Table Of Contents

Are you unsure how to handle accounting questions like bank reconciliations, financial ratios or deferred income? The key is understanding how to answer them with clarity and real-world examples. Chartered Accountant Interview Questions can be challenging since they test your technical knowledge and analytical skills.

Employers want professionals who can apply accounting principles in practical business scenarios. With the right preparation, you can present your answers in a structured and professional way that creates a lasting impression. In this blog, we’ve compiled 30+ Chartered Accountant Interview Questions and Answers to help you prepare effectively. Let’s dive in!

Chartered Accountant Interview Questions and Answers

The following Chartered Accountant Interview Questions and answers are designed to help you prepare for both technical and behavioural aspects, giving you the confidence to perform at your best.

1) Can you briefly introduce yourself?

“My name is Alice, and I’m a Chartered Accountant with four years of experience in accounting, auditing and financial reporting. I hold a degree in Accounting and have worked with ABC Company, where I managed financial statements, supported audits and improved cost efficiency. I’m well-versed in GAAP, IFRS and local tax regulations.”

2) What are the various types of accounting?

“Accounting can broadly be classified into financial accounting, management accounting, cost accounting and tax accounting. Financial accounting focuses on external reporting, management accounting aids decision-making, cost accounting tracks production costs and tax accounting ensures compliance with laws and regulations.”

3) How would you define working capital?

“Working capital is the difference between a company’s current assets and current liabilities. It shows how well a company can handle its short-term financial obligations. In my previous role, I regularly monitored working capital to ensure sufficient cash flow for daily operations, which helped maintain smooth vendor payments and improve overall financial stability.”

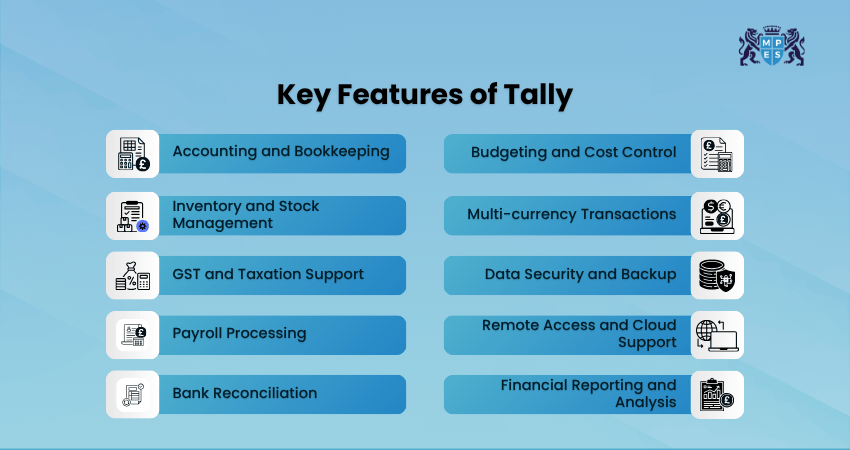

4) Could you explain Tally accounting?

“Tally is an Accounting Software used to record transactions, create invoices and manage payroll. It helps automate Bookkeeping and financial reporting, making it simple for businesses to maintain accurate records. In my previous role, I used Tally to streamline monthly financial entries and generate GST reports, which significantly reduced manual workload and improved reporting accuracy.”

5) What are fictitious assets in accounting?

“Fictitious assets are not tangible or real assets but represent expenses or losses that have not yet been written off. Examples include preliminary expenses, promotional costs or discounts on share issues. They appear on the asset section of the balance sheet until fully written off.”

6) How do you ensure the accuracy of your accounting records?

“I ensure accuracy by regularly reconciling the accounts, using proper Accounting Software and maintaining all the supporting documentation. Additionally, I cross-check transactions, perform periodic audits and comply with internal control measures to minimise the risk of errors or fraud.”

Sharpen your strategic reporting skills with our Case Study (CS) Course – Register today!

7) What is TDS, and where is it reflected on the balance sheet?

