Table Of Contents

Have you ever thought about what happens when a business gets paid before delivering a service or product? That money isn’t counted as income right away. Instead, it’s recorded as Deferred Revenue, a concept that plays a key role in Financial Reporting.

Understanding how Deferred Revenue works not only helps businesses stay transparent but also improves cash flow management and reduces the risk of accounting errors. In this blog, we’ll break down what it means, why it matters, and how to handle it with confidence.

Table of Contents

1) What is Deferred Revenue?

2) Characteristics of Deferred Revenue

3) Why is Deferred Revenue Considered a Liability?

4) Why Companies Record Deferred Revenue?

5) What are the Principles Involved in Deferred Revenue?

6) Accounting for Deferred Revenue

7) Deferred Revenue Journal Entry Example (Debit or Credit)

8) Impact of Deferred Revenue on Financial Statements

9) Examples of Deferred Revenue

10) Deferred Revenue vs Accrued Revenue

11) How to Manage and Track Deferred Revenue?

12) Risks of Deferred Revenue and Ways to Reduce Them

13) Benefits of Correct Deferred Revenue Management

14) Conclusion

What is Deferred Revenue?

Companies record Deferred Revenue to reflect income that hasn’t yet been earned. When a customer pays in advance for a product or service, the amount is listed as a liability, showing that the business still owes the delivery. This approach prevents inflated revenue figures and ensures financial records remain clear and accurate. By doing this, companies follow the principle of recognising income only when the obligation is fulfilled.

Recording Deferred Revenue also supports better financial planning and decision-making. It provides a clear view of upcoming responsibilities and ensures compliance with accrual accounting standards. This method is especially useful for businesses that rely on subscriptions, retainers, or long-term service contracts. It helps manage cash flow, meet reporting requirements, and maintain financial transparency.

Characteristics of Deferred Revenue

Deferred Revenue plays a crucial role in financial reporting. Here are its key characteristics that help businesses manage income accurately:

1) Deferred Revenue is money received in advance before a company delivers goods or services.

2) It is recorded as a liability on the balance sheet because it represents an accountability to the customer.

3) The revenue is recognised gradually as the company fulfils its delivery or service obligations.

4) Deferred Revenue is commonly found in industries with prepaid or subscription-based models.

5) Companies must make adjusting journal entries to recognise the earned portion over time.

Why is Deferred Revenue is Considered a Liability?

Deferred Revenue is a liability as the company has been paid for services or products it has not delivered. It owes a product, value, or service to a customer in the future. The company cannot consider the money as earned revenue until it honours its commitment.

Rather, it is on the balance sheet as a liability, representing the company's obligation to provide what has been committed. Once the service is rendered or the product is handed over, the Deferred Revenue is then accounted for as real revenue in the income statement.

Why Companies Record Deferred Revenue?

Companies record Deferred Revenue to show that they have received payment for goods or services they haven’t delivered yet. For instance, when a customer pays upfront for a one-year software subscription or a training programme, the business cannot treat that payment as earned income right away.

Instead, it is recorded as Deferred Revenue until the service is fully delivered over time. This helps maintain accurate financial records, prevents overstating profits, and ensures compliance with accounting standards. It also gives investors a clearer view of the company’s financial position. By tracking revenue properly, businesses can plan better and build long-term trust with stakeholders.

Start Managing CIMA’s CGMA® Managing Performance (E2) Training today and become a trusted advisor in business performance

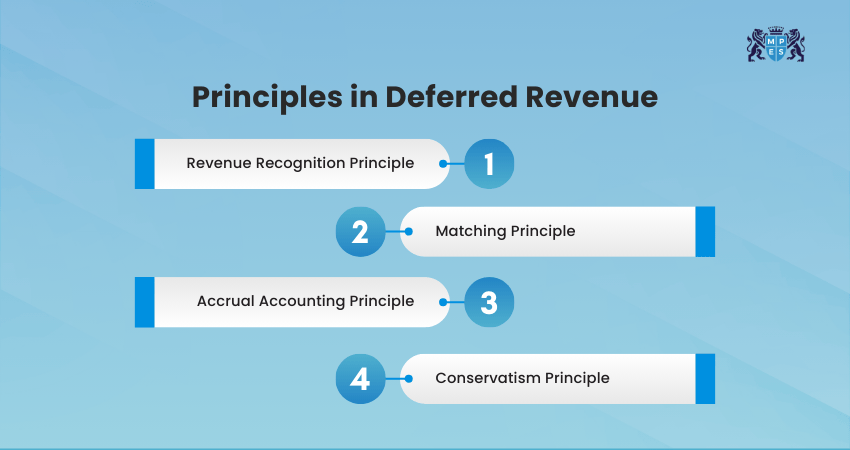

What are the Principles Involved in Deferred Revenue?

