Table Of Contents

Every business faces financial uncertainty, whether it is rising costs, sudden market shifts, or unexpected cash flow pressures. These challenges can appear without warning and quickly impact stability. That is why Financial Risk Management is essential, helping organisations stay in control and protect resources with confidence.

In this blog, we will explain Financial Risk Management, including what it is, why it matters, key risk types, strategies, and best practices to support better decisions and long-term success. Keep reading!

What is Financial Risk Management?

Financial Risk Management is the process of identifying, assessing, and addressing possible risks that could negatively impact an organisation’s financial health. These risks might include market fluctuations, credit defaults, liquidity challenges, or operational failures. The goal is to minimise losses and protect a company’s assets, investments, and reputation.

Companies use a variety of tools such as insurance, diversification, hedging, and internal controls to manage Financial Risks effectively. It plays an important role in strategic planning and helps businesses make informed decisions and remain stable during economic uncertainty.

How Financial Risk Management Works?

Financial Risk Management works through a structured process to identify, assess, and control Financial Risks. It reduces uncertainty and protects stability. Here is how it works:

Measuring and Quantifying Risk

Financial Risk Management begins with measuring and quantifying exposure. This process uses tools like Value at Risk (VaR), which estimates potential portfolio losses over a specific time.

Alongside these are metrics such as standard deviation, beta, and the Sharpe ratio to assess risk relative to returns. These measures help organisations understand the magnitude of potential financial threats and make informed decisions on how to respond.

Applying Risk Controls

This step involves putting strategies into action, such as hedging, diversification, insurance, or credit checks. These measures lower the chances of financial shocks and ensure stability. Clear policies and regular audits make these controls more effective.

Monitoring and Adjusting

Financial Risks are never static. Continuous monitoring allows organisations to adapt strategies when markets, regulations, or internal conditions change. Regular reviews ensure risks remain within acceptable limits and new threats are addressed quickly.

Why is Financial Risk Management Important?

Financial Risk Management is important because it helps organisations protect themselves from unexpected losses that can affect profitability, operations, or long-term goals. By identifying and managing risks early like market volatility, credit issues, or cash flow problems, businesses can make smarter decisions. They can remain stable during uncertainty and maintain investor confidence. It ensures financial health and supports sustainable growth.

Key Importances:

1) Helps manage financial losses and uncertainties

2) Widely applied across finance, insurance, and corporate sectors

3) Covers major risks such as credit, market, and liquidity

4) Combines careful analysis with strategic planning

5) Builds resilience and investor confidence

Gain confidence in financial statements – Register with the Financial Accounting and Reporting (FARI) Course today!

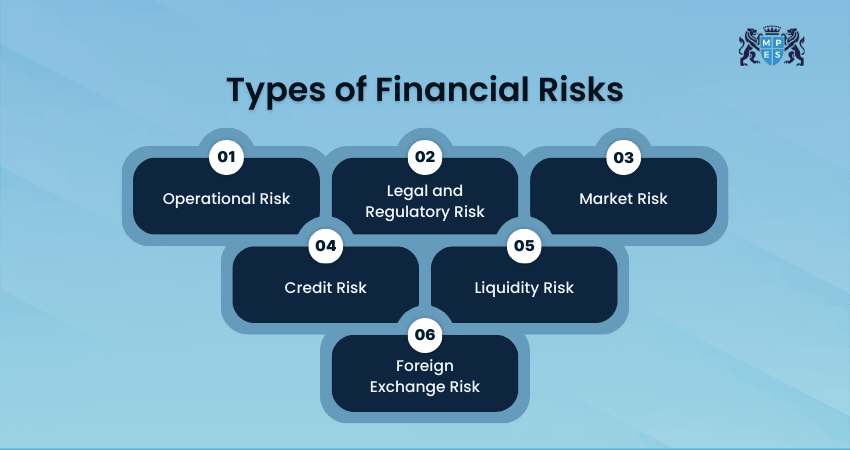

Types of Financial Risks

Understanding the different types of Financial Risks is essential for protecting assets, ensuring stability, and making sound business decisions. Below are the key categories of Financial Risk that organisations must monitor and manage carefully:

Measuring and Quantifying Risk

Financial Risk Management begins with measuring and quantifying exposure. This process uses tools like Value at Risk (VaR), which estimates potential portfolio losses over a specific time.

