Table Of Contents

When people hear Accounts Payable, they often think it’s just about paying invoices, but insiders know it’s a high-stakes balancing act. As the link between a company’s money and its vendors, Accounts Payable (AP) professionals ensure financial accuracy, build trust, and protect the bottom line.

In interviews, you’ll be expected to prove that you’re not just detail-oriented, but also organised, analytical, and proactive under pressure. That’s why we’ve created this in-depth blog with 20+ frequently asked Accounts Payable Interview Questions and expertly crafted answers. Keep reading!

Table of Contents

1) Frequently Asked Accounts Payable Interview Questions with Answers

a) How would you define Accounts Payable?

b) Can you explain what a vendor invoice is?

c) How do you describe a Purchase Order (PO)?

d) In your opinion, what qualities make someone a strong Accounts Payable clerk?

e) How do you identify and resolve invoice discrepancies?

f) How would you explain the concept of workflow in Accounts Payable?

g) What is a “voucher” in the context of Accounts Payable?

h) How is Accounts Payable different from bills payable?

i) Which accounting principle do you use most often, and why?

j) Can you walk me through the three-way matching process in Accounts Payable?

2) Conclusion

Frequently Asked Accounts Payable Interview Questions with Answers

To succeed in an Accounts Payable interview, you’ll need more than just knowledge of basic accounting terms. You have to show accuracy, problem-solving skills, and an understanding of financial workflows. Below, we’ve compiled some of the most commonly asked questions along with effective sample answers to help you prepare with confidence:

1) How would you define Accounts Payable?

This assesses your understanding of the Accounts Payable function in financial operations.

Sample Answer:

“I define Accounts Payable as the amount a company owes to suppliers or creditors for goods and services received but not yet paid for. It’s recorded as a liability on the balance sheet and managed through processes that ensure timely, accurate payments and strong vendor relationships.”

2) Can you explain what a vendor invoice is?

This tests your knowledge of common Accounts Payable documentation.

Sample Answer:

“A vendor invoice is a formal document issued by a supplier requesting payment for goods or services provided. It typically contains invoice number, date, item descriptions, quantities, prices, payment terms, and tax details, serving as the basis for recording liabilities and initiating payments in Accounts Payable.”

3) How do you describe a Purchase Order (PO)?

This checks your understanding of procurement documentation in Accounts Payable processes.

Sample Answer:

“I describe a PO as a formal document issued by a buyer to a vendor, specifying details such as items, quantities, prices, and delivery terms. Once accepted, it becomes legally binding and is essential for matching invoices during the three-way matching process.”

4) In your opinion, what qualities make someone a strong Accounts Payable clerk?

This assesses self-awareness and role-specific competencies.

Sample Answer:

“I believe strong organisational skills, attention to detail, and accuracy are essential. Good communication helps in resolving vendor issues, while time management ensures deadlines are met. Proficiency with accounting software and a strong understanding of financial processes also contribute to excelling in the Accounts Payable role.”

5) How do you identify and resolve invoice discrepancies?

This evaluates problem-solving skills in AP processes.

Sample Answer:

“I compare the invoice against the purchase order and delivery note to find mismatches. If I identify an issue, I contact the vendor or relevant department for clarification. I document the discrepancy, follow escalation procedures if necessary, and ensure corrections before processing the payment.”

6) How would you explain the concept of workflow in Accounts Payable?

This checks your understanding of process structure and efficiency.

Sample Answer:

“I explain workflow in Accounts Payable as the structured sequence of steps for processing invoices, from receipt and verification to approval and payment. It can be manual or automated and ensures accuracy, compliance, and timely payments by defining clear responsibilities and approval hierarchies.”

7) What is a “voucher” in the context of Accounts Payable?

This tests your knowledge of essential AP documents.

Sample Answer:

A voucher is an internal document authorising payment to a vendor. It includes the vendor invoice, purchase order, receiving report, and approval signatures. Vouchers provide proof of a valid transaction, help with audit trails, and facilitate payment processing in Accounts Payable.