Deferred Revenue follows some main accounting principles that help companies show their real financial situation correctly. These are:

1) Revenue Recognition Principle

This principle explains that revenue should be recorded only after it has been earned. When a customer pays in advance, the business waits to record it as income until the promised product or service is fully delivered.

2) Matching Principle

This principle ensures that income and related expenses are recorded in the same accounting period. Deferred Revenue follows this by recognising income only when the promised service or product is delivered.

3) Accrual Accounting Principle

This principle states that transactions are recorded when they happen, rather than when cash is received. Payments made in advance are treated as a liability until the company delivers the agreed product or service.

4) Conservatism Principle

This principle ensures that income is not reported too early. Deferred Revenue helps businesses stay cautious by recognising income only after it is earned. It prevents overstating profits and ensures financial statements remain realistic and trustworthy.

Accounting for Deferred Revenue

Imagine a company that provides annual software support to its customers. The service costs £1,200 per year, and customers pay the full amount in January. The support service runs from January to December.

1) Initial Transaction (June)

When a customer pays £1,200 in January, the company records:

a) Debit: Cash £1,200

b) Credit: Deferred Revenue £1,200

Here, the company’s cash increases because it has received payment, but it also records a liability, since it still owes a year of service to the customer.

2) Monthly Recognition (July to December)

Each month, as the company provides the service, it recognises £100 (£1,200 ÷ 12) as earned income:

a) Debit: Deferred Revenue £100

b) Credit: Revenue £100

This means that every month, Deferred Revenue decreases by £100, while the same amount is recorded as actual income.

3) Final Position (December)

By December, the company will have:

a) Recognised all £1,200 as earned revenue

b) Reduced Deferred Revenue to £0

This shows that the company records income gradually as it delivers the service, ensuring the accounts reflect what has truly been earned.

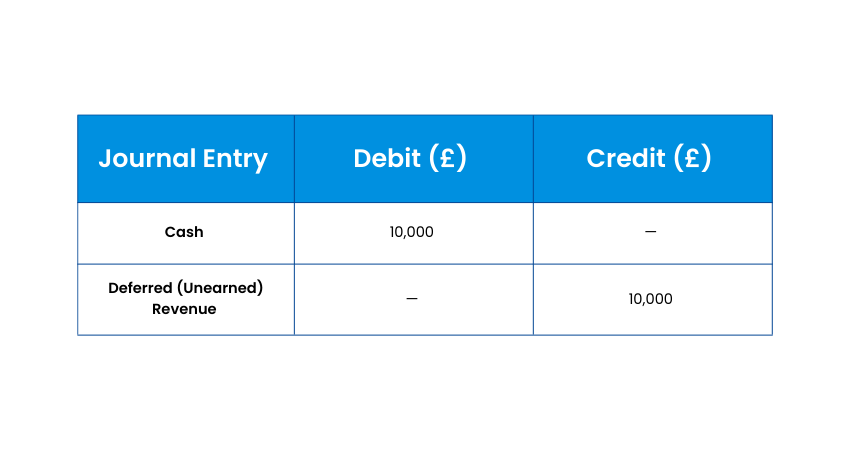

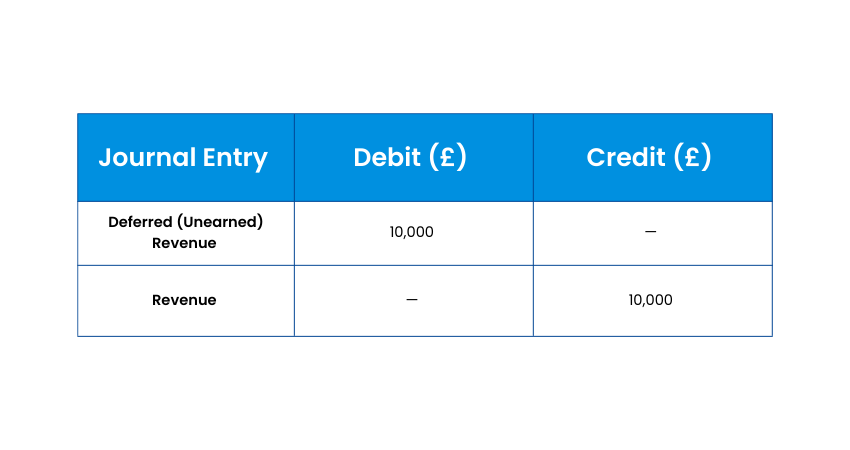

Deferred Revenue Journal Entry Example (Debit or Credit)

A journal entry records money movement between accounts. For example, if a company gets £10,000 in advance for future services, it records it as Deferred Revenue until the service is provided. Here’s how it appears in the accounts.

