Table Of Contents

If you've ever wondered where your money really goes in a business, then consider the Cash Flow Statement (CFS) your financial GPS. It's the watchful eyes of business finances tracking every pound in and out. From budding entrepreneurs to curious investors, understanding this statement is the key to a company’s financial health.

In this blog, we’ll decode the process of reading and preparing a Cash Flow Statement, so that you can turn any number into future-ready insights. So read on, follow the money trail, spot potential issues early, and make smarter business decisions.

What is a Cash Flow Statement?

A Cash Flow Statement (CFS) shows the movement of cash into and out of a business, offering insight into its financial health and operational efficiency. It helps identify whether a company is generating enough cash to support its activities, pay expenses, and maintain stability.

As one of the three main financial statements, the CFS works alongside the Income Statement and Balance Sheet to give a complete picture of an organisation’s performance. It highlights how effectively a business manages its cash, making it essential for assessing sustainability, liquidity, and long-term viability.

Importance of Cash Flow Statement

A Cash Flow Statement tracks actual cash movement, offering insights beyond the Income Statement and Balance Sheet. Its importance lies in:

1) Assessing liquidity and confirming whether the business can meet short-term commitments.

2) Supporting planning by forecasting cash positions and helping organisations prepare for seasonal fluctuations.

3) Presenting real cash activity by excluding non-cash accounting items gives a clearer view of financial health.

4) Guiding strategic decisions on expansion, financing, and investments.

5) Building confidence among investors and lenders by demonstrating steady operating cash flow.

6) Ensuring compliance with regulatory and reporting requirements for loans or public investors.

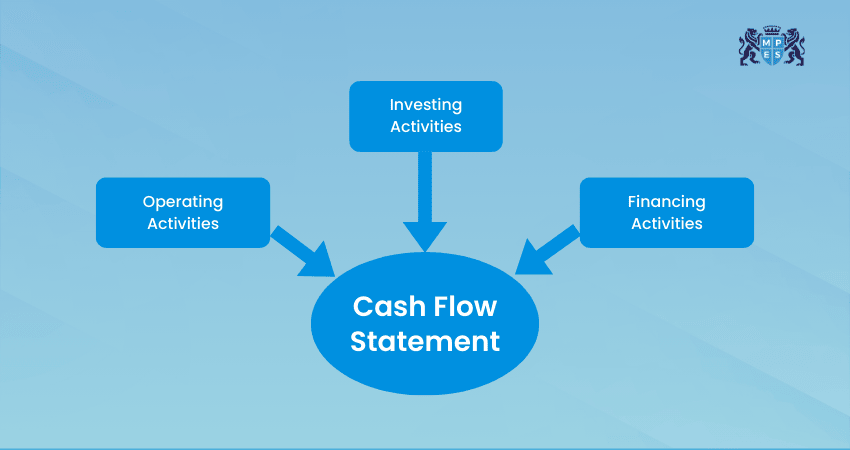

Structure of a Cash Flow Statement

Understanding the structure of a Cash Flow Statement is essential for analysing a company's financial health. This statement is broken down into three crucial sections. Let's explore them in detail:

1) Cash Flow from Operating Activities

The operating activities phase of the CFS encompasses all cash inflows and outflows arising from business operations. Essentially, it shows the cash generated from an organisation's products or services.

These activities can encompass receipts from sales, interest bills, profits tax payments, payments to suppliers, rents, salaries and wages, and other operating expenses.

2) Cash Flow from Investing Activities

Investing activities encompass all cash inflows and outflows related to a company's investments. This includes the purchase or sale of assets, loans given or collected, and cash movements related to acquisitions. Essentially, any changes involving equipment, long-term assets, or investments appear within this section.

Typically, changes in cash from investing are considered cash-out items, as funds are used to acquire new equipment, buildings, or short-term assets like marketable securities. However, when a company sells an asset, the transaction is regarded as cash-in for the purpose of calculating cash from investing.

3) Cash Flow From Financing Activities

Cash from financing activities encompasses funds sourced from traders and banks, in addition to payments made to shareholders. This includes dividends, inventory repurchases, and the compensation of loan principals. Changes in coins from financing are taken into consideration as cash inflows while capital is raised and coins outflows while dividends are paid.

For example, issuing a bond to the public generates coin financing for the company. Conversely, paying interest to bondholders reduces the organisation's cash. It's crucial to notice that while interest bills are cash-out expenses, they may be classified as operating and not financing activities.

Sign up for our ACA Professional Level Training, your gateway to becoming a trusted business advisor - Join now!

Types of Cash Flow Statements

Cash Flow Statements are prepared using two primary tactics: the direct method and the indirect method. Let's explore these methods in detail:

1) Direct Method

Under the direct method, all the cash inflows and outflows related to operating activities are listed explicitly for the reporting period. This method shows the exact sources and uses of cash, including receipts from customers and payments to suppliers and employees.

