Table Of Contents

Behind every suspicious financial trail, there’s a team of experts uncovering the truth. But who exactly are they? Welcome to the world of Forensic Accounting, where accounting meets investigation. This shows that accounting can be more than just about crunching numbers. It can help expose fraud and crimes and protect any business from financial disputes.

Understanding it can help you spot red flags, improve compliance, and build a fulfilling career in financial justice. This blog will show you the way. So read on to discover what Forensic Accounting is, why it matters, where it’s used, and its significance in today’s legal and economic world.

Table of Contents

1) What is Forensic Accounting?

2) Why is Forensic Accounting Important?

3) Types of Forensic Accounting

4) Audit Techniques in Forensic Accounting

5) Skills Required to Become a Forensic Accountant

6) Building a Career in Forensic Accounting

7) Key Areas Where Forensic Accountants Work

8) Examples of Forensic Accounting

9) Conclusion

What is Forensic Accounting?

Forensic Accounting refers to the use of accounting, auditing and investigative skills to examine financial records in cases of suspected fraud, embezzlement, or financial misconduct. The term “forensic” relates to matters that are suitable for use in court, which means that Forensic Accountants often provide expert testimony or evidence in legal proceedings.

They examine financial documents to uncover irregularities, trace transactions, and interpret financial data that may indicate criminal or unethical activity. While they don’t file lawsuits themselves, their findings are used in litigation, insurance claims, business valuations, and criminal investigations. Their role is to explain financial complexities in a clear and legally acceptable manner.

Why is Forensic Accounting Important?

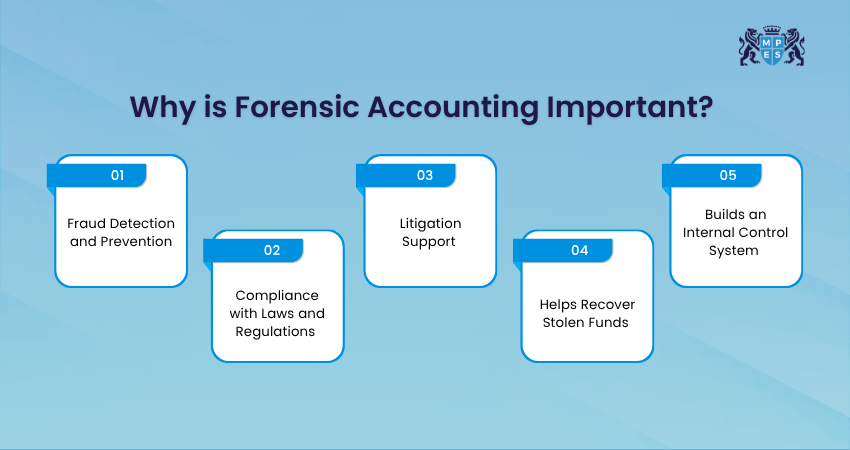

Forensic Accounting plays a significant role in today’s business and legal world. Here are the key reasons why it is needed:

1) Fraud Detection and Prevention

Forensic Accounting is used to identify signs of fraud or suspicious financial activity before they escalate. It helps businesses detect irregularities early and implement corrective actions to prevent serious financial damage.

2) Compliance with Laws and Regulations

Organisations must follow strict financial regulations. Forensic Accountants assist by reviewing records to uncover discrepancies or non-compliance, helping businesses avoid legal issues or regulatory penalties.

3) Litigation Support

In legal disputes involving finances, Forensic Accountants provide objective, evidence-based analysis. Their reports and expert testimony help courts and legal teams understand complex financial matters.

4) Helps Recover Stolen Funds

When financial misconduct occurs, forensic accountants trace the movement of funds across transactions and accounts. This investigation increases the likelihood of recovering misappropriated assets and identifying those responsible.

5) Builds an Internal Control System

Forensic Accounting not only investigates what went wrong but also analyses the weaknesses in systems that allowed it to happen. This helps businesses enhance their internal control frameworks to prevent future incidents.

Shape the future of business with our CIMA’s CGMA® Strategic Level Training - Sign up now and achieve global recognition!

Types of Forensic Accounting

There are different types of Forensic Accounting, depending on the situation. Here are some of its types for you to check:

1) Fraud examination

2) Dispute resolution

3) Tax evasion

4) Defaulting on debt

5) Bankruptcy and insolvency investigations

6) Matrimonial disputes

7) Securities fraud

8) Litigation support

9) Insurance claims

10) Business valuation disputes

Audit Techniques in Forensic Accounting

So far, you might have an idea of what Forensic Accounting is and where it is used. Now, it is time for you to explore how Forensic Accountants use several methods to find problems in financial records. Here is how they do it:

1) Investigative Procedures

The first step involves collecting all relevant evidence, including financial statements, bank transactions, internal communications, contracts, and other supporting documentation. Forensic Accountants then examine this information to identify inconsistencies, unusual patterns or transactions that may indicate misconduct.