Unlock strategic accounting expertise - Start the CIMA’s CGMA® Managing Performance (E2) Training now!

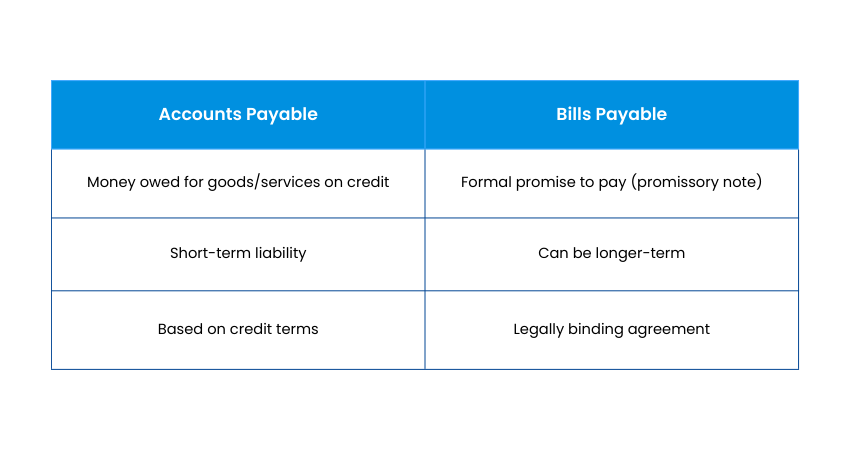

8) How is Accounts Payable different from bills payable?

This evaluates your understanding of accounting terminology differences.

Sample Answer:

Accounts Payable is the money owed for goods or services bought on credit, usually short-term liabilities in the AP ledger. Bills payable refers to promissory notes or formal commitments to pay, often involving more formal agreements and potentially longer payment terms.

9) Which accounting principle do you use most often, and why?

This reveals how you apply accounting concepts in practice.

Sample Answer:

“I most often use the accrual principle because it ensures expenses are recorded when incurred, not when paid. This approach gives a more accurate financial picture, aligns revenue and expenses, and supports better cash flow and budgeting decisions.”

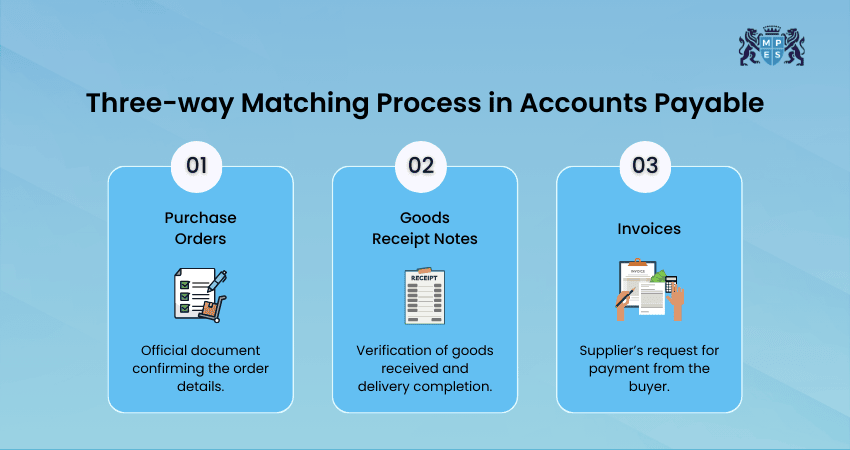

10) Can you walk me through the three-way matching process in Accounts Payable?

This assesses your knowledge of AP control measures.

Sample Answer:

“I match the purchase order, receiving report, and vendor invoice to ensure consistency in quantities, prices, and terms before approving payment. This process prevents overpayments, duplicate payments, and fraud, making it a crucial internal control in Accounts Payable.”

11) What are the business benefits of an effective Accounts Payable system?

This checks your understanding of AP’s strategic role.