2) Indirect Method

The indirect method begins when the net income is reported on the income statement and is adjusted for non-cash expenses, such as depreciation and amortisation. To find the actual cash flow from operations, it also factors in changes in working capital components like accounts receivable, accounts payable and inventory.

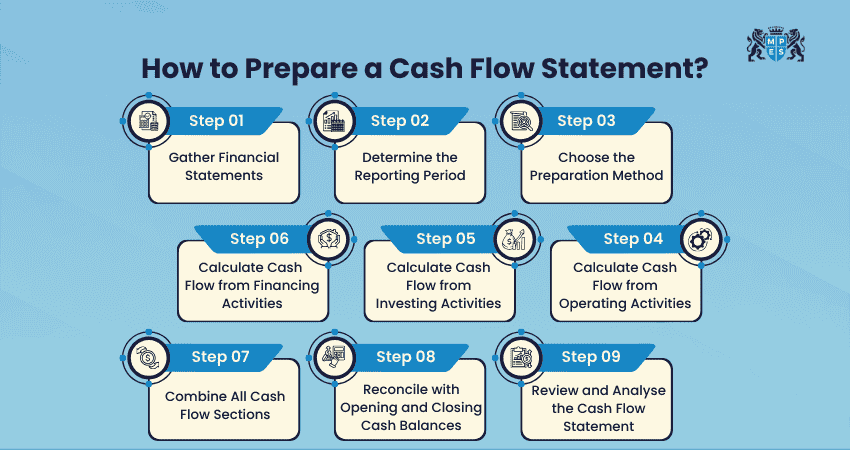

How to Prepare a Cash Flow Statement?

Preparing a Cash Flow Statement requires accurate financial data, a clear reporting period, and the right calculation method. Below are the essential steps to create a reliable and easy-to-understand Cash Flow Statement.

1) Gather Financial Statements

Start by collecting all relevant financial records, including the Income Statement, Balance Sheet, and detailed bank transactions. Identify figures such as net income, depreciation, amortisation, and changes in working capital. Having accurate data ensures a fully reliable Cash Flow Statement.

2) Determine the Reporting Period

Select the timeframe for the Cash Flow Statement, such as monthly, quarterly, or annually. This provides a clear basis for analysing cash movements.

3) Choose the Preparation Method

Select either the direct or indirect method. The direct method lists cash receipts and payments, while the indirect method adjusts net income for non-cash items and working capital changes. The choice depends on reporting needs and accounting guidelines.

4) Calculate Cash Flow from Operating Activities

Identify all cash inflows and outflows from normal business operations. Depending on your chosen method, list cash receipts and payments (direct method) or adjust net income for depreciation, amortisation, and working capital movements (indirect method). This step shows how much cash your core business actually generates.

5) Calculate Cash Flow from Investing Activities

Record cash used for long-term investments, such as purchasing equipment, property, or financial assets. Also include inflows from selling assets. This section highlights how much the business is spending on future growth.

6) Calculate Cash Flow from Financing Activities

Identify cash inflows from issuing shares, taking loans, or raising capital. Include outflows such as dividend payments, share buybacks, and loan repayments. This gives insight into how the business funds its operations and expansion.

7) Combine All Cash Flow Sections

Add together the totals from operating, investing, and financing activities to determine the overall net change in cash for the period. This figure shows whether the business generated or used cash during that timeframe.

8) Reconcile with Opening and Closing Cash Balances

Add the net change in cash to the opening cash balance. The result must match the closing cash balance reported on the Balance Sheet. This reconciliation confirms the accuracy of your Cash Flow Statement.

9) Review and Analyse the Cash Flow Statement

Evaluate the final Cash Flow Statement for trends or red flags. Look for recurring negative operating cash flow, declining liquidity, or inconsistency between profit and cash generation. Use this analysis to improve budgeting, manage financing needs, and strengthen long-term financial planning.

Advance your ACA success - register in Financial Accounting and Reporting (FARI) Training now to master financial accounting and reporting.

Strategies for Improving Cash Flow

Here are some effective strategies to strengthen your cash flow management:

1) Conduct Customer Credit Checks: Assess the customer’s creditworthiness before extending credit to minimise the risk of delayed or missed payments. Implementing credit limits can reduce potential defaults.

2) Lease Instead of Buy: Opting to lease assets such as equipment, property or vehicles can spread the costs over time rather than requiring large upfront investments. This approach preserves liquidity and allows for easier upgrades.

3) Offer Discounts for Early Payment: You can encourage quicker payments by offering small discounts to customers who pay before due dates. This tactic can boost immediate cash inflows and client relationships through mutual financial benefit.

4) Improve Inventory Management: You must regularly review stock levels to eliminate any obsolete or slow-moving items. This can free up capital tied up in excess inventory.

