Table Of Contents

Council Tax is something we all hear about, but what does it actually mean? Every year, millions across the United Kingdom pay it, yet many don’t understand how it works, who is responsible, or why some households pay more than others. Knowing the basics could help you avoid overpaying and stay on top of your financial duties.

In this blog, we’ll walk you through What is Council Tax, how it works, who pays it, and how to check your band. Whether you're renting, owning, or have just moved into a flat, everything you need to know is right here. Let's begin!

What is Council Tax?

Council Tax is a local tax that people in England, Scotland, and Wales pay to their local council. The money goes to your local council to help pay for the many public services they provide in your area. This money helps pay for local services like:

1) Rubbish collection and street cleaning

2) Maintaining roads and street lighting

3) Care services like ‘Meals on Wheels’ for elderly residents

4) Schools, libraries, and local parks

5) Social care and other emergency services

How Does Council Tax Work?

Council Tax is charged by local authorities based on the value of your home. Each year, councils set the amount they need to collect to fund local services. Your household then pays a portion of this amount, based on the value band of your property. The three main things you need to know to understand your Council Tax bill are:

1) Your home’s valuation band

2) How much does your local council charge for that band

3) Whether you qualify for a discount or exemption

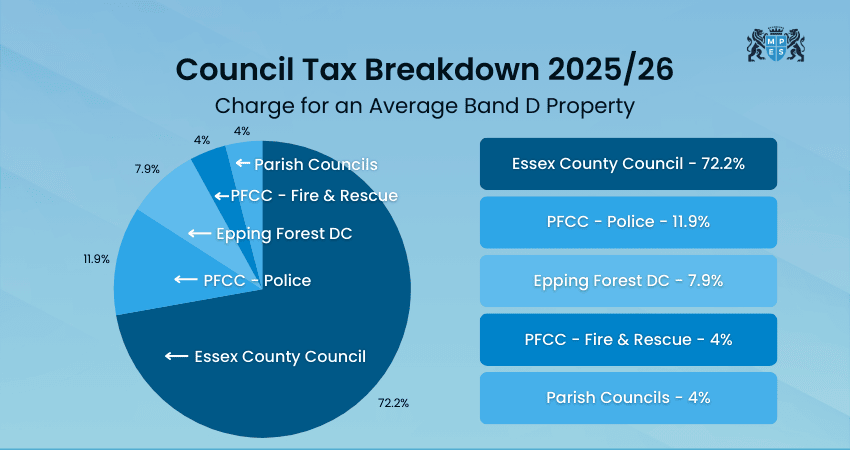

Property Valuation Bands

Every home is assigned a valuation band by the Valuation Office Agency (VOA) in England and Wales, or the Scottish Assessors Association (SAA) in Scotland. This band is based on the property’s market value as of 1 April 1991 in England and Scotland, or 1 April 2003 in Wales. Here’s a quick look at valuation bands in England:

Who Should Pay Council Tax?

The person who lives in the home usually pays the Council Tax. Usually, one household member is the ‘liable person.’ This could be:

1) The owner who lives in the property

2) The tenant, if the property is rented

3) Joint tenants or co-owners, who are jointly liable

4) If no one lives in the property, the owner is liable

If multiple adults live in the home, the council expects them to pay jointly. In general, Council Tax is not charged per person. It is charged per property, but there are rules around discounts, exemptions, and reductions.

People Who Might not Need to Pay Council Tax:

Some people are not counted on when working out the Council Tax bill. These people include:

1) Full-time students

2) People under 18

3) People with certain disabilities

4) Live-in carers (not family members)

5) People with severe mental conditions

So, for example, if a property has one adult and one full-time student, the adult can get a 25% discount. Likewise, if everyone in the home is not counted, the home may not need to pay Council Tax at all.

Learn advanced tax planning strategies and focus on compliance with our Business Planning Tax (BPT) Course – Register now!

How Will I Know How Much My Council Tax is?

Each year, the local council sends you a bill telling you:

1) The total amount you must pay for the year

2) A breakdown of the services the money funds

3) Your monthly payment amounts, due dates, and payment methods

You can also check the website of your local council using your postcode to see your property’s band and the exact rates.

How is Council Tax Calculated?

