Table Of Contents

Picture a scenario where a company's leadership is transparent, risks are meticulously managed, and every stakeholder's interest is prioritised. This is the power of Corporate Governance. But have you ever wondered how Corporate Governance influences a company's success? What are the fundamental principles that underpin it?

In this blog, we will delve into the principles, importance, and real-world examples of Corporate Governance. Read ahead to explore its critical role in shaping the integrity and prosperity of organisations.

Table of Contents

1) What is Corporate Governance?

2) The Importance of Corporate Governance

3) Principles of Corporate Governance

4) The Five Key Components of Corporate Governance Framework

5) Corporate Governance Models Across the Globe

6) Corporate Governance: Key Roles and Responsibilities

7) Examples of Good Corporate Governance

8) Examples of Not-So-Good Corporate Governance

9) Conclusion

What is Corporate Governance?

Corporate Governance refers to the systems, rules, and processes that guide how a company is directed and controlled. It defines the structure through which decisions are made, responsibilities are distributed, and accountability is maintained. In simple terms, it ensures a company is run ethically and in the best interests of its stakeholders, including shareholders, employees, customers, and the wider community.

At its core, Corporate Governance ensures that organisations set and pursue their goals within social, regulatory, and market contexts while fostering stakeholder trust and confidence through transparent and ethical practices.

The Importance of Corporate Governance

Have you ever thought why is Corporate Governance important? It is important because it helps a company to ensure accountability, transparency, and ethical decision-making. In today’s competitive world, businesses need clear rules and responsible leadership to earn people’s trust and grow steadily.

Corporate Governance also helps companies manage risks effectively and maintain trust with investors, employees, and customers. Poor governance, however, can lead to serious consequences like:

1) Financial loss due to weak oversight, fraud, or mismanaged resources

2) Reputational damage caused by unethical behaviour or lack of transparency

3) Regulatory penalties due to non-compliance with legal and industry requirements

Principles of Corporate Governance

There are many governing principles guiding a company that its founders and directors deem appropriate. However, the following principles are commonly observed across companies and industries.

1) Fairness

The Board of Directors should ensure fair and equal treatment for shareholders, employees, vendors, and communities. This helps build trust and prevents any group from being treated unfairly or left out of key decisions.

2) Transparency

The board should provide timely, accurate, and clear information regarding financial performance, conflicts of interest, and risks to shareholders and other stakeholders. This makes it easier for people to understand how the company is being run and to make informed decisions.

3) Risk Management

The board and management must identify all types of risks and determine the best ways to control them. They must act on these recommendations to tackle risks and inform all related parties about the existence and status of such risks.

4) Responsibility

The board is responsible for overseeing corporate matters and management activities. It must ensure the successful, ongoing performance of the company. This includes recruiting and hiring a Chief Executive Officer (CEO) and acting in the best interests of the company and its investors.

5) Accountability

The board must explain the purpose of the company's operations and the results of its conduct. Both the board and company leadership are accountable for assessing the company's capacity, potential, and performance. They must communicate important issues to shareholders.

The Five Key Components of the Corporate Governance Framework

A strong Corporate Governance framework is essential for leading how an organisation is directed, managed and held accountable. Below are five core components frequently recognised across businesses and industries:

1) Board Structure and Practices

This explains how the board is set up and what each member is responsible for. A strong board provides good guidance, makes key decisions, and ensures the company is run properly.

Key Features:

1) Clear roles for board members and managers

2) Board members with the right skills and independence

3) Regular checks to make sure the board is working well

2) Risk Management and Internal Controls

This helps the company spot problems early and manage them before they become serious. Good controls protect the company from mistakes, fraud, and financial losses.

Key Features:

1) Systems to prevent fraud and errors

2) Regular reviews to identify risks

3) Simple rules and procedures to keep work safe and consistent

3) Transparency and Disclosure

Transparency means being open and honest with information. Sharing clear and accurate details helps people trust the company and its Corporate Governance.

