Table Of Contents

Before diving into balance sheets and profit margins, every professional needs a strong grasp of the basics. The core lies in Accounting Concepts. These aren’t just academic ideas; they shape how businesses track money, report on performance, and stay legally compliant. Ready to make accounting your friend, not your fear? Let’s start with the basics that build brilliant financial thinking.

Table of Contents

What are Accounting Concepts?

14 Important Concepts in Accounting

Business Entity Concept

Going Concern Concept

Accrual Basis Concept

Money Measurement Concept

Materiality Concept

Accounting Period Concept

Consistency Concept

Revenue Realisation Concept

Dual Aspect (Duality) Concept

Full Disclosure Concept

Conclusion

What are Accounting Concepts?

Accounting concepts are the fundamental rules that guide how financial transactions are reported and recorded. They establish a consistent framework, ensuring that businesses follow the same standards when preparing financial statements. By applying these concepts, Accountants can ensure clarity, comparability and reliability in financial reporting.

Examples include the Business Entity Concept, Accrual Concept, and Going Concern Concept. These principles help Accountants record transactions in a structured and standardised way, promoting transparency and fairness. They form the foundation of Generally Accepted Accounting Principles (GAAP) and are essential for maintaining trust in financial systems.

14 Important Concepts in Accounting

Accounting Concepts are the backbone of financial reporting. You can ensure consistency, transparency, and comparability in financial statements with this. Here are the must-know Accounting Concepts that form the bedrock of sound financial management:

1. Business Entity Concept

The Business Entity Concept is a foundational accounting principle that states a business is separate and distinct from its owners, both legally and financially.

Here are the Main Purposes:

It ensures that only business-related transactions are recorded in the company’s books.

This helps to maintain precise financial records, and clear analysis of business performance.

It is essential for assessing profitability, tax obligations, and making informed decisions.

It is also important for legal liability and compliance in corporations and partnerships.

Example: If the owner withdraws £1,000 for personal use, it’s recorded as “drawings” in the business books, not as a business expense.

From zero to chartered hero - start with the Business, Technology & Finance (BTF) Course Today.

2. Going Concern Concept

The Going Concern Concept makes the assumption that a business will continue to operate at least for the upcoming future. This is of no intention or need to liquidate its assets or shut down operations.

Here are the Main Purposes:

It allows businesses to spread the cost of long-term assets over their useful lives through depreciation.

Justifies the use of the historical cost concept rather than adjusting asset values based on liquidation or market value.

Ensures that liabilities are not immediately classified as due, which would be necessary in liquidation scenarios.

Helps users of financial statements like investors, banks, and auditors, assess the company as a continuing investment or credit risk.

Example: A company continues to depreciate assets over its useful life because it plans to operate in the long term.

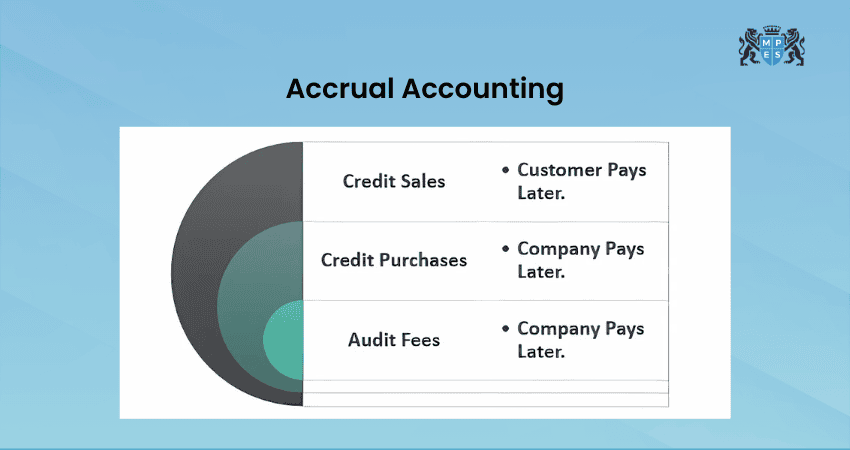

3. Accrual Basis Concept

This concept is central to modern financial reporting and is used in Generally Accepted Accounting Principles (GAAP) and IFRS.

