Table Of Contents

Let’s imagine you receive your salary, and you notice that the numbers do not match what you expected. It left you wondering since a chunk of your money is gone, which is referred to as “Income Tax.” It touches almost everyone, from your monthly budget to long-term savings. Each month, a part of your savings goes toward taxes, yet many people are unsure of how it truly works and why it matters.

In this blog, you will learn What is Income Tax, its different types, and how it is calculated. With clear explanations and practical insight,you’ll gain the confidence to understand your taxes and make informed financial decisions. So, keep reading to learn more!

What is Income Tax?

Income Tax is paid by individuals and businesses on the money they earn. This includes your salary, business profits, and even income from savings or rental properties. This deduction from your wages is utilised by the government for funding essential public services, such as schools, hospitals, public transport or roads.

If you are working as an employee, your Income Tax is deducted automatically through the Pay As You Earn (PAYE) system. Also, it is crucial to know that if you are self-employed or run a business, you must calculate your own tax liability and pay it directly to the government through a tax return.

How Does Income Tax Work?

Income Tax is a tax you pay on your earnings. It helps fund public services like healthcare, education, and infrastructure. Here's how it works

1) Personal Allowance

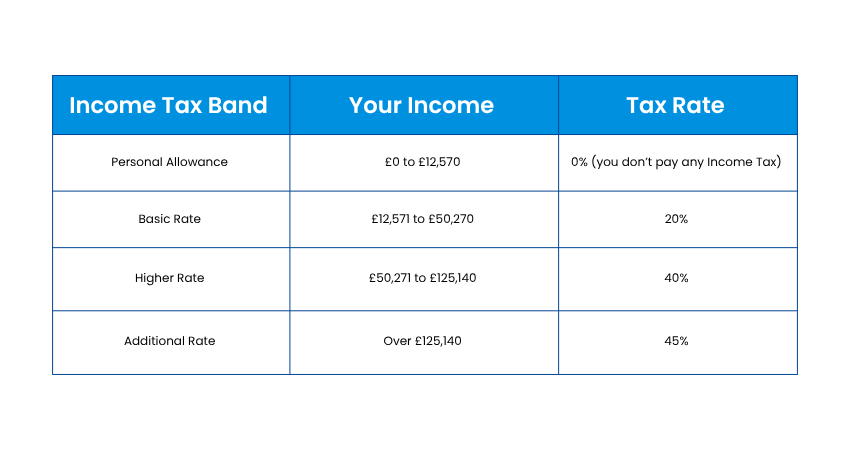

Personal Allowance is the tax-free amount you can earn each year. For 2025/26, it is £12,570. This means you do not pay Income Tax on this part of your earnings.

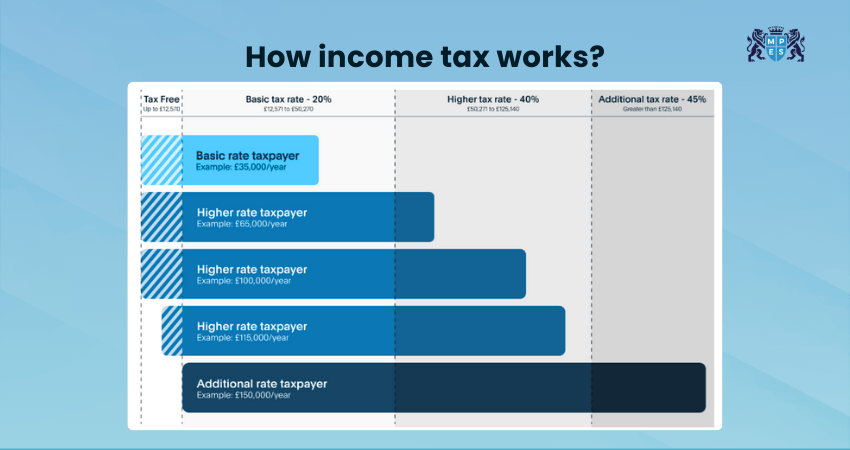

2) Tax Bands

After your Personal Allowance of £12,570, your income is taxed in bands.

1) Basic Rate (20%): Applies to income between £12,571 and £50,270.

2) Higher Rate (40%): Applies to income between £50,271 and £125,140.

3) Additional Rate (45%): Applies to income above £125,140.

Here, only a portion of your income is applied. If your income exceeds £100,000, your Personal Allowance may be reduced.

3) PAYE System

If you're employed, your employer deducts tax from your salary automatically through Pay As You Earn (PAYE). This ensures tax is collected automatically instead of you needing to calculate or submit taxes yourself.

4) Self-Assessment

If you're self-employed or have other income (like rent or investments), you must complete a Self-Assessment tax return and pay the tax directly to the government.

5) Other Considerations

You may also pay National Insurance, which is separate from Income Tax. Tax reliefs and deductions (like pension contributions or charitable donations) can reduce your taxable income.

Master the basics of auditing and boost your career with our Foundations in Audit (FAU) Course – Join now!

