Table Of Contents

Bookkeepers and Accountants are like Batman and Robin in the financial world; one keeps everything in order, and the other strategises the next big move. But their core responsibilities and career trajectories are worlds apart. If you’ve ever confused the two or wondered which career path to follow, you’re in the right place.

In this blog, we’ll unravel the mystery between the two, break down their roles, and help you figure out which one might just be your calling. Let's decode the real Difference Between Bookkeeping and Accounting, one transaction at a time.

What is a Bookkeeper?

A Bookkeeper is a detail-oriented professional who records daily financial transactions, including sales, purchases, receipts, and payments. They keep the financial heartbeat of a business running smoothly by maintaining ledgers and reconciling bank statements. This ensures every penny is accounted for. In simple terms, Bookkeepers keep the books balanced.

Why Choose Bookkeeping?

Bookkeeping is often a great stepping stone into broader finance roles. Here are some of the areas that need attention before choosing Bookkeeping:

1) You love structure and routine

2) You have an eye for detail

3) You’re great with numbers and spreadsheets

4) You want a quicker entry into the finance field

5) You enjoy hands-on, transactional work

What is an Accountant?

An accountant builds upon the foundation that Bookkeepers lay. They analyse financial data, create reports, and help guide strategic decisions. Accountants interpret the financial story of a business and offer insights that drive growth, compliance, and profitability. In short, accountants turn numbers into knowledge.

Why Choose Accountancy?

Accounting offers more analytical and strategic depth than Bookkeeping. Here are some of the areas that need attention before choosing an Accountant:

1) You want to advise businesses and individuals

2) You love interpreting trends and solving financial puzzles

3) You're interested in taxation, auditing, or management Accounting

4) You seek a higher-level career with upward mobility

5) You enjoy working with regulations and legal compliance

Key Differences Between Bookkeeping and Accounting

Though these two complement each other, here’s the Difference Between Bookkeeping and Accounting in some key areas:

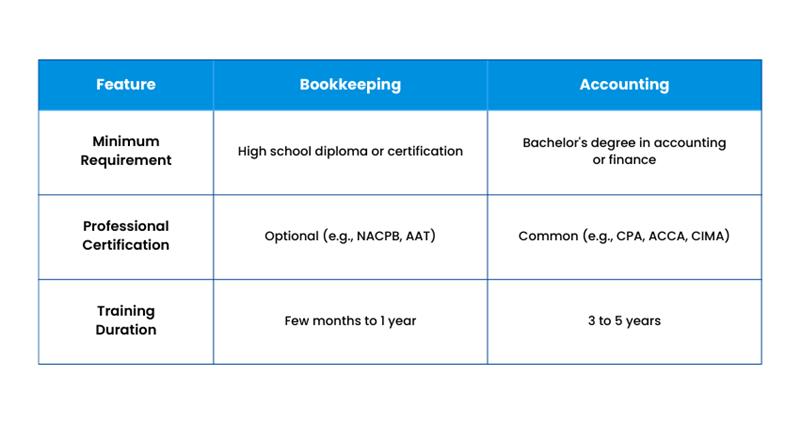

Education Requirements

Bookkeepers can begin their careers with a high school diploma and some practical training or certification. On the other hand, Accountants need a formal degree in Accounting or finance, along with professional certifications like CPA or ACCA.

The education path for Accountants is longer and more academically rigorous, preparing them for analytical and advisory roles. Here comes a table below:

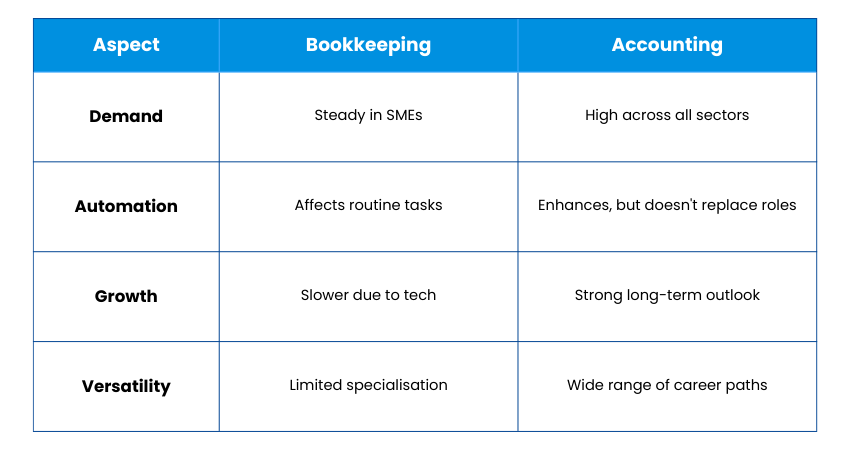

Job Outlook

Bookkeeping remains valuable in small and medium-sized businesses, but automation is reducing the need for traditional roles. In contrast, Accounting continues to grow across industries, with professionals in high demand for financial planning, auditing, and compliance.

