Table Of Contents

Picture this: you’re a freelance Graphic Designer, and you’ve just finished a project for a client. They pay you on the spot, and you happily log that income in your records. Simple, right? That’s the beauty of Cash Basis Accounting—you only record transactions when cash actually changes hands. But how does this method work if you’re running a small retail shop or a growing consultancy? Is it still the best fit?

But such simplicity comes with trade-offs. From tax perks to potential pitfalls, understanding this approach is key to making smart financial decisions. This blog will help you do that by exploring Cash Basis Accounting in detail. So are you ready to explore the pros, cons and tax twists? Let’s dive in!

What is Cash Basis Accounting?

Cash Basis Accounting is an effective accounting strategy where income and expenses are recorded when money moves in or out of a business. In simple words, you keep record of the revenue when you receive money, and record expenses when payment is made.

For instance, imagine you are a freelance Graphic Designer who completed a logo project in December, but the client pays you in January. Under Cash Basis Accounting, the income will be recorded in January, not when you have sent the invoice. This method focuses on real cash movement, for making it easy to track, manage and organise funds.

Who Uses Cash Basis Accounting?

Most commonly, Cash Basis Accounting is widely used by small sized businesses, sole traders, and freelancers. Since, this accounting method records income and expenses during real cash movement, it provides a clear picture of the fund's businesses own.

This is a preferred method due to its simplicity to managing finances. It reduces the need to perform complex accounting tasks and makes bookkeeping easier. It is helpful for businesses with low inventory, direct transactions, and limited amount of accounting resources.

Cash Basis Accounting Principles

To understand Cash Basis Accounting, it’s essential to familiarise yourself with some key ideas , along with Accrual Accounting. Let’s take a more in-depth appearance:

1) Recognition of Income and Expenses: Under Cash Basis Accounting, you can understand earnings whilst it’s received and charges once they’re paid. Simple as that. This method doesn’t trouble with invoices, bills, or credit score notes until the cash falls within your financial account or out of it.

2) No Accounts Receivable or Payable: In Accrual Accounting, groups require to track what is owed to them (money owed receivable) and what they owe to others (payable bills). But, in Cash Basis Accounting, you simply need to track real cash movement. There is no need of tracking future bills except what is available in the present.

3) Focus on Cash Flow: This is where Cash Basis Accounting shines . It offers you an instantaneous picture of your cash flow, so that you know how a good deal money is to be had to pay your bills and make commercial enterprise decisions.

How Cash Basis Accounting Impacts Financial Statements?

Cash Basis Accounting helps to reflect the financial performance and position of a business. It focuses on recording transactions when money is paid or received. Some integral ways it impacts financial statements are mentioned below:

1) Income Statement

Under Cash Basis Accounting, revenue is shown when money is received. This means earnings might not be shown in the period when it earned if the payment status is pending. Also, expenses appear only when paid. This results in income statement not always showing the genuine profit for a specific period.

2) Balance Sheet

Under the cash basis method, balance sheets do not include receivable or payable accounts. Since these figures are not shown, the balance sheet cannot reflect the genuine financial position of the business. This affects decision-making process of investors, or stakeholders who are reliant on an accurate report.

3) Impact on Financial Insights

Cash Basis Accounting provides clarity over the present cash movement but, it does not give a complete picture of long-term finances. This makes it difficult for businesses to estimate profits, plan for the long-term and proactively spot financial risks.

Cash Basis Accounting: Example

Let’s look at a simple example to understand how cash basis accounting works for a freelance accountant.

A freelance accountant finishes preparing quarterly accounts for a client on 22 September and issues an invoice for £3,200 the same day. However, the client doesn’t make the payment until 6 October. Under cash basis accounting, the accountant records this £3,200 as income on 6 October, when the cash is actually received, rather than when the work was completed.

The accountant also has an expense of £300 for annual tax software, billed on 28 September, but the payment isn’t made until 12 October. This expense is recognised on 12 October, when the money leaves their account, not on the date the service was used.