Sample Answer:

An effective AP system improves cash flow, ensures timely vendor payments, and enhances vendor relationships. It reduces errors, prevents fraud, increases efficiency through automation, ensures compliance with tax regulations, and provides accurate financial data for better decision-making and planning.

12) How do you manage multiple invoices from the same vendor efficiently?

This tests organisational and prioritisation skills.

Sample Answer:

“I consolidate invoices into one payment run when possible, ensuring each is matched and approved. I use accounting software to track due dates, apply vendor terms, and avoid duplicates. I also keep open communication with vendors to ensure smooth processing.”

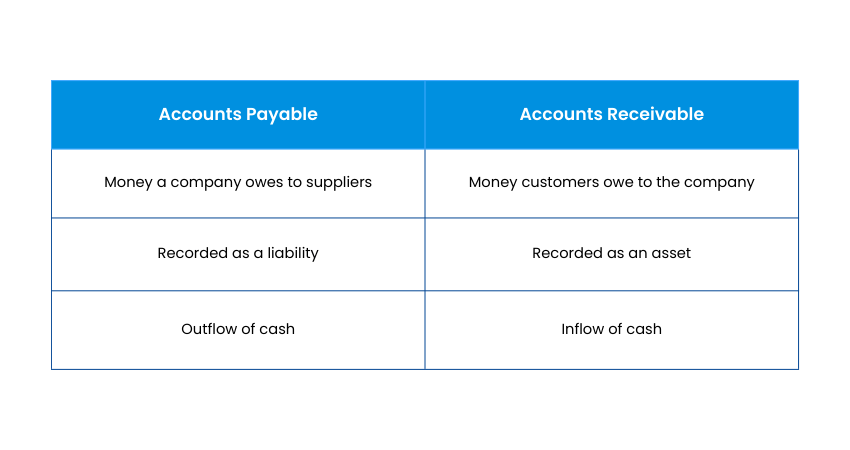

13) What is the difference between Accounts Payable and Accounts Receivable?

This checks your understanding of basic accounting distinctions.

Sample Answer:

Accounts Payable refers to money owed to suppliers for purchases made on credit, recorded as a liability. Accounts receivable refers to money owed to the company by customers for goods or services provided, recorded as an asset. Both represent opposite sides of financial transactions.

14) What process do you follow before authorising an invoice for payment?

This tests procedural compliance and attention to detail.

Sample Answer:

“I verify the invoice details against the purchase order and delivery note, ensure quantities and prices match, confirm approvals, and check vendor information. I also verify tax calculations and payment terms before entering it into the system for authorisation.”

Advance your finance career with CIMA’s CGMA® Advanced Management Accounting (P2) Course - Register today!

15) What accounting software are you familiar with, and how have you used it in past roles?

This assesses your technical competency with AP tools.

Sample Answer:

“I have worked with SAP, QuickBooks, and Oracle NetSuite. I’ve used them for invoice processing, vendor account management, payment scheduling, and AP reporting. This experience allows me to adapt quickly to new systems and maintain process efficiency.”

16) Data entry accuracy is crucial in this role - how do you maintain it?

This evaluates your attention to detail and process discipline.

Sample Answer:

“I double-check entries against source documents, use system validation features, and maintain organised records. I take short breaks to stay focused, review reports for inconsistencies, and follow standard data entry procedures to ensure accuracy.”

17) What motivates you to be part of our team?

This explores cultural fit and alignment with company values.

Sample Answer:

“I’m motivated by the chance to contribute to a team that values efficiency, accuracy, and vendor relationships. Your company’s commitment to innovation and growth aligns perfectly with my career goals, and I’m excited to bring my skills to enhance your AP processes.”

18) How do you explain debit and credit from both the bank's and the customer's perspectives?

This checks your understanding of double-entry accounting perspectives.

Sample Answer:

From a bank’s perspective, a customer’s deposit is a liability (credit) and a withdrawal is a debit. From a customer’s perspective, a deposit is a debit to their bank account (asset), and a withdrawal is a credit, representing money leaving their account.

