Table Of Contents

What makes a business worth more than its balance sheet? That’s where Goodwill in Accounting steps in as a powerful asset in accounting. It’s not just numbers; it’s reputation, brand value and customer trust rolled into one. When one business acquires another, goodwill becomes a key measure of its true worth.

Essentially, Goodwill tells the story of why companies pay more than book value during acquisitions. This blog explores What is Goodwill in Accounting, its different types and examples to help you understand this concept. So read on and learn why this intangible asset can make or break a deal!

What is Goodwill in Accounting?

Goodwill in Accounting is an intangible asset that represents the value of a business which is beyond its tangible assets. Understanding this requires familiarity with fundamental Accounting Concepts, which clarify how intangible elements like brand reputation, customer loyalty, skilled workforce, and technology contribute to business value despite not being easily quantified.

Under US GAAP and IFRS Standards, goodwill has an indefinite life and is not amortised. However, it must undergo annual impairment testing to assess any decline in value. Private companies may choose to amortise goodwill over 10 years as an alternative.

Importance of Goodwill in Accounting

Goodwill can be positive or negative reflecting the difference between a business’ value and its net assets. Positive goodwill indicates that a company’s market value exceeds its assets and liabilities, while negative goodwill suggests the opposite. This is imperative in valuing a business as goodwill directly impacts the overall brand image for the potential buyers. A high goodwill value often signals a competitive advantage making business appear more attractive to investors and influences strategic decisions. On the contrary, a decline in the goodwill indicates underperformance, poor management choices and puts reliability in question.

From a financial reporting perspective, GAAP and IFRS require goodwill to be recorded annually on the balance sheet as an intangible asset, ensuring transparency in financial statements.

Types of Goodwill

Goodwill comes in different forms, depending on the type of business and its customers. At its core, it represents the extra value a business holds beyond its physical assets; things like brand reputation, customer loyalty and industry standing. There are three broad categories of goodwill in accounting as explored below:

1) Inherent Goodwill

Inherent (or Internally Generated) Goodwill grows naturally over time. It comes from strong customer relationships, excellent service, and a well-established brand. While it adds value, accounting standards don’t allow it to be recorded on financial statements. But it still plays a huge role in a business’s competitive edge.

2) Business Goodwill

Business Goodwill applies to businesses that offer products or services and reflects factors such as brand strength, market reputation and overall customer experience. It highlights how effectively a business attracts and retains customers.

3) Purchased Goodwill

Purchased Goodwill is the goodwill that appears when one company buys another for more than its net asset value. The extra amount paid reflects intangible benefits like a loyal customer base, market position, and brand recognition. Unlike inherent goodwill, purchased goodwill is recorded as an intangible asset on the balance sheet and must undergo annual impairment testing to ensure its value remains accurate.

Turn complex standards into clear financial insights with our ACA Professional Level – Financial Accounting and Reporting: UK GAAP Course - Sign up now!

How to Calculate Goodwill in Accounting

Goodwill can be calculated using a simple formula. However, determining the fair value of each component often requires a detailed financial assessment.

Goodwill Formula:

Goodwill = Consideration Paid + Fair Value of Non-Controlling Interests + Fair Value of Existing Equity Interests – Fair Value of Net Assets Recognised

Here's what the components stand for:

1) Consideration paid: The total amount paid to acquire the business.

2) Fair value of non-controlling interests: The market value of the portion of the business you do not own at the acquisition date.

3) Fair value of equity interests: The market value of any stake you previously held in the business.

4) Net assets recognised: The fair value of all identifiable tangible and intangible assets minus liabilities.

Methods for Calculating Goodwill Valuations

There are three common approaches to estimating goodwill. Each method helps assess intangible worth based on a company’s financial history and expected performance.

1) Average Profits Method

This is perfect for businesses with consistent and predictable earnings.

This calculates the average profits from previous years and multiply the figure by the number of years required to recover the goodwill investment.

The formula is: Goodwill = Average profit × Years of acquisition

It’s a simple, practical option for small businesses with steady income.

2) Capitalisation Method

1) This is best for businesses where income-generating ability and tangible assets are key drivers of value.

2) It's calculated by dividing the average net profit by the capitalisation rate, then subtracting the value of tangible net assets.

