Table Of Contents

It didn't take long for Artificial Intelligence (AI) to transition from a mind-boggling futuristic concept to a ubiquitous force transforming every field and industry at an exponential rate. The field of Accounting is no exception. From automating tedious tasks such as Data Entry to unearthing real-time financial insights, AI in Accounting is transforming the way businesses handle money.

Essentially, AI is transforming the ledgers of yesterday into sleek, smart, future-ready systems. This blog dives into the integration of AI in Accounting, spotlighting real-world applications, emerging trends, the cutting-edge tools and more. So read on and explore how AI is rewriting the rules of the Finance world!

Table of Contents

1) What is AI in Accounting?

2) Benefits of AI in Accounting

3) Latest AI Trends in Accounting

4) Can AI Replace Accountants in Future?

5) Applications of AI In Accounting

6) Top AI Tools Used in Accounting

7) Challenges of AI in Accounting

8) How to Get Started With Accounting Intelligence?

9) Conclusion

What is AI in Accounting?

AI in Accounting involves using technologies like Machine Learning (ML) and Natural Language Processing (NLP) to make accounting tasks more efficient and intelligent. It can handle jobs such as financial reporting, audits, compliance checks, fraud detection, and data analysis. Today, many tax professionals and Accounting firms are turning to AI to offer stronger support to their clients.

AI is also changing the way Accountants work by taking over the repetitive tasks, thus allowing them to direct their focus more on strategy and client advice. Instead of spending hours on Data Entry or reconciliations, professionals can use AI-powered tools to get real-time insights, spot risks earlier and make smarter business recommendations.

Benefits of AI in Accounting

AI in accounting makes work faster, smarter and more reliable while freeing up time for higher-value tasks. Here are some of the key benefits:

1) Task Efficiency

AI automates repetitive tasks such as Data Entry, reconciliations, and invoicing, which saves hours of manual work. By reducing time spent on routine administration, accountants can shift their focus to strategic tasks, client support, and improving overall business outcomes.

2) Error Reduction

AI processes large volumes of data quickly and with high precision, significantly reducing the risk of human error. It can detect unusual activity, highlight inconsistencies and ensure accurate reporting. This improves reliability and lowers the risk of fraud or compliance issues.

3) Cost Savings

Automating labour-intensive jobs means firms can save on resource costs and improve productivity. With more time freed up, Accountants can take on extra clients, provide more value-added services and increase profitability without significantly raising overheads.

4) Real-time Insights

AI gives instant access to up-to-date financial data, helping Accountants provide better advice to clients. Real-time reporting supports smarter business decisions, long-term planning, and quick responses to changing financial situations, making firms more agile and client-focused.

5) Data Protection

AI strengthens security by identifying suspicious patterns and potential fraud much faster than manual methods. It also helps safeguard sensitive financial information through advanced monitoring, giving both firms and clients greater peace of mind when handling important data.

Equip yourself with the financial tools to thrive in a tech-driven world. Sign up for our Business, Technology & Finance (BTF) Training now!

Latest AI Trends in Accounting

From data summarisation to practice integration, the following trends are reshaping how Accountants and firms deliver performance:

Trend 1: Data Summarisation

AI tools are increasingly helping accounting teams digest large datasets with speed and clarity. They can sift through complex financial records, extract vital insights and present them in easy-to-understand summaries. This capability saves time and turns dense reports into actionable information.

Trend 2: Predictive Analytics

AI-powered Predictive Analytics is transforming how accounting firms forecast financial trends and assess risk. By analysing both the historical and real-time data, these tools can anticipate future outcomes and flag potential issues before they arise. This helps Accountants move from reactive reporting to decision-making.

Trend 3: Practice Integration

A growing trend in Accounting is embedding AI directly into end-to-end Practice Management systems. Rather than standalone tools, AI capabilities such as automated workflows, smart insights, and real-time data synchronisation are becoming core parts of unified platforms. This is helping firms work more efficiently and deliver smoother services.

Can AI Replace Accountants in the Future?

AI will change the role of Accountants, not remove it. AI can already do many accounting tasks like Data Entry, reconciliations, and report generation, but it cannot fully replace Accountants. What AI lacks are human skills such as judgement, problem-solving and communication.

Accountants remain essential for interpreting results, providing tailored advice, and ensuring compliance and accuracy. Rather than replacing the profession, AI serves as a powerful assistant; automating repetitive work so accountants can focus on higher-value services like business consulting, financial planning, and strategic decision-making.