“Tax Deducted at Source (TDS) is a tax collected by the payer on behalf of the government when making payments such as salaries, rent, or interest. On the balance sheet, TDS deducted but not yet remitted appears as a current liability until it is paid to the tax authorities.”

8) Which accounting software platforms have you used?

“I’ve worked with Accounting Software such as Tally ERP 9, QuickBooks, SAP and Zoho Books. Each platform offers different features. For example, SAP is ideal for enterprise-level operations, while QuickBooks and Tally are efficient for small and medium-sized organisations.”

9) What common mistakes do you often see in accounting?

“Common mistakes include wrong data entry, not reconciling accounts, missing transactions or classifying items incorrectly. Regular reviews, automation and clear processes can help prevent most of these errors. In my experience, maintaining proper documentation and performing monthly reconciliations are key to detecting and correcting such issues early.”

10) Why do you believe accounting standards are essential?

“Accounting Standards ensure that all companies follow the same rules when preparing financial statements. They make financial reports more consistent, comparable and transparent, which helps investors, regulators and stakeholders make informed decisions.”

11) How is the acid-test ratio calculated?

“The acid-test ratio or quick ratio shows a company’s ability to pay its short-term liabilities without selling inventory. It is calculated as:

(Current Assets – Inventory) ÷ Current Liabilities

A result above one generally means the company has required liquid assets to cover its immediate debts. In my previous role, I calculated this ratio monthly to evaluate cash availability. This helped our finance team manage short-term liabilities more efficiently.”

12) What is the purpose of a bank reconciliation statement?

“A bank reconciliation statement compares a company’s records with its bank statement to spot any differences. It helps find errors like missed entries, bank charges or fraudulent transactions, ensuring the cash balance is accurate.

For example, during one reconciliation, I discovered an unrecorded bank charge that had caused a mismatch in our cash book and correcting it ensured our financial statements had the true cash position.”

13) Could you explain the fundamental accounting equation?

“The fundamental accounting equation is:

Assets = Liabilities + Equity

It represents the balance between what a company owns and how those assets are financed, either through debt (liabilities) or shareholder investment (equity). Using this equation, we once found an imbalance caused by an incorrectly recorded loan adjustment. This equation helped us quickly correct the entry to restore accuracy in the balance sheet.”

14) What does scrap value mean in accounting?

“Scrap value, also called residual value, is the estimated amount an asset will be worth after its useful life ends. It is used when calculating depreciation, showing how much value the asset retains after full use.”

Discover IFRS-based statement preparation and advanced analysis with our Financial Accounting and Reporting (FARI) Course – Join now!

15) What were your key responsibilities in your previous accounting role?

“My responsibilities included preparing financial statements, maintaining general ledgers, managing tax compliance and supporting external audits. I also assisted in budgeting, variance analysis and implementing internal control improvements to enhance financial accuracy.”

16) How would you differentiate between current and non-current liabilities?

“Current liabilities are debts due in a year, like accounts payable or short-term loans. Non-current liabilities are long-term debts such as bonds or loans payable after one year. Understanding this difference helps a company manage its cash flow effectively, plan repayments efficiently and maintain a healthy balance between short-term liquidity and long-term financial stability.”

