Table Of Contents

When it’s time to say goodbye to an asset, the story doesn’t end there. This is where Asset Disposal comes in as a transformative process. More than just about clearing spaces, it’s a strategic move that impacts your books and your bottom line. From selling old equipment to writing off damaged assets, it helps you record transactions correctly, stay compliant and reflect the true value of your organisation.

This blog explores the concept of Asset Disposal in detail, outlining how it’s a crucial part of managing a business’s financial health through real-world examples. So read on and master the financial art of letting go!

What is Asset Disposal?

Asset Disposal is the process of removing a fixed asset from a company's records. This can happen when an asset is sold, scrapped, donated, or no longer useful. It means the business no longer owns or uses that asset, and its value is removed from the balance sheet.

For example, if a company owns an old delivery van that breaks down often, they may decide to sell it or scrap it. When the van is sold, the company records the amount received and removes the van's cost and accumulated depreciation from its accounts. Any gain or loss from the sale is also recorded in the books.

Types of Asset Disposal

Here are the two common types of Asset Disposal used by businesses:

1) Normal Disposal

Normal Disposal happens when an asset is no longer useful and is either scrapped, sold, or given away. The company removes the asset from its records and notes any gain or loss from the transaction. This is often done when the asset is fully used or outdated.

2) Trading Disposal

Trading Disposal is when a business trades an old asset for a new one, often with a payment adjustment. The value of the old asset is used as part of the cost for the new item. This type of disposal is common with vehicles or machinery.

Transform your Asset Disposal knowledge today with our CIMA’s CGMA® Operational Level Course - Join today!

Important Components of an Asset Disposal Strategy

Here are the key parts to think about when planning how to dispose of a business asset:

1) Clear Asset Records: Keep up-to-date details about each asset, including its cost, age, and condition.

2) Proper Valuation Method: Use the right method to find the asset’s current or disposal value.

3) Compliance with Laws: Make sure the disposal follows legal and environmental rules.

4) Disposal Plan and Timeline: Set a clear process and deadline for removing or replacing the asset.

5) Cost Analysis: Check if the disposal will result in a gain or loss and plan the budget accordingly.

6) Documentation and Reporting: Keep all records of the disposal for financial and tax purposes.

Take charge of Financial Management with our CIMA’s CGMA® Managing Finance in a Digital World (E1) Course - Join today!

Methods to Determine the Disposal Value

Here are the ways businesses use to calculate the value of an asset before disposal:

1) Straight-line Method

This method divides the asset’s cost equally over the years it is used. It’s simple and commonly used when the asset loses value steadily each year. At the end of its life, the remaining value helps determine the disposal value.

Formula:

Disposal value = (Cost -Salvage Value) ÷ Useful Life

2) Double Declining Balance Method

This method reduces the asset’s value faster in the early years. It’s helpful when the asset loses more value at the beginning of its life. The remaining book value at the time of disposal gives its estimated disposal value.

Formula:

Disposal value = (2 × Straight-line Rate) × Book Value at Beginning of Year

Journal Entries for Asset Disposals

Journal entries for disposal vary depending on how the asset is removed from the company’s books. Here are three common scenarios that require different journal entries. For example, Motors Inc. Owns machinery recorded on its balance sheet at £3,000.

1) Scenario 1: Disposal of Fully Depreciated Asset

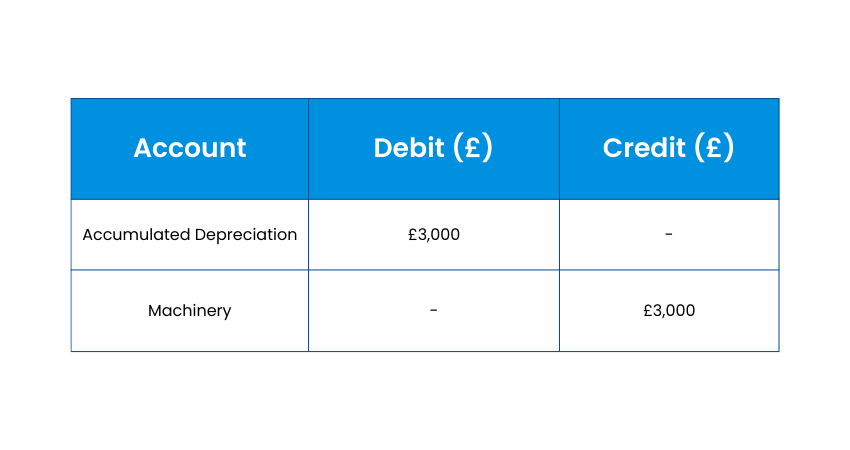

The machinery has a useful life of three years with an annual depreciation of £1,000, By the end of three years, the asset is fully depreciated. This means it must be removed from the books. Since the machinery account has a £3,000 debit balance and the accumulated depreciation has a £3,000 credit, both accounts must be written off. The journal entry will be:

