Table Of Contents

If you wonder why some people get a huge tax refund while the rest see a small reduction, it all comes down to the difference between Tax Credit Vs Tax Deduction. While both are designed to reduce your tax burden, they work differently. Tax credits directly decrease the tax owed and offer a pound-for-pound benefit.

On the other hand, tax deductions reduce taxable income and the portion subject to tax. Both can boost your savings, but knowing how to use them wisely is the real game-changer. This blog will help you navigate it by offering in-depth insight into these benefits. So read on and learn how to maximise your tax savings like a pro!

Table of Content

Tax Credit Vs Tax Deduction: An Overview

Types of Tax Credits

Benefits of Tax Credits

Types of Tax Deductions

Benefits of Tax Deductions

Conclusion

Tax Credit Vs Tax Deduction: An Overview

Taxpayers in the UK must pay government-imposed taxes which support public service financing and public initiatives. All reporting of financial activities alongside income takes place between taxpayers and HM Revenue & Customs (HMRC). The government department called HM Revenue & Customs establishes tax liabilities by checking against active laws and regulations. Tax credits act as a specific tax benefit because they eliminate the need for direct calculation of taxes after taxable earnings have been deducted. The following section explains tax credits and deductions in detailed form to help you grasp tax system principles better.

What is Tax Credit?

A tax credit is an amount of money that taxpayers can subtract directly from the taxes they owe to the government. It can reduce the tax bill on a pound-for-pound basis, making it a more beneficial type of tax relief compared to deductions, which only reduce taxable income.

Statistics on Child and Working Tax Credits

These points will illustrate the important aspects of tax credits:

Government payments under tax credits serve to deliver financial assistance toward parents and low-income individuals and people with disabilities.

Tax credits serve as both payment programs that help parents taking care of children and people who work at low wages.

An individual who files taxes with HM Revenue & Customs (HMRC) gets to deduct a predetermined sum before their tax liability calculation phase.

Tax credits come with two types: refundable and nonrefundable.

A tax credit refund occurs if the calculated credit exceeds the amount of taxes owed.

Tax credits that belong to the nonrefundable category cut the taxable liability to complete exhaustion yet prevent any refund possibility.

What is a Tax Deduction?

These points will help you understand the idea behind tax deductions:

Tax deductions allow taxpayers to reduce taxable income. This lowers their overall tax liability.

Deductions are subtracted from gross income, resulting in a lower taxable income figure on which tax is calculated.

Unlike tax credits, which directly decrease the tax owed, deductions reduce the income that's subject to taxation.

Individuals and businesses can claim deductions for certain expenses or qualifying contributions to offset taxable income.

Tax deductions serve as incentives for behaviours that benefit society or the economy, such as charitable donations or business investments.

The government uses tax deductions to encourage activities that support economic growth, social welfare, or public policy objectives.

Deductions must meet criteria set by HM Revenue & Customs (HMRC) to be eligible for claims.

Taxpayers must comply with HMRC audits or verification processes

Taxpayers must maintain accurate records to support deduction claims.

ACA Certificate Level Course for Professionals

Types of Tax Credits

There are four main types of tax credits namely Working Tax Credit, Child Tax Credit, universal credit and pension credit. You can find details on each of these categories below:

Working Tax Credit (WTC)

WTC supports low-income individuals and families by topping up their earnings.

The eligibility for it depends on age, hours worked, and income level. It includes additional support for disabilities or childcare needs.

WTC incentivises work by providing financial assistance that covers day-to-day living costs.

WTC is essentially available to those working a minimum number of hours per week. It ensures income stability for the working population.

Eligibility for Working Tax Credit

Child Tax Credit (CTC)

Child Tax Credit (CTC) provides financial support to families with children, offering a credit for each qualifying child under a certain age.

CTC helps reduce the financial burden of raising children by assisting with childcare costs, education expenses, and essential needs.

The amount received depends on the number of children and household income, ensuring targeted financial assistance.

It ensures families have additional support to meet their children’s basic and developmental needs.

Develop a strong foundation in Audit and assurance practices in our detailed and up-to-date Assurance (AS) Training - Sign up now!

Universal Credit

Universal Credit is a means-tested benefit that provides financial support to low-income individuals and families or those out of work.

It replaces multiple benefits, including Working Tax Credit and Child Tax Credit, and consolidates them into a single payment.

Universal credit is designed to simplify the welfare system and ensure those in need receive the much-needed financial support.

The benefit gets adjusted based on earnings. This encourages employment and financial independence.