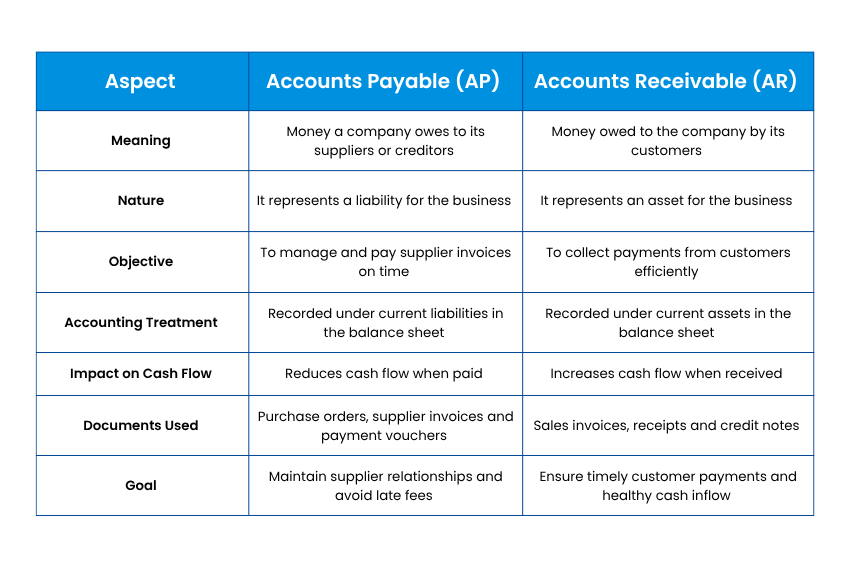

17) Can you explain the difference between Accounts Payable (AP) and Accounts Receivable (AR)?

“Accounts Payable are the money a business owes its suppliers. Accounts Receivable is the money owed to the business by its customers. Managing both helps maintain good cash flow and strong financial control.”

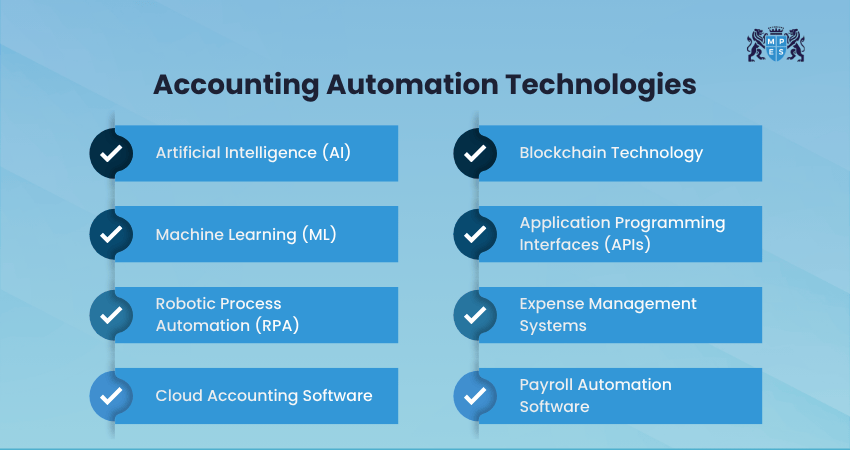

18) In your opinion, what is the biggest challenge the accounting industry is currently facing?

“I believe the biggest challenge in the accounting industry today is keeping up with rapid technological change. Many accountants are still adapting to automation and digital tools, but as technology becomes more integrated, it is also creating opportunities for greater accuracy and efficiency in financial reporting.”

19) How do you manage and prioritise tasks when facing multiple deadlines?

“I organise my work by urgency and importance. I use to-do lists and project tracking tools to plan my week. Breaking big tasks into smaller ones helps me meet deadlines without stress or confusion. In my previous role, this approach allowed me to handle multiple month-end reports efficiently for clients while maintaining accuracy.”

20) How do you handle external audits and interact with auditors?

“I prepare all records in advance, ensure documentation is complete and stay transparent with auditors. I answer queries clearly and work closely with them to fix any issues they find during the audit.”

21) What is the importance of internal controls in accounting?

“Internal controls prevent fraud, protect company assets and ensure that financial records are accurate. They create a reliable system for tracking transactions and meeting compliance requirements. For example, in my previous role, implementing a dual-approval process for payments has reduced the risk of unauthorised transactions and improved financial transparency.”

22) How do you incorporate risk management into financial reporting?

“I identify financial risks such as errors, non-compliance or fraud and take steps to reduce them. Regular reviews, internal audits and proper documentation help make financial reporting more secure and reliable. In my previous role, by strengthening review controls and audit checks, I helped reduce reporting discrepancies by nearly 25%, improving overall accuracy and compliance.”

23) Could you explain deferred tax assets and liabilities?