3) Here's the formula: Goodwill = Capitalised average net profit – Tangible net assets

4) It highlights the company’s long-term earning capacity.

3) Weighted Average Profit Method

This method is best for businesses with fluctuating profits where recent performance is more meaningful.

It's calculated by assigning weights to annual profits based on their relevance, then calculating the weighted average and multiplying the result by the years of acquisition.

The formula is: Goodwill = Weighted average × Years of acquisition

It reflects profit trends and places greater emphasis on recent financial performance.

Examples of Goodwill Calculation

Example 1:

Let's consider an example of buying a cafe. Let's say you purchase a cafe with the following details:

1) You pay £900,000 to acquire 85% of the cafe.

2) You previously owned 10%, valued at £70,000.

3) You do not own the remaining 5%, valued at £45,000.

4) On the purchase date, the fair value of all identifiable assets minus liabilities is £420,000.

Goodwill Calculation:

Goodwill = £900,000 + £45,000 + £70,000 – £420,000

Goodwill = £595,000

This £595,000 represents the cafe’s brand strength, loyal customers, location advantage, and other intangible value beyond its physical assets.

Example 2:

Let's say you decide to buy a clothing boutique

1) You pay £850,000 to acquire 88% of the boutique.

2) You already owned 7%, valued at £40,000.

3) You do not own the remaining 5%, valued at £55,000.

4) On the purchase date, the fair value of all identifiable net assets (tangible + intangible) is £360,000.

Goodwill Calculation:

Goodwill = £850,000 + £55,000 + £40,000 – £360,000

Goodwill = £585,000

This £585,000 represents the boutique’s brand strength, customer loyalty, prime location, and overall reputation.

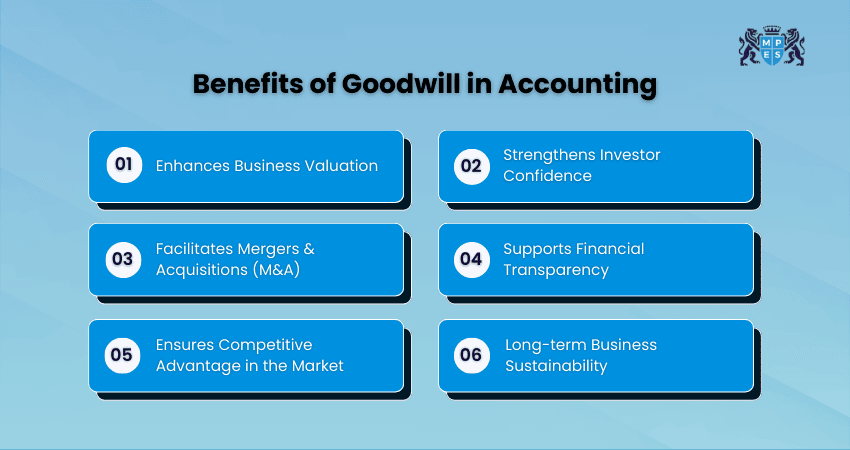

Benefits of Goodwill in Accounting

As mentioned above, Goodwill in Accounting is more than just an intangible asset; it represents a company’s reputation, customer relationships and brand strength, all of which contribute to its long-term success. While it’s not a physical asset, it plays a crucial role as explained by these benefits:

1) Enhances Business Valuation: A company with high goodwill often commands a higher market value. It reflects brand strength, customer loyalty, and operational efficiency, making the business more attractive to investors and buyers.

2) Strengthens Investor Confidence: Investors consider goodwill as an indicator of a company's stability and long-term growth potential. A company with strong goodwill is perceived as having a competitive advantage and sustained profitability.

3) Facilitates Mergers & Acquisitions (M&A): Goodwill plays a key role in business acquisitions, helping justify premium purchase prices. It reflects intangible value beyond tangible assets, such as customer relationships, brand recognition, and intellectual property.

4) Supports Financial Transparency: Under GAAP and IFRS, goodwill must be recorded on the balance sheet and tested annually for impairment, ensuring accurate financial reporting. Impairment tests help prevent overstated asset values, improving financial accountability.

5) Competitive Advantage in the Market: A business with high goodwill enjoys strong customer retention and brand loyalty, leading to consistent revenue and market leadership. It helps differentiate the company from competitors, making it easier to attract new customers and retain existing ones.

