Table Of Contents

Have you ever wondered how businesses keep their financial records balanced and error-free? Well, that’s where the Trial Balance comes in. It's like a financial checkpoint, ensuring that all the debits and credits match up perfectly. This simple yet powerful tool helps Accountants spot mistakes before they become bigger issues.

More than just a list of balances, it’s a critical step in preparing financial statements that reflect the true health of a business. In this blog, we’ll explore everything you need to know about the Trial Balance and why it’s so important. So read on!

What is a Trial Balance?

A Trial Balance is a financial report that lists all the ledger account balances of a business at a specific point in time. It is used to check that the total of all debit balances matches the total of all credit balances. If both sides are equal, it means the accounts are balanced, and the Bookkeeping entries are likely correct.

The Trial Balance is usually prepared at the end of an accounting period, such as a month, quarter, or year, before the creation of financial statements. It includes all categories of accounts, including assets, liabilities, expenses, and revenues. Its relevance in assessing whether debits and credits match is also a common point in Credit Control Interview Questions, as financial accuracy forms the basis of effective credit management. For instance, if a business purchases equipment worth £5,000, it would be recorded as a debit to Equipment and a credit to Cash. These entries would then appear in the Trial Balance, ensuring the total debits and credits are equal.

What Does a Trial Balance Include?

A Trial Balance includes the total balances of all general ledger accounts in one place. It typically lists:

1) Account number

2) Account name

3) Account closing debit or credit balance

4) Reporting date

Unlike a general ledger, which records every individual transaction, a Trial Balance summarises only the ending totals for each account. If adjusting entries have been posted, the Trial Balance should also display the pre-adjustment figures, the adjustments made and the revised final balances.

Purpose of the Trial Balance?

1) These points highlight the purpose of the Trial Balance:

2) It acts as the first step in preparing official financial statements.

3) It helps verify that total debits and credits match in the Double-entry Accounting system.

4) It identifies basic mathematical errors before final reporting.

5) It ensures discrepancies are investigated prior to creating official statements.

6) It does not detect missing transactions or classification errors.

7) It's used only as an internal working document, not an official financial statement.

Types of Trial Balance

There are three types of Trial Balances used in accounting. Each serves a different purpose during the financial reporting process. Let’s look at each one:

1) Adjusted Trial Balance

It is prepared after making necessary adjustments for accrued and deferred items. It shows the updated balances of all accounts, reflecting any adjustments made for the period. This checks that the financial statements are accurate and complete.

1) Reflects all adjustments for the accounting period

2) Ensures financial statements are prepared correctly

3) Helps identify any errors before final reporting

2) Unadjusted Trial Balance

It is prepared before any adjustments are made at the end of an accounting period. It lists all account balances from the ledger as they are, without reflecting any adjustments for accruals or deferrals. It is used as the first step in the preparation of financial statements.

1) Shows raw data before adjustments

2) Helps spot errors in the ledger

3) Serves as a base for further adjustments

3) Post-closing Trial Balance

It is created after all temporary accounts (like revenues and expenses) are closed. It only includes the balances of permanent accounts, such as assets, liabilities, and equity. This ensures the ledger is ready for the next accounting period.

1) Contains only permanent account balances

2) Confirms all temporary accounts are closed

3) Ensures the ledger is balanced for the new period

Achieve financial expertise confidently with our CIMA Certificate in Business Accounting– Join today!

How a Trial Balance Works?

Here’s how it works step by step:

1) Recording Transactions in the Ledger

1) Every transaction is recorded in the ledger with both debit and credit entries

2) Debits are recorded on the left side, while credits are on the right side

3) The ledger keeps a complete record of all financial transactions

4) It serves as the main source for preparing the Trial Balance

2) Summing Up Debits and Credits

1) All the debit and credit balances from the ledger are added up

2) The total debits and credits are then transferred to the Trial Balance

3) This helps in checking if both sides are equal

4) If they match, it indicates that the records are correct

3) Checking for Discrepancies

1) If the credit and debit totals do not match, there may be errors

2) Common mistakes include incorrect entries or missed transactions

3) The differences are checked and corrected before finalising the accounts

4) Finding and fixing these errors helps keep financial records accurate

Key Requirements for Preparing a Trial Balance

Here are the key requirements for preparing a Trial Balance:

1) Record all the business transactions in the general ledger, using proper double-entry accounting.

2) Calculate the ending balance of each ledger account by summing all the individual debits and credits.

3) In the Trial Balance worksheet, arrange the account titles with their debit balances in one column and credit balances in another column.

4) Make sure that total debits equal total credits to confirm the mathematical accuracy of the entries.

5) Maintain awareness that a balanced Trial Balance does not guarantee the absence of other errors, like omissions or misclassifications.