“Deferred tax assets are future tax savings created when you effectively pay or recognise more tax now such as carry-forward losses. Deferred tax liabilities are future tax amounts you will owe because you paid less tax now due to timing differences, such as accelerated depreciation.”

24) How do you approach consolidating financial statements for multiple companies?

“I make sure all subsidiaries use the same accounting policies, remove inter-company transactions and then combine the results. This ensures accurately consolidated financial statements that meet IFRS or local standards.”

25) What are your views on the impact of automation in accounting?

“Automation saves time, reduces errors and helps analyse data faster. But it also means accountants must develop new skills like data interpretation and software management to stay valuable.

For instance, when my previous company adopted automated reconciliation software, processing time for monthly reports dropped and that helped the finance team to focus more on analysis and decision-making.”

26) What motivated you to become a Chartered Accountant?

“I’ve always been interested in numbers and problem-solving. Becoming a Chartered Accountant allows me to work with different industries, make strategic business contributions and help organisations grow through sound financial planning.”

Become a trusted advisor in financial transparency and compliance with our Audit and Assurance (AA) Course – Sign up soon!

27) Can you share your experience with IFRS and how it affects financial reporting?

“I’ve prepared and reviewed financial statements in compliance with IFRS, particularly focusing on standards like IFRS 15 and IFRS 16. Applying these helped ensure our reports were transparent and comparable with international benchmarks.

For example, implementing IFRS 16 required reassessing lease liabilities, which improved the accuracy of our balance sheet and provided clearer insights into the company’s long-term commitments.”

28) What happens to customer cash received but not yet recognised as revenue?

“This will be recorded as Unearned Revenue or Deferred Income, shown as a liability. It becomes recognised revenue only when the company delivers its goods or services to the customer.”

29) How do you maintain work-life balance in a demanding Chartered Accountant role?

“I plan my work carefully and set clear boundaries between my work and personal time. I also delegate tasks when needed and keep good communication with my team. This helps me meet deadlines and stay balanced without feeling overwhelmed.”

30) What distinguishes you from other candidates for this CA position?

“I bring technical expertise along with a strong focus on process improvement and collaboration. My ability to translate financial data into actionable insights helps organisations make better decisions. In my previous job, I streamlined reporting processes and improved audit readiness, which supported better financial control and cost efficiency.”

31) Where do you see your career in the next five years?

“In the next five years, I see myself growing into a more strategic role where I can lead financial planning and support major business decisions. I want to use my accounting expertise to help the organisation achieve long-term stability and growth while continuing to learn through new technologies and industry developments.”

32) Can you describe a time when you improved an accounting process at work?

“In my previous job, we faced frequent delays and errors during the bank reconciliation process due to manual data entry. To resolve this, I automated key parts of the process using Excel formulas and macros. This reduced reconciliation time by over 30%, minimised errors and made monthly reporting much faster and more accurate.”

33) What have you done in the past year to enhance your skills for this role?

“I’ve completed courses in advanced Excel, GST updates and financial analysis. I also stay updated with the new accounting standards and digital tools that improve efficiency.”

34) Can you share a situation when you identified a financial discrepancy during an audit?

“During an internal audit that I did recently, I noticed a mismatch between the inventory valuation report and the purchase ledger. After investigating, I discovered that a batch of goods had been recorded twice due to data entry oversight. I corrected the entries and introduced a verification step before final submissions, which reduced similar discrepancies in later audits.”

Conclusion

The Chartered Accountant interview process isn’t just about assessing your technical expertise. It is about understanding how you solve problems, handle pressure and add value to a business. Every answer you give to the Chartered Accountant Interview Questions reflects your professionalism, integrity and growth mindset. By preparing thoughtfully, you can showcase not only what you know, but who you are as a future leader in finance.

Empower your ambition to become a Chartered Accountant with our ACA Advanced Level Training – Explore now!

Have Any Question?

Have Any Question?

+44 7452 122728

+44 7452 122728

Back

Back

44 7452 122728

44 7452 122728