5) Send Invoices Promptly: Issue the invoices immediately after goods or services are delivered and specify clear payment terms. Timely billing supports a healthier cash position.

6) Utilise Electronic Payments: Use online payments and credit facilities to extend the payment cycles and simplify transactions. This approach provides short-term liquidity advantages and improves overall payment efficiency.

7) Negotiate with Suppliers: Discuss flexible payment schedules or early-payment discounts with suppliers. Strong negotiation helps align cash outflows with inflows and fosters beneficial long-term partnerships.

8) Form Buying Cooperatives: Partner with other businesses to purchase supplies in bulk and reduce costs through shared discounts. Collaborative buying power strengthens bargaining leverage.

9) Increase Pricing Strategically: Gauge market trends and gradually adjust the prices to reflect value and costs. Thoughtful pricing improvements can increase profit margins without deterring loyal customers.

10) Establish Lines of Credit: Secure a credit line to cover temporary cash shortages. Having financial backup ensures business continuity during low-revenue periods or unexpected expenses.

Cash Flow Statement Example

Given below is an example of a Cash Flow Statement:

This example of a CFS indicates that the net cash flow was £1,217,600 for the 2024 fiscal year. The majority of the positive cash flow originates from cash earned through operations, which is a positive indicator for investors. It signifies that core operations are generating revenue and that there is sufficient money to purchase new inventory.

The acquisition of new equipment demonstrates that the company has the cash to reinvest in itself. Finally, the amount of cash available to the company should reassure investors regarding the notes payable, as there is ample cash to cover that future loan expense.

Cash Flow Statement vs Income Statement vs Balance Sheet

Understanding the key differences between the Cash Flow Statement, Balance Sheet, and Income Statement is necessary for thorough Financial Analysis. Here are five key differences, with connecting words to highlight the contrasts:

1) Purpose: While the Cash Flow Statement outlines the cash inflows and outflows over a certain period, the Income Statement summarises the company's revenues and expenses to show net profit or loss. On the other hand, the Balance Sheet delivers a clear snapshot of a company's financial position at any specific point in time, outlining assets, liabilities, and equity.

2) Time Frame: Both the Cash Flow Statement and Income Statement cover a specific period, such as a quarter or a year. However, the Balance Sheet represents the financial position at a single point in time, offering a static view rather than a dynamic one.

3) Components: The Cash Flow Statement is categorised into three sections: operating activities, investing activities, and financing activities. In contrast, the Income Statement includes revenues, expenses, gains, and losses, culminating in net income. Meanwhile, the Balance Sheet is structured into assets, liabilities, and shareholders' equity.

4) Cash vs Accrual Basis: The Cash Flow Statement records transactions based on actual cash movements, whereas the Income Statement adheres to the accrual accounting method, recognising revenues and expenses when they are earned or incurred, regardless of cash flow. Similarly, the Balance Sheet reflects the accrual basis, showing receivables and payables.

5) Financial Health Indicators: The Cash Flow Statement is crucial for assessing liquidity and cash management. In contrast, the Income Statement is vital for evaluating profitability and operational performance. However, the Balance Sheet is key to understanding the company's overall financial stability and capital structure.

Master Financial Management – register in Financial Management (FM) Training now to strengthen decision-making and strategic planning skills.

How to Enhance Decision-making with Cash Flow Statement?

A Cash Flow Statement is an essential economic document that offers insights into the inflows and outflows of cash within a business enterprise. Here are a few methods to leverage the cash flow announcement for better decision-making:

1) Evaluate Liquidity: Use the Cash Flow Statement to evaluate the organisation's liquidity through analysing cash flows from operating activities, making sure the company can meet short-term duties.

2) Identify Cash Flow Patterns: Regularly review cash flow statements to spot developments and styles in cash inflows and outflows, helping in correct forecasting and making plans for future cash requirements.

3) Assess Investment Feasibility: Leverage insights from the cash flow declaration to assess the corporation's capability to generate coins, supporting the determination of the viability of the latest funding opportunities.

4) Monitor Financial Health: Compare cash flow from operating activities with internet earnings to gauge the best of income and perceive potential troubles like poor receivables control or excessive stock levels.

5) Manage Debt and Financing: Analyse cash flows from financing activities to understand the employer's debt management strategy and its potential to handle economic responsibilities successfully.

Conclusion

Mastering the Cash Flow Statement is essential for understanding your company's financial health. By tracking cash inflows and outflows, you can make informed decisions, which foster growth and stability. Start creating your own CFS today and take control of your financial future!

Think big and lead with tech-driven insight. Sign up for our Business Strategy and Technology (BST) Training and shape tomorrow’s business world

Have Any Question?

Have Any Question?

+44 7452 122728

+44 7452 122728

Back

Back

44 7452 122728

44 7452 122728