Table Of Contents

Before your coffee hits your hand, you’ve already paid a tax. Whether you realise it or not, tax is part of almost everything you buy, earn, or own. It is one of the most important systems that keeps a country running, but many of us don’t understand how it works.

Being aware of What is Taxation helps you make smarter money choices, plan your finances better, and manage your business wisely. You can be an employee, student, or Entrepreneur, knowing the types and purpose of tax puts you one step ahead. In this blog, we’ll explain what it means, its types, how taxes are grouped, and why they’re important. Read on!

Table of Contents

What is Taxation?

Classification of Taxes

Types of Taxation

What is the Purpose of Taxation?

Taxation Examples from Different Countries

Conclusion

What is Taxation?

Taxation is the process by which the taxing authority, like governments, collect money from people and businesses to pay for public services. This includes things like roads, hospitals, schools, police, defence, and social services.

When you earn money, buy items, or own a property, a part of that money is taken by the government as a tax. This is used to run the country and serve the public. Therefore, tax is not optional. Instead, it is required by law.

Classification of Taxes

There are different ways to group or classify taxes which you pay in your everyday life. Let’s look at three common ways:

1. Direct Taxes

These are taxes directly paid to the government by individuals or businesses. These are based on things like your personal income (like salaries or profits), wealth or assets and spending.

Examples:

Income tax (paid on the money you earn, like salary or wages)

Corporate tax (the tax that companies pay on the profits they make)

Property tax (on land or buildings)

Wealth tax (on total assets minus liabilities)

2. Indirect Taxes

Indirect taxes are not directly paid by the individual. Instead, they are included in the cost of goods and services which you buy and are collected by sellers. These taxes are charged on transactions of buying or selling goods, imports and exports, manufacturing and production, consumption of services, etc.

Examples:

Sales tax

Value Added Tax (VAT)

Excise duty tax on items like alcohol, petrol, and tobacco

Customs duty tax on goods brought into a country

3. Progressive, Regressive, and Proportional Taxes

These terms are based on how Taxation is calculated for people based on their income.

Progressive Tax:

A progressive tax means that people who earn more money pay a higher tax. It is designed to reduce inequality by asking the rich to contribute more. This system helps fund public services without placing too much burden on low-income earners.

Regressive Tax:

A regressive tax is the opposite of a progressive tax. This is because people with lower incomes will pay a high percentage of tax compared to wealthier people. Even though everyone pays the same amount, it affects the poor people more.

Proportional Tax:

A proportional tax, also called a flat tax, charges the same percentage to everyone, no matter how much they earn. It is simple to understand and apply, but it doesn’t consider income differences between people.

Discover the fundamental role of finance in supporting decision-making with our Business, Technology & Finance (BTF) Course – Register today!

Types of Taxation

There are several types of taxes paid to the government. Each one applies to different types of income, property, or activity. Let’s check those types:

1. Income Taxes

Income tax is the money the government takes from what you earn, like your wages, salary, or profits from investments. The more money you make, the more tax you usually pay. This is often a progressive tax.

Example:

If you earn £25,000 in a year, your income tax will be 20% of your income. But if you earn £100,000, you might pay 40% on part of that income.

2. Corporate Taxes

Corporate tax is a tax that businesses pay on the money they earn, like their profits. While the company is responsible for paying this tax, its impact can extend to consumers and employees. To offset the cost, companies may raise prices or reduce wages.

Example:

If a company makes £1 million as a profit and the corporate tax rate is 25%, it must pay £250,000 as a tax to the government.

3. Payroll Taxes

Payroll taxes are taken directly from employee’s salaries and paid to the government by employers. This money helps fund social benefits like pensions, healthcare, and unemployment support. In many countries, both the employer and employee contribute to payroll taxes.

Example:

If your salary is £2,000, your employer might take out £150 for national insurance or social security.

4. Capital Gain Taxes

Capital gain taxes are charged when you sell something for more money than you paid for it. This can include houses, cars, stocks, bonds, and business shares. The extra money you gain from selling these items at a profit is called a capital gain, and you must pay tax on that gain.

Example:

If you buy a share for £2,000 and later sell it for £3,500, you make a capital gain of £1,500. So, you need to pay tax on that profit.

