Table Of Contents

Imagine your business as an aircraft soaring through dynamic skies. You wouldn’t fly blind but do rely on a dashboard packed with vital instruments for tracking altitude, speed, direction, and fuel. That’s exactly what Management Accounting does for a company.

From fuel efficiency (cost control) to route changes (planning), every dial matters. In this blog, we’ll explore 22 powerful Functions of Management Accounting that help companies navigate through uncertainty, seize opportunities, and avoid turbulence. Read on!

Table of Contents

What is Management Accounting?

Functions of Management Accounting

Profit Planning

Product Costing

Budgeting

Risk Management

Planning

Communication

Controlling

Organising

Decision Making

Break-even Analysis

Conclusion

What is Management Accounting?

Management Accounting is the process of using financial information to help a business run better. It focuses on giving useful data to managers, so they can make smart decisions about daily operations for a better future. Unlike financial accounting, which is made for outside people like investors or tax departments, this is only for people inside the business, like the owner, managers, or team leaders.

Some Common Tasks in Management Accounting are:

Creating budgets to plan spending

Tracking costs to control waste

Forecasting sales or expenses to prepare for the future

Comparing actual performance with goals to see what’s working

Helping managers set prices or choose between business options

Let's Understand with the Help of an Example:

Let's assume a person works as a Management Accountant at a growing e-commerce startup. His/her job is helping the company grow smartly. One day, the founders want to know whether they should launch a new product line and ask them for advice.

The person dives into the data:

He/She checks production costs

Compares past sales trends

Forecasts demand

And evaluates possible profits

Based on their report, the team decides not to go ahead with the new product just yet. Why? Because the data shows it may not be profitable right now.

Functions of Management Accounting

Management Accounting helps businesses make smart decisions and stay on track. Here are the main functions it performs:

1. Profit Planning

Profit planning focuses on setting financial targets and mapping out strategies to achieve them. Management accountants use past data, forecasts, and market trends to guide decisions and resource allocation. It ensures alignment with profit goals and supports long-term sustainability.

Helps forecast profit margins and financial growth

Aids in aligning operations with financial goals

Encourages proactive rather than reactive Financial Management

2. Product Costing

Product cost determines the total cost of producing goods or delivering services. It includes direct costs (like materials and labour) and indirect costs (like rent and utilities), offering a clear view of product profitability.

Assists in setting competitive prices

Identifies cost reduction opportunities

Enhances decision-making on product lines

3. Budgeting

Budgeting involves preparing a financial roadmap for a defined period. It helps organisations allocate resources efficiently and maintain control over their financial activities.

Sets spending limits for departments

Tracks progress toward financial targets

Detects budget overruns early

4. Risk Management

Management Accounting plays a critical role in identifying and assessing financial risks that could impact the organisation. Accountants help develop strategies to avoid, transfer, or mitigate these risks to safeguard the business.

Assesses market, credit, operational, and compliance risks

Implements controls to minimise financial exposure

Ensures business continuity during disruptions

5. Planning

Planning is about deciding how to achieve organisational goals using available resources. It encompasses both long-term strategic planning and short-term operational planning. Management accountants support this by providing reliable financial data and forecasts.

Helps businesses stay focused on key objectives

Improves coordination between departments

Enhances adaptability to changes in market conditions

Why just dream of success? Build it with our Recording Financial Transactions (FA1) Training now!

6. Communication

Clear communication of financial data is essential for informed decision-making. Management accountants translate complex data into reports and dashboards that are easily understood by non-financial managers.

Promotes transparency across the organisation

Facilitates collaboration between departments

Ensures everyone works towards shared financial goals

7. Controlling

Controlling involves comparing actual performance with the planned budget and taking corrective action when necessary. This ensures the organisation stays aligned with its financial goals.

Highlights variances and inefficiencies

Enables timely adjustments in strategy

Maintains cost-effectiveness

8. Organising

This function focuses on designing and maintaining an efficient financial system within the business. It involves defining roles, setting procedures, and streamlining operations to enhance productivity.