2) Scenario 2: Disposal by Asset Sale with a Gain

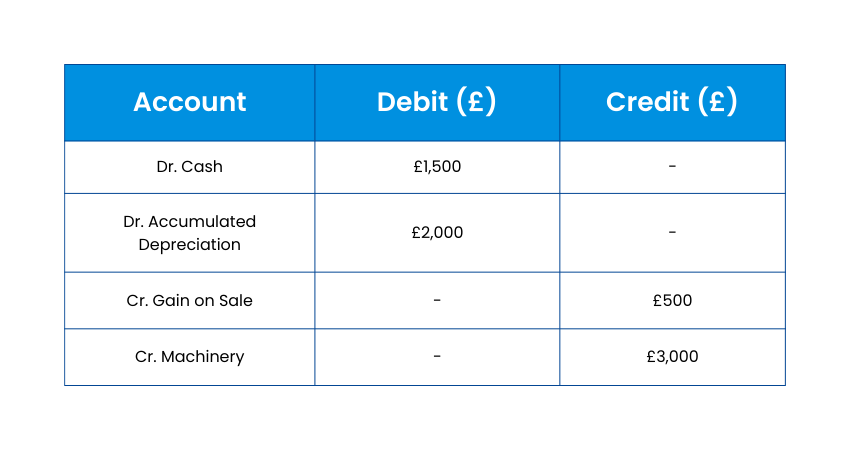

At the end of the second year, the accumulated depreciation is £2,000, leaving a book value of £1,000 (Book Value = £3,000 – £2,000). Let’s say Motors Inc. sells the machinery for £1,500. Since the sales price is higher than the book value, the company recognises a profit of £500. Here, the journal entry will be:

Scenario 3: Disposal by Asset Sale with a Loss

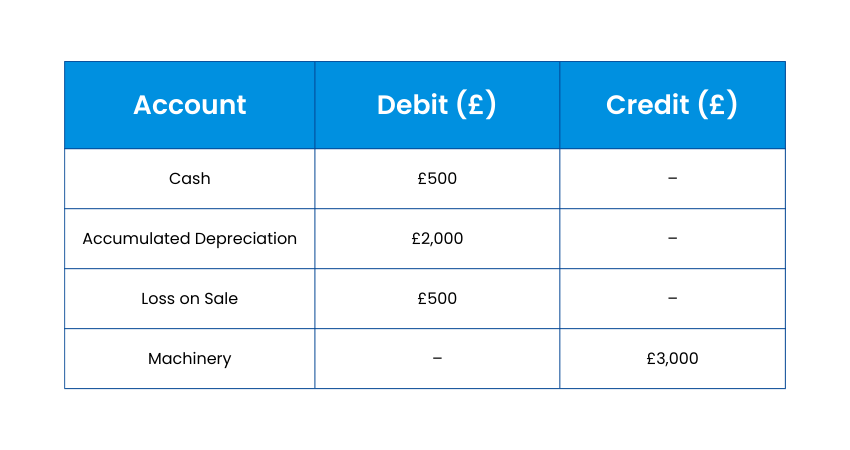

By using the same example from the second scenario, if the machinery is sold for £500, the business receives a £500 loss. It is because: Loss = Book Value of £1,000 – Sales Price of £500. Thus, the journal entry will be:

The Benefits of Disposing of an Asset

When assets are disposed of at the right time, it can provide plenty of advantages for a business. Let’s look at the key advantages of Asset Disposal:

1) Reduces Asset Management Costs

Old or unutilised assets require maintenance, storage, tracking and administrative oversight. All these add extra costs to Asset Management. By disposing of assets that have no functionality, businesses can cut expenses. This is valuable for companies that have large equipment inventories, such as construction or manufacturing firms.

2) Improves Inventory Tracking

Asset Disposal creates a clear end-of-period company record. After an asset is disposed of, its value is finalised and the entry is closed. This makes inventory tracking simpler, easier, and accurate. Also, proper disposals help to avoid cluttered records and helps to maintain an organised asset register.

3) Increases Company Revenue

Asset Disposal can generate income. If an asset holds value, a business can decide to sell it to another company at its disposal value. The money that is received can be invested again, helping to fund additional purchases. In this way, it not only removes outdated assets but also contributes to financial and operational growth.

Asset Disposal on Financial Statements

Here’s how Asset Disposal is shown in a company’s financial records:

1) The asset is taken off the balance sheet

2) Any money earned from selling the asset is recorded as income

3) If sold for more than its book value, the extra is listed as a gain

4) If sold for less, the difference is shown as a loss

5) Depreciation is stopped once the asset is disposed of

Examples of Asset Disposal

Some common examples of how businesses utilise Asset Disposal in different situations include:

End-of-life Disposal

This happens when an asset has reached the end of its useful life and can no longer be used. The asset may be scrapped, sold for parts, or donated if it still has minor value. It's a planned and expected form of disposal.

1) Old office computers sent for recycling

2) Broken machinery is scrapped after years of use

3) Worn-out vehicles are sold to junkyards

Unforeseen Disposal

This type of disposal happens suddenly and is not planned. It may occur due to accidents, natural disasters, or theft. The business may need to write off the asset unexpectedly.

1) Equipment damaged in a warehouse fire

2) A delivery van was lost in a road accident

3) Theft of valuable office equipment

Disposal with High Cost

Sometimes, getting rid of an asset costs a lot of money. This could be due to environmental rules or the need for special handling. It affects the business's expenses and may require budgeting.

1) Disposing of hazardous chemical waste

2) Removing old industrial equipment with safety risks

3) Paying fees to dismantle and remove large machines

Conclusion

Asset Disposal is a strategic decision that helps to enhance financial accuracy, boost operational efficiency, and support long-term business planning. Whether it is selling, scrapping, or trading an asset, understanding disposal value helps to avoid mistakes. By adopting the right strategy, businesses can save time, remain compliant and make the most of their resources.

Master future-ready asset planning with our CIMA’s CGMA® Financial Reporting Training (F1) Course - Join today!

Have Any Question?

Have Any Question?

+44 7452 122728

+44 7452 122728

Back

Back

44 7452 122728

44 7452 122728