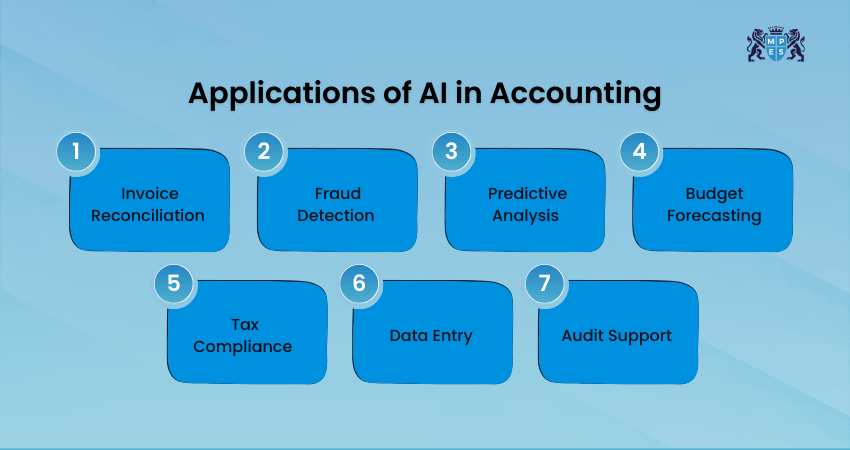

Applications of AI in Accounting

From invoice reconciliation and fraud detection to tax compliance and audit support, these are the most exciting applications of Artificial Intelligence in Accounting:

1) Invoice Reconciliation

AI streamlines invoice reconciliation by scanning documents, extracting data, and automatically matching it against financial records. This significantly reduces manual effort, minimises errors, and ensures smoother financial workflows. By handling repetitive tasks, AI allows accountants to focus on more complex responsibilities that require human judgement.

2) Fraud Detection

AI can analyse vast volumes of financial data to detect unusual patterns or irregularities. By spotting these patterns early on, it helps reduce the risk of fraud and ensures greater accuracy in reporting. This proactive approach improves trust and strengthens overall financial security.

3) Predictive Analysis

AI uses historical and real-time financial data to identify trends and forecast future outcomes. This enables firms to anticipate risks, prepare for challenges, and make informed business decisions. Predictive insights give businesses a competitive edge and improve adaptability in dynamic markets.

4) Budget Forecasting

With AI, budget forecasting becomes more reliable. It analyses spending patterns and financial behaviour to create accurate forecasts, supporting better planning and long-term financial stability. This accuracy gives decision-makers confidence when allocating resources and setting priorities.

5) Tax Compliance

AI streamlines tax compliance by reviewing financial records for deductions, credits, and errors. This helps ensure tax filings are accurate, timely, and aligned with regulations. It also reduces the risk of penalties by catching issues before submissions are made.

6) Data Entry

AI reduces the burden of manual bookkeeping by automatically processing and categorising transactions. This speeds up routine tasks and minimises the chances of mistakes in financial records. By automating these processes, Accountants can deliver results faster and with greater consistency.

7) Audit Support

AI improves audits by quickly validating records, cross-checking data, and highlighting inconsistencies. This makes the auditing process more efficient, accurate, and less time-consuming. It also increases transparency, making it easier to meet compliance requirements.

Lay the groundwork for every great Accountant with our Financial Accounting (FA) Training - Register now!

Top AI Tools Used in Accounting

AI tools are quickly changing how Accountants work. Just like Artificial Intelligence itself, these tools are developing fast. Here's a list of the best AI tools in Accounting:

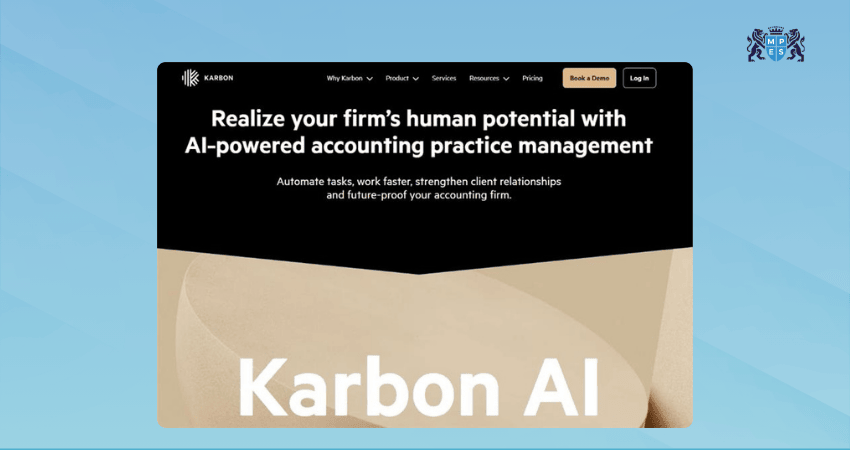

1) Karbon AI

Karbon AI is part of Karbon’s Practice Management software. It uses AI and GPT technology with accounting context. It can do the following tasks:

1) Summarise long email threads and internal discussions into clear, short updates.

