Table Of Contents

What truly defines a successful business? Is it high sales, rapid expansion, or brand popularity? While these factors contribute to success, they don’t tell the full story. A company must effectively manage revenue, expenses, and stability. This is where Financial Performance comes in – it serves as the ultimate scorecard, revealing a company’s ability to generate profits, control costs, and sustain growth over time.

In this blog, we’ll explore the key aspects of Financial Performance, from its definition and importance to how it’s measured. We’ll break down essential financial metrics and examine real-world examples. By the end, you’ll have a clear understanding of how businesses assess their financial health and sustain long-term success.

Table of Contents

What is Financial Performance?

Why is Financial Performance Important?

How is Financial Performance Measured?

Financial Performance Metrics

What is Financial Statement Analysis?

Financial Performance Examples

Conclusion

What is Financial Performance?

Financial Performance refers to how well an organisation uses its assets to generate revenue and profit. It is typically assessed through financial statements, including the balance sheet, cash flow statement and income statement. Key indicators of Financial Performance include Return On Equity (ROE), Profitability, revenue growth, Return On Assets (ROA), and cash flow.

Strong Financial Performance indicates efficient management and a healthy financial position, while poor performance may signal financial difficulties or inefficiencies. IStakeholders often evaluate performance using various Accounting Ratios, enabling them to make informed financial decisions.

Excel in Advanced Performance Management!

Why is Financial Performance Important?

Imagine you’re running a business (or investing in one). Would you make decisions blindly, or would you want some concrete proof that things are going well? That’s where Financial Performance steps in.

Here’s why it matters:

For Business Owners: Helps in planning, managing cash flow, and making strategic decisions.

For Investors: Determines whether a company is a worthwhile investment.

For Employees: Indicates job security and future growth potential.

For Regulators & Creditors: Ensures compliance and financial stability.

In short, Financial Performance isn't just for accountants - it's for everyone who has a stake in a business.

Global revenue of the top 500 increased by 12% in 2024

How is Financial Performance Measured?

Now comes the interesting part—how do you actually measure Financial Performance? It’s not just about looking at profits; you need to consider multiple factors:

1. Financial Statements:

These are the company’s report cards. The balance sheet, income statement, and cash flow statement tell you everything you need to know about its financial standing.

2. Financial Ratios:

Numbers alone don’t tell the full story, but ratios help compare performance over time or against competitors.

3. Trends & Benchmarks:

Is the company growing, staying stagnant, or declining? Comparing past performance helps spot patterns.

Achieve ACCA excellence with ACCA Strategic Professional Training - unlock new career opportunities starting today!

Financial Performance Metrics

Let's explore some of the most crucial Financial Performance metrics and why they matter:

1. Gross Profit Margin – Are You Really Making Money?

The Gross Profit Margin demonstrates the percentage of revenue remaining after the deduction of the Cost Of Goods Sold (COGS). It highlights how efficiently a company produces and sells its products or services.

Formula:

Formula for Gross Profit Margin

Why It Matters?

A higher margin means a company retains more profit after production costs, indicating strong pricing strategies and cost management.

A lower margin suggests high production costs or pricing inefficiencies, potentially hurting profitability.

2. Working Capital – Can You Pay Your Bills?

Working capital measures a company’s short-term financial health by comparing its present assets to current liabilities. It shows whether a business has enough resources to meet its short-term obligations.

Formula:

Formula for Working Capital

Why It Matters?

Positive working capital means the company has enough short-term assets to cover short-term debts, ensuring financial stability.

Negative working capital may indicate cash flow problems, potentially leading to liquidity issues or difficulty in meeting obligations.

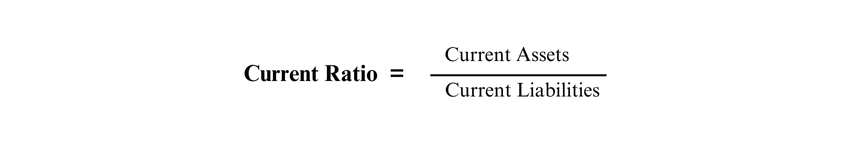

3. Current Ratio – How Liquid Are You?

The Current Ratio assesses a company’s ability to pay off short-term liabilities using short-term assets. It is a key measure of liquidity.

Formula:

Formula for Current Ratio

Why It Matters?

If the ratio is greater than 1, the business can meet its short-term debts, reflecting strong liquidity.

A very high ratio (e.g., above 3) suggests the company is holding excess assets that could be better invested.

A low ratio (below 1) signals potential liquidity risks, indicating the company may struggle to pay short-term obligations.

4. Inventory Turnover Ratio – Are Products Selling Fast Enough?

The Inventory Turnover Ratio measures how frequently a company sells and replaces its inventory within a given period. It reflects sales efficiency and inventory management.

Formula:

Formula for Inventory Turnover Ratio

Why It Matters?

A high inventory turnover suggests strong sales and efficient inventory management, reducing storage costs and obsolescence risks.