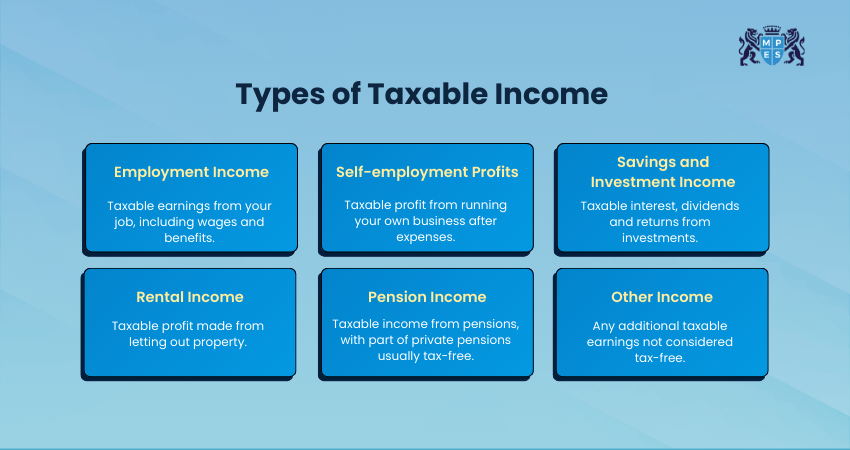

Different Types of Taxable Income

Taxable Income is any money you receive that His Majesty’s Revenue and Customs (HMRC) require you to pay tax on. Earnings that fall under this category are governed by Taxation, and below, we have provided the list of different types of income that qualify as taxable income

1) Employment Income

Under this type, it refers to the money you earn working for an employer. It includes your job, such as wages, salaries, commissions or bonuses. These earnings are taxable since they add value to your overall pay.

2) Self-employment Benefits

If you are self-employed or run your own small business, the profits you earn after subtracting allowable expenses come under Taxable Income. This applies to freelancers, sole traders, and contractors who earn income through selling products or services.

3) Savings and Investment Income

This refers to the interest earned on your savings accounts, dividends from shares, and income from investments. It is important to note that allowances might reduce the total amount you pay, but these earnings need to be declared to the HMRC.

4) Rental Income

This includes income earned from renting out a house, room or flat. Here, usually expenses such as repairs, insurance, or agent fees are deducted. Although the profit you earn through letting the property is taxable.

5)Pension Income

Under this type, your state pension, workplace pensions, or private pension is taxed. While most pension income is taxable, normally only 25% of private pension income is tax-free, while the State Pension is fully taxable.

6) Other Income

Some additional earnings, such as income from trusts, benefits, or occasional jobs, are also taxable. If the payment is not listed as tax-free by the HMRC, it falls under taxable income.

Start your accounting journey and master transaction records. Join our Recording Financial Transactions (FA1) Course now!

How is Income Tax Calculated?

Calculating Income Tax depends on how much money you earn and what type of income it is. Here’s a simple breakdown of how it's calculated:

1) Start With Your Total Income:

This includes all the money you earn, like your salary, wages, business profits, benefits, rent, or savings interest.

2) Take Away Your Tax-free Allowance:

Most individuals in the UK can earn up to £12,570 tax-free (2025/26), known as the Personal Allowance.

3) Use the Correct Tax Bands:

After removing your allowance, the rest of your income is taxed in parts using the UK’s tax bands. Each band has a different tax rate.

4) You may get Extra Allowances:

Some people get extra help, such as married couples or people with children. These reduce the total tax they need to pay.

5) Employers Help Employees with Taxes:

If you're an employee, your employer usually handles taxes for you. They take the right amount from your wages before you get paid.

Income Tax Rates, Bands and Allowances

UK Income Tax rates depend on how much you earn and where you live. In the UK region, England, Wales and Northern Ireland use the same tax bands, except Scotland, which uses its own rate system.

Every individual receives a Personal Allowance. This is the income you earn without paying any tax. You begin paying taxes once your earnings go above this allowance. Here is how the UK Income Tax rates work:

Who Pays Income Tax?

Almost everyone who earns over a certain amount pays Income Tax. This includes:

1) Employees working for a company or organisation

2) Self-employed people

3) Company directors and business owners

4) Pensioners whose total income exceeds the tax-free allowance

5) People who earn money from savings, investments, or renting out property

If you earn below the tax-free amount, you don’t pay Income Tax. This includes many young or part-time workers. However, understanding how Income Tax works is still useful for future earnings.

What are the Tax-free State Benefits?

Tax-free state benefits refer to the payments you receive from the government without paying any Income Tax on them. These benefits are implemented to support individuals and families in certain situations, such as low income, disability or childcare needs. Let’s look at some of the benefits:

1) Attendance Allowance

2) Severe Disablement Allowance

3) Personal Independence Payment (PIP)

4) Bereavement Support Payment

5) Housing Benefit

6) Guardian’s Allowance

7) Pension Credit

8) Maternity Allowance

9) War Widow’s Pension

10) Winter Fuel Payments and Christmas Bonus

11) Child Benefit (tax-free unless income exceeds threshold)

Conclusion

Income Tax helps fund important public services like healthcare, education, and transport. It is based on how much income you earn, using fair tax bands. Whether you’re an employee or business owner, understanding What is Income Tax helps you manage your finances better and stay compliant. Paying tax shows responsibility and supports the growth of communities and organisations.

Start your accounting journey by mastering transaction records with our Managing Costs and Finance (MA2) Course – Join now!

Have Any Question?

Have Any Question?

+44 7452 122728

+44 7452 122728

Back

Back

44 7452 122728

44 7452 122728