Alongside there are metrics such as standard deviation, beta, and the Sharpe ratio to assess risk relative to returns. These measures help organisations understand the magnitude of potential financial threats and make informed decisions on how to respond.

Applying Risk Controls

This step involves putting strategies into action, such as hedging, diversification, insurance, or credit checks. These measures lower the chances of financial shocks and ensure stability. Clear policies and regular audits make these controls more effective.

Monitoring and Adjusting

Financial risks are never static. Continuous monitoring allows organisations to adapt strategies when markets, regulations, or internal conditions change. Regular reviews ensure risks remain within acceptable limits and new threats are addressed quickly.

The Financial Risk Management Process

The process of managing financial risk involves a structured, proactive approach that helps organisations protect their assets and ensure stability. Below are the key stages that guide effective Financial Risk Management:

1) Operational Risk

This refers to risks arising from internal processes, people, or systems failing. It includes human errors, system breakdowns, fraud, or even external events like natural disasters. Though often overlooked, operational risk can cause significant financial damage if not properly managed.

For example, a system crash during a critical transaction or a data breach can lead to financial losses, reputational damage, and even legal consequences. Effective internal controls, employee training, and strong disaster recovery plans are essential to manage this risk.

2) Legal and Regulatory Risk

This occurs when a company fails to comply with laws or regulations. It can lead to lawsuits, fines, license revocations, or reputational damage. Staying updated with industry regulations and having strong compliance practices can help mitigate this risk.

For instance, a financial firm not complying with anti-money laundering laws may face severe fines and loss of customer trust. Legal Risk Management involves having legal advisors, keeping up with changing laws, and maintaining compliance frameworks.

3) Market Risk

Market risk is the risk of losses because of changes in market conditions, such as stock prices, interest rates, or commodity prices. It is especially relevant to investors and financial institutions, as market volatility can significantly affect returns.

For example, a sudden drop in interest rates can affect a bank’s lending profitability. There are several subcategories of market risk, including equity risk, interest rate risk, and commodity risk. Organisations use techniques like portfolio diversification and hedging strategies to manage exposure.

4) Credit Risk

Credit risk occurs when borrowers or counterparties fail to meet their financial obligations. This could be due to insolvency, delayed payments, or unwillingness to pay. Banks and lenders face this risk heavily, but any business extending credit to customers is exposed.

For example, if a major client defaults on payment, it can affect cash flow and create working capital issues. Credit risk is managed by conducting credit assessments, setting limits, and using credit insurance.

5) Liquidity Risk

Liquidity risk refers to a company’s inability to convert assets into cash quickly without substantial loss in value, or failure to meet short-term financial obligations. This can happen due to poor cash flow management, economic downturns, or unexpected expenses. In the worst cases, it can lead to bankruptcy.

For example, a business might have high-value assets but still struggle to pay suppliers on time. To mitigate liquidity risk, companies monitor cash flow regularly and maintain accessible reserves or credit lines.

6) Foreign Exchange Risk

Foreign exchange risk, also termed as currency risk, affects businesses dealing with international operations, trade, or investments. It arises from fluctuations in currency exchange rates, which can impact revenues, costs, and asset values.

For instance, if a UK company invoices a client in euros and the euro weakens, the company receives less in pounds than expected. Currency hedging, invoicing in home currency, and diversification can help manage this risk.

