Table Of Contents

Picture this: A business provides services today but gets paid next month. If it only recorded transactions when cash arrived, its financial reports might not truly reflect its earnings and expenses. This is where Accrual Accounting helps. But What is Accrual Accounting? It allows businesses to recognise revenue when earned and expenses when incurred, no matter when money is received or paid.

In this blog, we’ll explore What is Accrual Accounting, how it works, along with an example, as well as its advantages and disadvantages. So if you are wondering why businesses rely on this method, and how it impacts financial decision-making, you’ve come to the right place. Let’s dive in.

What is Accrual Accounting?

Accrual Accounting is a method where revenues and expenses are recorded when they are incurred or earned, not necessarily when cash is exchanged. This approach adheres to the matching principle, ensuring that income and expenses for a specific period are recorded in that same period. Compared to cash accounting, it offers a more precise view of a company's financial health.

In Accrual Accounting, revenue is recorded when goods or services are delivered, even if payment is received later. Similarly, expenses are recorded when incurred, not when paid. This ensures financial statements accurately reflect a company’s performance by aligning income and expenses within the same period.

This method helps businesses track profitability, manage obligations, and comply with financial reporting standards. It is widely used by larger companies with credit transactions, providing transparency for stakeholders and investors.

Why is Accrual Accounting Important?

Learning What is Accrual Accounting is essential because it records financial transactions in the period they occur, not when cash is received or paid. This provides a far more accurate view of a company’s financial position. For example, revenue from credit sales is recognised when the sale happens, even if payment comes later.

Likewise, expenses are recorded when they’re incurred, not when the bill is paid. This approach ensures income and costs are reported in the correct accounting period for tax and compliance purposes. Overall, it helps businesses make smarter decisions about budgeting, borrowing and operational planning.

How Accrual Accounting Works?

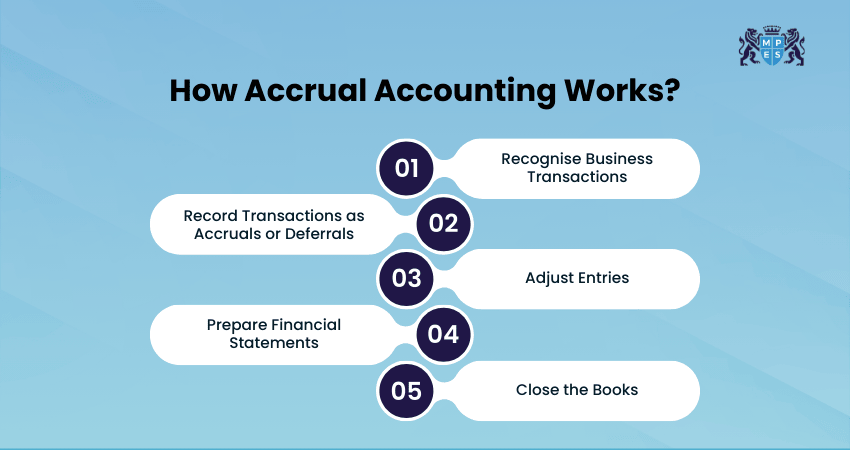

Now that you’ve learned What is Accrual Accounting and its importance, it’s time to learn how it works. Accrual Accounting follows a structured process to ensure accurate financial reporting. The key steps include the following:

1) Recognise Business Transactions

Any economic activity that affects the company’s financial position and can be reliably measured is treated as a transaction. Each transaction must be supported by verifiable evidence, such as invoices or receipts, to ensure accurate and traceable records.

2) Record Transactions as Accruals or Deferrals

Under the accrual method, revenues and expenses are recorded when earned or incurred, even if cash is received later. For example, unpaid wages at month-end are recorded as an expense and shown as a liability.

Cash received or paid in advance is recorded as a deferral. For example, an advance payment received from a customer is recorded as unearned revenue and recognised later when the service is delivered.

3) Adjust Entries

By the end of an accounting period, adjusting entries are posted to update accruals and deferrals. For instance, if rent remains unpaid, an entry records the rent expense and creates a liability balance, such as Rent Payable.

4) Prepare Financial Statements

Once adjustments are completed, financial statements are prepared. Under Accrual Accounting, these financial reports accurately show performance by matching revenues with related expenses in the correct period, giving a true measure of profit.

5) Close the Books

Finally, temporary accounts such as revenues and expenses are closed to a permanent account, typically Retained Earnings. This process ensures that the next accounting cycle starts with zero balances in temporary accounts and accurate cumulative balances in permanent accounts.

Gain essential ACA skills - join the Business, Technology & Finance (BTF) Course and excel!

Core Principles of Accrual Basis Accounting

Accrual Accounting is built on two key principles: the revenue recognition principle and the matching principle. Together, they ensure that a business reports a clear and accurate picture of its financial performance.

1) Revenue Recognition Principle

This principle states that revenue must be recorded when it is earned, not when payment is received. Imagine you run a digital marketing agency. You complete a client’s website redesign in November, but the client pays the invoice in December.

Under the revenue recognition principle, you record the revenue in November, because that’s when the service was delivered, even though the payment arrives later.