5. Property Taxes

Property tax is paid on land, buildings, and other real estate that you own. These taxes are usually charged by local governments, and the amount often depends on the value of the property.

Example:

If your house is worth £200,000 and the council tax rate is 1%, you may pay £2,000 a year in property tax.

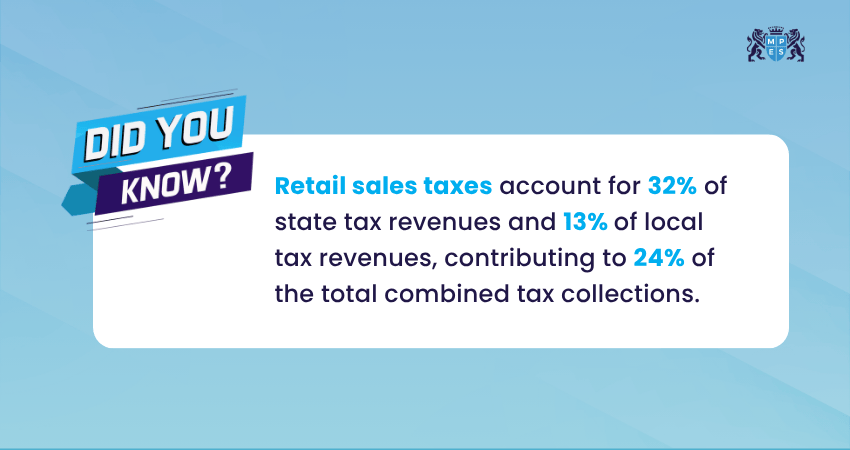

6. Sales Taxes

Sales tax is an indirect tax, linked to the goods and services when you buy them. In the UK, this is known as Value Added Tax (VAT).

Example:

For example, if an item costs £100 and there’s a 10% sales tax, the total price becomes £110. The seller then sends the £10 to the government.

What is the Purpose of Taxation?

Now, let’s look at the purpose behind imposing Taxation on almost everything:

Public Services: Taxes fund essential services such as schools, hospitals, roads, police, and fire departments.

Social Welfare: Tax revenue supports the elderly, unemployed, and vulnerable members of society.

Infrastructure: Governments use tax money to build and maintain bridges, railways, and airports.

Economic Stability: Taxes can help reduce inflation or stimulate the economy when needed.

Wealth Redistribution: Progressive taxes help reduce the gap between the rich and the poor.

National Defence: Taxes fund the military and security systems of a country.

Without taxes, essential services would stop, and the country’s growth would suffer. Moreover, taxes are used to make life better and safer for everyone.

Do you want to interpret your financial information? Join our Accounting (AC) Course immediately!

Taxation Examples from Different Countries

Here's how Taxation works with different countries to understand how systems can vary around the world:

United Kingdom Taxation System

The UK has a well-structured and progressive tax system. The tax body in the UK is His Majesty’s Revenue and Customs (HMRC). The Taxation system follows:

Income Tax: Rates range from 0% to 45% depending on income and region.

National Insurance (NI): Paid by workers and employers to fund pensions and benefits. The employee’s contributions are 8% and the employer’s contributions are 15%.

VAT: Standard rate is 20% on goods and services.

Council Tax: Paid to local councils based on property value.

Capital Gains Tax: Ranges from 18% to 24% depending on income and asset type.

United Arab Emirates Taxation System

The United Arab Emirates (UAE) is known for having very low direct taxes. It is one of the few countries with no personal income tax for individuals. The Taxation system follows:

Personal Income Tax: Individuals do not pay tax on salaries, investments, or capital gains.

Corporate Tax: Introduced in 2023 at a rate of 9% for businesses making profits over AED 375,000.

VAT: Standard rate is 5%, applicable to most goods and services.

Excise Tax: Levied on harmful goods like tobacco and sugary drinks.

Conclusion

Whether you’re earning a salary, running a business, or buying a coffee, taxes are part of your everyday life. Figuring out What is Taxation and how it works helps you manage your money better, plan wisely, and even grow your business more confidently. The more you know about it, the better you can make informed financial decisions that benefit both you and your community.

Build a solid foundation in accountancy, finance, and business with our ACA Certificate Level – Sign up now!

Have Any Question?

Have Any Question?

+44 7452 122728

+44 7452 122728

Back

Back

44 7452 122728

44 7452 122728