Table Of Contents

Imagine running your business with full confidence, knowing where every pound goes and how each choice affects your future. That is the power of strong Accounting. It turns complex numbers into clear insights and helps you choose the right approach by understanding the different Types of Accounting.

In this blog, you will explore what Accounting is, the 20 different Types of Accounting, and key areas such as financial, tax, cost, fiduciary and social Accounting. You will also learn how to choose the right type of Accounting for your business.

What is Accounting?

Accounting is the procedure of recording, organising, and understanding financial information. It gives a clear picture of how much money a business earns, how much it spends, and how those funds are managed. This information helps business owners and Managers to plan effectively, meet tax obligations, and make smarter financial decisions. By choosing the right Types of Accounting for their needs.

There are many Types of Accounting, each designed to serve a specific need. While some help track profits, others focus on managing costs, filing taxes, or meeting legal standards. In the following sections, we’ll explore each type to understand how they support business success.

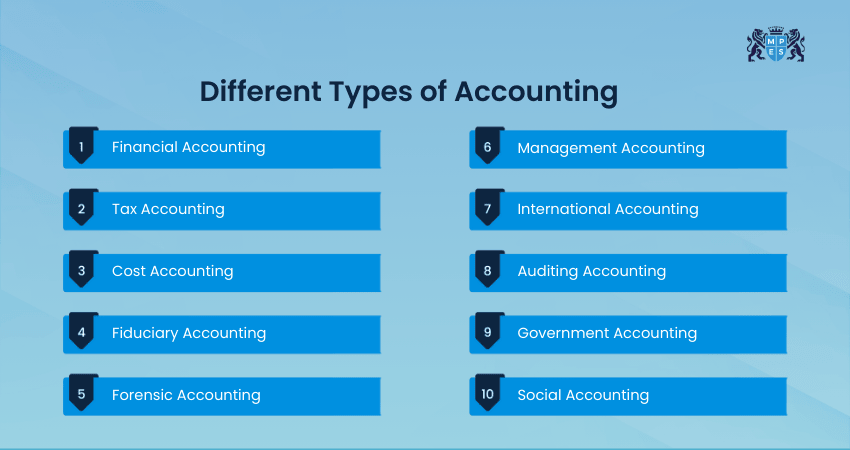

20 Types of Accounting

Accounting comes in many forms, each serving a unique purpose in managing finances. Below are 16 different Types of Accounting that can help businesses operate efficiently, stay compliant, and grow sustainably.

1) Financial Accounting

Financial Accounting deals with preparing reports like income statements, balance sheets, and cash flow statements. These are shared with people outside the company, like investors, banks, or government departments. It follows standard rules, such as Generally Accepted Accounting Principles (GAAP). Preparing a Trial Balance is also a core step in this process, making financial accounting vital for transparency and external reporting.

Used by: Large companies, public firms, and external stakeholders

Example: A listed company reports quarterly earnings to shareholders

Without it: Stakeholders may lose trust, and funding could become difficult

2) Tax Accounting

Tax Accounting focuses on tax returns and payments, following government tax laws. Businesses use this Accounting to file income tax, Goods and Services Tax (GST), and other taxes accurately and on time, helping them avoid penalties and stay compliant.

Used by: All businesses, tax consultants, and Accountants

Example: A retail store calculates GST and income tax annually

Without it: You risk penalties, audits, and legal issues

3) Cost Accounting

Cost Accounting looks at all the costs of producing goods or services. It helps businesses understand spending patterns and find ways to reduce expenses. This Type of Accounting is mainly used in manufacturing and production to improve efficiency and profitability.

Used by: Manufacturers, production firms, and CFOs

Example: A car company tracks costs per vehicle to improve pricing

Without it: Profit margins shrink due to hidden or rising costs

4) Fiduciary Accounting

Fiduciary Accounting is used to manage someone else’s money, such as in a trust, estate, or guardianship. It requires clear reporting to courts or beneficiaries, making it crucial for legal and ethical financial responsibility.

