Table Of Contents

One tradition in business remains unchanged when it comes to money; estimated costs often replace exact figures on expense lists. Traditional costing methods can miss important details, especially in businesses offering multiple products or services. That’s where Activity-Based Costing (ABC) comes in. It provides a more accurate understanding of your costs, helping you manage them more effectively. Read on to discover what ABC is, how it works, and the benefits it brings.

Table of Contents

What is Activity-Based Costing (ABC)?

A Step-by-step Guide to the Activity-Based Costing Process

Benefits of Activity-Based Costing

Limitations of Activity-Based Costing

Example of Activity-Based Costing

Conclusion

What is Activity-Based Costing (ABC)?

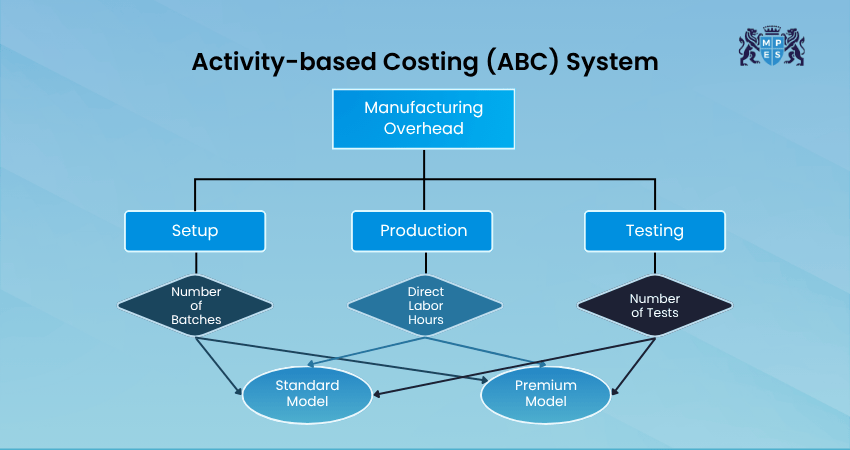

Activity-Based Costing (ABC) is a method used to understand the true cost of products or services in a business. Instead of simply dividing costs evenly, it looks at all the individual tasks or activities involved in production or service delivery.

Once these activities are identified, ABC assigns costs based on how much each product or service uses them. This provides a more accurate picture of expenses and helps in smarter decisions around pricing, budgeting, and efficiency.

For example, if you make both chairs and tables, ABC helps you see how much time, effort, and resources go into each one. It is more accurate than simply dividing all the costs evenly.

A Step-by-step Guide to the Activity-Based Costing Process

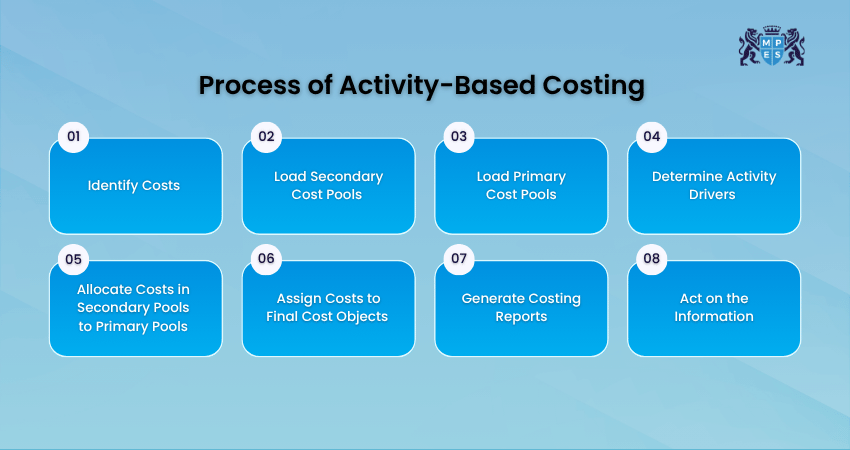

Activity-Based Costing follows certain steps to achieve accurate pricing for the tasks. Here are the steps involved in the process:

Step 1. Identify Costs

You can start by listing all the costs of your business. These could be direct costs, which are easy to track (like materials), or indirect costs, which are harder to track (like electricity or office rent). This helps you know what you work with. ABC focuses mostly on indirect costs, which are often spread out unfairly in traditional costing.

Step 2. Load Secondary Cost Pools

Some costs support the whole business but don’t directly make products. For instance, IT support teams, HR departments, accounting or office cleaning work. These are added into secondary cost pools to be shared out later. While doing so, these are grouped together so that they can be shared fairly.

Step 3. Load Primary Cost Pools

When you have sorted out the secondary cost pools, now look at the main business activities that actually create your products or services. It includes things like setting up machines, packaging, quality checking, assembling, taking customer orders, and more. Each of these gets its own cost pool.

Step 4: Determine Activity Drivers

Next, you need to figure out what causes each activity to cost money. Activity drivers cause the cost of an activity to go up or down. For example, things like more deliveries, the number of machine setups, or hours spent on design might increase packaging costs. These drivers help track how much each activity is used.

Learn to focus on strategic decision-making and organisational financial health with our Financial Management (FM) Course – Register now!