Key Features:

1) Easy-to-understand financial and business reports

2) Open communication about risks or issues

3) Important information available to everyone who needs it

4) Stakeholder Rights and Responsibilities

This ensures the company listens to everyone it affects, such as employees, customers, suppliers, communities, and shareholders. It also ensures that people are treated fairly.

Key Features:

1) Equal treatment and fair access to information for shareholders

2) Ways for employees and others to share their concerns

3) Decisions that consider long-term benefits for everyone involved

5) Ethical Business Conduct

This focuses on doing the right thing and following all laws and company rules. Good ethics help protect the company’s reputation and create a positive culture.

Key Features:

1) A clear code of conduct for all employees

2) Training to help people understand what is right and wrong

3) Strong actions taken when rules are broken

Corporate Governance Models Across the Globe

There are various types of Corporate Governance that a company might adopt. Some follow a traditional hierarchical leadership structure, while others are more flexible. Different Corporate Governance models can be found around the world. Here are a few examples:

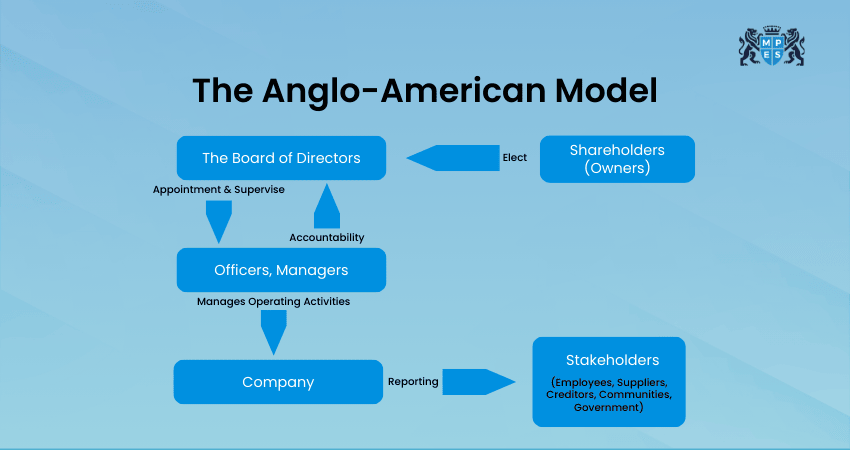

1)The Anglo-American Model

This governance model is most common in countries like the United Kingdom, the United States and Australia. It is primarily shareholder-oriented, focusing on maximising shareholder value and relying heavily on market forces to discipline management.

This model places control primarily in the hands of shareholders and the Board of Directors. While stakeholders such as employees, suppliers, and communities are acknowledged, they do not have decision-making authority. Management is expected to operate in the best interests of shareholders, supported by incentive structures designed to align executive actions with shareholder objectives.

The board usually includes both insider and independent directors to ensure effective oversight. Modern governance favours separating the CEO and board chair roles, and regular communication between the board, management, and shareholders is essential, with major decisions often requiring shareholder approval.