Accountants benefit from broader career flexibility and stronger job security. Here is a table below:

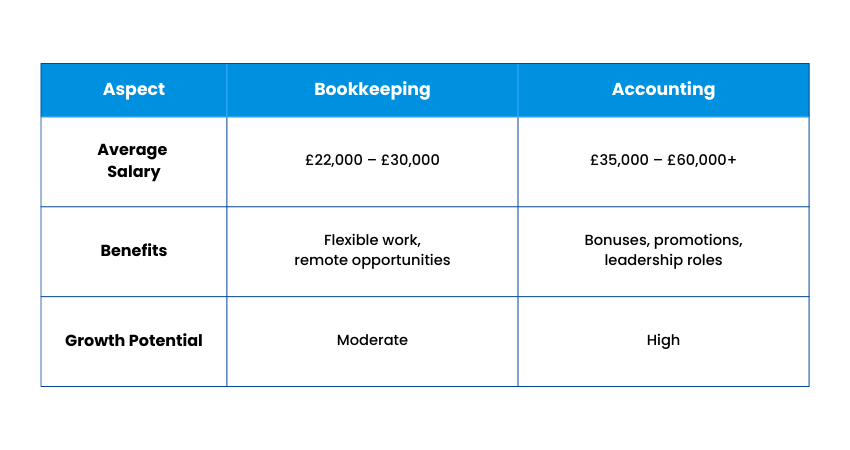

Salary and Benefits

Accountants usually earn significantly more than Bookkeepers, reflecting their broader scope and responsibilities. While Bookkeepers enjoy benefits like flexible hours and remote work options, accountants often access performance bonuses, promotions, and leadership roles.

The earning potential and career progression are generally higher in Accounting. Here is a table below:

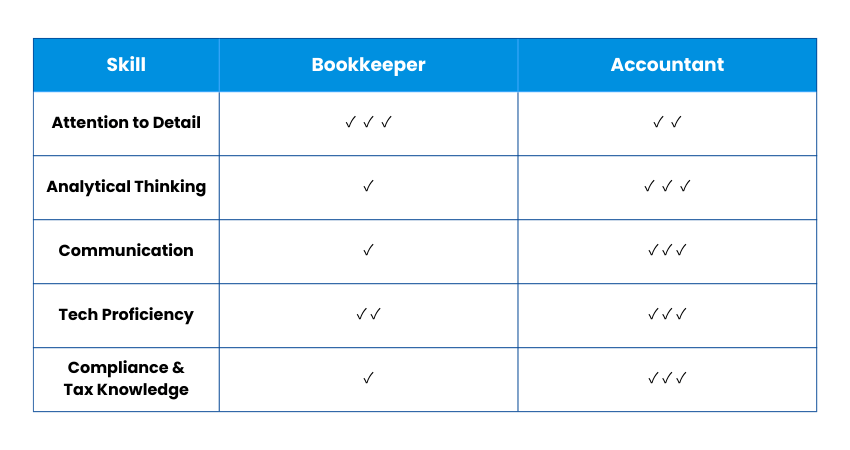

Essential Skills

Both roles demand strong attention to detail and tech proficiency, but accountants also require advanced analytical thinking and a deep understanding of tax laws and compliance.

Communication is also more central to an accountant’s role, as they often advise management and clients based on financial insights.

The Bookkeeping Tasks and Responsibilities

Bookkeeping helps businesses stay organised by keeping clear and accurate financial records. It makes sure money coming in and going out is tracked properly and that the business follows appropriate rules. This gives Accountants the information they need to make good decisions.

Key Responsibilities:

1) Recording daily sales, purchases, payments, and receipts in accounting software.

2) Creating and sending invoices, checking for payments, and following up on late ones.

3) Managing payroll, calculating wages, and making sure all rules are followed.

4) Matching bank statements with company records each month.

5) Keeping the general ledger updated with all financial activity.

6) Preparing simple reports like balance sheets and income statements.

