Table Of Contents

Every pound your company spends tells a story. The question is, does it lead towards growth, or is it quietly holding you back? Behind every financial decision lies a choice: to simply keep the business running or to push it towards something greater.

In today’s competitive world, success isn’t just about earning more. It is about spending smart, planning ahead, and turning numbers into strategy. That is exactly the essence of Strategic Financial Management. It is the difference between reacting to problems and facing them with confidence. Eager to discover how Strategic Financial Management can shape your company’s future? Let’s dive in!

What is Strategic Financial Management?

Strategic Financial Management (SFM) can be defined as the process of managing an organisation’s finances to achieve long-term goals. It focuses on how financial decisions such as investments, budgeting, and risk control can help a business grow steadily and remain successful in the future.

This approach ensures that money is used wisely to create long-term value, not just to solve short-term issues. In short, it turns finance into a strategic tool that drives performance, growth, and resilience.

Why is Strategic Financial Management Important?

Strategic Financial Management helps businesses make smarter decisions, manage resources effectively, and maintain financial stability over the long term. When finance becomes part of a company’s overall strategy, it fuels growth, improves competitiveness, and builds resilience.

It also allows leaders to spot risks early, identify new opportunities, and make confident choices that shape the organisation’s future. Businesses that use Strategic Financial Management benefit from:

1) Smarter Resource Allocation: Making sure money is spent where it has the most impact.

2) Better Decision-making: Using financial information to set clear priorities.

3) Steady Growth: Staying strong and prepared, even when markets change.

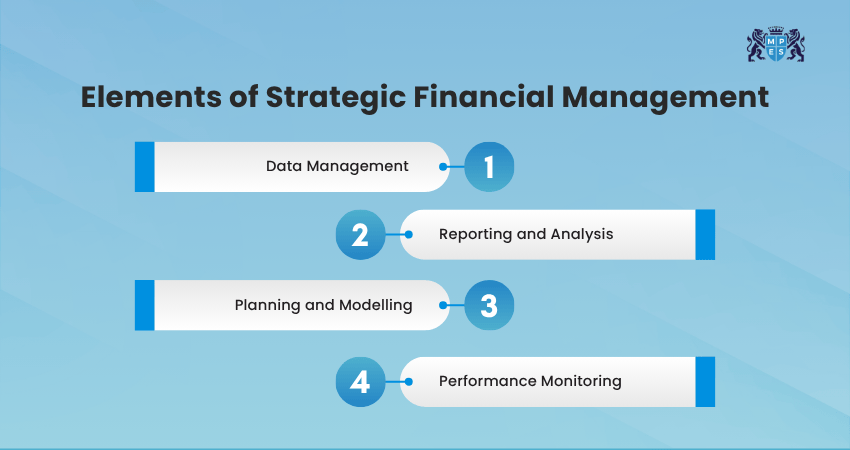

What are the Elements of Strategic Financial Management?

Strategic Financial Management lays the foundation for sustainable, long-term success. It brings together key elements that ensure financial decisions are well-informed, data-driven, and aligned with business goals. Here are the essential elements every organisation should focus on for steady growth:

1) Data Management

Strong financial decisions depend on accurate, timely, and well-organised data. When financial information is consistent and centralised, it reduces the risk of costly mistakes and supports smarter planning. Businesses can strengthen data management by:

1) Setting clear rules for collecting and storing financial data

2) Checking and updating data regularly to fix errors and remove old information

3) Keeping all important data in one place so everyone works with reliable information

2) Reporting and Analysis

Reporting turns data into useful insights that show how the business is performing. Clear reports help leaders understand where money is coming from, where it is going, and where improvements can be made. To make it effective, you can:

1) Use simple visuals like charts or dashboards to show financial trends clearly

2) Compare current and past results to see progress or changes

3) Share key insights across teams to support better joint decisions

3) Planning and Modelling

Planning and modelling guide how financial resources are allocated to achieve long-term goals. They offer a forward-looking view of potential outcomes and help test different strategies before making major decisions. This includes:

1) Budgeting: Setting limits on spending based on future income

2) Cash Flow: Make sure there’s enough money available to run operations smoothly

3) Scenario Modelling: Testing different plans to see which option gives the best results

4) Performance Monitoring

Strategic Financial Management is an ongoing process. Businesses track Key Performance Indicators (KPIs) such as sales growth, profit margins, and cash flow to see if they’re on the right path. Regular monitoring helps spot issues early and make quick changes when needed.

1) Check results often to spot problems early and fix them quickly

2) Use tools and dashboards to track finances in real time

3) Connect results to business goals so everyone stays focused on what is important

Convert complex financial data into clear insights with our CIMA’s CGMA® Financial Reporting Training (F1) - Register today!

What is the Process of Strategic Financial Management?

Strategic Financial Management follows a clear, step-by-step process that helps organisations plan, execute, and refine their financial strategies effectively. Each stage ensures that decisions are well-informed, aligned with business goals, and adaptable to change.