Step 5. Allocate Costs in Secondary Pools to Primary Pools

The next step in ABC costing is distributing and merging the cost of the pools together. Now, take the supporting costs (from Step 2) and spread them across the main activities. For example, if the IT support team helps both packaging and order processing, its cost is split between those two.

Step 6: Assign Costs to Final Cost Objects

After this, take the costs from each activity and assign them to the actual products or services based on how much they use each activity. This shows the real cost of making each product or offering each service. Knowing these exact costs helps you price your products more accurately and manage profits better.

Step 7: Generate Costing Reports

Use the data you have gathered to make reports. These show you exactly where your money is going and help you understand which products are most costly or most profitable. This might include cost per product or service, cost per customer, profit margins, and more. These reports help Managers make better decisions.

Step 8. Act on the Information

Now that you know how much everything really costs, use that information to make better decisions. Those might involve things like changing prices, cutting waste or altering how things are done. ABC costing is not just about numbers; it is about making smarter choices for your business.

Benefits of Activity-Based Costing

So far, you have been introduced to what ABC costing is and its process. It is time for you to know its benefits. Here are some of its benefits:

1. Adapts to Change

Can be updated quickly when new products or services are added

Adapts well to changes in production methods or business processes

Helps track costs in new departments or product lines

Supports flexible decision-making in dynamic markets

Keeps cost data relevant as processes evolve

2. Improved Workflow

Identifies high-cost activities that need improvement

Reduces waste by highlighting unnecessary tasks

Encourages process improvements across departments

Enhances team coordination by showing activity impact

Makes it easier to streamline operations

3. Future Planning

Provides detailed insights into cost behaviour

Helps create more accurate budgets and forecasts

Assists in evaluating new product or service ideas

Aids in resource planning and capacity management

Supports strategic planning and resource allocation

4. Boosting Long-term Efficiency

Helps eliminate unprofitable products or services

Encourages smarter use of resources over time

Drives continuous improvement in operations

Builds a data-driven culture for long-term success

Strengthens profit margins by improving cost control

Become an expert in financial accounting and reporting by signing up for our Financial Accounting and Reporting (FARI) Course immediately!

Limitations of Activity-Based Costing

While Activity-Based Costing offers many advantages, it also comes with certain challenges. These limitations can affect the accuracy, ease of use, and overall effectiveness of your business. Let's check what are the limitations that come with ABC:

1. High Dependence on Data Accuracy

ABC relies on accurate and updated data.

Errors in data or missing activities can distort cost results

Even small data mistakes can lead to large costing errors

Choosing incorrect cost drivers causes confusion and inaccuracy

Regular data updates are essential to maintain accuracy

2. Limited Insight from One-time Data

ABC based on one-time data does not reflect ongoing business changes

It may miss seasonal trends, sudden shifts, or process changes

Decisions made on outdated data can lead to incorrect pricing

Without regular updates, ABC loses relevance and accuracy

Continuous data collection is needed for long-term effectiveness

3. Complex Data Collection Requirements

Needs inputs from various departments: finance, operations, HR, etc.

Lack of collaboration can slow or disrupt costing

Data from different systems may be hard to combine

May require new tools or integrations to gather complete data

Cross-functional teamwork is critical

4. Inability to Capture Idle Time

ABC mainly tracks active tasks and may miss idle periods

Downtime (e.g., machines waiting or employees idle) is often excluded

Ignoring idle time can hide inefficiencies and inflate productivity data

Total operational costs may be underestimated as a result

Requires separate tracking systems to capture and allocate idle costs

5. Greater Information and System Demands

ABC needs more detailed information than traditional costing methods

Collecting this data takes time, tools, and trained staff

Adds to the workload of finance or operations teams

Might require software upgrades or system changes

Employees may need training to manage the process

6. Complexity in Implementation and Use

ABC can be too complex for smaller businesses

It often requires training, special software, or external expertise

Understanding and maintaining the system may take time

High complexity can slow processes and increase workload

For some companies, the effort may outweigh the benefits

Example of Activity-Based Costing

Let’s look at an example to clearly understand how Activity-Based Costing works. Let's say a business makes two products: wooden chairs and wooden tables. Using traditional costing, they might split the overhead costs 50/50. But in reality, chairs take more work and time because of extra shaping and painting.

Due to such conditions, with ABC, you can check things like:

Observing all activities: cutting, assembling, sanding, painting, checking quality

Calculate how much each activity costs

Work out how often each product uses those activities

Assign the costs fairly based on usage

With this screening, they found that chairs actually use 60% of the activities and tables only 40%. This helps the business see that chairs cost more to make, so they may need to be priced higher, or the production process improved.

Conclusion

Activity-Based Costing helps businesses understand the true cost of making products or providing services. Yes, it takes more time and effort than traditional costing, but the insights it provides are often worth it, especially for companies with many products or complex operations. If you are looking for a smarter way to manage costs and grow your business, ABC could be a great choice.

Understand organisational structures, technological advancements, and financial frameworks with our Business, Technology & Finance (BTF) Course – Join soon!

Have Any Question?

Have Any Question?

+44 7452 122728

+44 7452 122728

Back

Back

44 7452 122728

44 7452 122728