Establishes a clear financial structure

Aligns tasks with employee strengths

Improves workflow and reporting accuracy

Build your finance career from the ground up – Sign up for the Foundations in Financial Management (FFM) Course now!

9. Decision Making

Management accountants provide essential data that supports business decision-making. Whether it's launching a new product, entering a new market, or outsourcing services, these decisions require solid financial analysis.

Minimises guesswork and assumptions

Supports data-driven decision-making

Reduces risk of poor financial outcomes

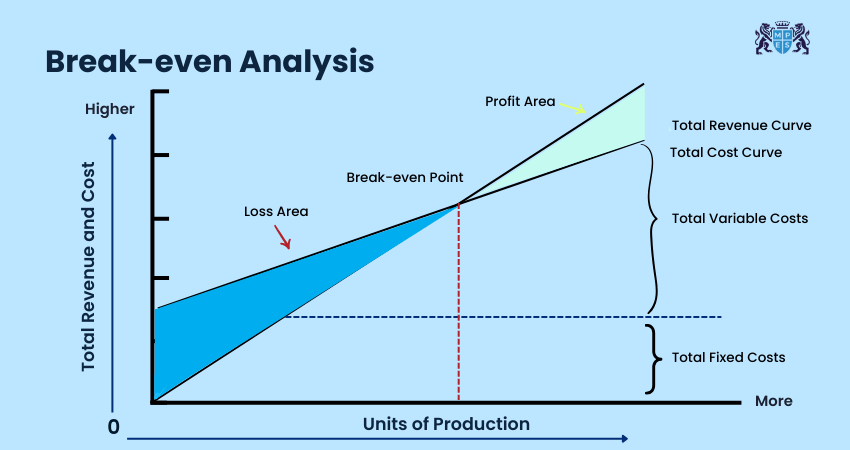

10. Break-even Analysis

This analysis helps determine the point at which a company’s total revenue equals its total costs. It’s essential for understanding when a business will start making a profit.

Identifies the minimum sales required to avoid losses

Assists in pricing and cost control strategies

Evaluates profitability for new ventures

11. Cost Analysis

Cost analysis examines all expenses in detail to identify areas where savings can be made without affecting performance. It helps maintain a lean, cost-efficient operation.

Reduces unnecessary spending

Highlights waste and inefficiencies

Supports better resource allocation

The fast track to financial fluency starts here – Start learning with our Managing Costs and Finance (MA2) Course now!

12. Performance Variances

This involves analysing differences between actual and budgeted performance. It helps identify the reasons for underperformance or overachievement.

Pinpoints operational strengths and weaknesses

Encourages accountability at all levels

Enables informed corrective measures

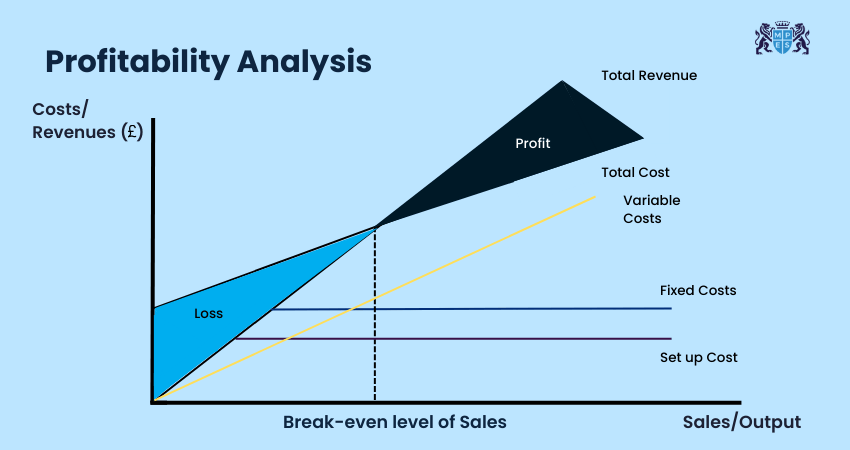

13. Profitability Analysis

Profitability analysis measures how much profit each product, department, or region generates. It enables management to focus on the most profitable parts of the business.

