Table Of Contents

Money affects almost everything we do, from paying bills and buying food to planning holidays and future dreams. Many of us often wonder, “Where did my money go?” or feel stressed when surprise expenses appear. The good news is you do not need to be a financial expert to take control. Small steps and simple habits can help you feel confident with your money.

In this blog, we will explain personal finance and Personal Financial Management (PFM), why they matter, key finance areas, simple strategies, tips, and how PFM is different from budgeting. By the end, you will learn easy steps to manage your money well and build a secure future.

What is Personal Finance?

Personal finance is all about how you manage your money in daily life. It covers everything from earning and spending to saving, investing, and planning for the future. It also includes managing debt and protecting yourself from financial risks. Good personal finance helps you stay on top of bills, save for your goals, avoid unnecessary debt, and feel confident about your financial future.

It’s not just about managing money; it’s about making smart financial choices that improve your quality of life. Personal finance helps you set priorities, build good habits, and make your money work towards what truly matters to you, such as stability, comfort, and long-term goals.

What is Personal Financial Management (PFM)?

Personal Financial Management (PFM) is about keeping track of your money and making smart decisions about how you use it. In today’s digital world, most people manage their finances through mobile apps or online banking tools. These tools help you see where your money goes, check all your accounts in one place, and plan your spending effectively.

PFM tools also help you make a budget, understand your spending habits, see your total savings and debts, and manage your money better over time. The goal is to help you stay in control of your money and make good financial decisions easily.

Why is Personal Financial Management Important?

Personal Financial Management is essential for maintaining financial stability, managing daily expenses, and building a secure future. It helps you stay organised, prepare for emergencies, and make progress toward long-term goals like buying a home or retiring comfortably.

Here are some simple reasons why PFM matters:

a) Helps you understand where your money goes

b) Makes it easier to pay bills on time for consumers

c) Helps you save money for future needs

d) Prevents overspending and helps you live within your means

e) Reduces stress about money

f) Helps you avoid too much debt

g) Prepares you for emergencies

h) Supports long-term goals like buying a house or retirement

Start your finance foundation today with our Recording Financial Transactions (FA1) Training - Join now!

What are the Areas of Personal Finance?

Personal finance covers several key areas that help you manage your money wisely. Each area plays a role in shaping how you earn, save, spend, and grow your wealth. Understanding these areas makes it easier to build healthy financial habits and stay in control of your finances.

1) Budgeting

Budgeting means creating a plan for how you’ll use your money. It helps you decide how much to spend, save, and set aside for future needs. With a good budget, you can cover all your expenses, reach your goals, and avoid running out of money before the month ends.

2) Savings

Saving is about putting money aside for future needs or emergencies. It gives you financial security and peace of mind. Whether it’s for unexpected bills, holidays, or long-term goals like buying a car or a home, saving a small amount regularly can make a big difference over time.

3) Manage Debt

Managing debt means paying back the money you borrowed. It is important to pay loans on time and not borrow more than you need. This helps you stay safe from money problems and stress.

4) Income

Income is the money you earn from your job, business, or other work. It is the money that comes into your pocket. When you try to build your skills and work better, you can earn more in the future.

Personal Financial Management Strategies

Personal Financial Management strategies help you plan your spending, save effectively, and avoid unnecessary debt. These habits keep you organised, financially secure, and better prepared for the future. Let’s look at some simple but powerful strategies you can follow.

1) Understand and Prioritise Your Financial Goals

Start by thinking about what matters most; buying a home, paying for education, or building an emergency fund. Once you’ve listed your goals, rank them in order of importance. Focusing on one goal at a time makes progress easier and more rewarding.

2) Budget Creation

Make a monthly plan for your income. Write down how much you earn and how much you will spend on things like food, travel, rent, and savings. This helps you control your spending and avoid running out of money.

3) Make Sure Your Goals are SMART

Set goals that are Specific, Measurable, Achievable, Relevant, and Time-bound (SMART). For example, instead of saying, “I’ll save money,” try “I’ll save £200 each month for one year.” SMART goals keep you focused and motivated.

4) Track Your Spending

Keep a close eye on where your money goes each week or month. You can record it in a notebook or use an app to make tracking easier. Regularly checking your expenses helps you spot wasteful habits and stay in control of your finances.

5) Pay off Debt and Avoid New Debt

If you owe money, try to pay it back as soon as you can. Do not take new loans unless it is truly needed. Less debt means less stress and more financial freedom in your daily life and future, giving you peace.

6) Automate Your Savings and Payments

Set up automatic payments for bills and savings. This way, you do not forget to save or pay on time. It makes managing money easier. Automatic payments also help you build good habits without extra effort.

7) Find Smart Ways to Cut Costs and Boost Your Monthly Cash Flow

Find small ways to save more money. For example, cook at home more often, cut unused subscriptions, or look for cheaper options. Small savings every month add up to big savings over time.

8) Get Help from a Financial Advisor and ask for Debt Support When Needed

If you feel unsure about managing money or handling debt, speak to a financial advisor. Expert guidance can help you make better decisions, create realistic plans, and prevent small problems from becoming major financial challenges.