Benefits of Using a Trial Balance

Here are the key benefits of using Trial Balance:

1) Error Detection

1) Helps identify mistakes in ledger entries

2) If debits and credits do not match, it signals an error

3) Makes it easier to find and fix wrong transactions

4) Prevents accounting mistakes from affecting final reports

2) Financial Accuracy

1) Ensures that all entries are properly recorded

2) Confirms that transactions are balanced and correct

3) Helps maintain clear and accurate financial records

4) Reduces the chance of confusion during audits

3) Easier Preparation of Financial Statements

1) Provides a clear summary of all financial accounts

2) Makes it simple to prepare balance sheets and income statements

3) Saves time during financial reporting periods

4) Ensures all transactions are recorded before reports are made

4) Better Financial Control

1) Helps monitor income, expenses, and assets

2) Makes it easier to track financial changes over time

3) Provides a quick snapshot of financial health

4) Assists in planning and budgeting decisions

Limitations of a Trial Balance

Despite its benefits, there are some disadvantages of the Trial Balance you need to consider:

1) Does Not Detect All Errors

1) Some mistakes won't show even if the Trial Balance is balanced

2) Errors like duplicated entries remain hidden

3) It only checks the total amounts, not the details

4) Misplaced transactions may still balance out

2) Ignores Missing Entries

1) If a transaction is not recorded, it won't appear in the Trial Balance

2) Missed entries will not affect the debit and credit totals

3) Important financial details might be left out

4) It relies on complete and accurate ledger entries

3) Cannot Detect Misclassification

1) Transactions entered into the wrong account will still balance

2) Income recorded as an expense will not show an error

3) Misclassifications are not caught by the Trial Balance

4) Financial statements might still look correct even with errors

4) Does Not Show Fraud or Manipulation

1) Fraudulent entries can still be balanced

2) Intentional changes to records may go unnoticed

3) False entries are hard to detect without deeper checks

4) Additional audits are needed to uncover fraud

Learn strategic management skills with our CIMA Fundamentals of Management Accounting (BA2) Course – Join today!

Correcting Trial Balance Errors

Consider these steps to correct errors in the Trial Balance:

1) Recheck your Trial Balance by reviewing figures carefully, taking a break, and asking someone else to spot possible typos.

2) Verify your ledger to ensure all account balances are accurate before transferring them to the Trial Balance.

3) Use Accounting Software like Xero to minimise manual errors and streamline calculations for improved accuracy.

Trial Balance vs Balance Sheet

Here are the key differences between them:

1) Purpose

A Trial Balance checks that the debit balances equals the credit balances. It helps identify any errors in the bookkeeping process. It’s mainly for internal use to ensure accounts are accurate.

On the other hand, a Balance Sheet refers to a financial statement that presents a company’s financial status. It includes assets, liabilities, and equity, helping stakeholders understand the company’s value.

2) Timing

A Trial Balance is made at the end of an accounting period, before adjustments are made. It acts as a checkpoint to verify that the books are balanced. It is also used for error detection.

In contrast, a Balance Sheet is prepared after all adjustments are made and the accounts are finalised. It is presented to investors, creditors, and management to show the company’s financial health.

3) Information Included

A Trial Balance lists all accounts from the ledger with their debit or credit balances. It does not distinguish between types of accounts, and it only checks the mathematical accuracy of the Bookkeeping.

On the other hand, a Balance Sheet categorises accounts into assets, liabilities, and equity. It provides a clear picture of what the company owns, owes, and the value held by shareholders.

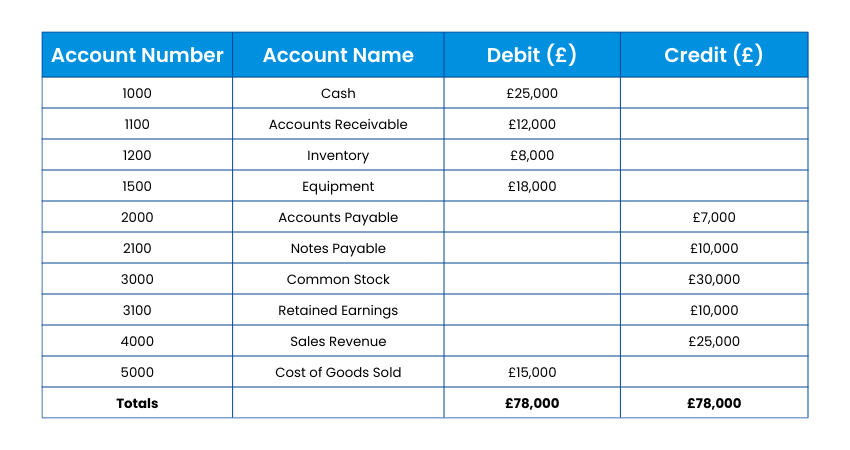

Trial Balance Example

This example illustrates how a Trial Balance works:

In this example, the Total Debits (£78,000) equal the Total Credits (£78,000), indicating the Trial Balance is balanced correctly.

Conclusion

A Trial Balance is like the checkpoint that keeps financial records organised and ready for accurate reporting. Confirming the balanced debits and credits helps you uncover mistakes early on and strengthens the overall reliability of Bookkeeping. Understanding its purpose and requirements helps businesses maintain clarity and control over their financial story.

Transform business knowledge into lasting success with our CIMA Fundamentals of Business Economics (BA1) Course – Sign up now!

Have Any Question?

Have Any Question?

+44 7452 122728

+44 7452 122728

Back

Back

44 7452 122728

44 7452 122728