Table Of Contents

Ever searched your inbox for a missing invoice like it was buried treasure? Or played “guess the expense” with a crumpled coffee-stained receipt? If yes, it’s time to break up in chaos. Currently, new generation entrepreneurs are choosing Accounting Software for Small Business, that turns the financial mess into magic with just a few clicks.

Whether your side-hustling at midnight or running your empire on the go, you need tools to keep up. The best Accounting Software for Small Business saves time, cuts stress, and makes you look pro. This blog highlights top tools, key benefits, and pricing to help you choose the right fit.

Table of Contents

Top Accounting Software for Small Businesses

Intuit QuickBooks Online

Xero

Zoho Books

ZipBooks

FreshBooks

Sage

FreeAgent

Wave

Crunch

Cloud Books

Conclusion

Top Accounting Software for Small Businesses

Choosing the right accounting software can completely change how you manage your business finances. The best small business accounting software supports everything from invoicing and expense tracking to tax filing and real-time reporting, offering smart, time-saving features that make managing money easier, faster, and far less stressful.

1. Intuit QuickBooks Online

QuickBooks Online is one of the most popular accounting tools worldwide. It’s easy to use and designed with small business owners in mind.

Key Benefits:

Automates invoices and tax calculations

Offers real-time financial insights

Saves time with smart expense tracking

Supports payroll and employee payments

Connects easily with banks and apps

Pricing:

Starts Plan: £25.76/month (Simple Start)

Advanced Plan: £172.96/month

Payroll Add-on: £25.76- £58.88/month

2. Xero

Xero is a cloud-based accounting platform that’s very beginner-friendly. It’s especially useful for businesses that need to manage cash flow and collaborate with accountants.

Key Benefits:

Simplifies bank transactions

Enables smooth collaboration with accountants

Provides custom invoice templates

Supports unlimited users

Easy to scale as business grows

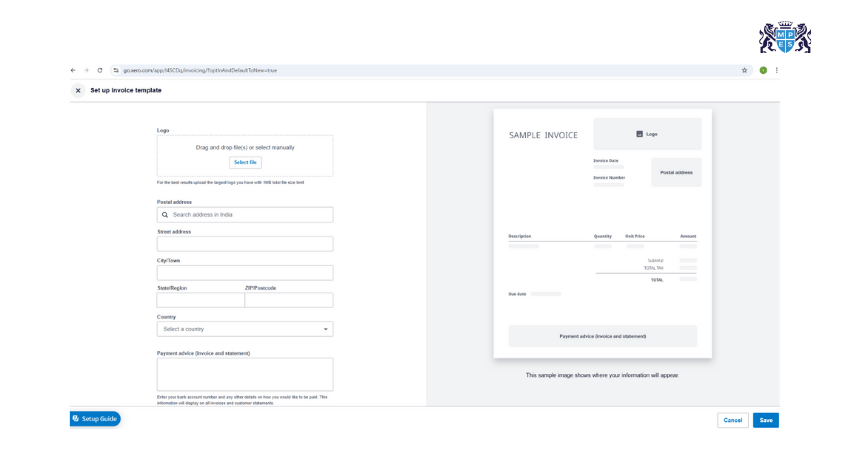

Xero Example

Pricing:

Early: £14.72/month

Growing: £34.59/month

Established: £58.88/month

Intro Offers: Up to 90% off for first 3 months

3. Zoho Books

Zoho Books is a powerful tool from the Zoho suite. It’s ideal for small businesses looking for affordability and rich features.

Key Benefits:

Supports local and global tax laws

Handles recurring billing with ease

Offers smart workflow automation

Tracks stock and orders efficiently

Integrates with other Zoho apps

Pricing:

Free plan available (3 users)

Paid (Global): £ 14.72- £81.70/month

Develop skills in cost analysis, planning, and financial decision-making. Join our Managing Costs and Finance (MA2) Course now!

4. ZipBooks

ZipBooks is a modern tool with a simple design and solid features. It has a free plan, which is great for new businesses.

Key Benefits:

Helps track business performance with smart insights

Offers built-in time tracking

Speeds up billing and payments

Categorises transactions automatically

Pricing:

Free plan

Paid: £11.04- £25.76/month

5. FreshBooks

FreshBooks is perfect for freelancers and service-based businesses. It’s easy to use and has excellent customer support.