2) Matching Principle

The matching principle states that expenses must be recorded in the same period as the revenue they contribute to earnings. Suppose you operate a bakery and cater a large event in November.

You buy ingredients and pay staff overtime in the same month, but the event organiser pays you in December. According to the matching principle, all costs of producing the catering order should be recorded in November, the same period in which the revenue is earned.

Types of Accrual Accounting

Accrual Accounting encompasses various types of transactions that make sures financial statements reflect the true financial position of a company. The primary types include:

1) Accrued Revenue

Accrued revenue refers to income that has been earned but not yet received. This situation often arises in services provided on credit. For instance, a consulting firm may complete a project in March but receive payment in April. The revenue was recognised in March when the service was rendered.

2) Prepaid Expenses

Payments made before for goods or services that will be obtained later. These are recorded as assets until the benefit is realised. Common examples include insurance premiums or rent paid in advance. For example, if a company pays an annual insurance premium upfront, the payment is recorded as a prepaid expense and expensed monthly over the policy period.

3) Deferred Revenue

Deferred revenue, or unearned revenue, occurs when a business is paid before providing goods or services. This is recorded as a liability until the obligation is fulfilled. For example, a software company may receive payment for a one-year subscription in advance. The revenue is recognised monthly over the subscription period as the service is provided.

4) Accrued Expenses

Expenses incurred but not yet settled through payment. These are recorded as liabilities. Examples include wages earned by employees but not yet paid or utilities used but not yet billed. Recognising these expenses in the period they are incurred ensures accurate financial reporting.

Begin your Accounting career with our ACA Certificate Level – Join now!

Example of Accrual Accounting

Let's go through an example of Accrual Accounting to illustrate how it works in practice.

Consulting Services

Imagine a consulting firm, ABC Consultants, that provides services to a client. Here’s how Accrual Accounting would handle a specific transaction:

1) Scenario

a) Service Provided: ABC Consultants completes a project for a client on December 15th.

b) Invoice Sent: The firm sent an invoice for £7,900 on December 20th.

c) Payment Received: The client paid the invoice on January 10th.

2) Accrual Accounting Entries

a) December 15th: Service is provided.

No entry has been made yet because the revenue will not be recognised until the invoice is sent.

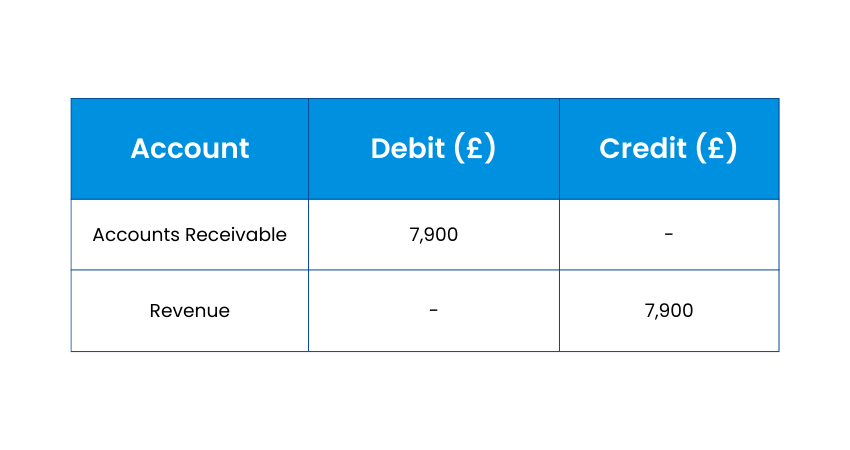

b) December 20th: Invoice is sent

The revenue is recognised when the invoice is sent, not when the payment is received.

Journal Entry

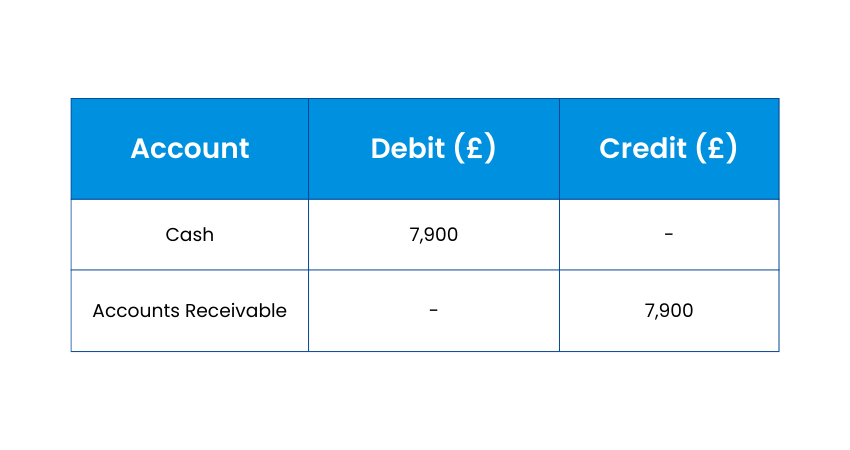

4) January 10th: Payment is Received

Cash Receipt: When the payment is received, it is recorded as a reduction in receivables.