This means that although the accountant appears to be £2,900 better off at the end of September, this won’t show on the cash basis financial statements until October. It highlights how cash basis accounting records income and expenses only when cash moves, giving a clearer picture of day to day cash flow.

Benefits of Cash Basis Accounting

Now that we’ve covered the basics, let’s look at why Cash Basis Accounting is so popular, especially for small businesses and freelancers.

1) Simplicity

The beauty of Cash Basis Accounting lies in its simplicity. As a small business owner, you don’t need to fear about maintaining track of future earnings and expenses. If the cash hasn’t come in, it’s not counted. If it hasn’t been paid, it’s now not recorded. For many small groups, that is a big remedy and saves time on bookkeeping.

For instance, if you’re a local plumber, you don’t ought to juggle loads of invoices and receipts. You just track what’s in your bank account and receive reminders on getting the work done.

Master the Accounting fundamentals by joining our ACCA Foundations Course today!

2) Clear Cash Flow Visibility

Cash Basis Accounting offers you an actual-time image of your available cash. This is mainly crucial while you’re starting out or in case your commercial enterprise is seasonal. If you’re a wedding photographer, for example, you may book loads of paintings earlier; but best get hold of charge in instalments closer to the marriage date.

With Cash Basis Accounting, you’ll understand precisely the amount of fund you have got available to cover charges in the meantime.

3) Reduced Complexity for Small Businesses

Small agencies regularly don’t have the need for the complexity of Accrual Accounting. With Cash Basis Accounting, there’s no need to track things like accounts payable or receivable, which can soak up treasured time.

This makes bookkeeping a straightforward process, especially for businesses who oversee their own accounts. By reducing complex accounting tasks, businesses can focus on growing and operating instead of spending time with Financial Management.

If you’re a freelancer doing advertising for neighbourhood groups, cash foundation is a trustworthy technique that enables you stay on pinnacle of factors without needless complications.

4) Tax Advantages

Cash Basis Accounting can also offer tax benefits. You’ll only pay tax on income that you’ve actually received. So, if you’re waiting for payments in January, you can defer reporting that income until the following tax year. This might be useful if you’re in a pinch or need to manage cash flow carefully.

Drawbacks of Cash Basis Accounting

While Cash Basis Accounting has its perks, it’s now not ideal for each enterprise. Here are a few matters to recall:

1) Not Accurate for Larger Businesses

As organisations grow, they frequently need to hold track of more complicated transactions, like debts payable and receivable, as well as stock. For example, if you run a big online retail store, cash basis might not provide you with the full image.

Accrual accounting, then again, helps you fit income with the prices incurred to generate that income, supplying you with a clearer idea of profitability.

2) Delays in Recognising Income and Expenses

One limitation is it can delay recognising income and expenses. For instance, you complete a work for a client in December but don’t receive the payment until January. This means your earnings will not appear until the next year. This gap can give an inaccurate picture of your finances.

This won't be a hassle for a small business; however it can make economic planning difficult , particularly in case you’re seeking to grow or apply for a mortgage.