Learn Cost Analysis, budgeting & performance reporting with our Management Information (MA1) Training – Join today!

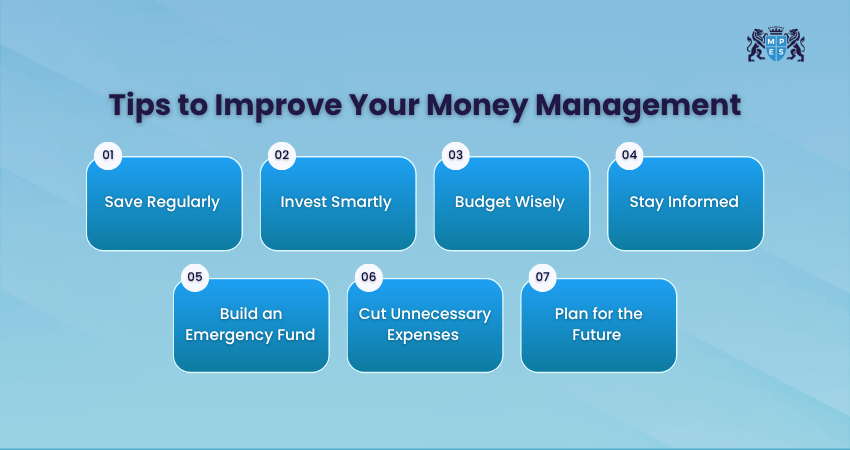

Money Management Tips for Improving Your Personal Finance

Money management means handling your income wisely so you can save more, spend smartly, and stay financially secure. Here are some simple and effective tips to help you manage your money better every day.

1) Save Regularly

Keep some money aside every month or every time you get paid. Even if it is a small amount, saving often helps you build good habits. Over time, your savings grow and give you safety and peace of mind.

2) Invest Smartly

Use part of your savings to earn more money in the future. Choose safe and simple options that grow slowly and steadily. You do not need to rush or take big risks, and focus on long-term growth.

3) Budget Wisely

Create a monthly budget that tracks your income and expenses. This helps you understand where your money goes, avoid overspending, and ensure you’re saving enough. A realistic budget keeps you in control and reduces financial stress.

4) Stay Informed

Keep learning about money and how to handle it. Read easy articles, watch videos, or talk to someone who understands finance well. The more you learn, the better choices you can make, both now and later.

5) Build an Emergency Fund

Set aside money for unexpected situations such as medical bills, repairs, or job loss. Aim to save enough to cover at least three to six months of living expenses. An emergency fund protects you when life takes an unexpected turn.

6) Cut Unnecessary Expenses

Look at what you spend money on and remove things you do not really need. Small changes, like eating at home or cancelling unused subscriptions, can save a lot over time. This gives you more money for goals and needs.

7) Plan for the Future

Think about what you want your money to do in the coming years, like buying a home or saving for retirement. Set simple goals and work on them step by step. Planning early makes your future more secure and comfortable.

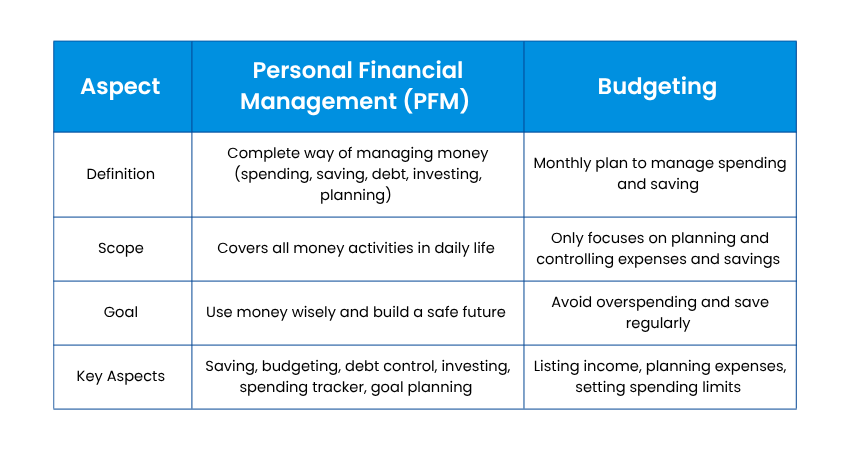

PFM vs Budgeting

Personal Financial Management (PFM) is the full way of handling your money, including saving, budgeting, paying bills, managing debt, and planning for future needs. Budgeting is one part of PFM. It focuses on planning how much you will spend and save each month to control your daily use of money and avoid overspending.

Conclusion

Managing your money wisely helps you stay prepared, avoid stress, and build a secure future. Simple habits like saving, budgeting, and planning ahead make a big difference over time. Start small and stay consistent, and you will see steady progress. With good Personal Financial Management, you can achieve your goals, handle challenges with confidence, and enjoy greater peace of mind.

Take the first step toward accounting mastery with our ACCA Foundations Course – Join now!

Frequently Asked Questions

FaQ's not available

Have Any Question?

Have Any Question?

+44 7452 122728

+44 7452 122728

Back

Back

44 7452 122728

44 7452 122728