7) Watching cash flow to make sure the business has enough money available.

8) Helping create budgets and comparing planned spending with actual spending.

Think numbers, think success – Register for the Management Information (MI) Course today!

The Accounting Tasks and Responsibilities

Accounting helps businesses understand their overall financial health, meet legal requirements and make informed decisions. Accountants turn financial records into meaningful insights, manage taxes and guide long-term planning.

Key Responsibilities:

1) Preparing profit and loss accounts, balance sheets, and cash flow statements.

2) Checking financial records through audits to ensure accuracy and compliance.

3) Managing tax duties, including Corporation Tax, VAT and PAYE, in line with HMRC rules.

4) Giving financial advice on budgets, investments, and business growth.

5) Reviewing financial data to spot trends and support business planning.

6) Setting up efficient Accounting systems and software.

7) Reconciling bank accounts to keep records accurate.

8) Advising on major business transactions like mergers and acquisitions.

Skills for Bookkeepers and Accountants

Bookkeeping and Accounting serve different purposes, but they share a common foundation of essential skills that make professionals in both fields successful. Let’s dive into their core competencies:

1) Mathematical Ability

You must have a strong grasp of basic Math and a natural comfort with numbers. Whether it's calculating invoices or balancing financial reports, precision with numbers is at the heart of both roles.

2) Digital and Computer Literacy

Modern Bookkeeping vs Accounting relies heavily on digital tools. Professionals must be comfortable using Accounting software like QuickBooks, Xero, or Sage, along with spreadsheets and cloud-based systems. Good computer skills help streamline tasks, reduce errors, and improve efficiency.

3) Strategic Thinking

While Bookkeepers focus more on day-to-day records, both roles benefit from strategic thinking. This helps them interpret financial trends, support budgeting, forecast future performance, and guide business planning. Accountants especially use this skill to provide financial advice and long-term insights.

4) Selling Your Services

For freelancers or those working in client-based environments, the ability to promote and sell services is essential. This includes explaining your value, communicating clearly, building trust, and maintaining strong relationships. Effective self-marketing helps attract clients and grow a sustainable Bookkeeping vs Accounting practice.

Apply tax laws in various business scenarios through the Principles of Taxation (PTX) Training – Sign up soon!

5) Written Communication

Writing clear financial summaries, email updates, and internal memos is crucial. Your ability to present financial data in an easy way ensures clarity for clients, colleagues, and stakeholders.

6) Verbal Communication

Whether it’s explaining a financial discrepancy or offering strategic insights, strong speaking skills help communicate complex financial information to non-finance professionals.

7) Organisational Skills

From managing multiple accounts to staying on top of monthly closing tasks, both roles demand exceptional organisation. Keeping financial records orderly and accessible is essential.

8) Problem-solving Skills

Discrepancies in financial records are common. Knowing the Difference Between Bookkeeping and Accounting will make both of them investigate, analyse, and resolve the issues swiftly.

9) Business Knowledge

Understanding the industry and operations of the business you're working with helps you interpret financial data more effectively. It also allows you to spot trends, forecast issues, and offer valuable insights.

10) Time Management

With deadlines for payroll, tax filings, and monthly reports constantly looming, managing time effectively is critical. Being able to prioritise tasks and handle time-sensitive responsibilities is a must.

11) Attention to Detail

One small error in data entry or a misplaced decimal can throw an entire financial statement off track. Accuracy is everything when working with large volumes of financial data daily.

How to Transition from Bookkeeper to Accountant?

Transitioning from Bookkeeper to Accountant is possible with these steps:

1) Get Certified: Pursue ACCA or a bachelor's degree

2) Gain Experience: Seek out higher responsibilities in your current role

3) Master Accounting Software: Advance from Bookkeeping to full-suite Accounting tools

4) Learn Tax & Compliance: These are core areas for Accountants

5) Network with Professionals: Get mentorship and guidance

Conclusion

Bookkeeping and Accounting may work closely together, but they serve distinct purposes in keeping a business financially healthy. Therefore, understanding the Difference Between Bookkeeping and Accounting creates a strong financial foundation that helps businesses stay organised, make informed choices, and grow with confidence. It even helps you decide which support your business needs at each stage of its journey.

Become the brains behind the balance sheet – Learn knowledge from the Business, Technology & Finance (BTF) Course now!

Have Any Question?

Have Any Question?

+44 7452 122728

+44 7452 122728

Back

Back

44 7452 122728

44 7452 122728