Here are the Main Purposes:

Ensures that financial statements reflect the true economic data of a business within a specific accounting period.

Provides a more accurate and fair view of profitability, performance, and financial health.

Prevents distorted results that may arise if only cash movements are recorded (as in cash-based accounting).

It helps to better match revenues with related expenses.

Example: A company delivers goods in December and receives payment in January; revenue is recorded in December.

4. Money Measurement Concept

The Money Measurement Concept states that transactions or events that can be quantified in monetary terms are recorded in a company’s accounting records.

Main Purposes:

Establishes uniformity and consistency in recording business activities.

Helps ensure that all financial information can be compared, audited, and interpreted accurately.

Maintains objectivity by focusing only on values that have clear monetary measurements.

Example: Customer satisfaction or employee loyalty isn’t recorded, although both affect business success.

5. Materiality Concept

The Materiality Concept states that all important information that could influence the decision-making of users must be included in financial statements. If the omission or misstatement of an item could affect the economic decisions of users.

Here are the Main Purposes:

Focuses attention on items that truly impact financial decisions.

It helps maintain clarity by avoiding clutter from insignificant details.

Supports efficient and relevant reporting without overwhelming users.

Example: A company may expense a £10 calculator immediately instead of capitalising it as an asset.

From student to strategy star – Your Law (LW) Training is one click away.

6. Accounting Period Concept

Financial statements must be prepared for specific time periods. These periods are used to evaluate performance, financial health, and compliance with reporting standards or taxation laws.

Here are the Main Purposes:

Allows businesses to measure and report performance regularly.

Enables stakeholders to compare financial results over time.

Supports timely tax filings, audits, and investor reports based on defined time frames.

Example: Revenue and expenses from January to March are recorded in the first quarter report.

7. Consistency Concept

This concept states that revenue should be recorded when it is earned and realisable, regardless of when cash is received.

Here are the Main Purposes:

Promotes comparability of financial information over different periods, helping stakeholders analyse trends and performance.

Reduces confusion by preventing frequent changes in accounting policies, which can distort financial outcomes.

Builds credibility and reliability in financial statements by ensuring that like transactions are treated in a like manner over time.

Example: Using straight-line depreciation every year unless a justified change is disclosed.

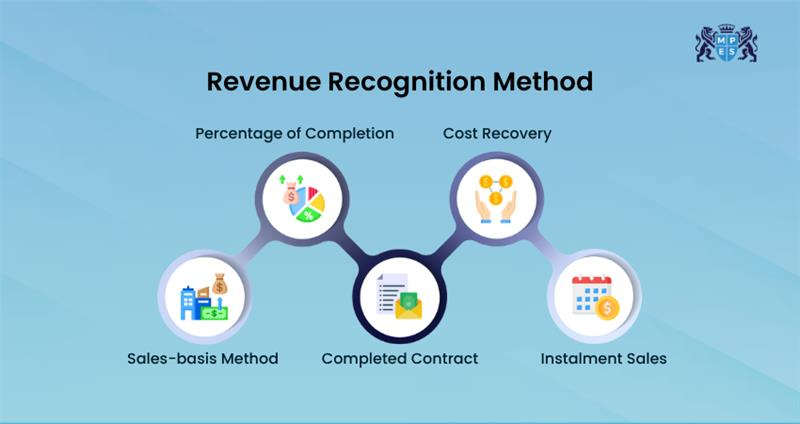

8. Revenue Realisation Concept

This concept states that revenue should be recorded when it is earned and realisable, regardless of when cash is received.

Here are the Main Purposes:

Ensures that revenue figures reflect the actual performance of the business within a given period, not just cash inflows.

It helps prevent the overstatement of income by requiring that services be substantially completed before revenue is recognised.

Aligns with the matching concept, allowing expenses to be recognised in the same period as the revenue they helped generate.

Example: A software firm delivers a service in March but receives payment in April. Revenue is recognised in March.

9. Dual Aspect (Duality) Concept

This principle shows that every financial transaction affects at least two accounts, maintaining the accounting equation:

Here are the Main Purposes:

Forms the foundation of the double-entry system and ensures all debit cards have a corresponding credit.

Maintains the balance in accounting records, which is crucial for accurate financial reporting.