Step 1: Define Financial Goals and Objectives

Start by deciding what the company wants to achieve financially. This could mean increasing profits, reducing debt, improving cash flow, or expanding into new markets. The goals should be clear, measurable, and linked to the company’s overall strategy.

Things to Consider:

1) Make sure goals are achievable and based on real data

2) Connect financial goals with the company’s overall strategy

3) Get input from key teams so everyone understands the targets

Step 2: Develop Financial Plans

Once goals are set, make financial plans and budgets. These plans show how the company will use its money to reach its targets. This may include investment plans, funding options, and risk management strategies.

Things to Consider:

1) Base plans on accurate and updated financial data

2) Prepare for different outcomes like best, worst, and likely

3) Leave some room to adjust if conditions change

Step 3: Implement Financial Strategies

This step is about turning plans into real actions. It could involve investing in new projects, managing costs, or improving efficiency. Finance teams work closely with other departments to make sure every activity supports the company’s financial goals.

Things to Consider:

1) Make sure everyone understands their role in the plan

2) Keep spending under control

3) Focus on activities that bring the best financial results

Step 4: Monitor and Control Financial Performance

Once strategies are in motion, tracking performance is essential. Compare actual outcomes with forecasts, analyse key financial metrics, and adjust where necessary. Continuous monitoring helps detect problems early and keep the business on track.

Things to Consider:

1) Review financial performance often

2) Use tools and software to monitor progress in real time

3) Fix any issues quickly to stay on track

Develop your strategic thinking and financial planning skills with our CIMA’s CGMA® Management Accounting (P1) Course – Join now!

Step 5: Evaluate and Refine Financial Strategies

Finally, look back at the results to see what worked well and what can be improved. Use these insights to refine strategies for the future. This keeps the company flexible and ready to adapt to market changes or new opportunities.

Things to Consider:

1) Collect feedback from teams and stakeholders

2) Stay aware of market trends and risks

3) Treat this as a continuous process, not a one-time task

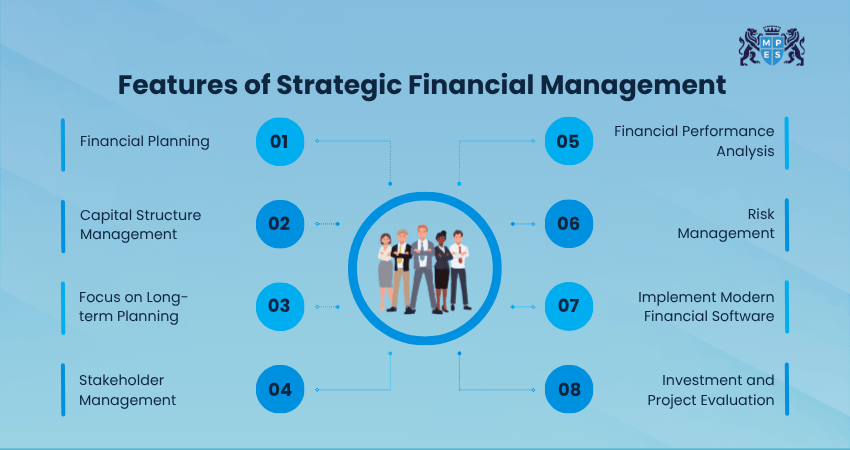

Features of Strategic Financial Management

Strategic Financial Management helps organisations plan, allocate, and control their finances effectively to achieve long-term goals. It combines financial discipline with strategic vision, ensuring every decision contributes to sustainable success. Here are the key features that make it effective:

1) Financial Planning

Financial planning means creating clear money plans that match the company’s goals. It helps decide where to spend, how to save, and what to expect in the future.

Key Traits:

1) Sets clear and achievable goals

2) Links financial plans with business aims

3) Helps the company plan ahead with confidence

2) Capital Structure Management

This means choosing the right mix of debt and equity to fund the company’s needs. The goal is to keep finances balanced and strong.

Key Traits:

1) Balances borrowing and company funds

2) Reduces financial risks and costs

3) Keeps enough flexibility for future needs

3) Focus on Long-term Planning

Strategic Financial Management goes beyond short-term goals, it focuses on building long-term strength. It encourages organisations to anticipate market changes, adapt strategies, and plan for future growth.

Key Traits:

1) Establishes long-term objectives for steady expansion

2) Changes plans when markets shift

3) Keeps the company focused on the future

4) Stakeholder Management

Managing relationships with investors, lenders, and other stakeholders is crucial for maintaining confidence and trust. Regular communication ensures transparency and supports the company’s credibility.

Key Traits:

1) Promotes honesty and clear updates

2) Builds trust with investors and partners

3) Keeps everyone informed and confident

5) Financial Performance Analysis

This feature involves assessing how efficiently the business is using its financial resources. By analysing profits, costs, and cash flow, companies can identify strengths, weaknesses, and improvement opportunities.

Key Traits:

1) Tracks profits, costs, and cash flow

2) Uses KPIs to measure progress

3) Helps make quick and smart decisions

6) Risk Management

Every business face uncertainty, but effective financial management helps identify and control risks before they escalate. It ensures business continuity even in challenging conditions.