Supports portfolio optimisation

Helps in discontinuing underperforming products

Aids in investment and expansion decisions

14. Analyses and Interprets Data

Data Analysis is about making sense of financial data to support management decisions. Accountants use charts, KPIs, and dashboards to turn numbers into stories.

Transforms data into meaningful insights

Identifies market trends and business patterns

Supports continuous improvement

15. Tax policies

Management accountants help ensure that the business complies with tax regulations and makes use of all legal tax-saving opportunities.

Ensures compliance with tax laws

Minimises tax liability legally

Supports efficient tax planning

16. Forecasting and Planning

Forecasting uses past and current data to predict future performance. It plays a vital role in planning for resource needs, market changes, and financial stability.

Helps prepare for seasonal trends and demand shifts

Improves supply chain and resource planning

Reduces uncertainty in decision-making

17. Coordinating

Coordination ensures all departments work together harmoniously toward common financial objectives. Management accountants help align departmental goals with overall business strategy.

Encourages collaboration and information sharing

Prevents operational silos

Improves workflow and efficiency

18. Business Asset Protection

Management Accounting systems help protect company assets from theft, misuse, or loss through internal controls and regular audits.

Implements tracking and monitoring systems

Prevents fraud and errors

Ensures accurate asset valuation

Bridge the gap between business and tech – Register for our Business and Technology (FBT) Course now!

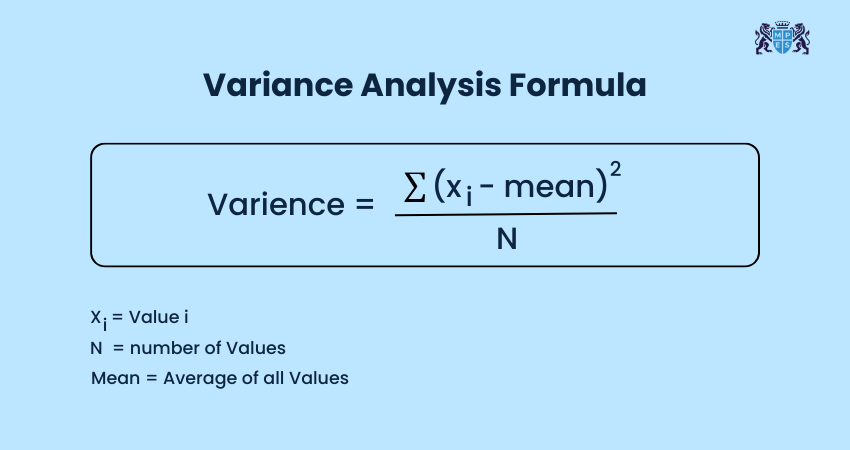

19. Variance Analysis

Variance analysis compares planned figures to actual outcomes. It highlights areas of concern and supports better financial control.

Identifies causes of budget deviations

Improves future budgeting accuracy

Helps evaluate employee and project performance

20. Strategic Planning

Strategic planning involves setting long-term goals and determining how to achieve them. Management accountants support this by aligning financial plans with business vision.

Provides financial projections for strategy development

Ensures strategic goals are financially feasible

Monitors progress against long-term objectives

21. Financial Statement Analysis

Analysing income statements, balance sheets, and cash flow statements helps assess a company's overall financial health and performance.

Identifies trends in revenue, costs, and profits

Assesses liquidity, solvency, and efficiency

Helps attract investors and lenders

22. Cash Flow Management

Proper management of cash flow ensures the business can meet its short-term obligations and invest in growth opportunities.

Tracks and forecasts cash movements

Prevents cash shortages and overdrafts

Supports sustainable business operations

Conclusion

Management Accounting helps businesses make smarter decisions, manage money better, and plan. From budgeting to Risk Management, each of the Functions of Management Accounting plays a key role in keeping things running smoothly. With the right insights and tools, you can take control, cut through the chaos, and drive your business toward lasting success in a fast-moving world.

Future-proof your career with ACCA Foundation Courses – Sign up and join the leaders!

Have Any Question?

Have Any Question?

+44 7452 122728

+44 7452 122728

Back

Back

44 7452 122728

44 7452 122728