1) When Payment is Received:

The company gets the cash but hasn’t earned the income yet, so it records:

Here, cash increases because the company received money, and Deferred Revenue increases because it still owes the customer the service.

2) When the Service is Delivered:

After the company completes the service, it recognises the income by moving the amount from Deferred Revenue to actual revenue:

Now, the liability decreases, and the income (revenue) increases, showing the company has earned the payment.

Impact of Deferred Revenue on Financial Statements

Understanding how Deferred Revenue affects financial statements is essential for accurate reporting, compliance, and informed business decisions. Below are the key ways it impacts both the balance sheet and income statement.

1) Balance Sheet Impact

On the balance sheet,Deferred Revenue is shown as a liability because it represents goods or services the company still owes. It reflects an obligation rather than earned income. This ensures that unearned revenue is not mistakenly treated as profit.

2)Income Statement Impact

As the company delivers the product or service, portions of Deferred Revenue are recognised as earned revenue on the income statement. This gradual recognition aligns with accrual accounting principles, ensuring revenue is reported in the period it is earned.

3) Prevents Overstated Profits

Recording revenue only when earned prevents inflated profit figures. It ensures the company’s reported earnings are accurate and reflective of actual performance.

4) Supports Compliance and Transparency

Properly accounting for Deferred Revenue supports compliance with standards. It also improves financial transparency and builds trust among investors and stakeholders.

5) Enhances Financial Planning

By clearly identifying future revenue, businesses can manage cash flow, plan budgets more accurately, and make better strategic decisions.

Commit to the CIMA’s CGMA® Management Level Case Study Course journey now and boost your professional impact

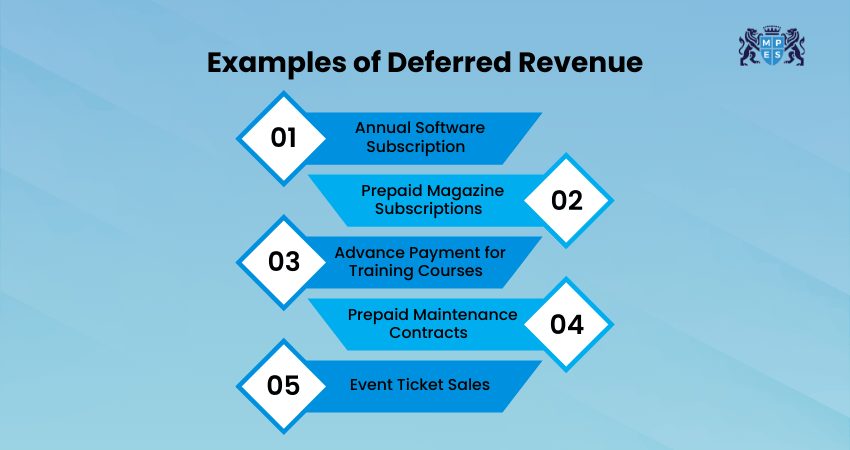

Examples of Deferred Revenue

Deferred Revenue can be found in many everyday business situations where payment is received before the work is done. Here are five simple examples to show how it works in practice:

1) Annual Software Subscription

A customer pays upfront for a 12-month software plan. The company does not count the full amount as income right away. Instead, it recognises one month at a time as the service is delivered.

2) Prepaid Magazine Subscriptions

A publisher receives full payment in January for a year’s worth of monthly magazines. Each issue delivered earns a portion of the total payment, which is recognised as revenue month by month.

3) Advance Payment for Training Courses

A business pays in advance for a workshop that will take place next quarter. The training company records this as Deferred Revenue and only recognises it once the session is completed.

4) Prepaid Maintenance Contracts

A client signs a one-year maintenance deal and pays upfront. The service provider spreads the revenue evenly across the year, recognising it month by month as service is provided.

5) Event Ticket Sales

Tickets for a seminar are sold three months before the event. The money is received in advance, but it only becomes revenue once the event actually takes place.