6) Long-term Business Sustainability: Unlike other assets that depreciate or become obsolete, goodwill has an indefinite life and represents long-term business stability and resilience. Strong goodwill fosters trust with customers, suppliers, and stakeholders, contributing to sustained profitability.

Become the Architect of profitable futures with our comprehensive Financial Management (FM) Training - Sign up now!

Drawbacks of Goodwill in Accounting

While goodwill is a valuable intangible asset, it also comes with challenges and risks that can impact financial statements and business valuation. Unlike tangible assets, goodwill is difficult to measure, cannot be sold separately, and is subject to impairment losses, making it a complex element in accounting.

1) Subjectivity in Valuation: Goodwill is difficult to quantify beyond the balance sheet since it represents intangible factors like brand reputation and customer loyalty. The premium paid in an acquisition is reflected as goodwill, but it’s not always clear what specifically justifies this valuation.

2) Cannot Be Sold Separately: Unlike patents, trademarks, or real estate, goodwill cannot be sold or transferred independently. If a business struggles or dissolves, goodwill loses all value.

3) Requires Annual Impairment Testing: Under GAAP and IFRS, goodwill cannot be amortised and must be tested for impairment annually. If goodwill is impaired (its value declines), the company must record a loss, reducing net income and possibly impacting stock prices.

4) Volatility in Financial Statements: Goodwill fluctuates based on market conditions, competition, and financial performance. A sudden drop in goodwill can negatively affect investor confidence and business valuation. Negative goodwill can occur when a company is acquired below its fair market value, indicating financial distress or an urgent sale.

5) Risk of Overpayment in Acquisitions: Companies acquiring businesses with overestimated goodwill may overpay, leading to financial strain and potential write-downs. If the acquired company underperforms, goodwill impairment can lead to significant financial losses.

7) No Direct Economic Benefit: Unlike physical assets (e.g., buildings, equipment), goodwill does not generate revenue on its own. It only holds value if the business continues to perform well and maintains customer loyalty and brand strength.

8) Should Not Be Evaluated in Isolation: Goodwill alone does not provide a complete picture of a company's financial health. It should always be analysed alongside other key performance indicators (KPIs), such as profitability, revenue growth, and market position, to get a well-rounded assessment of business performance.

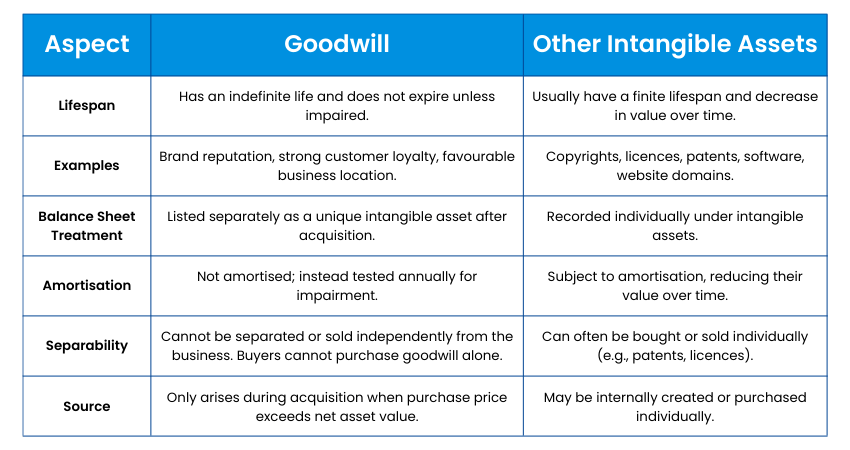

Goodwill vs Other Intangible Assets

Here are the key differences between Goodwill and other intangible assets

Conclusion

Understanding What is Goodwill in Accounting is important because it captures the unseen strength of a business: its trust, reputation and loyal customers. A firm grasp on how it’s defined, valued and recorded helps reveal a company’s true potential beyond the numbers alone. Whether you're buying a business or analysing its worth, goodwill offers a deeper view of long-term value and the intangible advantages that drive lasting success.

Take your Accounting skills to the summit of excellence with our ACA Professional Level Training - Register now!

Have Any Question?

Have Any Question?

+44 7452 122728

+44 7452 122728

Back

Back

44 7452 122728

44 7452 122728