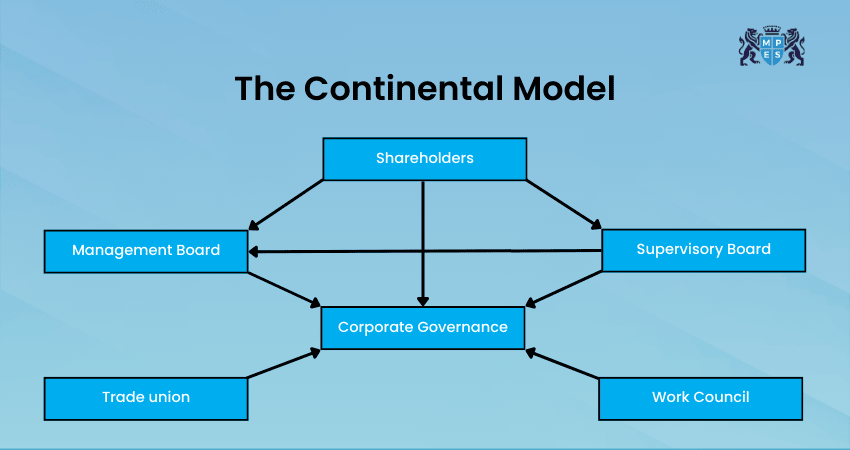

2) The Continental Model

Used widely across Europe, especially in Germany and the Netherlands, this model features a two-tier board structure. The Management Board runs day-to-day operations, while the Supervisory Board oversees management performance and represents broader stakeholder interests.

The Management Board consists mainly of company executives, whereas the Supervisory Board includes shareholders, employee representatives, and sometimes banks. Supervisory board composition and minimum size are set by national laws, but shareholders still play a role in electing representatives.

This model places strong emphasis on employees, creditors, and long-term national interests. Stakeholder engagement and social responsibility are central features, with governance often influenced by legal and governmental frameworks.

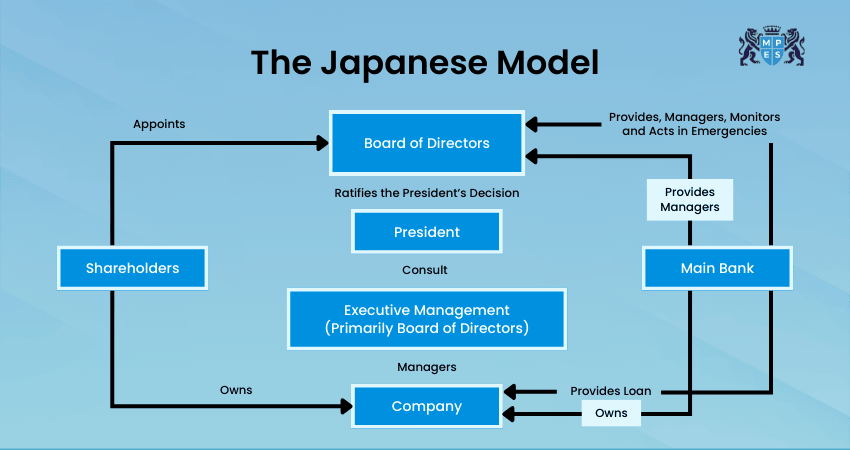

3) The Japanese Model

This model is characterised by close relationships between companies, banks, and affiliated groups, often known as Keiretsu. Banks and major corporate partners hold significant influence, and boards are typically dominated by insiders and senior executives.

Keiretsu firms may hold cross-shareholdings, strengthening long-term partnerships. Individual shareholders have limited influence, although governance reforms in recent years have increased expectations for transparency and independent oversight.

The government plays an important role through policies and regulations that guide corporate behaviour. While transparency can sometimes be reduced due to concentrated control, ongoing reforms continue to encourage more open reporting practices.

Ignite your team's potential with our innovative Performance Management (PM) Training today!

Corporate Governance: Key Roles and Responsibilities

A strong Corporate Governance structure depends on clearly defined roles, with each group contributing to the smooth and responsible running of the company. When these roles work together effectively, they help maintain accountability, transparency, and long-term success.

Who is Responsible for Governance?

Here are the key groups responsible for Corporate Governance:

1) Board of Directors:

The board is mainly in charge of company governance. They guide the company’s direction, choose senior leaders, and make sure the company is performing well and meeting its goals.

2) Independent Directors:

Independent directors are not part of the company’s daily operations. They give honest, unbiased opinions and help prevent conflicts of interest.

3) Audit Committee:

This group looks after the company’s financial health. They check financial reports, monitor internal controls, and make sure everything is transparent and accurate.