Journal Entry:

This entry records the cash received and clears the amount owed by the client.

5) Explanation

1) Revenue Recognition: The revenue of £7,900 is recognised in December when the service is provided, and the invoice is sent, even though the cash is received in January.

2) Matching Principle: Any expenses related to the project (e.g., employee wages, materials) would also be recorded in December to match the revenue earned.

Master financial insights with the Management Information (MI) Course – start your journey to success now!

Advantages of Accrual Accounting

Accrual Accounting offers numerous benefits, making it a smart choice for a range of businesses. Here are its key advantages:

1) Informed Financial Planning

By matching the expenses to the revenue they generate, Accrual Accounting helps businesses clearly assess profitability. This accuracy supports better budgeting and forecasting.

2) Budget Control

Since expenses are linked directly to specific revenues, it becomes easier to spot overspending and adjust accordingly. This improves resource allocation and helps maintain financial discipline in Accrual Accounting.

3) Effective Project Tracking

For long-term contracts, Accrual Accounting aligns revenue and costs with the actual work completed. This allows businesses to monitor project progress, evaluate margins and understand long-term profitability.

4) A Clearer Financial Picture

Accrual Accounting records income and expenses when they occur, not when cash moves. This provides a more accurate view of financial performance, especially for businesses that offer credit or handle long-term projects.

5) Better for Funding and Investment

Since Accrual Accounting aligns with Generally Accepted Accounting Principles (GAAP) standards, lenders and investors trust it more. Companies seeking funding or expansion often benefit from the increased transparency and credibility it provides.

6) Clearer Reporting for Stakeholders

Accrual Accounting offers transparent reporting that helps investors, lenders and partners assess company stability, operational efficiency and financial direction.

Kickstart your ACA Taxation Journey – gain expertise and elevate your future with our Principles of Taxation (PTX) Course now!

Disadvantages of Accrual Accounting

Despite offering a detailed view of financial performance, Accrual Accounting does come with some drawbacks that should be considered.

1) Time-intensive Record-keeping

Tracking receivables, payables, and adjustments can increase administrative work. Without proper systems, this process may overwhelm small businesses.

2) Potential Cash Flow Mismatch

Revenue may be recorded before cash is received, which can create the impression of profitability even when working capital is tight, increasing cash flow risk.

3) Increased Complexity

Accrual Accounting requires deeper accounting knowledge and precise record-keeping. Smaller businesses may find it challenging and often need specialised tools or professional assistance.

4) Higher Costs and Resources Needed

The added complexity of Accrual Accounting often means investing in software, bookkeeping services or accounting staff. For very small operations, these extra costs may outweigh the benefits.

5) Delayed Cash-based Feedback

Sales are recognised immediately, even if payments are delayed. This may slow down decisions related to spending, investment and financial planning.

Accrual Accounting vs Cash Accounting

Accrual Accounting differs from Cash Accounting, which records transactions only when money is actually received or paid. The two methods vary in both when and how transactions are recognised, leading to very different pictures of a business’s financial activity. The table below outlines the difference between Accrual Accounting and Cash Accounting

Best Practices for Accrual Accounting

Here are some best practices for Accrual Accounting to ensure accuracy and efficiency:

1) Follow a Close Checklist and Calendar: Maintain a detailed checklist and calendar for closing the books each month. This helps ensure accountability and timeliness.

2) Verify Expenses and Revenue with Operations Team: Collaborate with your operations team to understand the activities during the month. This ensures that all the revenues and expenses are accurately recorded for the purposes of Accrual Accounting.

3) Review Payables and Receivables Ageing Monthly: Regularly review the ageing of accounts payable and receivable to manage cash flow effectively and identify any overdue accounts.

4) Enforce Segregation of Duties: Implement segregation of duties to prevent fraud and errors. Different individuals should handle different aspects of financial transactions.

5) Review Reconciliations and Financial Statements: Regularly review reconciliations and financial statements to enhance accuracy and completeness. This includes reconciling bank statements, accounts receivable, and accounts payable.

6) Define Materiality Threshold: Establish a materiality threshold to determine the significance of financial transactions. This helps focus on the most impactful items and ensures efficient use of resources.

7) Prepare Annual Budget and Forecasts: Develop an annual budget and regularly update forecasts to plan for future financial needs and track performance against goals.

8) Conduct Monthly Variance Analysis: Perform variance analysis to compare actual results against the budget. Investigate and understand the reasons for significant variances.

9) Ensure Accurate Revenue Recognition: Follow the revenue recognition principle accurately, especially for businesses offering subscriptions or bundled services.

10) Use Accounting Software: Utilise reliable accounting software to automate processes, reduce errors, and improve efficiency.

Conclusion

Understanding What is Accrual Accounting is essential for accurate financial reporting and business planning. Recording transactions when they occur, not when cash is exchanged, it provides a clearer financial picture. Though complex, it helps businesses manage profitability, adhere to regulations, and make informed decisions for long-term success.

Take the first step towards financial excellence with our Accounting (AC) Course – Join now!

Have Any Question?

Have Any Question?

+44 7452 122728

+44 7452 122728

Back

Back

44 7452 122728

44 7452 122728