2) Create quick summaries of client information like emails, notes, and billing data.

3) Give highlights of ongoing work items.

4) Draft email responses from short prompts.

5) Suggest quick replies for faster email responses.

6) Recommend which team member should be assigned tasks.

7) Provide personalised client updates as work progresses.

Pros:

1) Built into Karbon, a top-rated accounting platform.

2) Uses Microsoft Azure OpenAI Service for secure data.

3) Frequently updated with new features.

4) Created by accounting experts who know industry needs.

5) Offers a free trial.

Cons:

1) The current version mainly focuses on summarisation.

2) Vic.ai

Vic.ai helps automate processes like invoices and payments to save time. It can perform the following tasks:

1) Automatically process invoices and approval workflows.

2) Improve accuracy in financial reporting.

3) Check expenses against company policies for compliance.

4) Maintain audit-ready records and trails.

5) Analyse expenses for financial planning.

6) Spot errors or possible fraud in financial data.

Pros:

1) Strong focus on data accuracy and compliance.

2) Can be customised to fit business needs.

3) Handles large volumes of expenses easily.

4) Works with multi-entity and multi-currency operations.

Cons:

1) Limited tools for team collaboration.

2) Pricing is only available via sales calls.

3) Docyt

Docyt is an Accounting Automation Software with two AI systems: Precision AI and Generative AI. This tool can accomplish the following:

1) Automate bookkeeping tasks like accounts payable and reconciliation.

2) Read and extract data from receipts and invoices.

3) Generate custom financial reports.

4) Summarise conversations into accounting actions.

5) Categorise most transactions automatically.

6) Match transactions with bank feeds for revenue reconciliation.

Pros:

1) Learns about your business as you use it.

2) Simple and easy to use for small to medium businesses.

3) Provides secure document storage.

Cons:

1) Not designed only for accounting firms.

2) Pricing not available online.

3) Some reports of slow customer support.

4) Blue Dot

Blue Dot is an AI platform focused on employee-driven transactions, mainly in European markets. It can do the following:

1) Manage VAT processes and refund requests.

2) Detect taxable employee benefits.

3) Analyse vendor performance and spending trends.

4) Ensure compliance with a strong audit mechanism.

5) Display tax regulations across multiple countries.

Pros:

1) Pulls data from multiple sources.

2) Easy for IT teams to set up.

3) Secure audit-trail functionality.

Cons:

1) No free trial.

2) Limited integrations compared to others.

3) Pricing not public.

5) Botkeeper

Botkeeper combines AI and human Accountants to handle bookkeeping tasks. It can perform the following tasks:

1) Provide automated dashboards and reporting.

2) Have human Accountants review AI work for accuracy.

3) Manage payroll, bills, invoices, and reconciliations.

Pros:

1) Unlimited reporting.

2) Accountants oversee AI work for better accuracy.

3) Can work alongside your team or fully automate tasks.

Cons:

1) No free trial.

2) Complex initial setup.

3) Steep learning curve.

6) Rows AI

Rows AI is a modern spreadsheet tool with AI integration. Here’s what it can do:

1) Summarise key points from your data.

2) Analyse trends and patterns.

3) Categorise and structure text automatically.

4) Clean and format data.

5) Enrich data with extra details like company info.

Pros:

1) Helpful setup guides and resources.

2) Free plan available.

3) Good range of templates and integrations.

Cons:

1) Not designed specifically for accounting.

2) Data sent to OpenAI, raising privacy concerns.

3) Lacks some advanced features compared to Excel.

7) Receipt-AI

1) Receipt-AI helps manage receipts using AI. Here are its key functions:

2) Upload receipts via photo, email, or text.

3) Connect directly with QuickBooks and Xero.

4) Automatically categorise receipts.

Pros:

1) Much faster than manual entry.

2) Machine learning adds context automatically.

3) Supports bulk uploads.

Cons:

1) Text uploads only work in the US and Canada.

2) Pricing is not clear.

3) Few reviews available.

8) Chat Thing

Chat Thing lets you build custom AI chatbots using your data. Here are its main functions:

1) Summarise complex documents like tax code updates.