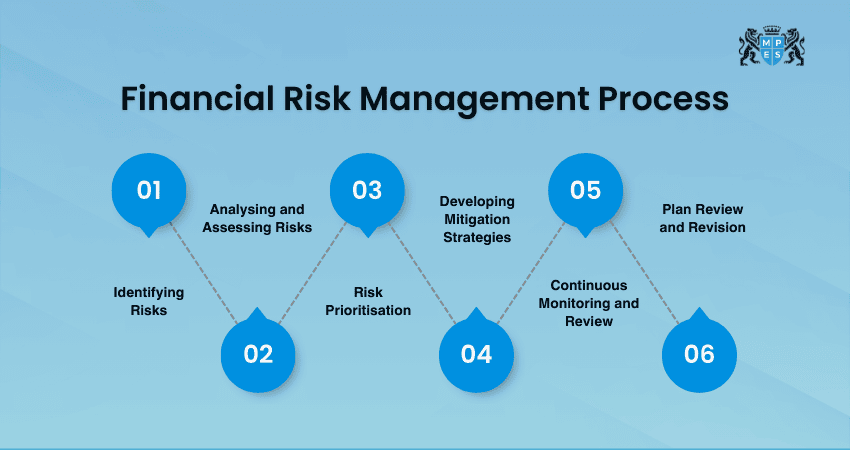

The Financial Risk Management Process

The Financial Risk Management Process uses a structured approach to identify, assess, and control Financial Risks. Here are the key stages involved in the process:

1) Identifying Risks

Identifying risks means recognising all financial threats that may affect an organisation’s goals or stability. Within Financial Risk Management, this involves reviewing financial statements, business operations, and market conditions to uncover risks early and avoid unexpected losses.

Organisations examine both internal risks, such as system failures or human errors, and external risks like market volatility or regulatory changes. Listing and categorising risks helps ensure even smaller issues are addressed before they grow into serious problems.

2) Analysing and Assessing Risks

After risks are identified, they are analysed to understand their causes and potential impact. This step focuses on estimating how likely a risk is to occur and how much financial damage it could cause within Financial Risk Management.

Businesses use qualitative judgement and quantitative tools, such as Value at Risk and expected loss calculations, to measure exposure. These assessments help organisations compare risks against tolerance levels and make informed financial decisions.

3) Developing Mitigation Strategies

Risk prioritisation focuses on ranking identified risks based on their likelihood and potential impact. High risk issues that could cause major financial damage are given priority over lower level risks.

This process ensures resources are used wisely. By addressing the most critical risks first, organisations avoid spreading efforts too thin and can focus on protecting their most important financial assets.

4) Continuous Monitoring and Review

Developing mitigation strategies means planning actions to reduce or control financial risks. These strategies may include improving controls, adjusting budgets, diversifying investments, or strengthening financial policies.

The aim is to limit potential losses and reduce uncertainty. Well planned mitigation strategies help businesses respond confidently to risks and maintain financial stability even during unexpected situations.

5) Continuous Monitoring and Review

Continuous monitoring involves regularly tracking risks and financial performance. Since risks change over time, businesses must stay alert to new threats and shifts in existing risk levels.

This step ensures mitigation measures remain effective. Ongoing review helps organisations identify early warning signs, respond quickly to changes, and maintain control over their financial risk environment.

6) Plan Review and Revision

Plan review and revision focus on keeping the risk management approach effective over time. As markets, regulations, or business operations change, existing risk strategies may become outdated and need adjustment.

Regularly updating the plan allows organisations to learn from past risks and outcomes. It ensures responses stay practical, aligned with business goals, and capable of managing both current and future financial challenges.

Enhance your strategic thinking and tech skills with Business Strategy and Technology (BST) Training – Register today!

Benefits of Financial Risk Management

Financial Risk Management helps businesses stay stable, profitable, and prepared for uncertainty. Beyond reducing losses, it supports smarter decisions, stronger operations, and long-term growth. Key benefits include:

1) Encourages Cross-functional Collaboration

Financial Risks often affect multiple departments. Risk Management brings teams from finance, operations, marketing, and other areas together, improving communication, data sharing, and decision-making across the organisation.

2) Optimises Business Processes

By identifying inefficiencies and bottlenecks, businesses can streamline workflows and reduce waste. Through Financial Risk Management, this often leads to better use of technology, automation, and resources, improving productivity, and cost control.

