Table Of Contents

A career as a Chartered Accountant is seen as a symbol of trust, expertise, and long-term success in the finance world. To understand What is a Chartered Accountant, it is crucial to know that they are professionals who manage accounting and financial reporting while helping organisations meet legal requirements. From advising organisations to safeguarding compliance, their role remains critical across industries.

The significance of What is a Chartered Accountant is emphasised in the profession’s global reach. The Chartered Accountants Worldwide (CAW) reports that the profession comprises around 1.8 million members and students across 190+ countries. This global recognition endures the value of CAs. In this blog, you will learn about Chartered Accountants, their roles and responsibilities, skills, and more. Keep reading to learn more!

What is a Chartered Accountant (CA)?

A Chartered Accountant is a professional who looks after the financial health of individuals, businesses, and organisations. They are trained and certified to handle tasks like preparing accounts, filing taxes, auditing records, and giving advice on how to manage money better.

Think of a Chartered Accountant as both a guardian and a financial guide. They make sure the rules are followed, but they also help businesses plan for the future. CAs can work in many areas, from big companies and banks to government offices and even running their own practice.

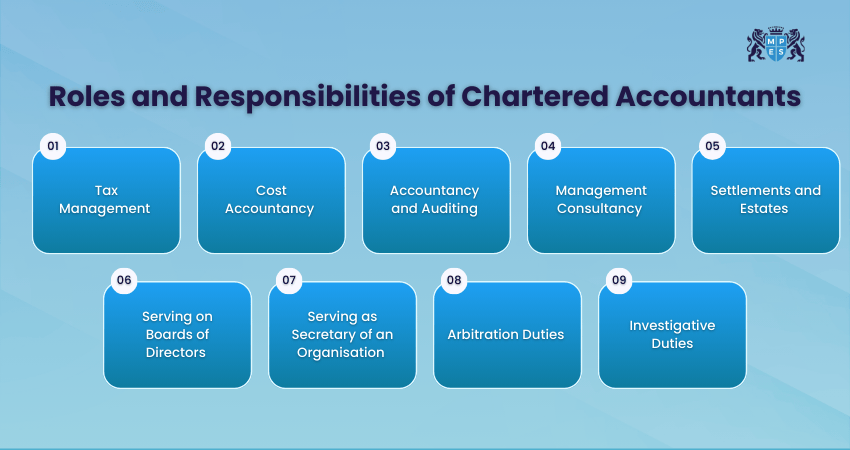

Roles and Responsibilities of Chartered Accountants (CAs)

Chartered Accountants wear many hats in their professional lives. Here are some of the key roles they perform:

1) Tax Management

Tax is something everyone must deal with, from individuals to large companies. Chartered Accountants make sure taxes are calculated correctly and paid on time. They also help reduce tax bills legally by using the right deductions and exemptions. Their role here is to keep clients safe from penalties and ensure compliance with tax laws.

2) Cost Accountancy

In businesses, controlling costs is just as important as making sales. A Chartered Accountant works on budgeting and cost analysis. For example, if a company spends too much on raw materials, the Chartered Accountant will identify it and suggest ways to cut costs without harming quality. This helps businesses increase profits.

3) Accountancy and Auditing

One of the most important duties of a Chartered Accountant is to keep accounts accurate. They prepare financial statements that show the real picture of a company’s finances. As auditors, they also check whether accounts are true and fair. This builds trust among investors, employees, and the public.

4) Management Consultancy

Chartered Accountants are not just number crunchers; they are also advisors. They guide businesses on how to grow, make investments, and manage risks. Their advice often helps companies expand into new markets, control expenses, or adopt better systems.

5) Settlements and Estates

Sometimes people pass away, leaving behind property, money, and businesses. CAs play a role in settling estates, making sure the legal and financial processes are handled properly. They ensure that debts are cleared, taxes are paid, and the remaining assets are fairly divided among heirs.

6) Serving on Boards of Directors

Chartered Accountants often sit on company boards as directors. In this role, they help make big decisions that shape the future of the organisation. Their knowledge of finance ensures that decisions are smart and sustainable.

7) Serving as Secretary of an Organisation

Many Chartered Accountants also act as company secretaries. They ensure the organisation follows laws, maintains proper records, and communicates clearly with shareholders and regulators. Their role helps build trust between the company and the people connected to it.

Gain banking and planning mastery. Sign up for Business Planning Banking (BPB) Training and power your career.

8) Arbitration Duties

Disputes can arise in business, such as disagreements about contracts or payments. Chartered Accountants are trusted to act as neutral parties (arbitrators) to resolve such disputes fairly. By doing so, they save both time and money for the parties involved.

9) Investigative Duties

Sometimes fraud, theft, or irregularities are suspected in a company. Chartered Accountants can be called in to investigate. They go through records carefully to find out what went wrong and report the truth.

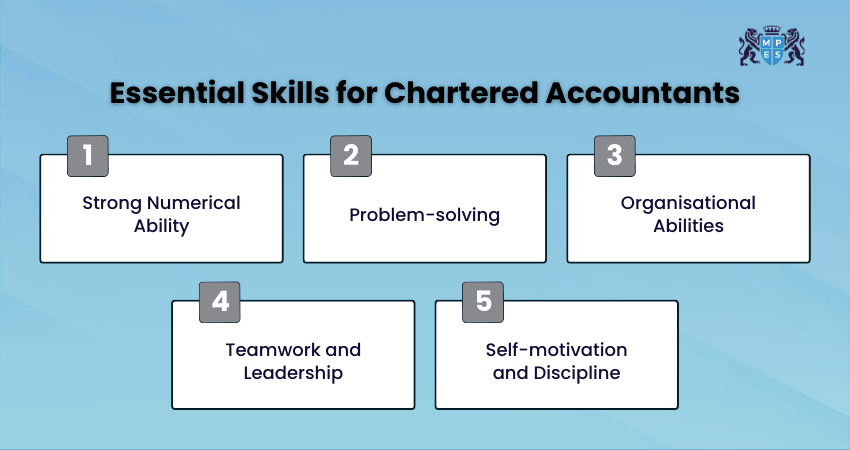

Essential Skills for Chartered Accountants

Becoming a CA is not only about passing exams; developing the right skills is essential in understanding What is a Chartered Accountant and succeeding in the profession.

