Table Of Contents

Imagine a company like Nike, using data to monitor every step of its supply chain, ensuring products are in the right place at the right time. By analysing trends and customer preferences, Nike can launch the perfect product exactly when the market needs it. This level of strategic precision isn’t accidental; it’s powered by Management Accounting.

Management Accounting equips businesses with real-time insights and data-driven tools to make game-changing moves. In this blog, we’ll explore the key characteristics of Management Accounting and how they empower decision-making, uncover valuable insights, and help organisations achieve their business goals.

Table of Contents

What is Management Accounting?

Characteristics of Management Accounting

Providing Financial Insights

Supporting Decision-making

Analysing Causes and Effects

No Fixed Conventions

Focusing on Goal Achievement

Enabling Forecasting

Using Specialised Techniques and Concepts

Enhancing Operational Efficiency

Informative Instead of Decision Making

Conclusion

What is Management Accounting?

Management Accounting is the process of preparing, analysing, and presenting financial and non-financial information to help internal stakeholders make informed business decisions. Unlike financial accounting, which focuses on external reporting, Management Accounting supports planning, budgeting, forecasting, and performance evaluation within an organisation.

Management Accounting helps managers allocate resources efficiently, control costs, and respond to changing market conditions. By turning raw data into actionable insights, Management Accounting plays a crucial role in driving operational effectiveness and achieving strategic business goals.

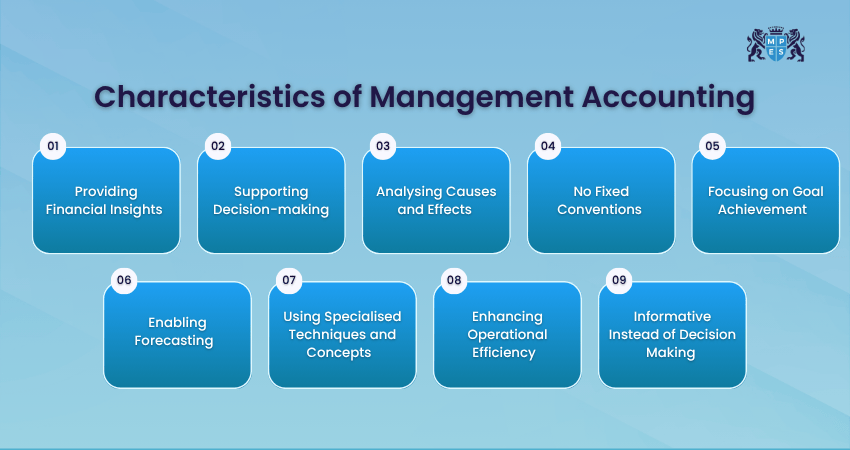

Characteristics of Management Accounting

Here are the Characteristics of Management Accounting:

1. Providing Financial Insights

It translates complex figures into clear business meaning. Managers get the right data at the right time. These insights highlight strengths, reveal weaknesses, and track changes over time. It helps businesses move from reaction to proactive strategy. They turn raw financial data into actionable guidance for better performance.

Key Benefits:

Helps find strengths and weaknesses

Makes decision-making easier

Helps decide where to spend money wisely

2. Supporting Decision-making

It backs every choice with solid evidence. Managers avoid guesswork and rely on real numbers. It enables a clear comparison between alternatives. This reduces uncertainty and boosts confidence in business strategies. This ensures that each business decision is data-driven and strategically sound.

Key Benefits:

Reduces guesswork

Helps make better choices

Makes comparing options easier

3. Analysing Causes and Effects

It looks beyond what happened to explain why. Trends are linked to specific actions or events. This helps in understanding the root causes behind performance. As a result, managers can replicate success and avoid repeating mistakes. It also helps in recognising patterns that can influence future decisions.

Key Benefits:

Helps understand what caused changes

Helps repeat successful actions

Helps avoid mistakes in the future

4. No Fixed Conventions

It’s not bound by rigid formats or rules. Every report fits the unique business need. This allows Management Accounting to adapt to various industries and situations. It ensures that insights are always relevant and timely. Its flexibility ensures that reporting evolves as the business grows and changes.

Key Benefits:

Reports can be customised for each business

Provides relevant and timely insights

Adapts as the business grows

Enhance Your Financial Knowledge with our Financial Accounting (FFA) Course - Join today!

5. Focusing on Goal Achievement

It aligns numbers with company targets. Every analysis points toward an objective. This ensures that teams are working with a shared vision. It also allows leaders to track whether actions are moving the business closer to its goals. It keeps departments aligned and accountable for their contributions to the mission.

Key Benefits:

Makes sure everyone is working with the same goal

Helps teams stay accountable for their work

Shows progress towards business objectives

6. Enabling Forecasting

It predicts what’s ahead based on current data. Budget plans and future costs are mapped out. Forecasts support long-term planning and Risk Management. Managers can make informed choices before challenges arise. It equips managers with foresight to seize opportunities and avoid pitfalls.

Key Benefits:

Helps avoid surprises

Makes planning easier

Helps businesses stay ready for changes

7. Using Specialised Techniques and Concepts

It applies advanced tools like Variance Analysis and break-even charts. These methods sharpen understanding and accuracy. Such tools help convert raw data into actionable knowledge. They also simplify complex decisions by presenting clear visual metrics. They also allow managers to assess financial health with greater precision.

Key Benefits:

Helps understand numbers more clearly

Makes tough decisions easier

Helps control money better

8. Enhancing Operational Efficiency

It spots delays, waste, and weak spots in systems. Resources are used where they matter most. This promotes Lean Management and continuous improvement. Over time, it can lead to major cost savings and better productivity. Ultimately, it helps reduce costs while boosting quality and productivity.

Key Benefits:

Spot areas where money is wasted

Helps improve processes

Reduces costs and increases productivity

9. Informative Instead of Decision Making

It does not directly make decisions; it simply supports them. Managers interpret insights according to their specific context. The role is informative and advisory, not directive. Ultimate decisions remain with business leaders, using the data provided to make sound judgments. It empowers them to act with confidence and clarity.

Key Benefits:

Provides useful information for smart choices

Supports strategic decision-making without enforcing it

Empowers managers with contextual understanding

Conclusion

The Characteristics of Management Accounting play a crucial role in business success. They provide insights that drive informed decision-making, effective cost control, and improved operational performance. By aligning financial planning with strategic goals, businesses can stay agile, minimise risks, and achieve sustainable growth.

Learn the essentials of Accounting and boost your career with our ACCA Foundations Training – Join now!

Have Any Question?

Have Any Question?

+44 7452 122728

+44 7452 122728

Back

Back

44 7452 122728

44 7452 122728