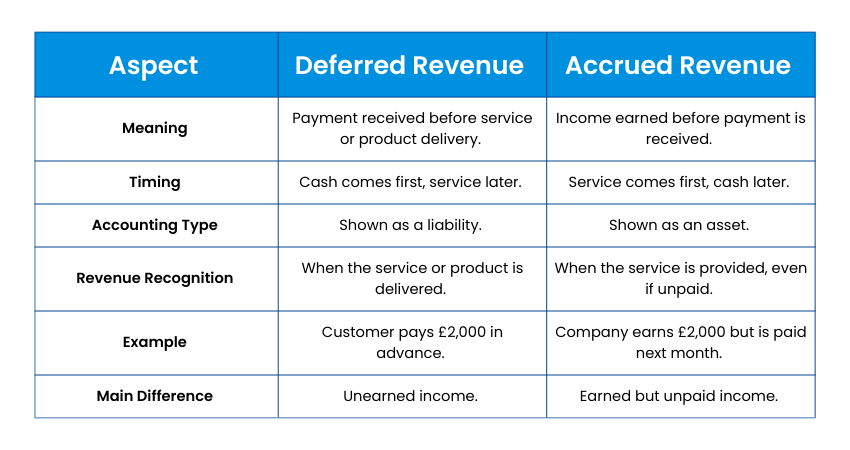

Deferred Revenue vs Accrued Revenue

Deferred and accrued revenue both relate to when income is recorded, but they’re opposites. Deferred Revenue means payment comes before service, while accrued revenue means service comes before payment. Here’s a clear comparison:

How to Manage and Track Deferred Revenue?

Managing Deferred Revenues helps a business record income at the right time and keep its accounts clear. Here are some ways to do it:

1) Keep Clear Records: Write down every advance payment you receive, what it is for, and when the service or product will be delivered.

2) Use Accounting Software: Use reliable Accounting Software that can record and update it automatically each month as you earn it.

3) Make a Revenue Schedule: Create a simple plan showing how much of the Deferred Revenue will be recognised each month. This keeps your income spread correctly over time.

4) Check Customer Agreements: Go through each customer agreement to know when the service is considered complete. Record income only after you meet those terms.

5) Review Regularly: Check your Deferred Revenue records as often as possible and compare them with your actual work and payments received. This ensures your accounts stay correct.

6) Follow Accounting Rules: Make sure your revenue reporting follows official accounting guidelines such as IFRS or GAAP.

Gain advanced Management Accounting expertise with our CIMA’s CGMA® Advanced Management Accounting (P2) Training – Register now!

Risks of Deferred Revenue and Ways to Reduce Them

Deferred Revenue means money a company gets before giving its product or service. It sounds simple, but if not managed well, it can create problems with money tracking and customer trust. Here are the main risks and how to handle them.

1) Inaccurate Reporting

If Deferred Revenue is recorded wrongly, the company’s earnings may look higher or lower than they really are. For example, if a company gets £12,000 for a year of service and counts it all as income right away, its profit will look too high at first.

How to fix it:

Record income only when the service or product is given. Using simple Accounting Software can help spread income evenly across the service period.

2) Audit Challenges

When records are unclear, checking accounts become difficult. For example, if payments and services are mixed up, it can be hard to prove when each service was delivered.

How to fix it:

Keep all contracts, receipts, and service records organised. This makes it easy to show when payments were received and services completed.

3) Unclear Cash Flow

Getting money early can make a business think it has more to spend than it really does. For example, a gym that collects yearly fees in January might spend too much at once and later struggle to cover running costs.

How to fix it:

Separate advance payments from real income. Check regularly how much money has been earned and how much is still owed in services.

4) Managing Customer Expectations

Customers who pay early expect good service and clear communication. If services are delayed or poorly managed, they may lose trust or ask for refunds.

How to fix it:

Deliver products or services on time and keep customers informed about any changes. Always make sure what you promise matches what you provide.

Benefits of Correct Deferred Revenue Management

Effective management of Deferred Revenue offers several critical advantages for maintaining financial integrity and supporting strategic decision-making. The following points highlight its key benefits:

1) Management of Deferred Revenue ensures that income is only recorded when the related goods or services have been supplied.

2) It avoids incorrect and inflated profit levels, providing a better understanding of the financial performance of the company.

3) It enhances the reliability of cash flow forecasts by explicitly defining when revenue will be earned in the future.

4) It guarantees adherence to accepted accounting standards like IFRS 15 and ASC 606, lowering regulatory risks.

5) Clear and uniform revenue recognition instils investor trust and signals excellent financial control.

6) It lessens the possibilities of accounting mistakes, for example, accounting for unearned revenue or forgoing earned revenue.

7) Keeping proper records enables companies to avoid unexpected problems during audits or financial checks.

8) It facilitates improved decision-making by providing management with a clear understanding of future revenue streams.

9) It assists in synchronising the delivery of services during the timing of revenue recognition, enhancing control of operations.

10) It favours stronger Financial Management and enables long-term business sustainability.

Conclusion

Deferred Revenue plays a vital role in accurate Financial Reporting and long-term planning. Properly managing it ensures compliance, builds investor confidence and supports sustainable growth. By recognising income at the right time, businesses can maintain transparency, avoid errors, and make well-informed financial decisions for continued success. It’s not just accounting; it’s a smart business strategy.

Join our CIMA’s CGMA® Management Level Course today and take your finance career to new heights.

Have Any Question?

Have Any Question?

+44 7452 122728

+44 7452 122728

Back

Back

44 7452 122728

44 7452 122728