1) Strong Numerical Ability

Numbers are the heart of a CA’s work. From quick sums to big financial reports, they need to be comfortable with figures every single day. This skill also helps them find mistakes easily and give the right advice.

2) Problem-solving

Chartered Accountants often face new problems, like a tricky tax case, a drop in profits, or mistakes in accounts. They must think clearly and find smart, practical answers. Staying calm under pressure makes them valuable.

3) Organisational Abilities

A Chartered Accountant must handle many clients, tasks, and deadlines at the same time. Being organised helps them manage everything without errors. When they plan well, work is done on time, and clients stay happy.

4) Teamwork and Leadership

Chartered Accountants don’t usually work alone. They guide junior staff, share ideas with managers, and advise company leaders. Good teamwork and leadership help them build strong connections with everyone they work with.

5) Self-motivation and Discipline

Becoming a Chartered Accountant takes a lot of years and hard work. Even after qualifying, they need to keep learning new things. Self-discipline and motivation push them to stay sharp and ready for new challenges.

Advance your accounting career. Register for our Financial Management (FM) Training now!

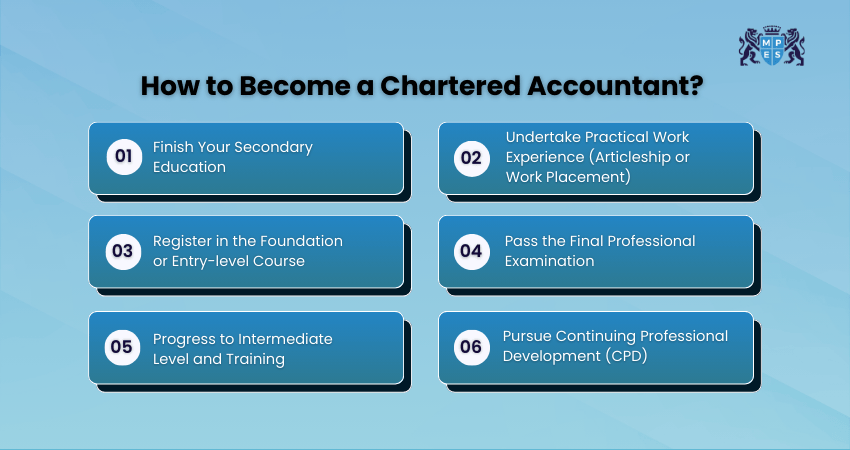

How to Become a Chartered Accountant in 2026?

The path to becoming a CA is challenging but rewarding. Here are the main steps:

1) Finish Your Secondary Education

Start by completing high school (or equivalent) with a focus on subjects like mathematics, economics, or business. A strong background in these areas gives you a solid foundation for future Accounting studies.

2) Register in the Foundation or Entry-level Course

The next step is to register for a foundation or entry-level accounting course (often called CA Foundation or equivalent). This introduces you to essential subjects like accounting principles, business law, and economics.

3) Progress to Intermediate Level and Training

After passing the foundation level, you move on to the intermediate or professional level. You study more advanced topics such as financial reporting, auditing, taxation, and corporate law. Simultaneously, you may take practical training in information technology, communication, or professional ethics to prepare you for real-world demands.

4) Undertake Practical Work Experience (Articleship or Work Placement)

A key part of becoming a CA is gaining on-the-job experience. You’ll work under the supervision of an experienced Chartered Accountant for a defined period (often 2–3 years). This helps you apply what you’ve learned to real business situations.

5) Pass the Final Professional Examination

The final exam is the culmination of all your studies and training. It tests your mastery of advanced accounting, strategic management, taxation, auditing, and other complex areas. Successfully clearing this exam grants you full CA status.

6) Pursue Continuing Professional Development (CPD)

After qualifying, a Chartered Accountant must continue learning to stay up to date. CPD helps them keep pace with changes in finance, regulations, and technology, ensuring their knowledge and skills remain relevant throughout their career.

Learn to maintain financial records – join our Maintaining Financial Records (FA2) Course now.

Career Outlook and Salary for Chartered Accountants in 2026

Chartered Accountancy is recognised as a highly valued career path within the finance profession. CAs are in demand across industries, from banking and insurance to IT, healthcare, and government. In terms of salary, Chartered Accountants can earn well right from the start. Freshers may earn between £30K - £51K per year in the UK. With experience, this can rise to £45K - £73K or more annually.

In countries like the USA or India, salaries are even higher, reflecting global demand. Apart from money, a career offers stability, growth, and the opportunity to work in leadership positions. Many CAs go on to become Chief Financial Officers (CFOs) or Chief Executive Officers (CEOs) of companies.

Conclusion

Understanding What is a Chartered Accountant is about recognising the responsibility, expertise, and long-term value they bring to the finance and business world. They play a significant role in building financial stability and helping organisations meet legal and regulatory requirements. Becoming a CA requires continuous learning and practical experience, but the rewards are lucrative and fulfilling for an impactful career in 2026.

Unlock your professional potential. Join our ACA Professional Level Training today!

Have Any Question?

Have Any Question?

+44 7452 122728

+44 7452 122728

Back

Back

44 7452 122728

44 7452 122728