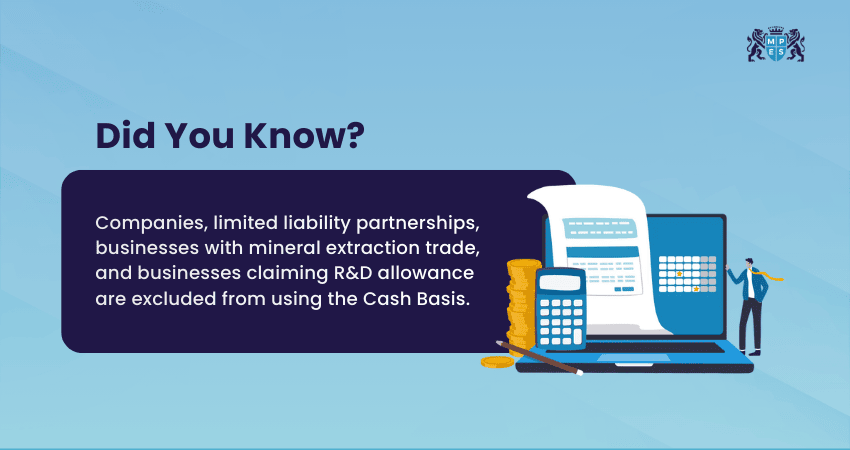

3) Not Available for All Businesses

In the UK, in case your enterprise is making greater than £150,000 in annual year, you won’t be capable to use Cash Basis Accounting. Larger organisations want to use accrual accounting to get a more accurate image in their financial status.

Also, certain businesses, such as partnerships with corporate or firms with intricate inventory may not utilise cash basis method. For them, Accrual Accounting is preferable for reporting, planning and managing finances.

Acquire the expertise to maintain flawless Financial Records – sign up for our Maintaining Financial Records (FA2) Course.

Changes to Cash Basis Accounting

Understanding the recent updates to Cash Basis Accounting is crucial for maintaining accurate financial records and ensuring compliance. Let’s explore them:

1) Cash Basis Set as the Default

From now on, Cash Basis Accounting will be the go-to option for qualifying businesses. This means that unless you specifically decide to switch to Accrual Accounting, your business will automatically be on the cash basis system. It’s a move aimed at making things easier for small business owners by keeping things simple and giving you a clear picture of your cash flow without all the extra paperwork.

2) Removal of the Turnover Threshold

Before, if your business turned over more than a certain amount, you weren’t allowed to use Cash Basis Accounting. Well, that rule has been scrapped. Now, even businesses with higher turnover can benefit from the straightforward approach of this procedure, making it more accessible for a wider range of businesses.

3) Elimination of the £500 Interest Deduction Limit in Cash Basis

If you’ve been using Cash Basis Accounting, you might have found that you could only deduct interest payments on loans up to £500. That limit is now a thing of the past. Businesses can now deduct the full amount of interest paid, giving you more flexibility and a more accurate reflection of your financial situation.

Unlock the power of financial data – sign up for our Management Information (MA1) Training.

4) Removal of Restrictions on Loss Relief Under Cash Basis

Another big change is that businesses will no longer be restricted from carrying forward losses when using Cash Basis Accounting. Previously, if you made a loss, you couldn’t offset it against future income, but that’s no longer the case. This change makes this procedure even more appealing, especially for businesses that might experience a bit of a bumpy ride financially.

5) Flexible Accounting

You now have more flexibility in how you choose to manage your accounts. While cash basis works brilliantly for small businesses with simpler needs, bigger businesses can still go for Accrual Accounting if that fits them better. It’s all about giving you the choice to pick the system that works best for your business as it grows and evolves.

Tax Implications of Using the Cash Basis Accounting Method

Cash Basis Accounting provides a potential tax benefit. Since, income is only recorded when received, businesses can delay identifying earnings until there is cash movement. This means taxable income would be lower in the current year if payments are going to be received later.

For instance, if you send an invoice to a client in December, but receive payment in January, the income will be taxed the following year. This reduces tax bill for the current year and manages seasonal income challenges. It is also crucial to understand large businesses may prefer early recognition of income to maintain accuracy. And tax rules differ across countries and businesses may have specific requirements.

How to Simplify Your Cash Basis Accounting Workflow

Some effective ways to simplify your Cash Basis Accounting and streamline daily financial tasks are:

1) Use Accounting Software

By investing in Accounting Software, you can save time and improve accuracy. In Cash Basis Accounting, these tools record payments and expenses for generating clear financial reports and remain compliant to tax regulations. Also, automating entries reduces the need for manual work and helps to direct focus towards running the business.

2) Cash Flow Tracking

Accounting software is useful for keeping a detailed log of cash movement. It records every payment; you receive and expense the business pays. This helps to review and update cash flow to reveal the true financial position.