Pension Credit Expenditure in UK

Pension Credit

Pension Credit provides additional income support for retirees with low pensions.

It’s designed to assure that individuals over a certain age receive a minimum guaranteed income.

The benefit helps reduce poverty among the elderly population.

For up-to-date information, you can consult official government resources or take advice from a Tax Professional.

Master the skills to record, report, and interpret financial information in our Accounting (AC) Course - Register now!

Benefits of Tax Credits

As hinted above, tax credits offer substantial benefits to a range of citizens, including incentive for work and fairness and equality. Here's a summary of WTC’s advantages:

Advantages of Tax Credits

Types of Tax Deductions

A broad range of tax deductions is available to UK's employers, including employee, business, and investment expenses. Let's explore these categories in detail:

Employee Expenses

Employers can claim tax deductions for various employee expenses.

Eligible expenses include travel and subsistence costs.

Home office expenses can be deducted if employees work remotely.

Uniform and work clothing expenses are also deductible.

Professional fees and subscriptions related to the job qualify for deductions.

Business Expenses

Employers can claim tax deductions for various business expenses.

Rent and utilities for business premises are deductible.

Office equipment and supplies qualify for tax relief.

Marketing and advertising expenses can be claimed.

Research and development (R&D) costs are eligible for deductions.

Staff costs, including wages and benefits, can be deducted.

Want to gain in-insight into the key principles and practices of taxation? Register for our Principles of Taxation (PTX) Course now!

Investment expenses

Employers can claim tax deductions for specific investment expenses.

Deductions apply to the cost of acquiring business assets.

Maintenance and upkeep of business assets are also eligible.

These deductions help reduce taxable income and support business growth.

Personal Allowance

Every UK taxpayer is entitled to a tax-free personal allowance each year.

This allowance is deducted from total income before tax is calculated.

It allows individuals to earn a certain amount tax-free before becoming liable for taxation.

The personal allowance provides a basic level of tax relief for all taxpayers.

Pension Contributions

Pension contributions is deducted from the taxable income which reduces tax liability.

These contributions provide tax relief for individuals saving for retirement.

Investing in a pension scheme helps build a secure financial future.

Pension savings grow over time, ensuring financial stability in retirement.

Charitable Donations

Donations to registered charities in the UK may qualify for tax relief.

Taxpayers can deduct donations from their taxable income, reducing tax liability.

This incentive encourages charitable giving among individuals and businesses.

It supports the important work of charitable organisations across the UK.

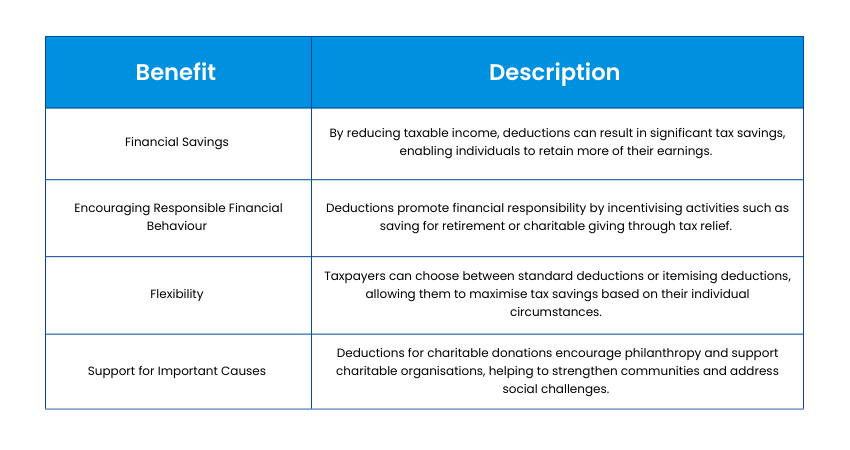

Benefits of Tax Deductions

Tax deductions provide several advantages for UK taxpayers as summarised below:

Advantages of Tax Deductions

Conclusion

Understanding the difference between Tax Credit Vs Tax Deductions is key to keeping more money in your pocket. While credits decrease your tax bill directly, deductions lower the taxable income. Both offer valuable benefits but knowing when and how to use them can impact your finances in amazing ways.

Master the concepts of fundamental accounting, finance, and business principles in our comprehensive ACA Certificate Level Training - Sign up now!

Have Any Question?

Have Any Question?

+44 7452 122728

+44 7452 122728

Back

Back

44 7452 122728

44 7452 122728