Key Traits:

1) Detects financial and market risks early

2) Uses insurance or diversification to reduce losses

3) Keeps the business steady during tough times

7) Implement Modern Financial Software

Technology plays a key role in finance today. Modern financial software automates data collection, creates instant reports, and provides quick insights with accuracy.

Key Traits:

1) Automates daily finance tasks to avoid mistakes

2) Shows real-time updates for quick decisions

3) Saves time and improves efficiency

8) Investment and Project Evaluation

Before spending money, companies check if projects or investments are worth it. This helps make sure money goes to the best opportunities.

Key Traits:

1) Looks at the expected returns before investing

2) Focuses on high-value, low-risk projects

3) Helps make smart spending choices

Strengthen your understanding of finance, management, and operations with our CIMA’s CGMA® Operational Level Case Study Course – Sign up soon!

Benefits of Strategic Financial Management

Below are the benefits of Strategic Financial Management:

1) Improves Risk Management

1) Finds and fixes financial risks early

2) Keeps the business ready for uncertain markets

3) Uses flexible plans to handle changes easily

4) Helps respond quickly when issues arise

Reduces losses through smart decisions

Builds a strong risk-aware culture

Keeps the business stable and protected

2) Attracts More Stakeholders

1) Builds confidence among investors and partners

2) Improves the company’s reputation and credit score

3) Makes it easier to get loans or investments

4) Builds lasting relationships with stakeholders

5) Encourages honesty and transparency in finance

6) Shows the company is reliable and organised

7) Strengthens business credibility in the market

3) Enhances Business Performance

1) Helps make better spending and investment choices

2) Boosts efficiency and productivity

3) Finds which areas make the most profit

4) Matches financial plans with business goals

5) Supports innovation and growth

6) Keeps performance steady in changing markets

7) Builds long-term financial strength

4) Create Future-ready Finances

1) Builds a strong base for financial stability

2) Helps plan for both good and bad market conditions

3) Guides smart and safe investment choices

4) Makes better use of money and resources

5) Keeps cash flow steady and healthy

6) Promotes long-term financial growth

7) Supports better budgeting and forecasting

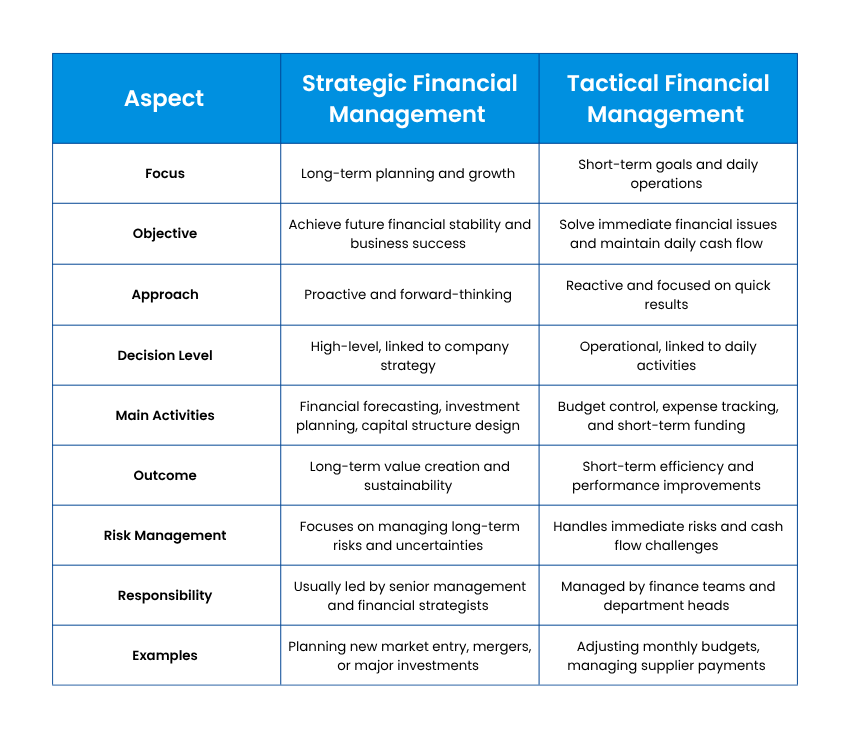

Strategic vs Tactical Financial Management: Key Difference

Both Strategic and Tactical Financial Management are important, but they serve different purposes. So, here are the differences between these two Financial Management:

Conclusion

Strategic Financial Management is the backbone of long-term business success. When finance becomes a strategic partner, every decision, investment, and plan works together to build lasting growth and resilience. In a world where markets change quickly, having a clear financial strategy is what separates thriving businesses from others.

Build a strong financial foundation with our CIMA’s CGMA® Operational Level Training – Explore now!

Frequently Asked Questions

FaQ's not available

Have Any Question?

Have Any Question?

+44 7452 122728

+44 7452 122728

Back

Back

44 7452 122728

44 7452 122728