4) Senior Management:

These are the leaders who run the company day to day. They follow the board’s plans, make operational decisions, and ensure employees follow rules and behave ethically.

5) Employees and Stakeholders:

Employees play their part by following policies and acting responsibly. Shareholders and other stakeholders also help by giving feedback and holding the company accountable.

Together, all these roles help create a strong and trustworthy Corporate Governance system that supports long-term success.

Examples of Good Corporate Governance

Good Corporate Governance is when a company is run in a fair, open, and responsible way. It means the leaders make honest decisions, share clear information, and think about what is best for everyone involved. The examples below show how some companies use good Corporate of Governance to build trust and long-term success.

PepsiCo

One company that has consistently demonstrated good Corporate Governance is PepsiCo, which frequently updates and adapts its practices. In preparing its 2020 proxy statement, PepsiCo sought input from investors on six key areas:

1) Board composition, diversity, and refreshment, along with leadership structure

2) Long-term strategy, corporate purpose, and sustainability issues

3) Good governance practices and an ethical corporate culture

4) Human capital management

5) Compensation discussion and analysis

6) Shareholder and stakeholder engagement

PepsiCo's proxy statement included its current leadership structure, showing a combined chair and CEO, an independent presiding director, and a connection amidst the company's "Winning With Purpose" initiative and adjustments to the executive compensation plan.

Microsoft

Microsoft is another strong example of good Corporate Governance. The company regularly updates its governance practices and focuses on accountability, transparency, and long-term value. Key features of Microsoft’s governance approach include:

1) Clear ethical standards and compliance programmes

2) Human capital development, including inclusion, well-being, and learning

3) Transparent executive compensation linked to performance and long-term goals

4) Active engagement with shareholders and stakeholders to improve decision-making

These practices show Microsoft’s commitment to responsible leadership and sustainable growth.

Examples of Not-So-Good Corporate Governance

Let’s check the examples of not so good organisations in Corporate Governance:

Enron

Public and government concerns about Corporate Governance tend to fluctuate. However, highly publicised revelations of corporate misconduct often reignite interest in the topic.

Enron's downfall was partly due to its Board of Directors waiving numerous conflict-of-interest rules, allowing the Chief Financial Officer (CFO), Andrew Fastow, to establish independent private partnerships that conducted business with Enron. These partnerships were used to conceal Enron's debts and liabilities, which, if properly accounted for, would have significantly reduced the company's profits.

Enron's poor Corporate Governance facilitated the creation of these entities that hid losses. The Enron scandal, along with others from the same period, led to the enactment of the Sarbanes-Oxley Act in 2002. This legislation established modern SOX Compliance requirements. These include stronger internal controls, tighter audit oversight, and stricter financial reporting standards designed to prevent similar governance failures.

Boeing

Boeing’s 737 MAX crisis revealed severe Corporate Governance failures. After two fatal crashes in 2018 and 2019, shareholders sued the board in 2021 for ignoring critical safety risks. Key issues included:

1) No Board-level Safety Oversight: The board lacked aviation safety expertise and had no dedicated safety committee.

2) Poor Risk Reporting: Safety concerns were managed internally and never escalated to the board, which was unaware of the safety team until after the aircraft was grounded.

3) Leadership Accountability Failure: Despite repeated missteps, the board continued supporting CEO Dennis Muilenburg and later allowed him to exit.

4) Consequences: These failures led to loss of life, massive financial damage, lawsuits, and long-term reputational harm.

Conclusion

Corporate Governance is the bedrock of a company's integrity and long-term success, fostering transparency, accountability, and sustainable growth. By embracing strong governance principles, businesses can build trust with stakeholders and effectively navigate challenges. Harness its power to steer your organisation towards a thriving future.

Master essential Accounting skills and stand out in the job market- Join our ACCA Applied Skills Training now!

Have Any Question?

Have Any Question?

+44 7452 122728

+44 7452 122728

Back

Back

44 7452 122728

44 7452 122728