Table Of Contents

Running a business means navigating a labyrinth of taxes, but one key question often stands out: What is Corporation Tax? This tax, being an imposition on company earnings, is not only a burden but can be a mechanism for influencing corporate choices as well as the direction of their development. But it’s important to understand it because such knowledge can help businesses make wise decisions concerning their money.

Views and insights into What is Corporation Tax comprise, who pays it, the benefits that arise from it, when and how to pay it, and how to cut down on Corporation Tax will be discussed in this blog as well. Let’s get started!

Table of Contents

1) What is Corporation Tax?

2) Who Pays Corporation Tax?

3) Steps to Pay Corporation Tax

4) How is Corporation Tax Calculated?

5) How Much is Corporation Tax in the UK?

6) When Does Corporation Tax Have to be Paid?

7) Benefits of Corporate Taxation

8) How to Reduce Your Corporation Tax Bill?

9) Corporation Tax Deadlines

10) What are the Late Filing and Payment Penalties?

11) Conclusion

What is Corporation Tax?

Corporation Tax is a direct tax charged on the profits earned by UK companies and some organisations, such as clubs and associations. These profits can come from trading activities, investments, or the sale of business assets. Companies are required to calculate their taxable profits each financial year and report them to His Majesty's Revenue and Customs (HMRC) through a Corporation Tax return.

The amount of Corporation Tax a business pays depends on current tax rates and applicable reliefs or allowances. It plays an important role in funding public services and shaping government economic policy.

Who Pays Corporation Tax?

Corporation Tax is charged on limited companies, foreign companies operating through a branch or office in the UK, and certain clubs, societies, or unincorporated associations that carry on taxable activities. These organisations are required to pay tax when their total business income goes beyond the threshold specified by the tax authorities.

On the other hand, sole traders and business partnership organisations do not pay Corporation Tax. They declare their income through personal income tax returns, making the differentiation between individual and Corporate Taxation critical.

Steps to Pay Corporation Tax

Corporation Tax is just like any other tax that requires individuals or companies to complete several easy steps to follow the law. As is shown in this case, businesses have to register, file, and pay according to the procedure. Here's a breakdown:

1) Registering for Corporation Tax

After trading begins in your company or earning profits, you’re required to declare your company with the taxation department, which is usually done through a website. This step informs the government of the Corporation Tax liability, which also ensures that you receive updates about important dates and compliance.

2) Preparing and Filing a Company Tax Return

Business organisations need to assess their taxable profits after considering

all allowable expenses and so on. A company tax return that comprises these computations must be lodged with the appropriate tax administration. It is recommended that a search for professional accounting help be pursued to successfully adhere to all rules.

3) Making Your Corporation Tax Payment

The last process is the payment process, which has to be made either within the year or with reference to your company’s financial year, most probably on an annual basis. These require timely and accurate payment to eliminate any accrued interest costs or penalties to enhance accrual operations.

Elevate your expertise in accounting with our Taxation Compliance (TC) Course - Sign up now!

How is Corporation Tax Calculated?

Corporation Tax is calculated through a step-by-step process that ensures businesses are taxed fairly on their actual profits after allowable deductions. Below are the steps involved in its calculation when you are aware of What is Corporation Tax:

1) Calculate Taxable Profits

To calculate the Corporation Tax, you need to start by working out the company’s taxable profits for the accounting period. This includes income from trading activities, investments, and gains from selling assets. After that, you need to deduct allowable business expenses such as wages, rent, utility bills, and raw materials. The remaining amount is the company’s net taxable profit.

2) Check for Allowances and Relief

Companies may be able to reduce their taxable profits by claiming allowances and reliefs. So, apply any available allowances and tax reliefs, such as capital allowances or loss relief. These reduce your taxable profit and can significantly lower the overall tax liability.

3) Apply the Tax Rate

After determining the adjusted taxable profits, the relevant Corporation Tax rate is applied. If a company’s taxable profits are above £250,000, the main Corporation Tax rate of 25% applies. If its profits are below £50,000, it pays a lower rate of 19%. For companies earning between £50,000 and £250,000, marginal relief applies, which means the tax rate slowly increases from 19% up to 25% as profits rise.

4) Calculate the Amount Due

As a final step, calculate the total Corporation Tax payable and ensure it is reported and paid to HMRC within the required deadlines. This helps you avoid any penalties or interest due to late payments.

Marginal relief calculators can help businesses in the mid-profit range determine their exact liability. To ensure accuracy and compliance, many companies rely on accounting software or professional advice when submitting their Corporation Tax returns.

How Much is Corporation Tax in the UK?