2) Create client-facing bots for FAQs.

3) Build internal bots for team policies and processes.

Pros:

1) Password protection available.

2) Customisable tone and style.

3) More accurate than generic chatbots.

Cons:

1) Limited file upload formats.

2) Notion is the only workspace integration.

3) Not designed specifically for accounting.

Challenges of AI in Accounting

AI has many advantages, but it also brings some challenges that you need to consider. Here are the big challenges:

1) Skill and Knowledge Gaps: Many Accountants are still figuring out how to use AI effectively. A lack of proper training makes this harder. Firms that invest in AI education save more time, so leaders should focus on training their teams.

2) Outdated Workflows: Most current systems weren’t built with AI in mind. Updating them takes effort, and with technology changing so fast, these workflows need frequent adjustments to stay efficient.

3) Errors in AI Processing: AI isn’t flawless. It can make mistakes or give misleading answers. That’s why Accountants should always review AI’s output, especially when dealing with financial data.

4) Adoption Resistance: Firm leaders are excited about AI, but some staff worry about job security. To ease these concerns, strong leadership and involving employees early in the process are key.

5) ROI Uncertainty: AI is still fairly new, and its exact benefits are sometimes hard to measure. This uncertainty can make some firm leaders hesitant to fully adopt it, even though it’s already saving time in many cases.

The gateway to global reporting standards awaits. Sign up for our Financial Accounting and Reporting (FARI) Course now!

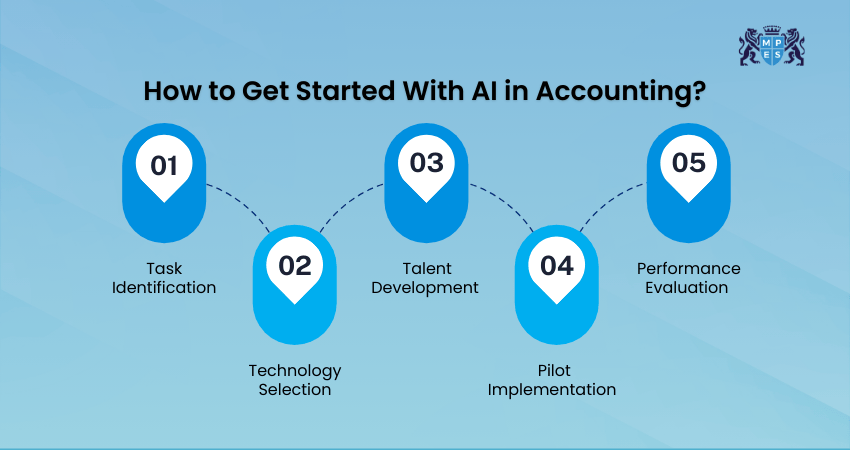

How to Get Started With Accounting Intelligence?

As we’ve explored before, Artificial Intelligence in Accounting has the power to transform how businesses handle their finances. However, for many organisations, getting started can feel overwhelming. Consider the following steps for a clear pathway to begin:

1) Task Identification

Pinpoint accounting processes that can benefit most from AI, such as Data Entry, invoice handling, and fraud detection. Focusing on high-impact areas first ensures maximum value and aligns AI use with long-term business goals.

2) Technology Selection

There are various AI technologies for accounting, including machine learning, natural language processing, and robotic process automation. Each should be carefully evaluated to match the firm’s needs and budget. The right choice depends on the specific goals of the business.

3) Talent Development

Equipping employees with AI knowledge is essential. Businesses can hire professionals with AI expertise or provide training for existing staff. A team that understands AI will be better prepared to integrate the technology effectively into daily operations.

4) Pilot Implementation

Begin with a small pilot project to test AI in one area of the business. As employees become more confident and results are achieved, expand AI adoption gradually. This approach reduces risks and encourages smoother implementation.

5) Performance Evaluation

Consistently track and assess how AI is performing against set objectives. Regular evaluation helps identify gaps, improve outcomes, and ensure that AI continues to support efficiency and growth.

Conclusion

More than a mere technological upgrade, AI in Accounting is a powerful shift for the future of finance. By embracing smart applications, keeping up with emerging trends and adopting the right tools, businesses can unlock greater efficiency and innovation than before. The firms that adapt now will lead tomorrow’s financial landscape with confidence.

Embrace the foundation for future-ready financial leaders in our ACA Certificate Level - Sign up now!

Have Any Question?

Have Any Question?

+44 7452 122728

+44 7452 122728

Back

Back

44 7452 122728

44 7452 122728