A low turnover may indicate weak sales or excessive inventory, leading to increased holding costs and potential write-offs.

5. Debt-to-Equity Ratio – How Much Debt is Too Much?

This ratio compares a company's total liabilities to its shareholders’ equity, showing how much debt is used to finance the business.

Formula:

Formula for Debt-to-Equity Ratio

Why It Matters?

A lower ratio (e.g., below 1) indicates a company is primarily financed through equity rather than debt, which is safer but may limit growth potential.

A higher ratio suggests a company relies heavily on borrowing, which can amplify returns but also increases financial risk if debts become difficult to manage.

6. Return on Assets (ROA) – Are You Using Assets Wisely?

ROA measures how effectively a business takes advantage of its assets to generate profit. It helps assess overall operational performance.

Formula:

Formula for Return on Assets

Why It Matters?

A high ROA suggests that the company effectively utilises its assets to generate earnings.

A low ROA may indicate inefficiencies in asset use or lower profitability compared to asset investment.

7. Return on Equity (ROE) – Are Investors Getting Their Money’s Worth?

ROE measures how effectively a company generates profit from its shareholders' equity. It reflects management’s efficiency in using investors’ funds.

Formula:

Formula for Return on Equity

Why It Matters?

A higher ROE shows that the business is producing strong profits relative to shareholders' investments, making it an attractive investment.

A lower ROE may suggest inefficient use of equity capital or lower profitability.

What is Financial Statement Analysis?

Financial statement analysis involves examining a company's financial statements to evaluate its performance and make informed decisions. This analysis helps stakeholders understand the financial health, operational efficiency, and overall stability of an organisation. Let's explore the primary financial statements used in this analysis:

What is Financial Statement Analysis

1. Balance Sheet

Gives a brief overview of the financial status of a business, detailing assets, liabilities, and shareholders' equity at a specific point in time.

Key Components:

Assets: Resources owned by the company.

Liabilities: Obligations owed to creditors.

Shareholders' Equity: Owners' residual interest in the company.

2. Income Statement

Highlights the company's Financial Performance over a period, detailing revenues, expenses, and profits or losses.

Key Components:

Revenues: Income from sales or services.

Expenses: Costs incurred in generating revenues.

Net Income: Profit or loss after expenses.

3. Cash Flow Statement

Details cash inflows and outflows over a period, categorised into operating, investing, and financing activities.

Key Components:

Operating Activities: Cash from core business operations.

Investing Activities: Cash from buying or selling assets.

Financing Activities: Cash from borrowing or repaying debts and equity transactions.

4. Annual Report

A comprehensive report providing insights into a company's operations, Financial Performance, and future prospects.

Key Components:

Financial Statements: Audited balance sheet, income statement, and cash flow statement.

Management Discussion and Analysis (MD&A): Management's perspective on financial results and future outlook.

Notes to Financial Statements: Additional details and disclosures.

Take the next step in finance – register for the Advanced Financial Management Course and excel professionally!

Financial Performance Examples

By analysing financial reports from leading companies, we can see how key metrics reflect profitability, stability, and strategic decision-making in action. Let’s explore some notable examples.

1. Microsoft Corporation

Fiscal Year Ended: June 30, 2024

Key Financial Highlights:

Revenue: £198 billion

An increase of 16% year-over-year

Operating Income: £88 billion

An increase of 24% year-over-year

Capital Expenditures: £45 billion

Significant investment, representing 23% of the annual revenue

Analysis:

Microsoft demonstrated strong financial growth, with rising revenue and operating income. Its significant capital investment highlights a strategic push into AI and cloud services, reflecting both growth potential and the industry's capital-intensive nature.

Source: Microsoft 2024 Annual Report

2. Apple Inc.

Fiscal Year Ended: September 30, 2023

Key Financial Highlights:

Revenue: £310 billion

A slight decrease from £319 billion in 2022

Net Income: £78.5 billion

A decrease from £81 billion in 2022

iPhone Revenue: £162 billion

A decrease from £166 billion in 2022

Services Revenue: £69 billion

An increase from £63 billion in 2022, marking a new all-time high

Analysis:

Apple's revenue declined by 2.8%, but its Services segment hit record highs. The slight iPhone sales dip suggests market saturation, yet strong Services growth and a diversified product line support its financial stability.

Source: Apple Reports Fourth Quarter Results

Conclusion

Understanding Financial Performance is crucial for businesses, investors, and stakeholders to make informed decisions. Analysing key metrics and financial statements helps assess profitability, stability, and growth. Strong performance ensures long-term success, while weak performance highlights improvement areas. Regular evaluation allows businesses to refine strategies, enhance efficiency, and achieve sustainable growth.

Take your finance career further - register for the Advanced Performance Management Course and sharpen your decision-making skills!

Have Any Question?

Have Any Question?

+44 7452 122728

+44 7452 122728

Back

Back

44 7452 122728

44 7452 122728