2) Reporting Findings

Once the investigation is complete, a formal and comprehensive report is prepared. This report clearly presents the findings, supported by documentation and analysis. Depending on the case, the report may be shared with internal stakeholders, auditors, law enforcement, or legal teams.

3) Legal Proceedings and Litigation Support

If legal action is initiated, Forensic Accountants may act as expert witnesses, offering testimony and helping legal teams interpret complex financial data. They may also prepare visual presentations, charts, or timelines to communicate findings clearly and effectively in court. Interpret financial statements and boost compliance with our CIMA’s CGMA® Advanced Financial Reporting (F2) Course – Join now!

Skills Required to Become a Forensic Accountant

This specialised field focuses on uncovering financial misconduct. That's why a combination of technical expertise and workplace skills is essential. Here are the necessary skills:

1) Technical Skills

You’ll require solid knowledge in accounting, finance and IT. This will help you interpret financial statements, trace transactions and rebuild financial data. Key technical skills include:

1) Understanding accounting software

2) Analysing financial documents

3) Conducting interviews with witnesses or suspects

4) Reviewing legal documentation

5) Identifying trends through Data Analysis

6) Performing internal audits

2) Workplace Skills

Alongside technical knowledge, you must be prepared to manage data and communicate findings clearly. Valuable workplace skills include:

1) Critical thinking

2) Strong attention to detail

3) Clear communication

4) Analytical mindset

Building a Career in Forensic Accounting

A career in Forensic Accounting combines financial expertise with investigative work, making it ideal for individuals who enjoy problem-solving, data analysis and uncovering financial misconduct. As organisations place greater emphasis on fraud prevention, regulatory compliance and transparent financial reporting, the demand for skilled Forensic Accountants continues to rise across both public and private sectors. Below is a clear pathway to help you understand how to enter, grow and excel in this profession.

1) Required Qualifications

Most Forensic Accountants start with:

1) A degree in Accounting, Finance, Economics, or a related field

2) Strong knowledge of auditing, financial reporting and data analysis Professional Qualifications strengthen credibility and open doors to senior roles:

1) ACCA

2) CIMA

3) ACA (ICAEW)

Many Forensic Accountants begin with ACCA or CIMA and later specialise through short forensic training programmes or certifications.

2) Gain Essential Skills

Forensic Accountants require a blend of strong technical abilities along with essential workplace skills. These combined capabilities enable them to investigate complex financial issues effectively and present findings confidently to legal teams, management and, when needed, the courts.

3) Develop Specialisation

As you gain experience, you may specialise in areas such as:

1) Fraud examination

2) Litigation support

3) Insurance claim investigations

4) Anti-money laundering

5) Corporate investigations

6) Data forensic analysis

4) Career Pathway

Here’s a typical progression route:

Step 1: Gain Accounting Experience

Build a strong foundation in accounting and analytical skills through early career finance roles.

Step 2: Enter a Forensic or Investigative Role

Move into junior investigative positions to apply accounting knowledge in real-world cases.

Step 3: Develop Specialisation

Focus on specific forensic areas such as fraud, litigation or financial investigations.

Step 4: Progress to Senior or Advisory Positions

Advance into roles that involve leading investigations, advising teams and handling complex cases.

Step 5: Move Into Leadership or Consultancy

Reach high-level positions where you manage forensic teams, offer expert opinions or provide independent consultancy.

5) Typical Industries That Hire Forensic Accountants

1) Big 4 accounting firms

2) Law firms

3) Insurance companies

4) Banks and financial institutions

5) Government departments

6) Law enforcement agencies

7) Corporate compliance departments

8) Specialist forensic and fraud investigation consultancies

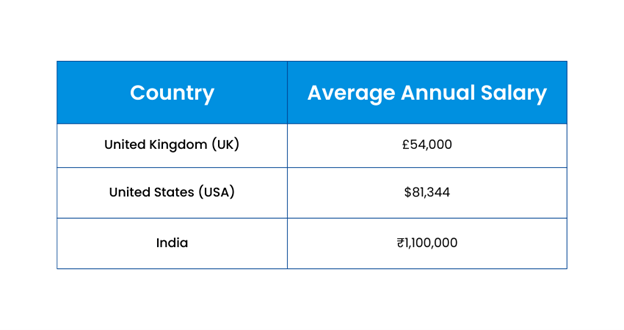

6) Salary Overview

Typical salary progression in the UK, USA and India:

Salaries vary depending on qualifications, experience and industry sector.