Key Benefits:

Tracks time and expenses from mobile

Automates client billing

Simplifies project collaboration

Enhances client communications

Provides clean, user-friendly dashboard

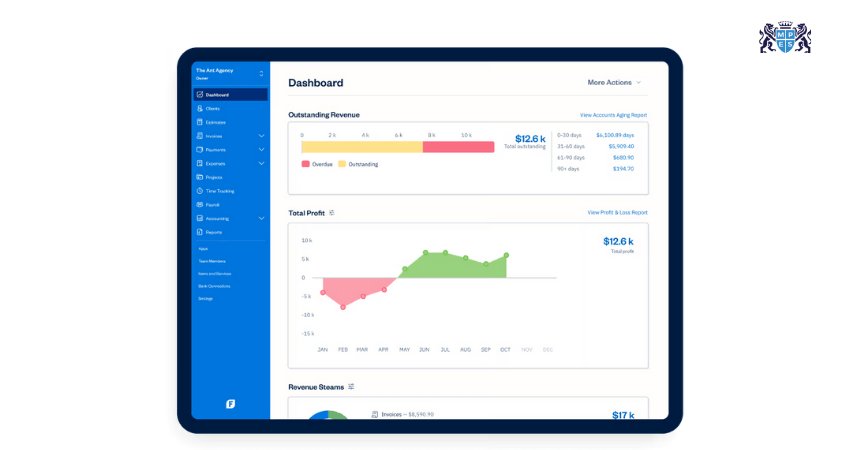

FreshBooks Example

Pricing:

Lite: £7.73/month

Plus: £13.98/month

Premium: £23.92/month

Select: Custom pricing

6. Sage

Sage Business Cloud Accounting is well known for its reliability and strong industry reputation. It offers essential features such as tax compliance and real-time reporting.

Key Benefits:

Gives real-time financial snapshots

Assists in forecasting cash flow

Automates tax and VAT filing

Offers strong compliance and audit features

Pricing:

Starts Price: £220.07/year (Pro Accounting)

Premium: £330.47/year

Quantum: £1103.27/year

7. FreeAgent

FreeAgent is tailored for freelancers, contractors, and small service providers. It simplifies invoicing, expense tracking, and tax management in one place.

Key Benefits:

Auto-generates tax estimates

Manages invoices and projects in one place

Simplifies bank reconciliation

Tracks time, mileage, and expenses

Pricing:

£16.50/month (first 6 months, then £33/month)

Annual Plan: £165/year (first year, then £330/year)

Free for NatWest, RBS, Ulster Bank, and Mettle customers

8. NCH Express Accounts

NCH Express Accounts is desktop-based software offering basic yet reliable features. It's ideal for small businesses needing offline accounting solutions.

Key Benefits:

Supports detailed financial reporting

Works offline with full control

Easy for small stores or service providers

One-time cost; no monthly fee

Pricing:

Free version available

Paid: £94.94 one-time license

Quarterly Plan: £6.50/month

Global Accounting Software Market

9. Wave

Wave is a completely free accounting solution with premium features for payment and payroll. It's perfect for freelancers and small businesses on a budget.

Key Benefits:

No-cost accounting and invoicing

Simple receipt capture

Syncs with bank accounts

Clean interface for solo entrepreneurs

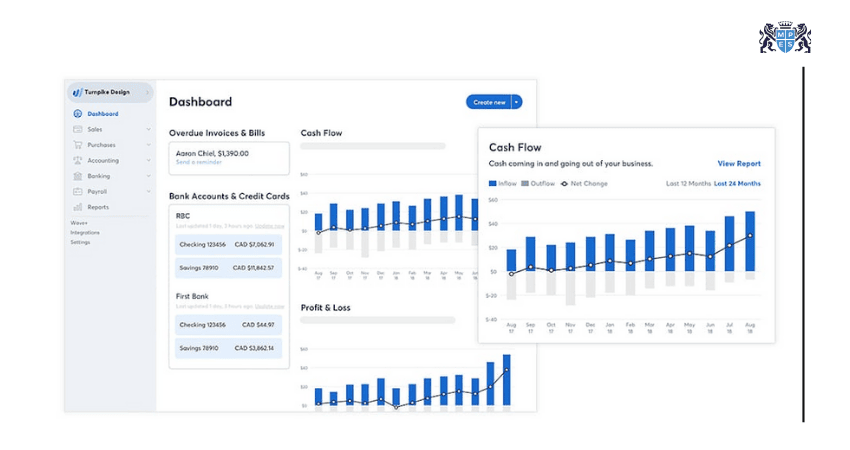

Wave Example

Pricing:

Accounting and Invoicing: Free

Payroll: Starts at £14.72/month

Pro Plan: £11.78/month

10. Crunch

Crunch is designed for UK freelancers and small businesses, providing all-in-one online accounting. It also includes expert support for tax filing and compliance.

