounting focuses on past and present records, while Finance plans for the future. Here is the key difference between Finance and Accounting.

1) Finance vs Accounting: The Scope and Focus

Accounting shows the current financial position of a business. It records all transactions and uses them to prepare reports. A basic idea used in Accounting is the Accounting equation:

Assets = Liabilities + Owner’s Equity

This equation must always balance. It helps a company check if its financial records are accurate.

Finance focuses on planning, investing, and managing money to support future growth. It looks at how much cash a business can make and how that cash can be used to increase value. The main goal is to earn good profits while managing risks wisely.

Boost your Accounting expertise with Management Accounting (MA) Training - Sign up and transform your future

2) Finance vs Accounting: Measuring Financial Performance

Accounting measures performance by looking at earnings, expenses, and other recorded financial data. It often uses the accrual method. This means income and costs are recorded when they are agreed on, even if the money has not yet been received or paid. This approach gives a clear view of how a company has performed over time.

Finance measures performance by looking at actual cash flow. It studies how much cash is coming in and going out. Finance believes that cash in hand tells a more realistic story of a company’s strength because it shows what the company can really use right now. Cash flow also helps in making strong decisions for future investments.

3) Finance vs Accounting: Assessing Value

Accounting follows a cautious approach when valuing assets and liabilities. If a value is uncertain, accountants often record it at a lower, safer figure. This conservative method protects the business from overstating profits or asset values and helps maintain accurate financial reporting. Finance, on the other hand, focuses on estimating the future value of assets, projects, or entire businesses. A common method used is forecasting future cash flows and calculating their present value. This helps finance professionals decide whether an investment is worthwhile and if it will deliver strong returns over time.

4) Finance vs Accounting: Degree & Coursework

Finance and Accounting degrees both begin with common business subjects like business law, marketing, statistics, international business, management, and basic Finance. These subjects help students understand how organisations work and how money flows in a business environment.

As the programmes progress, the coursework becomes different. Finance students study investments, markets, banking, and risk management for future growth. Accounting students learn financial reporting, auditing, and taxation to keep records accurate and compliant. Finance focuses on planning ahead, while Accounting focuses on maintaining correct financial information.

5) Finance vs Accounting: Top Jobs

Both fields offer many career opportunities, but the type of work is different. Here are the Accounting and Finance jobs:

Common Finance Jobs:

a) Financial Analyst

b) Investment Banker

c) Portfolio Manager

d) Finance Manager

e) Risk Analyst

f) Wealth Advisor

These roles focus on planning and improving financial performance.

Common Accounting Jobs:

a) Accountant

b) Auditor

c) Tax Consultant

d) Accounts Manager

e) Cost Accountant

f) Controller

These roles focus on accurate financial reporting and following rules.

6) Finance vs Accounting: Salary Expectations

In the Accounting vs Finance salary comparison, Finance roles like Financial Analysts and Investment Bankers often earn higher pay because they focus on increasing profits and managing investments. Accounting roles like Auditors and Tax Consultants also provide high income, especially with experience or advanced qualifications. Here are some examples:

Salaries can increase more in Finance jobs, such as investment banking, where bonuses can be very high.

Advance your career with Business and Technology (BT) Training and learn how technology drives business growth

7) Finance vs Accounting: Career Outlook

Both Finance and Accounting offer strong job opportunities because businesses always need financial experts. Accounting careers are very stable since companies must maintain accurate records and follow tax rules. Accountants can find jobs in many sectors, such as banking, government, and corporate offices. Finance careers can grow faster and often lead to higher-paying roles. Jobs in investment, financial planning, and risk management are in high demand as businesses focus more on future economic success. In short, Accounting is great for job security, while Finance is ideal for those who want faster career growth.

Finance or Accounting: Which is Better for You?

The best choice depends on what you enjoy and how you like to work. If you like planning for the future, studying markets, and helping businesses grow money, then Finance may be the better fit. Finance jobs are exciting and often offer higher earning potential as you gain experience in the Finance vs Accounting career path. If you prefer working with accurate numbers, checking records, and making sure everything follows rules, then Accounting may be the right choice for you. It provides steady job opportunities in almost every industry. In the end, choose the field that matches your strengths and keeps you motivated to build a successful career.

Conclusion

Deciding between Finance and Accounting is about finding a career that matches your abilities and passions. Both fields offer great job options, strong salaries, and room to grow. When looking at Finance vs Accounting, think about whether you enjoy shaping the future or ensuring accuracy today. Choose the path that excites you the most and start building a confident and successful career.

Upgrade your Accounting expertise with ACCA Applied Knowledge Training. Start learning and unlock new opportunities

Have Any Question?

Have Any Question?

+44 7452 122728

+44 7452 122728

Back

Back

44 7452 122728

44 7452 122728