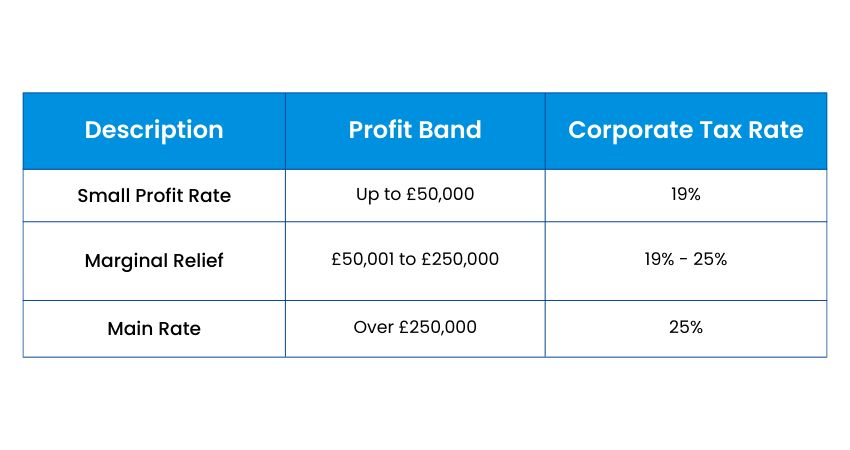

In the United Kingdom, Corporation Tax depends on a company’s profits. Here's a table defining the tax rate:

When Does Corporation Tax Have to be Paid?

Corporation Tax in the UK is normally payable within nine months and one day after the end of a company’s accounting period. This deadline applies to most small and medium-sized businesses. However, large companies with higher profits are required to pay their Corporation Tax in instalments, usually spread across the accounting year, rather than in a single payment.

Strengthen your understanding of financial planning with the Financial Management (FM) Course - Register today!

Benefits of Corporate Taxation

Corporate Taxation is not only a financial burden, but a key mechanism in maintaining and regulating economic relations as well as increasing business transparency. Contribution to public services and allowing deductions and Corporate Taxes pose the prospects for development while the firms meet their social responsibilities. Now that you know What is Corporation Tax, let’s check its benefits:

1) Encourages Financial Transparency: Companies need to come up with good financial records to build trust with the stakeholders and investors.

2) Deductions for Business Expenses: Larger firms can reduce their tax liability through allowances for all expenses necessary for business, rent for physical business premises, stationery, and other benefits to employees.

3) Supports Public Infrastructure: You fund public infrastructure such as roads, schools, healthcare, and transport systems. This supports economic stability and creates a stronger environment for businesses and communities to grow.

4) Incentives for Investments: Governments offer tax incentives to encourage businesses to invest in research, innovation, and environmentally friendly projects. This reduces the tax burden and motivates companies to support economic growth.

5) Stimulates Economic Growth: The earnings from corporate contributions are repurposed for subsidiaries, thus helping the growth of business and the economy.

How to Reduce Your Corporation Tax Bill?

Reducing your Corporation Tax bill involves making use of legitimate allowances and smart financial planning. Here are the ways you can do it with a proper understanding of What is Corporation Tax:

1) Claim Your Allowable Expenses

Ensure you claim all allowable business expenses, such as office costs, travel, utilities, and employee wages. These expenses reduce your taxable profits, which lowers the amount of Corporation Tax you need to pay. Remember to maintain a record of all these expenses.

2) Pay Yourself a Salary

Paying yourself a salary as a company director is an allowable business expense. This reduces company profits and, in turn, lowers the Corporation Tax bill, while also providing personal income.

3) Make Employer Pension Contributions

Employer pension contributions are usually tax-deductible and do not count as a taxable benefit for employees. Making contributions can reduce company profits while helping build long-term financial security.

4) Make an Early Payment to HMRC

Paying Corporation Tax early may allow your company to receive interest from HMRC. While it does not reduce the tax itself, it can slightly offset costs and help with cash flow planning.

Corporation Tax Deadlines

When it comes to Corporation Tax, deadlines are crucial if a company wants to avoid incurring penalties. Any business must register for Corporation Tax within the first three months of its trading or making some level of profits. This first step means that the business is acknowledged by the tax authorities and receives important notifications about its obligations.

Filing company tax returns is mandatory, and the reason is that the time limit within which the return has to be submitted is within the calendar year or 12 months after the end of the company’s accounting period. However, the Corporation Tax computation payment is normally due one day after the end of the accounting period, plus nine months.

What are the Late Filing and Payment Penalties?

If a company files its Corporation Tax return or pays its tax late, HMRC can charge penalties and interest. A late return usually results in an automatic £100 penalty, which increases if the delay continues. Further penalties may apply if the return is more than three, six, or twelve months late.

Late payment of Corporation Tax also attracts interest, which is charged daily from the payment deadline until the tax is paid in full. For long delays, HMRC may impose additional penalties based on a percentage of unpaid taxes.

Conclusion

Corporation Tax is a fundamental part of the UK business landscape and affects companies of all sizes. Ultimately, understanding What is Corporation Tax gives businesses greater control over their finances. Rather than viewing it as just an obligation, it can be managed strategically through proper planning, accurate reporting, and timely payments. With the right knowledge, businesses can remain compliant while focusing on growth and long-term success.

Develop advanced accounting skills with our ACA Professional Level Training – Explore now!

Have Any Question?

Have Any Question?

+44 7452 122728

+44 7452 122728

Back

Back

44 7452 122728

44 7452 122728