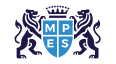

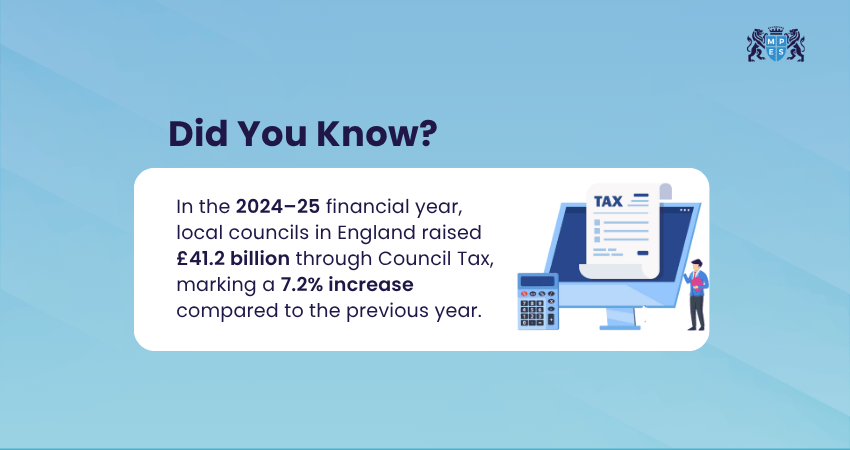

When you know What is Council Tax, you also need to know how it is calculated. Local authorities start by identifying the services they will provide in the coming year and how much these will cost. They then subtract the income they expect to receive from fees and charges, government grants, other contributions, and their share of business rates.

The amount that is left has to be covered by the Council Tax. This total is shared between all residential properties in the borough, and each household pays a different amount depending on its property valuation band.

How to Pay Council Tax?

Council Tax is billed annually. It is based on the financial year, which runs from 1 April to 31 March. Your local council usually sends the bill in March each year, covering the full 12 months ahead. Even if your household is fully exempt, you’ll still receive a Council Tax bill, and it will show that you don’t owe any tax.

Payment Methods

Here are the common ways to pay your Council Tax:

1) Direct Debit the easiest and most common method

2) Online via your local council’s website

3) By phone, using automated services or calling the council

4) Bank transfer or standing order

5) At your bank or Post Office, using the payment slip provided

You need to always pay by the date mentioned in your bill. Missing payments can lead to reminders, fines, or court action.

How Does the Council Collect Council Tax?

Once your bill is issued, payment is typically made in 10 equal monthly instalments from April to January, followed by a two-month break (February and March) for account reconciliation. You can request to spread payments over 12 months instead or choose to pay in full or in two half-yearly instalments.

What Happens if a Payment is Missed?

If you don’t pay your Council Tax on time, here’s what might happen:

1) Reminder Notice: You will get a notice as a reminder after 7 days of non-payment.

2) Second Reminder: It will be sent if you miss a second payment later in the year.

3) Final Notice: If you keep missing payments, the council may demand the full year’s tax immediately.

4) Court Summons: If ignored, they can take you to court to recover money.

5) Deductions or Enforcement: Councils can take money from your wages or benefits or send enforcement agents.

Assess financial statements and evaluate internal controls with our Audit and Assurance (AA) Training – Join soon!

When to Update Council for Situational Changes?

If there are any situational changes, such as:

1) Someone moving in or out of your home

2) Starting or losing a job

3) Becoming eligible for a discount or benefit

You need to inform the council. Most councils have an online form for this. If your payment amount needs to change, you’ll receive a new bill and updated payment plan.

How Council Tax Revenue is Used?

Council Tax revenue helps fund the essential services that keep local areas running smoothly. If you know What is Council Tax, you will know that it supports day-to-day community services to vital care and safety functions. This money allows councils to maintain facilities and invest in the well-being of the community. The revenue is also used for:

1) Funding essential services like rubbish and recycling collection, street cleaning, and road maintenance.

2) Supporting libraries, parks, leisure centres, and other community facilities.

3) Paying for vital social services, including adult social care, education, and children’s services.

4) Contributing to police, fire, and rescue services.

5) Supporting housing services, local planning, and environmental health.

6) Providing funds to parish or town councils for additional local amenities.

Conclusion

Council Tax is a major part of the UK household budget. It can seem confusing, but understanding What is Council Tax helps you know that it is the money you pay to your local council to help run services in your area. Staying up to date with Council Tax helps you avoid problems and keep your home safe and legal.

Explore audit, business strategy, and Financial Management with our ACA Professional Level Training – Sign up today!

Have Any Question?

Have Any Question?

+44 7452 122728

+44 7452 122728

Back

Back

44 7452 122728

44 7452 122728