Key Benefits:

Includes support from real accountants

Handles self-assessment and company taxes

Simplifies invoicing and reporting

Fully HMRC-compliant

Pricing:

Starts at £99/month

Includes expert accounting support

11. Cloud Books

CloudBooks is a simple cloud-based tool for small businesses and agencies. It offers invoicing, time tracking, and expense management on one platform.

Key Benefits:

Manages time, teams, and billing

Offers client portal and team tools

Helps track expenses in real-time

Affordable and easy to use

Pricing:

Free plan

Paid: £7.35- £14.71/month

Lifetime Plan: £735.27 one-time

Build essential skills in cost management and financial planning. Join our Foundations in Financial Management (FFM) Course now!

12. Odoo

Odoo offers much more than accounting. It’s part of a full ERP suite, combining finance, inventory, CRM, and project management in one system.

Key Benefits:

Works across accounting, CRM, inventory

Helps manage multiple companies

Customisable and modular

Cost-effective for scaling businesses

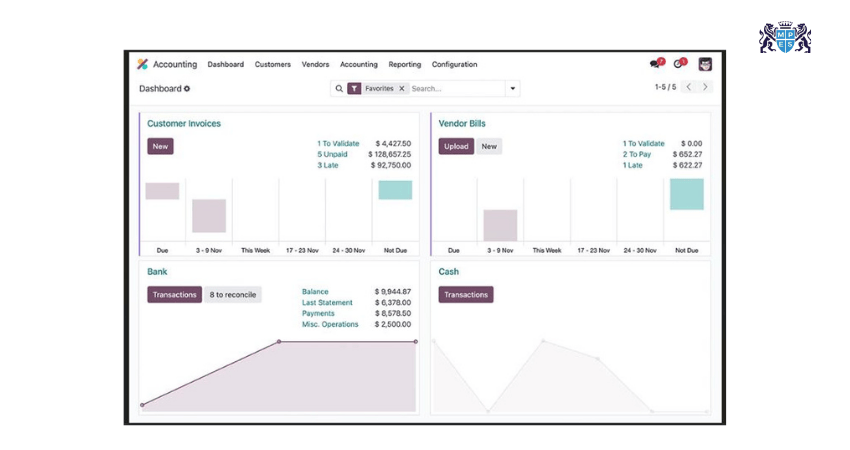

Odoo Example

Pricing:

Community Edition: Free

Enterprise: £18.33/month for all apps

13. Clear Books

Clear Books is a UK-based accounting software with a focus on simplicity and compliance. It’s ideal for small businesses needing VAT and HMRC support.

Key Benefits:

Built-in HMRC and VAT compliance

Easy online invoicing

Generates real-time financial reports

Handles payroll as an add-on

Pricing:

Small: £15/month

Medium: £31/month

Large: £32.80/month

14. Tide

Tide is a modern business banking app that also includes built-in accounting features. It simplifies expense tracking, invoicing, and VAT management.

Key Benefits:

Combines banking and bookkeeping

Tracks expenses automatically

Supports VAT and invoicing

Quick setup for new businesses

Pricing:

Free plan available

Paid Plans: £3.50-£69.99/month

15. Akaunting

Akaunting is free and open-source, great for businesses that want control and no recurring fees. It supports multi-currency, invoicing, and expense tracking.

Key Benefits:

No monthly fee if self-hosted

Full ownership of data

Supports vendors, customers, and multi-currency

Easy upgrade to cloud plan

Pricing:

Open Source: Free

Cloud Version: £5.89- £106.72/month

16. Brightbook

Brightbook is a free and minimalist accounting tool for freelancers and micro-businesses. It focuses on simple invoicing, expense tracking, and reporting.

Key Benefits:

Super simple and clutter-free

Great for freelancers with basic needs

Easy setup, no training needed

Brightbook Example

Pricing:

100% Free

17. Ember

Ember is a UK-focused software designed to automate accounting for freelancers and startups. It simplifies tax filing, expense tracking, and bank integration.

Key Benefits:

Auto-fills and submits tax returns

Tracks income and expenses in real-time

Open Banking integrated

Saves time on bookkeeping tasks

Pricing:

Starting Plan: £7-£159/month

Full-service Plan: £1,749/year

Conclusion

Choosing the right Accounting Software for Small Business can save you time, reduce errors, and give you better control over your finances. Whether you need simple invoicing or full-featured tools, there’s a solution that fits your needs and budget. Explore your options, try a few demos, and pick the software that helps your business grow with confidence and clarity.

Develop essential skills in bookkeeping, ledgers, and double-entry systems. Join our Financial Accounting (FFA) Course now!

Have Any Question?

Have Any Question?

+44 7452 122728

+44 7452 122728

Back

Back

44 7452 122728

44 7452 122728