Table Of Contents

Imagine you're the owner of a small café and take £300 from the register for personal use. This not only impacts your cash flow but also reduces your equity. So, how do you keep personal withdrawals in check? That’s where Drawings in Accounting come in helping you separate business and personal finances effectively.

In this blog, we’ll explain what Drawings in Accounting are, why a Drawing Account is important, how they work, their impact on financial statements, and the proper way to record them.

Table of Contents

What are Drawings in Accounting?

Why is a Drawing Account important?

How do Drawings in Accounting Work?

Characteristics of Drawings Accounts

How do Drawings Affect Financial Statements?

How to Record Drawings in Accounting?

Who Uses a Drawing Account?

Examples of How to Use a Drawing Account

Conclusion

What are Drawings in Accounting?

A Drawings Account is used in accounting to track money or assets that the owner withdraws from the business for personal use. This is typically seen in sole proprietorships and partnerships, where the owner and business are not separate legal entities. In contrast, corporations or companies taxed separately treat owner withdrawals as salaries or dividends, not drawings. This distinction is important for accurate financial reporting.

Drawings aren't limited to just cash. They can also include goods or services, like taking office supplies home or using the company car for personal errands. Recording these transactions ensures a clear separation between business expenses and personal use.

Why is a Drawing Account important?

A Drawing Account is crucial because it helps track and separate personal withdrawals from business transactions, ensuring accurate financial records. It maintains transparency and prevents confusion between business expenses and the owner's personal use of resources.

Ensures accurate accounting by clearly recording the owner's personal use of business funds or assets

Prevents the overstatement of business expenses, which could distort financial statements

Helps determine true business profitability by excluding personal withdrawals

Supports tax compliance by properly documenting non-deductible personal transactions

How do Drawings in Accounting Work?

1. Recorded in the Drawing Account:

A Drawing Account records the owner's personal withdrawals from the business, reducing equity without affecting expenses.

2. Debit the Drawing Account:

When the owner withdraws money or assets, the Drawing Account is debited.

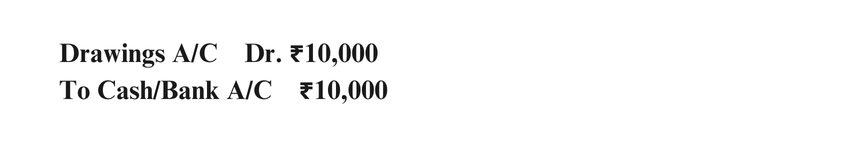

Example: If the owner withdraws ₹10,000, the journal entry is:

3. Impact on Capital:

At the end of the accounting period, the Drawing Account is closed by transferring its balance to the Capital Account, reducing the owner’s equity.

4. No Effect on Profit and Loss:

Drawings do not affect the business’s net profit since they are not business expenses.

Enhance your skills in management and accounting with our Management Accounting (FMA) Course. Register now!

Characteristics of Drawings Accounts

Drawing Accounts track personal withdrawals by the owner and are temporary and affect equity, not expenses. Here are their key characteristics:

1. Tracks Capital Withdrawn for Personal Use

The Drawing Account helps keep track of the money taken out of the business for personal use. It ensures accurate records and helps monitor reductions in the owner’s capital.

2. Temporary Account, Not Ongoing or Permanent

A Drawing Account is not a permanent account. At the end of the financial year, its balance is closed and transferred to the owner’s capital or equity account. It is used only for the current accounting period and resets annually.

3. Classified as Neither an Expense Account

The Drawing Account reduces the company’s value for personal use but is not an expense. It doesn't appear as a business cost because the company didn't actually spend the money. If it were an expense, it would show in the profit and loss statement.

How do Drawings Affect Financial Statements?

When the owner withdraws money or assets from the business, it’s recorded as a drawing. This action reduces the business’s assets and the owner’s equity.

Drawings do not impact profit, but they lower total equity.

They are recorded in the Drawings Account and adjusted in the capital account.

They do not usually appear directly on the cash flow statement but are reflected in changes to equity.

Proper documentation is important to maintain transparency and ensure accurate financial reporting.

How to Record Drawings in Accounting?

A Drawing Account tracks the money or things the owner takes from the business. When the owner takes something, the business records it as a debit from the Drawing Account and a credit to the cash account. At the end of the year, the Drawing Account needs to be balanced. Here’s how it works:

A debit is made to the Drawing Account and a credit to the cash account.

To close the Drawing Account, the debit goes to the owner’s capital account, and the credit goes to the Drawing Account.

Withdrawals are shown as a debit on the balance sheet. Cash withdrawals are easy to track.

If goods or services are taken, they are recorded at their cost.

Drawing Accounts are temporary and must be balanced by the end of the year, usually by the owner paying back or adjusting their salary.

The balance sheet shows the company’s money, what it owes, and the owner’s share in the business.

Get ahead in accounting with our Financial Accounting (FFA) Course. Register now!

Who Uses a Drawing Account?

Drawing Accounts are commonly used by sole proprietors and partners to record personal withdrawals from the business. They help separate business and personal finances, ensuring clarity in financial reporting.

Ideal for small businesses with individual or a few owners.

Not used by large corporations, which issue dividends or salaries instead.

Allows owners to track their withdrawals during the year for better capital management.

Essential for businesses where the owner is actively involved in daily operations.

Examples of How to Use a Drawing Account

Here are some examples of how business owners might use a Drawing Account:

Example 1

Scenario:

The business owner withdraws ₹15,000 from the business bank account for personal use.

Explanation:

This is a non-business transaction. Since the money is used for personal purposes, it should not be recorded as a business expense. Instead, it is recorded in the Drawing Account, which tracks the owner's personal use of business funds.

Journal Entry:

Drawings A/C is debited because the owner is taking value from the business.

Bank A/C is credited because cash is going out of business.

Example 2

Scenario:

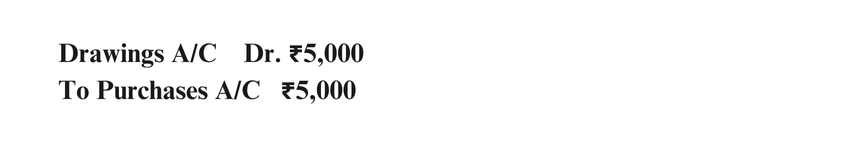

The owner takes inventory worth ₹5,000 for personal use at home.

Explanation:

This is also a personal withdrawal. The inventory (goods) is not sold or used for business operations, so it must be recorded as a drawing, not a sale or expense.

Journal Entry:

Drawings A/C is debited to reflect the owner's personal use.

Purchases A/C is credited to reduce the inventory or cost of goods available for sale.

Conclusion

Drawings in Accounting play a crucial role in tracking personal withdrawals by business owners. Properly managing these withdrawals ensures that the business’s financial records stay balanced and accurate. Whether it’s for small expenses or regular allowances, understanding how to account for drawings helps maintain clear and reliable financial statements.

Boost your career prospects with our ACCA Foundations Courses. Register today!

Have Any Question?

Have Any Question?

+44 7452 122728

+44 7452 122728

Back

Back

44 7452 122728

44 7452 122728