Key Areas Where Forensic Accountants Work

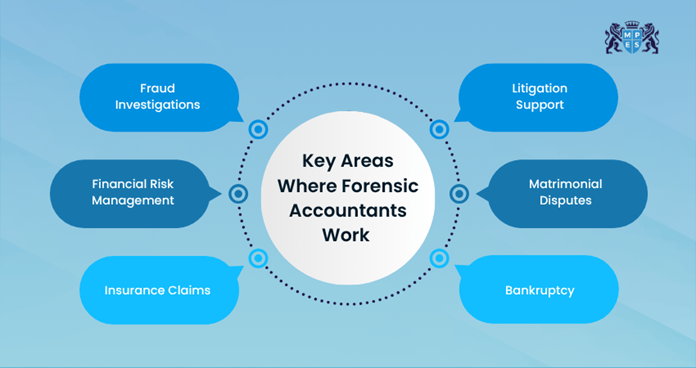

Forensic Accountants work in different sectors. Let’s check the key areas they work with:

1) Fraud Investigations: They usually check the claims of fraud, stolen money, corruption, bribes, and other financial crimes.

2) Financial Risk Management: Their job is not confined to investigating financial sections, but also suggesting preventive measures with compliance.

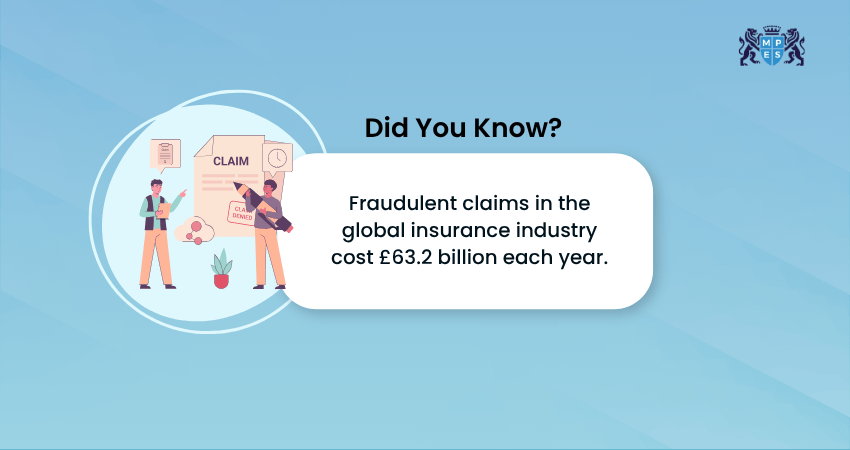

3) Insurance Claims: Forensic Accountants help insurers verify the accuracy and legitimacy of claims before approval by analysing supporting financial evidence.

4) Litigation Support: Forensic Accountants expand their work by assisting lawyers and legal teams to understand the history of any financial disputes.

5) Matrimonial Disputes: Here, they analyse the assets of how much money or property each person has during a divorce.

6) Bankruptcy: They investigate financial distress, identify potential misconduct and determine whether assets were concealed or mismanaged.

Moreover, Forensic Accountants provide exceptional contributions to businesses, organisations, consulting firms, insurance companies, public accounting firms, law enforcement agencies, and more.

Enhance your auditing practices and assurance engagements by signing up for our Advanced Audit and Assurance (AAA) Training soon!

Examples of Forensic Accounting

Forensic Accounting is applied across a wide range of financial and legal situations, including the following:

1) Valuations

1) Forensic Accountants determine the accurate value of a business for important financial decisions.

2) They assist clients in transferring shares to family members.

3) They support retirement planning and long-term succession strategies.

4) They provide detailed, evidence-based analysis of a company’s financial health.

2) Divorce Proceedings

1) Forensic Accountants assess the true value of assets when one or both partners own a business.

2) They prepare expert valuation reports requested by the court.

3) They identify hidden assets or undisclosed financial activity.

4) They review financial behaviour to support the fair division of property.

5) They provide neutral, evidence-based findings for balanced settlement decisions.

3) Shareholder Disputes

1) Forensic Accountants analyse financial records to resolve disagreements between shareholders.

2) They determine the amounts owed during business sales or changes in ownership.

3) They address disputes over payments, profit distribution or contract terms.

4) They provide an objective financial assessment to clarify issues.

5) They support negotiations or legal proceedings with clear, evidence-based findings.

Conclusion

Have you ever heard of this “Honesty is the best policy” proverb? In the financial sector, when honesty is mistreated or taken for granted, Forensic Accounting takes charge and ensures that the principle of honesty has a strong foundation. Their work reminds us that while numbers can be manipulated, the truth can be unveiled. Implement this practice to promote accountability, fairness, and financial integrity!

Learn the essential knowledge and skills to record, report, and interpret financial information with our Accounting (AC) Course– Register immediately!

Have Any Question?

Have Any Question?

+44 7452 122728

+44 7452 122728

Back

Back

44 7452 122728

44 7452 122728