Used by: Lawyers, trustees, and estate planners

Example: A trustee manages a family estate for underage children

Without it: There may be legal disputes or mismanagement of funds

5) Forensic Accounting

Forensic Accounting investigates fraud, theft, or financial disputes by combining Accounting skills with investigative techniques. These Types of Accounting are often used by law firms, courts, or police to uncover financial misconduct and support legal cases.

Used by: Legal teams, auditors, and government agencies

Example: Forensic Accountants helped uncover fraud in the Enron scandal

Without it: Financial crimes might go undetected or unresolved

Develop actionable financial data expertise with our Management Information (MI) Course for future success – Join now!

6) Management Accounting

Management Accounting is used by business owners and Managers to make day-to-day decisions. It includes budgeting, forecasting, and performance analysis. Unlike Financial Accounting, it is not shared with outsiders.

Used by: Internal Managers, Executives, and Planners

Example: A logistics company uses it to plan expansion

Without it: Businesses may miss growth opportunities or waste resources

7) International Accounting

International Accounting follows global standards like the International Financial Reporting Standards (IFRS). It helps companies operating in multiple countries maintain consistent, transparent, and comparable financial reports across borders.

Used by: Multinational companies and global firms

Example: A UK-based firm operating in India uses IFRS for reporting

Without it: Financial statements may not align across countries

8) Auditing Accounting

Auditing checks if financial records are correct and follow Accounting rules. It can be done by internal staff or external auditors. The goal is to make sure that reports are accurate and free from fraud.

Used by: Corporations, government bodies, and audit firms

Example: Annual audits help listed companies maintain investor trust

Without it: Mistakes or fraud may stay hidden, damaging the credibility

9) Government Accounting

Government Accounting is used by public organisations, such as councils or government departments. These types of Accounting follow specific rules to track how public funds are collected, allocated, and spent, ensuring transparency and accountability in public finance.

Used by: Government agencies and municipal authorities

Example: A city council tracks spending on education and roads

Without it: Public funds could be misused or untracked

10) Social Accounting

Social Accounting tracks the impact of a company’s actions on society and the environment. It includes things like waste, energy use, and employee wellbeing.

Used by: CSR departments and sustainability officers

Example: A tech company publishes a social impact report annually

Without it: The business may appear careless or unethical to the public

11) Environmental Accounting

Environmental Accounting tracks costs related to a company’s environmental impact. It includes expenses for Waste Management, energy use, and sustainability practices.

Used by: Corporations with sustainability goals and manufacturing firms

Example: A beverage company tracks its water usage and waste to reduce its carbon footprint

Without it: A company may fail to meet environmental standards or damage its public image

12) Public Accounting

Public Accounting supports individuals and organisations by offering professional services such as auditing, tax preparation and financial reporting. As one of the key Types of Accounting, it ensures transparency, compliance and trustworthy financial records for a wide range of clients.

Used by: Businesses, government bodies and individuals needing audits, tax support or advice

Example: A company hires a public Accounting firm to audit its yearly financial statements

Without it: Organisations risk inaccurate reports, tax issues and weaker credibility

Advance your career by learning business, tech and finance integration with our Business, Technology & Finance (BTF) Course – Register now!

13) Project Accounting

Project Accounting tracks the costs, income, and timelines of specific projects. It is vital in industries like construction, software, and events, helping businesses manage budgets, monitor progress, and ensure project profitability.

Used by: Project Managers and finance teams

Example: A construction firm tracks each site separately

Without it: Projects may run over budget or miss deadlines

14) Lean Accounting

Lean Accounting supports lean business practices by focusing on value streams, waste reduction, and simplified reporting. It replaces traditional Cost Accounting in lean enterprises.

Used by: Companies practising lean manufacturing or agile methods

Example: A tech hardware firm uses lean Accounting to improve efficiency and speed

Without it: Traditional methods slow decisions and conceal inefficiencies in lean systems

15) Inventory Accounting

Inventory Accounting tracks the value, cost and movement of a company's inventory, including raw materials, work-in-progress and finished goods. It helps businesses record stock accurately, determine the Cost of Goods Sold (COGS) and maintain proper financial reporting. This ensures better pricing decisions, cost control and Inventory Management.