19) Can you share an example of a dispute you’ve handled with a creditor or customer and how you resolved it?

This assesses your conflict resolution skills.

Sample Answer:

“In a previous role, a vendor disputed an underpayment due to a missed discount. I reviewed the PO and contract, confirmed the discount’s validity, and issued a corrected payment. Prompt communication and quick resolution preserved the vendor relationship.”

Transform into a finance leader - Join the CIMA’s CGMA® Management Level Case Study Course – Start today!

20) How do you typically manage late payments and aging accounts?

This tests your approach to vendor and payment management.

Sample Answer:

“I monitor aging reports regularly, prioritise urgent vendor payments, and negotiate extensions when needed. I coordinate with finance to improve cash flow, send reminders, and address recurring issues causing delays to reduce late payments.”

21) What would you do if the company faces cash flow challenges but has critical vendor payments due?

This assesses decision-making under financial pressure.

Sample Answer:

“I would prioritise vendors critical to operations, negotiate new terms with others, and explore short-term financing. I’d also maintain transparency with vendors to sustain trust and protect operational continuity.”

22) Describe your role in the month-end closing process from an Accounts Payable viewpoint.

This evaluates your contribution to financial reporting cycles.

Sample Answer:

“I ensure all invoices are processed and posted before cut-off, review accruals for unprocessed expenses, and reconcile vendor accounts. I also prepare AP reports to support accurate and timely month-end financial statements.”

23) What experience do you have with tax compliance in Accounts Payable, such as handling VAT or sales tax?

This tests regulatory compliance experience.

Sample Answer:

“I verify that VAT or sales tax is correctly applied, maintain proper documentation for audits, and reconcile tax accounts. I work with tax teams to ensure compliance with local laws and timely submissions.”

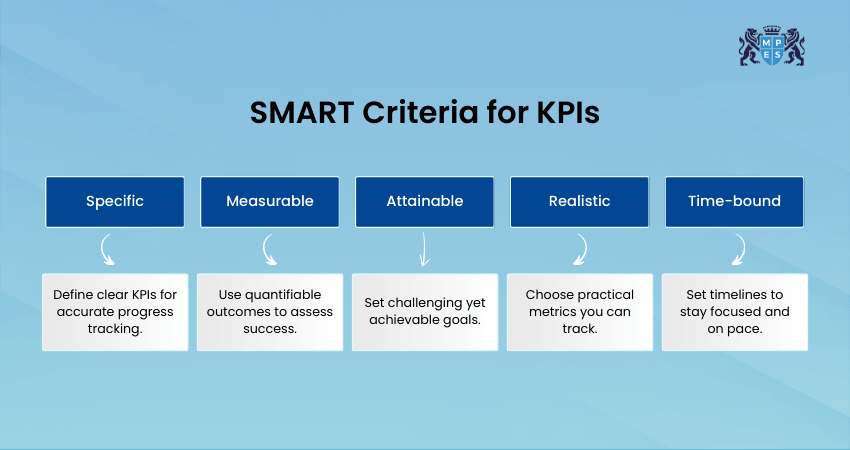

24) Which KPIs do you monitor to evaluate the performance of the Accounts Payable process?

This assesses your understanding of AP performance tracking.

Sample Answer:

“I track Key Performance Indicator (KPI) like invoice processing time, number of invoices processed per employee, early payment discounts captured, error rates, and aging of payables. Monitoring these helps identify inefficiencies and improve vendor relationships.”

Conclusion

Mastering Accounts Payable Interviews Questions is about blending technical expertise with problem-solving skills and professionalism. By preparing for these common questions, you can present yourself as accurate, efficient, and dependable. With confidence in your abilities and clarity in your answers, you’ll be ready to impress employers and secure your next AP role.

Develop advanced finance strategies through CIMA’s CGMA® Management Level Training – Sign up now!

Have Any Question?

Have Any Question?

+44 7452 122728

+44 7452 122728

Back

Back

44 7452 122728

44 7452 122728