Helps track the complete impact of a transaction on a business’s financial position.

Example: If a business purchases machinery for £10,000 in cash, assets (machinery) increase, and cash (another asset) decreases by the same amount.

10. Full Disclosure Concept

This concept demands that all relevant and important information be disclosed in financial statements or notes to ensure transparency.

Here are the Main Purposes:

Provides a complete picture to stakeholders and helps them make informed decisions.

Protects investors, creditors, and regulators from incomplete or misleading financial reporting.

Builds trust and accountability by explaining underlying assumptions, risks, or unusual transactions.

Example: Notes to accounts may explain pending legal disputes, significant liabilities, or accounting policy changes.

Think Like an Accountant - Learn Accounting Basics with Principles of Taxation (PTX) Course today!

11. Matching Concept

Expenses must be recorded in the same period as the revenue they generate.

Here are the Main Purposes:

Accurately reflects net profit by aligning costs with the revenues they produce.

Prevents misleading profit figures that could arise if costs are recorded in different periods.

Supports performance analysis, helping assess the true cost of operations.

Example: If a company earns £50,000 in sales and pays £5,000 in commission related to those sales, both revenue and commission expense are recorded in the same period.

12. Objectivity Concept

This principle requires all financial entries to be based on evidence rather than opinion or bias.

Here are the Main Purposes:

Enhances the credibility and accuracy of financial records.

Reduces the risk of manipulated or misleading data, as entries must be backed up by documentation.

Supports audit readiness and external verification of financial statements.

Example: Recording a purchase only when supported by a valid invoice or receipt.

13. Historical Cost Concept

Assets are recorded at the original purchase price, not the current market value.

Here are the Main Purposes:

Provides a stable and objective basis for asset valuation.

Avoids reliance on subjective or fluctuating market estimates.

Helps ensure that financial statements are conservative and not inflated.

Example: A building bought in 2005 for £200,000 is still recorded at that amount, even if its market value has doubled.

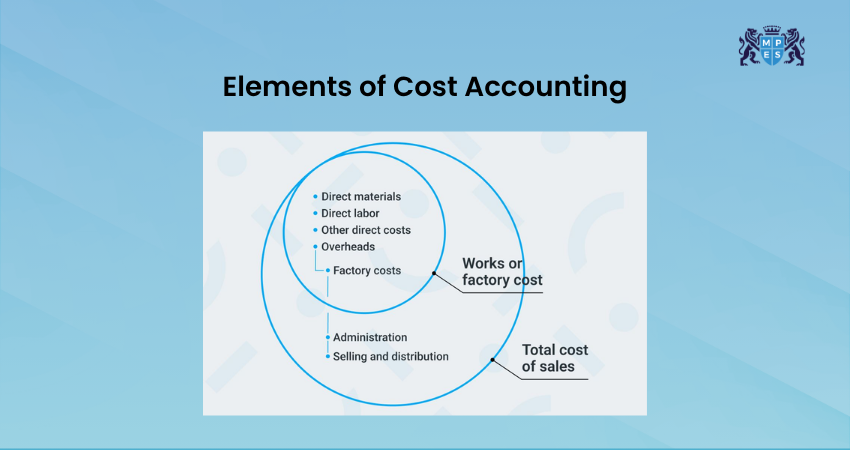

14. Cost Concept

This concept is closely related to historical cost; it states that all assets should be recorded at the cost incurred to acquire them.

Here are the Main Purposes:

Ensures factual, verifiable reporting by sticking to known transaction values.

Minimises overvaluation or speculation on the balance sheet.

Enhances comparability for companies by using a common, measurable base.

Example: A machine bought for £50,000 is entered into the books at £50,000, not its appraised or resale value.

Conclusion

Understanding these 14 Accounting Concepts isn’t just for Accountants but for anyone who wants to make smarter business decisions. These principles help bring order, clarity, and consistency to financial records. When you know what to record, when, and how, it becomes easier to plan, grow, and succeed. Keep these concepts in mind, and you'll feel more confident with every financial decision.

Crack the code to financial mastery - start your Management Information (MI) Training now.

Have Any Question?

Have Any Question?

+44 7452 122728

+44 7452 122728

Back

Back

44 7452 122728

44 7452 122728