3) Tax Planning

Under Cash Basis Accounting, it is essential to prepare for taxes proactively. Keep a portion of your income aside to cover tax payments and be aware of deadlines. By proactive planning, financial stress is relieved, and tax obligations are met effectively.

4) Separate Business and Personal Finances

For preventing confusion and maintain accurate records, keep business finances separate from your personal finances. Utilise a consistent business bank account and do not mix other expenses in it. This helps to track cash movement and ensures a clear financial record is maintained for tax and reporting purposes.

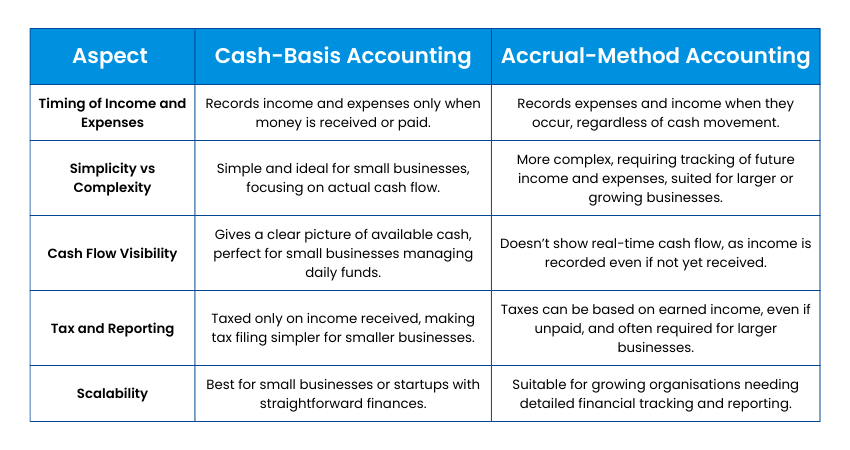

Cash-basis vs Accrual-method Accounting

While Cash Basis Accounting is great for small businesses, Accrual Accounting might be a better fit for larger, more complex businesses. Here’s a quick breakdown:

1) Timing of Income and Expenses

Cash Basis: It records income and expenses only when money is received or paid. This method closely mirrors actual cash movement, helping track liquidity in real time.

Accrual Basis: Records income and expenses when they occur, regardless of cash movement.

2) Simplicity vs Complexity

Cash Basis: It’s simple and ideal for small businesses, focusing on actual cash flow. It requires minimal accounting knowledge and fewer entries, making it easier to maintain.

Accrual Basis: More complex, requiring tracking of future income and expenses, suited for larger or growing businesses.

3) Cash Flow Visibility

Cash Basis: It gives a clear picture of available cash, perfect for small businesses that need to manage day-to-day funds. It ensures owners always know how much cash is truly on hand.

Accrual Basis: It doesn’t provide a clear cash flow picture, as income is recorded even if not yet received. Businesses may need separate cash flow statements for better monitoring.

4) Tax and Reporting

Cash Basis: You’re taxed only on income received, making it simpler for smaller businesses during tax season. It helps reduce tax liability by deferring income until cash is collected.

Accrual Basis: Taxes can be based on earned income, even if it hasn’t been paid yet, often required for larger businesses. It provides better compliance and transparency for investors and regulators.

5) Scalability

Cash Basis: It’s ideal for small businesses or startups with simpler needs. It allows quick setup and minimal administrative effort while maintaining essential financial records.

Accrual Basis: It’s better for growing businesses that require more detailed financial tracking and reporting. It supports scaling operations, financial forecasting and compliance with accounting standards.

Conclusion

To wrap it up, Cash Basis Accounting is a straightforward way for small businesses to stay on top of their finances by tracking actual cash flow. With the recent updates, it's become even more flexible and accessible, making it a great choice for many. If you're looking for simplicity and control over your cash, this might just be the perfect fit.

Unlock the secrets to effective Cost Management – register for our Managing Costs and Finance (MA2) Training.

Have Any Question?

Have Any Question?

+44 7452 122728

+44 7452 122728

Back

Back

44 7452 122728

44 7452 122728