Used by: Manufacturers, retailers, wholesalers and businesses managing physical stock

Example: A retailer uses FIFO to value inventory and calculate accurate COGS

Without it: Companies may misprice products, misstate profits and mismanage stock|

16) Human Resource Accounting

This type measures the value of a company’s workforce. It involves calculating the cost of hiring, training, and retaining employees, as well as assessing their contribution to the organisation.

Used by: HR departments, corporate strategists, and Business Analysts

Example: A software firm evaluates employee performance to decide on training investments

Without it: Businesses may undervalue talent or miss out on ways to boost productivity

17) Political Campaign Accounting

Political Campaign Accounting manages donations and spending during elections. It ensures that campaign funds are used correctly and reported to election authorities.

Used by: Campaign Managers, political parties, and watchdogs

Example: A national party tracks donor contributions for compliance

Without it: Campaigns may face fines or lose public trust

18) Fund Accounting

Fund Accounting is mainly used by nonprofit organisations and government bodies. It focuses on accountability rather than profitability, tracking how funds are received, allocated, and spent for specific purposes. This Type of Accounting ensures transparent fund management and builds stakeholder trust.

Used by: Charities, NGOs, churches, and universities

Example: A university tracks separate funds for scholarships and research grants

Without it: Funds may be misused, risking donor trust and legal compliance

19) Pension Accounting

Pension Accounting involves tracking and reporting the costs and obligations related to employee pension plans. It ensures organisations accurately measure pension expenses, future liabilities and funding status. This helps maintain transparency, comply with Accounting standards and protect employees’ retirement benefits.

Used by: Companies offering pension schemes or managing long-term retirement obligations

Example: A firm calculates pension liabilities to report true retirement benefit costs

Without it: Organisations may misstate liabilities, face issues and mismanage pensions

20) Not-for-Profit Accounting

Not-for-Profit Accounting focuses on tracking and reporting the finances of charities, NGOs, foundations and other non-profit organisations. As one of the key Types of Accounting, it emphasises accountability, proper use of funds and transparency. It ensures resources are used responsibly and supports the organisation’s mission.

Used by: Charities, NGOs, foundations, educational institutions and community organisations

Example: A charity records donations and grants separately to show how funds are used

Without it: Organisations may lose donor trust, misreport funds or miss requirements

Build strong tax knowledge and advance your finance career with the Principles of Taxation (PTX) Training – Join today!

How to Choose the Right Type of Accounting for Your Business?

Choosing the right type of Accounting depends on your business goals, structure, and operations. Here are some tips to help you decide:

1) Start with Financial and Tax Accounting. These are essential for all businesses to track performance and meet legal obligations.

2) If you manufacture products, consider Cost Accounting. It helps manage and reduce production expenses.

3) For growing companies, Management Accounting is key. It provides insights for better planning and decision-making.

4) Operating internationally? Follow International Accounting Standards to maintain compliance across borders.

5) For legal, trust, or investigation needs, opt for fiduciary or Forensic Accounting.

6) Nonprofits and public organisations should rely on funds or Government Accounting to ensure transparency and accountability.

7) Project-based businesses benefit from Project Accounting to track budgets and timelines accurately.

You can also talk to a professional accountant to get guidance. They can help you set up the right systems and ensure compliance.

Conclusion

Understanding the different Types of Accounting is essential to strong accountancy practices. It helps businesses manage finances effectively, stay compliant with regulations, and plan for future growth. Each type offers valuable insights from cost control to social responsibility, enabling companies to improve performance, reduce risks, and achieve long-term success across any industry.

Fast-track your finance and Accounting career by joining our best ACA Certificate Level today!

Have Any Question?

Have Any Question?

+44 7452 122728

+44 7452 122728

Back

Back

44 7452 122728

44 7452 122728