3) Reduces Risk Likelihood and Impact

Proactive Risk Management helps organisations anticipate problems before they escalate. Early actions, such as planning for cash flow gaps or market changes, reduce the chance of disruption and limit financial damage.

4) Boosts Confidence in Financial Reporting

Accurate and timely financial reports are important for managing risk. Strong Risk Management improves the quality of reporting, giving leaders, lenders, and stakeholders greater confidence in the organisation’s financial position.

5) Supports Effective Risk Mitigation

A structured approach makes it easier to take the right risk treatment strategies, such as diversification, insurance, or hedging. With Financial Risk Management, businesses can better protect profits and plan future investments more effectively.

6) Promotes Continuous Improvement

Financial Risks change over time, and Risk Management encourages regular review and adaptation. By updating strategies and responding to new risks early, organisations stay resilient, competitive, and better prepared for future challenges.

Key Financial Risk Management Strategies

Managing uncertainty requires the right tools to reduce losses and support better decisions. Financial Risk Management strategies help organisations control exposure and protect stability. Here are some key strategies businesses use.

Risk Reduction

Risk reduction involves taking active steps to lower the likelihood or impact of financial threats. Organisations often do this by strengthening internal controls, improving operational systems, and diversifying their investments.

For instance, a company might reduce credit risk by conducting thorough credit checks before lending or reduce market risk by spreading assets across different sectors.

Risk Transfer

Risk transfer means shifting the financial burden of certain risks to another party. The most common example is purchasing insurance, where the insurer absorbs the cost of specific losses. Another method is using contracts or outsourcing, where third parties assume certain financial responsibilities. Businesses also use financial tools like futures or options to hedge against market fluctuations.

Risk Retention

In some cases, organisations choose to accept and retain certain risks, especially when the cost of mitigating or transferring them outweighs the potential loss. This is known as risk retention. It often applies to low-impact or predictable risks that the business is prepared to handle internally. Effective risk retention involves setting aside financial reserves and preparing response plans to ensure the risk doesn’t disrupt operations if it materialises.

Risk Avoidance

Risk avoidance is the most extreme form of risk control. It involves eliminating exposure altogether by not engaging in activities that carry unacceptable risk. For example, a company might decide not to enter a volatile market or avoid launching a product that lacks regulatory clarity. It is often used selectively when the potential threat outweighs the possible reward.

Strengthen your tax and business planning skills with Business Planning Tax (BPT) Training – Join now!

Real-world Applications and Case Examples

Understanding Financial Risk Management is easier when seen in real situations. Across industries, organisations use different techniques to protect finances, operations, and long-term value. The examples below show how common Financial Risks are managed:

1) Credit Risk in Retail Banking

Retail banks face credit risk when customers fail to repay loans or credit cards. Banks manage this using credit scoring, customer data, and Predictive Analytics to accurately assess repayment ability and risk levels. These tools help approve safer loans, reduce defaults, and maintain healthier portfolios.

2) Market Risk in Asset Management

Asset Management firms deal with market risk caused by changes in interest rates, exchange rates or market prices. Portfolio Managers manage this risk by diversifying investments and using hedging tools such as options and swaps. These strategies help protect portfolios from sudden market movements and keep returns more stable for investors.

3) Operational Risk in Fintech

Fintech companies face operational risks linked to technology failures, cyberattacks, and process weaknesses. To reduce these risks, fintech firms invest in strong internal controls, secure IT systems, and cybersecurity measures. This helps protect customer data, prevent fraud, and ensure smooth digital operations.

Conclusion

Financial Risk Management is essential for protecting a business’s financial health and ensuring long-term stability. By identifying and responding to risks proactively, organisations can make better decisions, avoid costly losses, and stay resilient in changing markets. With the right strategies and tools, Financial Risk becomes manageable, empowering businesses to grow with confidence and control.

Confidently navigate complex finance with ACA Professional Level Certificate – Register today!

Have Any Question?

Have Any Question?

+44 7452 122728

+44 7452 122728

Back

Back

44 7452 122728

44 7452 122728